Lawyer Gao Peng Strives for the National Minimum Tax Rate in the Anti dumping Investigation of Galvanized Steel in South Africa

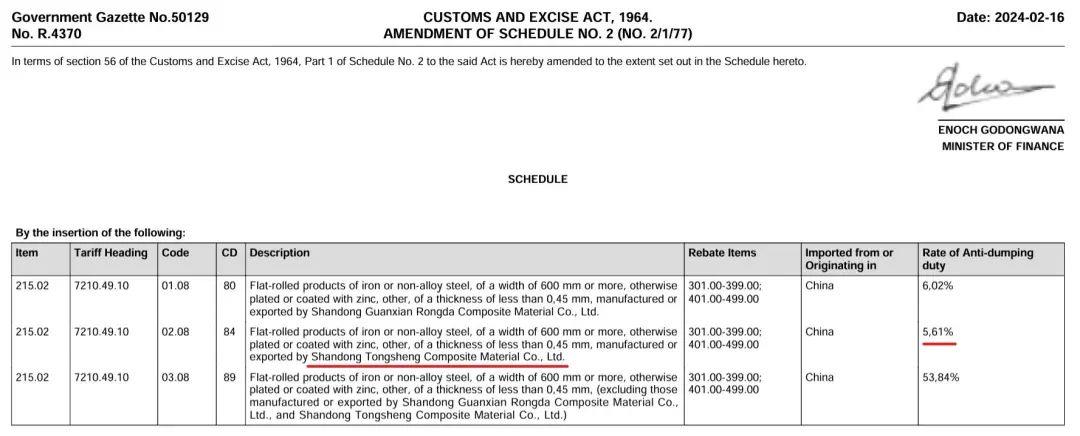

On October 12, 2022, the South African International Trade Administration Commission (ITAC) (on behalf of the Southern African Union - SACU, including five countries, South Africa, Botswana, Namibia, Lesotho and Eswatini) issued a notice to launch an anti-dumping investigation on galvanized steel products imported from China. The South African tax number of the product in question is 72104910. The international trade law team of Gaopeng Law Firm represented Shandong Tongsheng Composite Materials Co., Ltd. (hereinafter referred to as "Shandong Tongsheng") to participate in the lawsuit, and ultimately obtained a national minimum tax rate of 5.61% in this investigation.

This case is led by Lawyer Qian Wenjie from the trade team, with the assistance of Lawyer Yao Mingyue, a team member.

Case process

In the anti-dumping investigation launched by South Africa against China in recent years, the investigating authority usually calculated a higher preliminary determination tax rate based on the data provided by the applicant on the ground of incomplete replies to the Chinese questionnaire, which caused many Chinese enterprises to lose confidence in responding to the lawsuit. The same is true for this case. Although Shandong Tongsheng actively responded to the lawsuit after filing, ITAC still issued a preliminary ruling on March 17, 2023, imposing a temporary anti-dumping measure of 35.9% on all Chinese products. In response to this, the lawyer team led by Gao Peng immediately studied the calculation method of the investigating authority and proposed defense opinions based on WTO trade rules, South African anti-dumping legislation and practice, and combined with the actual situation of the enterprise's exports. In May 2023, the investigating officials conducted on-site inspections and ultimately adopted Shandong Tongsheng's own export data, and corrected the calculation of the dumping margin. On February 16, 2024, ITAC issued a final ruling, stating that Shandong Tongsheng received a national minimum tax rate of 5.61%, with the second lowest tax rate being 6.02%. The tax rate for other enterprises is 53.84%, which will be implemented from February 17, 2024.

Past performance

According to statistics, this is the 9th consecutive time that Gao Peng has won the lowest national tax rate for Chinese companies in South Africa's anti-dumping investigation against China. The previous performance list is as follows:

In January 2007, in the South African anti-dumping case against China, Gao Peng represented Jiangsu Rudong Iron Chain Factory in the lawsuit and was finally awarded zero tax rate.

In March 2007, in the South African citric acid anti-dumping case against China, Gao Peng represented the China Minmetals and Chemicals Import and Export Chamber of Commerce on behalf of the Chinese citric acid industry and five major export enterprises in a defense of no harm and causal relationships throughout the industry. The defense was ultimately successful and resulted in a zero tax rate for the entire industry.

In September 2007, in the South African anti-dumping case against China, Gao Peng acted as an agent for Guangdong Foshan Jianmei Aluminum Profile Co., Ltd. and was finally awarded zero anti-dumping duty rate.

In September 2011, South Africa filed an anti-dumping case against China against threaded rods. Gao Peng represented Zhejiang Dongming Stainless Steel Products Co., Ltd. in the lawsuit and obtained a zero anti-dumping duty rate.

In November 2014, South Africa filed an anti-dumping case against China for hexagonal screws. Gaopeng represented Shanghai Jiyou Machinery Co., Ltd. in response and obtained a zero anti-dumping duty rate.

In the sunset retrial case of South Africa's anti-dumping measures against China in April 2017, Gao Peng represented Jiangsu Rudong Iron Chain Factory in response, and obtained a final ruling of zero tax rate.

In September 2021, South Africa filed an anti-dumping case against China's iron chain, and Gao Peng represented Jiangsu Rudong Iron Chain Factory in response, obtaining the lowest anti-dumping tax rate in the country.

Related recommendations

- Gaopeng represents Zhejiang export enterprises to obtain the lowest tax rate in Ukraine's anti-dumping investigation against China

- Lawyer Fan Chao's team represented a headhunting company and won the lawsuit

- Lawyer Gao Peng assists in the successful issuance of China Energy Conservation Solar Convertible Bonds

- Gaopeng won a comprehensive victory in a financial entrusted wealth management contract dispute case on behalf of a certain company