Consequences of the Application of Chapter 5 of the "Nine People's Minutes" and How Private Fund Managers Should Respond

In our agency work in private fund manager dispute resolution cases, we have identified some common controversial points that determine the direction of relevant cases. This series of articles analyzes relevant issues from the perspective of safeguarding the rights and interests of fund managers. This article intends to analyze the impact of Chapter 5 of the "Minutes of the National Court Civil and Commercial Trial Work Conference" (hereinafter referred to as the "Nine People's Minutes") on private fund managers and defense ideas.

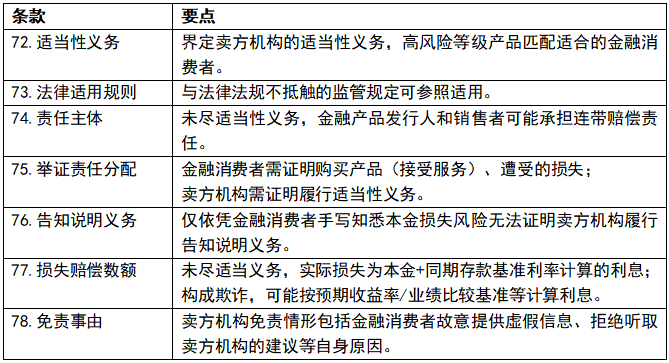

1、 Main points of Chapter 5 of "Minutes of the Nine People"

Chapter 5 of the "Nine People's Minutes" has a total of 7 articles, which have been discussed item by item in many previous articles, and will not be repeated here. The main points of the refined articles are as follows:

2、 Legal Consequences of the Application of "Nine People's Minutes" Here

If the "Nine People's Minutes" is applied here, we believe that it will have the following adverse consequences for private fund managers in individual cases:

1. Inversion of the burden of proof of the obligation of appropriateness

Article 75 of the "Minutes of the Nine People" revised the general principle of "who claims, who adduces evidence.". For disputes between financial consumers and financial institutions, the burden of proof of the appropriateness obligation is allocated to financial institutions. In this scenario, if the private fund manager cannot prove that it meets the investor's appropriateness obligations, it will bear the risk of losing the lawsuit.

2. Joint and Several Liability with Sales Agencies

In practice, private fund managers may entrust fund sales companies to sell private funds on their behalf, and often agree in agreements that any infringement caused by sales activities should be borne by the sales company. However, according to Article 74 of the "Nine People's Minutes", private fund managers still need to bear joint and several liabilities with the fund sales company, and agency sales may not be able to isolate the risk of failing to fulfill their appropriateness obligations during the fundraising stage. Therefore, although the relevant sales agreement can be used as a recourse, it may not be able to counter investors. In addition, the acts of the sales company may also have corresponding legal effects on private fund managers in accordance with the provisions of the Civil Code on agency.

3. Compensation for principal and interest

If it constitutes fraud, it will also face punitive compensation, that is, interest will be calculated based on the expected rate of return, performance comparison criteria, and even the upper limit of such standards, if any. Some parties request a court or arbitration institution that the manager bear the relevant performance comparison benchmark or expected yield to bear the losses. However, when the fund agreement is adjudicated invalid, a contradiction arises, that is, in fact, it is tantamount to recognizing the effectiveness of the agreement. This is tantamount to a de facto recognition of the exchange. This situation deserves deep consideration and vigilance.

3、 How Private Fund Managers Defend the Application of Chapter 5 of the "Nine People's Minutes"

We believe that although there are some views that combine with the financial products mentioned in Chapter 5 of the "Nine People's Minutes" when defining the appropriateness obligation, such as leveraged funds, new third board investments, and other grounds, and believe that Chapter 5 of the "Nine People's Minutes" should apply to private fund managers, private fund managers still have some room for defense, and should fully and actively advocate and defend.

First of all, Part V of the "Nine People's Minutes" clearly applies only to financial institutions. Given that financial activities are subject to administrative licensing, we believe that it can be positively argued that private fund managers do not obtain financial licenses, and therefore should not be simply considered as financial institutions. Although the China Securities Investment Fund Industry Association (hereinafter referred to as the "China Securities Association") registers private fund managers and records private fund products, the "China Securities Association" stated in the "Private Investment Fund Filing Instructions" (December 23, 2019) that "the association's filing for private investment funds does not constitute recognition of the investment ability of private investment fund managers (hereinafter referred to as the" managers "), Nor does it constitute recognition of the compliance of managers and private investment funds, nor does it serve as a guarantee for the safety of private investment fund assets. "Investors should identify the investment risks of private investment funds and bear the possible losses arising from their investment activities.".

"Private fund managers should further declare to investors that the registration and filing of private fund managers and private funds by the China Fund Industry Association does not constitute recognition of the investment ability and continuous compliance of private fund managers, nor does it serve as a guarantee for the safety of fund assets," as stated in the "Private Fund Investment Fund Contract Guidance No. 3 (Guidance on Necessary Terms of Partnership Agreement)" issued by the China Foundation Association.

To sum up, it may be argued that the registration and filing of the China Foundation Association is an industry self-discipline measure authorized by laws and regulations, aimed at promoting industry discipline and transparency, and should not be considered as a basis for licensing financial institutions.

Secondly, we believe that in view of the regulatory level, it is not clear that financial consumers include qualified investors, so it may be argued that qualified investors cannot be simply included in financial consumers. The Guiding Opinions of the General Office of the State Council on Strengthening the Protection of the Rights and Interests of Financial Consumers (GBF [2015] No. 81), issued in 2015, introduced the concept of financial consumers, but did not define financial consumers. Article 2 of the Measures for the Implementation of the Protection of the Rights and Interests of Financial Consumers of the People's Bank of China (Order [2020] No. 5 of the People's Bank of China) issued in 2020 defines financial consumers as "natural persons who purchase and use financial products or services provided by banks and payment institutions".

However, this provision is aimed at banking institutions or non banking payment institutions, and it cannot be inferred that financial consumers under the "Nine People's Minutes" should comply with the same scope of definition, nor can it be concluded that they include qualified investors. The regulatory regulations of the China Securities Regulatory Commission (CSRC) and the China Securities Regulatory Association (CCA) self-discipline rules applicable to private equity funds usually use qualified/professional investors to describe investors, without using the concept of financial consumers. In addition, there are also extraterritorial legislative practices that exclude natural or legal persons with certain financial or professional capabilities from financial consumers. "Article 4 of the Taiwan Financial Consumer Protection Law of China stipulates:" The term financial consumers as used in this law refers to those who receive financial goods or services from the financial services industry, but does not include the following objects: professional investment institutions; natural or legal persons with certain financial or professional capabilities. "It can be seen that the inclusion of qualified investors as financial consumers should not have a significant basis.".

4、 Conclusion

If Part V of the Nine Minutes of the People is not applicable to private equity fund companies, the general principle of tort liability should still be adhered to, specifically including: 1. The plaintiff/applicant should provide evidence as to whether the defendant/respondent violated the obligation of appropriateness; "The fund manager and seller shall bear their respective responsibilities based on their specific infringement situation, and shall not be jointly and severally liable to each other.".

However, based on our observation of judicial practice, the court's reasoning in private equity case disputes reflects, to a certain extent, the content and principles of Chapter 5 of the Nine Minutes of the People. In this case, for the sake of comprehensiveness, we suggest that private fund managers still need to establish appropriate appropriateness management systems in accordance with relevant regulatory and self-regulatory rules, and need to strictly follow the system for appropriateness management. We will elaborate on this in a separate article, but in short, first of all, managers should not omit any important documents and steps. Questionnaire and risk disclosure statements for risk assessment of investors (especially natural person investors) are key evidence related to the performance of appropriate obligations. When an investor purchases products across levels beyond their risk assessment results, relying solely on their written consent statement may not be sufficient, and supporting materials such as a calm down period and a return visit certificate, such as dual recorded videos, are also required. Secondly, the manager should pay attention to preserving relevant evidence, especially in the case of entrusting a fund sales company to raise funds, and should promptly request the fund sales company to submit the appropriate management system, documentary evidence, and audio and video materials to the private fund manager for retention and backup. Finally, to avoid confusing concepts, private fund managers should clearly explain to investors the exact meaning of expected returns (but it is recommended to use them with caution) and performance benchmarks in private fund promotional materials and private fund contracts, to avoid generating misconceptions about fixed income.

In relevant cases, private-equity fund managers should actively defend, strive to avoid the direct application of Chapter V of the "Nine People's Minutes" to managers by judicial bodies, and require the plaintiff/applicant to bear the burden of proof; On the other hand, by providing relevant evidence of the appropriateness of its performance, we strive to avoid bearing adverse consequences.

Related recommendations

- Tax lawyers review the draft of the revised Tax Collection and Administration Law for soliciting opinions

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 3): "Height Limit" Single Release Mechanism

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 2): Grace Period System

- Interpretation of the Management Measures for Compliance Audit of Personal Information Protection - Feeling the Rhythm and Rhythm of Regulatory Flow