Anti dumping in 2006: China remains the "protagonist"

Gaopeng & Partners In 2006, while China's import and export trade continued to maintain rapid growth, international trade disputes between China and foreign countries also showed a similar upward trend. On the one hand, Chinese products frequently encounter anti-dumping in countries and regions such as the EU and the United States; On the other hand, China's domestic industry has also taken up anti-dumping weapons against foreign imports. As a result, China has become a veritable "protagonist" in anti-dumping. The following first introduces the overall situation of anti-dumping among WTO members, and elaborates on the basic characteristics and typical cases of anti-dumping in 2006 from the EU, the United States, other countries' anti-dumping against China, and China's foreign anti-dumping. This article is contributed by a lawyer from Gaopeng Law Firm. Gaopeng Law Firm, founded in 1998, is a large comprehensive law firm. Led by lawyer Wang Lei, the trade law team of the Institute includes two partners, Yu Shengxing and Yang Lin, as well as 10 professional accountants and lawyers. Over the past decade, it has been acting as a professional agent for Chinese enterprises to respond to anti-dumping lawsuits in countries such as the European Union, the United States, Canada, India, Pakistan, Thailand, and has achieved good results, and has been highly praised by customers.

(Yu Shengxing) EU: Anti dumping Against China Reaches a New High After 2005, the EU once again "led" countries in anti-dumping against China. As of December 25, 2006, the EU has initiated up to 11 anti-dumping investigations against Chinese products, involving products such as color kinescope, pentaerythritol, frozen strawberries, ironing boards, car saddles, persulfates, silicomanganese, ferrosilicon, polyvinyl alcohol, coke, and air compressors. In 2006, the European Union made final rulings or decisions on 9 anti-dumping cases against Chinese products, involving tartaric acid, binder, tanned leather, labor protection shoes, plastic bags, leather shoes, CDs, DVDs, color kinescope, etc. The following four aspects outline the EU's anti-dumping situation against China in 2006. 1、 The anti-dumping case of leather shoes ended amid controversy. On October 6th, 2006, the European Council issued a communiqu é, deciding to impose an anti-dumping duty of 16.5% on leather shoes exported from China for a period of 2 years (9.7% for Foshan Nanhai Golden Shoes Co., Ltd. in Guangdong Province), thereby declaring the "first case" of EU anti-dumping against China to be temporarily ended. The main reasons why the leather shoes case has attracted attention from all parties are: 1. The amount involved in the case is huge and the industrial impact involved is significant. According to relevant statistics, the leather shoes case affected China's exports by 700 million US dollars, with over 1200 export enterprises and 4 million jobs, making it the most anti-dumping case against China by the European Union. At the same time, the case benefits a large number of importers and retailers in the UK, Sweden, Germany, and other EU countries. 2. The investigations and rulings of the European Commission (EC) are quite questionable. First of all, on December 12, 2005, the European Commission surprisingly rejected all applications for market economy status by Chinese selected enterprises (and this ruling has violated the EU legal requirement to make a ruling three months after filing the case). Secondly, the EU does not grant a separate tax rate to any one enterprise. Third, the EU has not reviewed the market economy treatment/separate tax rate applications of the remaining 140 or more responding but not selected enterprises. Fourth, during the entire investigation period, the European Commission arbitrarily and arbitrarily revised the plans, including product exclusion plans and measures taken, which not only lacked legal and factual basis, but also were contradictory and difficult to convince. 3. Concern and heated debate among China, the European Commission and EU governments. First of all, from the filing of the EU case to the final ruling, the Chinese government has been closely following and conducting strong negotiations, demanding that the European Commission make an objective and impartial ruling and correct its erroneous practices. On November 7th, at the Sino European Economic and Trade Mixed Commission, Chinese Minister of Commerce Bo Xilai visited European Union Trade Commissioner Mandelson on "criticism" of the EU's anti-dumping on leather shoes. Secondly, there have been fierce disputes and even public confrontations among EU members, and some European media have commented that there have been cracks between EU members due to anti-dumping cases for the first time - only at the last minute of the legal deadline did they pass a compromise case with a narrow margin of 13:12. Moreover, there are contradictions and mutual distrust between EU member States and the European Commission: on the one hand, northern importing countries strongly oppose illegal anti-dumping actions, and on the other hand, southern producing countries demand stricter anti-dumping measures. 4. The media closely followed and Chinese responding enterprises insisted on defending. Not only Chinese media and mainstream media in Europe, but also media such as CNN in the United States have repeatedly reported and paid attention to the leather shoe case. In addition, Chinese enterprises have rarely demonstrated unity and persevered in defense. In February 2006, some shoe enterprises took the lead in establishing the "EU Anti dumping Response Alliance for Chinese Shoe Products", becoming the main force of non harm defense and negotiation. After the announcement of the final measures of the European Union, domestic enterprises such as Aokang have expressed their intention to carry out the defense to the end. 2、 On the other hand, the EU's anti dumping against China has also shown an unprecedented momentum. In 2006, the European Union has successively terminated four anti-dumping investigations against China, including labor protection shoes anti-dumping cases, recordable DVD anti-dumping cases, recordable CD anti-dumping cases, and color kinescope anti-dumping cases. It can be seen from the announcement issued by the EU on the termination of the four anti-dumping cases mentioned above that the reasons for terminating the investigation are either because the plaintiff withdraws the lawsuit, because the adoption of anti-dumping measures would not be in the public interest of the EU, or because there is no sufficient causal relationship between the injury and the dumped imports and the investigation must be terminated. According to media reports, the four anti-dumping cases involved more than 1000 Chinese enterprises, with a cumulative amount of up to 300 million US dollars. As the four cases involve the employment of a large number of people, if the EU adopts anti-dumping measures, it will have a serious impact on China's exports. 3、 On July 13, 2006, the European Court of First Instance ruled on the case of China's Shandong Ruipu Biochemical Co., Ltd. ("Shandong Ruipu") suing the European Commission for final anti-dumping measures against cresol originating in China: to revoke the effect of the final anti-dumping measures imposed by the European Council on Chinese exports of cresol on Shandong Ruipu, which took effect on September 21, 2003. So far, this case of Chinese enterprises suing the European Commission has ended with the complete victory of Chinese enterprises. According to relevant data, this case is the first time that a Chinese enterprise has won a lawsuit in the European Court of First Instance against the EU's final anti-dumping measures, which will play a certain restrictive role in the greater discretion and arbitrariness of the competent authorities of the European Commission in anti-dumping investigations. In June 2002, the European Commission issued a filing announcement, deciding to launch an anti-dumping investigation against cresol originating in China. As one of the enterprises involved, Shandong Ruipu actively hired lawyers to participate in the response. During the response to the lawsuit, the company repeatedly communicated with the European Commission on how to handle the production costs of the by-products of the product involved, emphasizing that the production costs of the by-products must be deducted from the total production costs, but this legitimate request was not accepted by the European Commission. To this end, the company filed a lawsuit with the European Court of First Instance in December 2003, requesting that the final decision of the European Council be revoked in accordance with the relevant provisions of the EU Treaty. After hearing the case, the court held that the attitude taken by the European Commission and the European Council during the "preliminary ruling stage was very hasty, and they should have the obligation to diligently review the case in order to calculate the normal value of the product in a reasonable manner", and decided to rescind the final ruling passed by the European Council. On December 6, 2006, the European Commission announced in the Official Gazette that the final anti-dumping measures of the European Council against cresol were not applicable to Shandong Ruipu, and importers who returned Shandong Ruipu had previously paid anti-dumping duties. 4、 Since the second review of the bicycle anti-dumping case this year, the European Commission has also launched a review and investigation on bicycles, energy-saving lamps, ferromolybdenum and other products originating in China, with the bicycle case being the most typical. The case dates back to October 1991. At that time, the European Commission launched an anti-dumping investigation on bicycles originating in China for the first time. Subsequently, in September 1993, the European Council decided to impose a final anti-dumping duty of 30.6% for a period of five years. In April 1996, the European Union launched an anti circumvention investigation on bicycles originating in China and subsequently extended the above tax rate to bicycle parts. In September 1998, the European Commission initiated the due review process. By July 2000, the European Council had decided to maintain an anti-dumping duty of 30.6% on Chinese bicycles for a period of five years. In April 2004, the European Commission issued a provisional review announcement, and the European Council decided in July 2005 to increase the anti-dumping duty rate from 30.6% to 48.5%. In November 2006, the European Council decided to terminate the temporary review of Giante (China) Co., Ltd. and maintain the original tax rate. Meanwhile, the European Commission also initiated a review investigation on the extension of anti-dumping measures in this case. Throughout this case, it is now the 14th year. It is not yet known when the anti-dumping duty will be levied in this case. This case once again shows that once a product is subject to high anti-dumping duties, this situation may continue for several years, and the relevant enterprises will be excluded from a certain market for a long time, resulting in huge losses. At the same time, as one of the three major trade remedies recognized by the WTO, the drawbacks of anti-dumping measures are once again exposed here. (Cheng Kun)

The United States: Not many new "cases", but many new "incidents" From the perspective of the number of anti-dumping cases against China, the United States in 2006 was not significant. As of December 25, 2006, the United States has launched anti-dumping investigations against three Chinese products, including activated carbon, polyester staple fiber, and coated paper. However, the anti dumping of the United States against China in 2006 also deserves attention, including: (1) rejecting the first market economy country application filed by Chinese enterprises; (2) Further revising anti-dumping rules; (3) The United States Court of International Trade (CIT) ordered the Department of Commerce (DOC) to revise the rulings of the two major cases of furniture and shrimp; (4) DOC accepts an application to launch a countervailing investigation against Chinese coated paper. 1. "Refusing to recognize China's market economic status On September 8, 2006, DOC published in the Federal Register the final findings of the anti-dumping case against student use checkered paper originating in India, Indonesia, and China (the" checkered paper case "): The dumping margin for Chinese enterprises is 76.7% to 258.21%.". One interesting aspect of the Gezhi case is that the Chinese responding company Watanabe Group requested the DOC to review China's non market economy status in the anti-dumping investigation process for the first time. Unfortunately, DOC has refused this request from Watanabe Group. In the preliminary and final determination memorandums on China's non market economy status in the grid paper case published on May 15, 2006 and September 8, 2006, respectively, the DOC detailed the reasons for not granting China market economy status. This is another futile attempt by China to request the United States to recognize China's full market economy status. Due to its refusal to recognize China's market economic status, DOC does not use the domestic sales prices or costs of Chinese enterprises when calculating the dumping margin of Chinese enterprises, but instead determines the normal value based on the "factor of production method". Based on this, it is not surprising that DOC believes that manipulating and distorting the dumping margin has led to a bizarre high ruling by Chinese enterprises. As of December 2006, more than 60 countries have successively recognized China's full market economy status. Unfortunately, so far, several major trading partners, including the United States, the European Union, and Japan, have not recognized my full market economy status. 2. Amendments to Several Anti dumping Rules On August 17, 2006, the President of the United States signed the Pension Protection Act of 2006, which states in Article 1632 that from April 1, 2006 to June 30, 2009, new U.S. exporters will no longer be required to clear customs in the form of letters of guarantee for review, but will be required to pay cash deposits in accordance with assessed anti-dumping or countervailing duties. The next day, the DOC issued a notice to implement the bill. This means that for a considerable period of time in the future, US importers cannot pay anti-dumping duty deposits in the form of guarantees when importing products from new exporters, but must pay cash deposits. Industry insiders generally believe that the bill will make the review of new exporters of US anti-dumping duties "meaningless". In addition, following the changes proposed by the DOC in 2005 and soliciting public opinions on three rules, namely, market economy procurement, anti-dumping duty collection time, and labor wage calculation method, on October 19, 2006, the DOC published a notice in the Federal Register, adjusting three anti-dumping rules, namely, market economy procurement, workers' company, and export tax rebate adjustment, Among them, those that may have a significant impact on Chinese enterprises include: (1) Market economy procurement: DOC has decided to set the controversial market economy procurement threshold at 33%. That is, in anti-dumping investigations involving enterprises from non market economy countries, when the amount of a certain production factor purchased by enterprises from market economy countries exceeds 33% of the total procurement amount of that factor, The weighted average of the market economy purchase prices can be directly used to calculate all purchases for this element; When the quantity purchased by an enterprise from a market economy country is less than 33% of the total purchase quantity of the element, the element purchase is calculated based on the weighted average price of the substitute country and the actual purchase market economy price. (2) Labor Cost: DOC indicates modifying the labor cost calculation method to include welfare income such as social insurance. This method may lead to a further increase in the Chinese labor wage rate calculated by the Ministry of Commerce. 3. CIT has successively ordered DOC to modify the shrimp and furniture case, ruling against the order issued by DOC on February 1, 2005 to impose final anti-dumping duties on chilled and warm water shrimp imported from China and other countries. Two Chinese enterprises under compulsory investigation, Zoomlion and Yilin (DOC's final ruling on the dumping margin was 80.19% and 82.27%, respectively), disagreed, and have successively filed lawsuits with CIT. The challenges faced by Zoomlion and Yilin to DOC mainly include two points: the wage rate of Chinese workers and the price of raw shrimp substitutes adopted by DOC have no evidence support and legal basis, and they request CIT to order DOC to make a new ruling. During the CIT trial, DOC acknowledged that it may have made errors in calculating workers' wages, and requested CIT to allow it to recalculate. On June 12, 2006, CIT agreed to DOC's request to proactively correct errors in its application of worker wages, and ruled that the raw shrimp substitute country price used by DOC during the investigation period had no legal basis and evidence to support it. CIT ordered it to review and make a new ruling. On October 3, 2006, the DOC released a draft re ruling to stakeholders. In response, Zoomlion, Yilin, and others have respectively commented. The new ruling signed by the DOC on October 27, 2006 decided to adopt a worker's wage of $0.85 per hour and a substitute country price of $5.07 per kilogram of raw shrimp. Based on this, the anti-dumping tax rates of Zoomlion and Yilin were recalculated to be 55.56% and 56.37%, respectively. In addition, two mandatory investigation companies, Dongguan Taisheng and Dongguan Ruifeng, filed complaints to CIT in response to the DOC's order to impose anti-dumping duties on the Chinese wooden bedroom furniture case. On October 31, 2006, CIT ruled to support part of Dongguan Ruifeng's request. On November 20, 2006, the DOC issued a notice to exclude Dongguan Taisheng from the anti-dumping duty order, while increasing the tax rate of more than 110 responding but not selected enterprises from the original 6.65% to 7.24%. It can be seen that the independent judicial system of the United States has formed strong and effective constraints. In fact, in some past cases (such as the Apple Juice case), it was precisely due to the reasoned efforts of Chinese responding enterprises that better results were ultimately achieved. 4. Launch of Anti Subsidy Investigation Procedure against China On October 31, 2006, NewPage Company of the United States filed an application with the United States International Trade Commission and the DOC to initiate anti-dumping and countervailing investigations against coated paper from China, Indonesia, and South Korea. On November 21st, DOC announced that it had initiated anti-dumping and countervailing investigations against coated paper from China, Indonesia, and South Korea. On the one hand, DOC refuses to recognize China's market economy status, and on the other hand, it initiates a countervailing investigation against China, which is obviously unfair and contradictory. Since the US countervailing case against Czech steel products in the 1980s, it has almost become the consensus of the US government and industry that countervailing rules are not applicable to non market economy countries. In the countervailing case against Chinese nuts and ceiling fans, DOC also upheld this ruling. However, with the launch of the coated paper case, the issue of whether the anti subsidy rules apply to non market economy countries will once again become the focus of debate. On December 15, 2006, the DOC published a notice in the Federal Register inviting the public to comment on whether countervailing measures should apply to Chinese imported products. It is certain that the trend of the coated paper case and its impact on the future trade relief policies and practices of the United States and other countries towards China cannot be underestimated. All this remains to be further observed in 2007. (Ding Yanyan)

A Trend Not to Be Ignored: Developing Countries Play the Leading Role in Anti dumping Against China In 2006, there were a total of 19 countries and regions outside the European Union and the United States that initiated anti-dumping investigations or adopted anti-dumping measures against China. Among them, there are 3 developed countries, including New Zealand, Australia and Canada, and 16 developing countries and regions, including India, Pakistan, Indonesia, Thailand, South Korea, Türkiye, Mexico, Argentina, Colombia, Brazil, Peru, Egypt, Russia, Ukraine and South Africa. Among them, there are three types of products under anti-dumping investigations initiated by developed countries, including canned peaches, canned pineapples, colorless laminated safety glass panels, and copper pipe fittings, while the products investigated by developing countries cover a wide range of products. In 2006, the number of anti-dumping investigations initiated by developing countries against China increased significantly. As of December 11, 2006, the total number of new anti-dumping investigations launched by developing countries against China was 39, with the main countries being Brazil (9), India (8), Türkiye (4), Mexico and Thailand (3 each), Egypt and Colombia (2 each), and the remaining 9 countries and regional countries (1 each). The following is a brief comment on the prominent countries (regions). 1. The number of anti-dumping investigations initiated by Brazil against China has increased rapidly. As of December 11, 2006, the number of anti-dumping investigations initiated by Brazil against China has reached 9, mainly involving various product categories such as machinery, electrical appliances, handicrafts, and electromechanical products, including electric irons, aluminum pre coated photosensitive plates, hair combs, speakers, lens holders with or without lenses, sunglasses, manual lifting pulleys, Christmas trees, and decorative balls for Christmas trees SDS drill bits, etc. In terms of the number of newly initiated anti-dumping cases, Brazil this year surpassed India and Türkiye, the two traditional "big countries" in anti-dumping against China, and ranked first among developing countries. 2. As of December 11, 2006, India has initiated 8 anti-dumping investigations against China (including 1 termination of the investigation due to the withdrawal of the applicant); 6 temporary anti-dumping measures were taken (including 2 final anti-dumping measures); Seven final anti-dumping measures were taken.

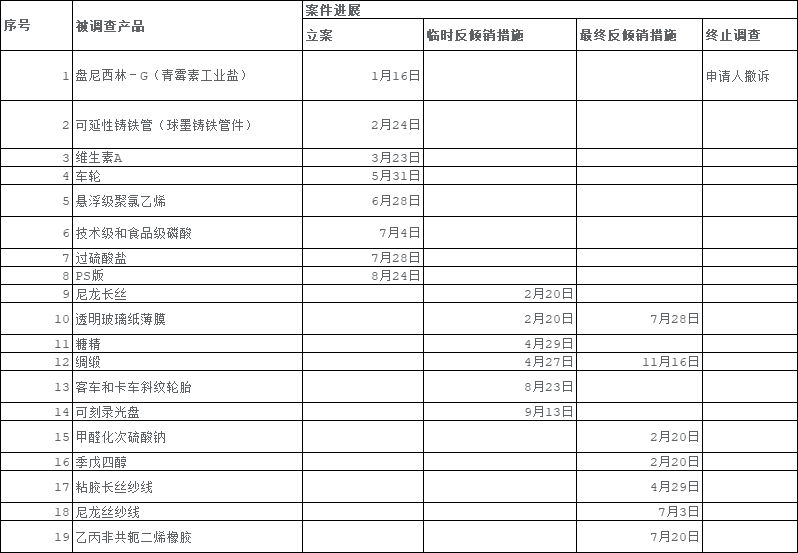

Anti dumping situation of India against China in 2006

According to the final determination results in India in 2006, except for the termination of the investigation of the penicillin salt case, none of the Chinese responding enterprises in the remaining cases received market economy status treatment. This result is greatly related to the harsh attitude of the Indian investigation authorities in reviewing the market economy status of Chinese enterprises. Currently, both the Ministry of Commerce and Industry of India and Indian applicants have a considerable understanding of China's relevant legal system and economic situation. When reviewing or discussing the issue of the market economic status of Chinese responding enterprises, the four criteria for market economic status stipulated in the Indian anti-dumping law have been further refined. Therefore, for Chinese enterprises, although the relationship between China and India is constantly improving, when responding to Indian anti-dumping investigations, The issue of market economy status remains the primary challenge. 3. Türkiye's anti-dumping against China As of December 11, 2006, Türkiye has launched four anti-dumping investigations against China (one of which took final anti-dumping measures); Seven final anti-dumping measures were taken. In 2006, four new cases were filed, mainly involving chemical, wood, stone, and other product categories.

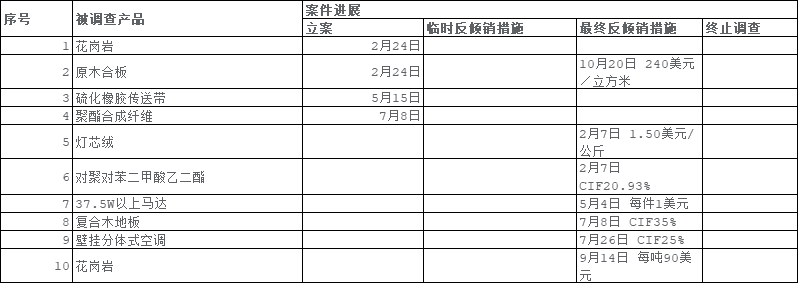

Türkiye's anti-dumping against China in 2006

According to our experience, the characteristics of Türkiye's anti-dumping against China are: (1) the procedure is not transparent; (2) There is no distinction between responding enterprises and non responding enterprises, and an anti-dumping tax rate is uniformly applied; (3) Not conducting on-site inspections of Chinese responding enterprises; (4) No preliminary ruling will be made, but the final ruling will be made directly. It is also noteworthy that in 2006, Taiwan initiated an anti-dumping investigation and adopted anti-dumping measures against the mainland for the first time. On March 1, 2006, Taiwan announced an anti-dumping investigation against towels from the mainland, involving product tax numbers 63026000 and 63029100. This is the first time that Taiwan has launched an anti-dumping investigation against mainland products. On March 17, Taiwan's "Trade Investigation Commission of the Ministry of Economic Affairs" made a preliminary ruling on the anti-dumping case of towels produced in the mainland, and made a final determination on the case of special safeguard measures for towels, asserting that the export of towels from the mainland caused "market disruption" and "substantial damage" to similar industries in the Taiwan region. On May 29, the "Ministry of Finance" of Taiwan announced a decision to impose a temporary anti-dumping duty on towels from the mainland for a maximum period of 4 months from June 1. On September 19th, the "Ministry of Finance" of Taiwan issued a press release, deciding to impose a final anti-dumping duty on towel products imported from the mainland for a period of five years. In addition, in October 2006, Taiwan also announced anti-dumping actions against leather shoes and paper products imported from the mainland. The leather shoes case was described by the industry as "adding salt to the wound" shortly after the EU announced the imposition of tariffs. Taking a comprehensive view of the first anti-dumping investigation conducted by Taiwan against the mainland of China, its main characteristics are as follows: First, it is fast and only takes 6 months and 18 days from filing a case to final adjudication and imposition of anti-dumping duties; 2、 The tax rate is high, such as the anti-dumping duty levied in the towel case, which is as high as 204.1%. (Shi Qinyan) China: Intensifying Industrial Protection With the rapid growth of imports, the Chinese government has also further increased its efforts in anti-dumping to protect domestic industries. On November 30, 2006, China launched a total of 5 anti-dumping investigations. The target countries and related products of anti-dumping were: (1) imported potato starch originating from the European Union; (2) Imported electrolytic capacitor paper originating in Japan; (3) Imported sulfamethoxazole originating in India; (4) Imported bisphenol A originating in Japan, South Korea, Singapore, and Taiwan; And (5) imported methyl ethyl ketone originating in Japan, Taiwan, and Singapore. 1. Taking anti-dumping measures (1) As of November 30, 2006, the Ministry of Commerce of China has issued four preliminary anti-dumping determinations this year, including: imposing a margin on imports of spandex originating in Japan, Singapore, South Korea, Taiwan, and the United States, with a margin ratio ranging from 0% to 61%; Impose a deposit on imported wear-resistant paper originating in the United States and the European Union, with the deposit ratio ranging from 10.35% to 42.79%; Impose a margin on imports of nonylphenol originating in India and Taiwan, with a margin ratio ranging from 9.07% to 20.38%; A deposit is levied on imported electrolytic capacitor paper originating in Japan, with the deposit ratio ranging from 15% to 40.38%. (2) As of November 30, 2006, the Ministry of Commerce of China has issued five final anti-dumping determinations this year, including: imposing anti-dumping duties on imports of furanol originating in Japan, the European Union, and the United States, with a tax rate ranging from 44% to 113.2%; Impose anti-dumping duties on imported nucleotide food additives originating in Japan and South Korea, with a tax rate ranging from 25% to 119%; Impose anti-dumping duties on imports of catechol originating in the United States and Japan, with a tax rate ranging from 4% to 42.86%; Impose anti-dumping duties on epichlorohydrin originating in Russia, South Korea, Japan, and the United States, with a tax rate ranging from 0% to 71.5%; An anti-dumping duty is levied on imported PBT resins originating in Japan and Taiwan, with a tax rate ranging from 6.2% to 17.31%. 2. Correlation analysis (1) From 2001 to 2006, the annual number of anti-dumping cases filed by the Ministry of Commerce of China is shown in the following figure: Overall, the number of anti-dumping cases filed in China has remained stable since 2001, and the number of cases filed in 2006 has decreased slightly compared to previous years. (2) Since the target country launched its first anti-dumping investigation against American newsprint in 1997, China has initiated a total of 47 anti-dumping investigations, mainly targeting the United States, Japan, South Korea, the European Union, Russia, Southeast Asia, Taiwan, India, and so on. The cumulative number of anti-dumping investigations initiated by China against various countries (regions) is shown in the figure below: In general, the objects of China's anti-dumping investigations are mainly concentrated in the United States, Japan, South Korea, and the European Union, followed by Taiwan, Southeast Asian countries, Russia, and India. The filing of anti-dumping cases in China in 2006 still conforms to the above characteristics. (3) The annual number of anti-dumping duties imposed by the Ministry of Commerce of China from 2001 to 2006 is shown in the figure below: From the above table, it can be seen that since 2003, China has significantly increased its efforts to impose anti-dumping duties on imported and dumped products. In 2003, 11 final tax decisions were made, with the largest number. Since 2003, the number of annual tax decisions made by China has remained basically stable. (4) The scope of products involved in anti-dumping has been from 1997 to now (as of November 30, 2006). China has initiated a total of 47 anti-dumping investigations involving products in the following fields: chemical, paper, steel, food, and communications. The percentage of products in various fields is shown in the figure below: It can be seen that China's anti-dumping investigations mainly involve chemical products, followed by paper and steel products. In 2006, among the 5 anti-dumping investigations initiated by China, chemical products accounted for 3 cases, basically in line with the past trend. (Jia Zheng)

[1] All statistical data in this article are derived from information released by the Fair Trade Bureau of the Ministry of Commerce of China. (This article has been published in the 2007 issue 1-2 of the "WTO Economic Guide")

(This article is translated by software translator for reference only.)

Related recommendations

- Gaopeng&Partners Partner Recruitment Program | The Talent Development and Construction in 2025 is Launched!

- The Party branch of the Qingdao office donated to the Qingdao Municipal Deaf School —— Carrying forward the spirit of Lei Feng and fulfilling the responsibilities of Party members.

- Lawyer Li Kejun, a partner of Gaopeng in Shenzhen, gave an interview to a reporter from Guangzhou Daily regarding the Law on the Promotion of the Private Economy (Second Draft for Deliberation)

- The 146th Session of Gaopeng Reading Club, "Compliance in Corporate Layoffs and Practical Supervision of Labor-Management Disputes," was Successfully Held