Special Topic on Financial Crimes | Analysis of the Eight Arguments on the Crime of Obtaining Loans by Deception

Since entering the 21st century, China's banking industry has experienced a golden development period of more than ten years, with rapid growth in the scale of deposits and loans, and the overall profitability of the industry is significantly higher than that of other industries. However, due to the lack of relevant systems and regulatory gaps, the characteristics of extensive management and development are relatively prominent, leading to chaos in the entire banking market. Entering a new era of development, a series of special actions to address industrial chaos have also been put on the agenda. On February 20, 2020, the General Office of the China Banking and Insurance Regulatory Commission (CBRC), in its Guiding Opinions on Preventing Financial Illegality and Crime among Employees in the Banking and Insurance Industry, also explicitly identified illegal and criminal acts in the field of credit business as illegal and criminal acts in the key financial field, and the crime of defrauding loans is one of the most frequent crimes, becoming the sword of Damocles hanging over many entrepreneurs. Based on years of experience in handling cases, legal theories, and changes in legislation in recent years, we will analyze and discuss the main arguments for this crime.

1、 New legislative changes in the crime of defrauding loans

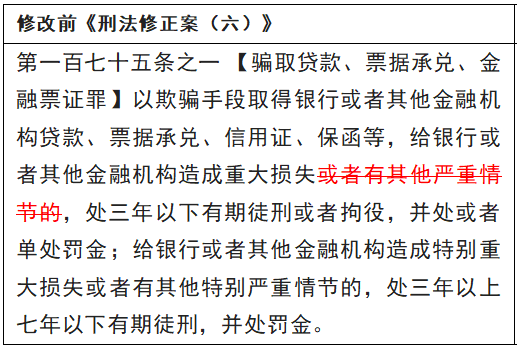

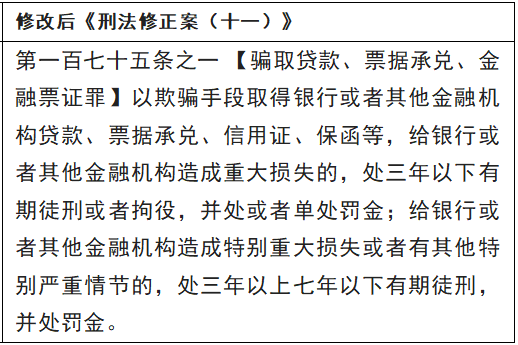

The crime of defrauding loans is a new crime added to the crime of loan fraud in the 2006 Criminal Law Amendment (VI). In order to meet the needs of the development of social and economic life, the "Criminal Law Amendment (XI)" promulgated and implemented on March 1, 2021 has revised this crime again. The comparison before and after is as follows:

It can be seen that Article 175-1 of the Criminal Law has deleted the provision of "or other serious circumstances" in the original provision in the first sentence of the sentencing range, and only retained the standard of "causing significant losses to banks or other financial institutions", which also means raising the threshold for criminalization of this crime, changing from the coexistence of the original consequential crime and the episodic crime to a single consequential crime.

2、 On the Eight Main Arguments of the Crime of Obtaining Loan by Deception

As a lawyer, the research and defense of a crime must be multifaceted, multi-level, and multi-angled, and the crime of defrauding loans is no exception. The specific facts of specific cases vary widely, but as a summary study, it is impossible to cover everything in detail. This article summarizes the common main arguments of this crime into eight aspects for analysis.

(1) Debate on the Structure of Objective Behavior - If a bank does not issue loans due to misconceptions, it does not conform to the causal relationship of fraudulent crimes

The objective aspect of the crime of defrauding loans is the act of obtaining loans from banks or other financial institutions by fraudulent means such as fabricating facts or concealing the truth, causing significant losses to banks or other financial institutions. The structure is that the perpetrator adopts fraudulent means to implement fraudulent behavior, leading to cognitive errors among the staff of financial institutions such as banks that the perpetrator meets the loan conditions, and issuing loans based on cognitive errors, ultimately resulting in the perpetrator obtaining loans and causing losses to the financial institution. In this crime, cheating and obtaining a loan are directly related to each other. That is to say, only when the fraudulent means implemented by the perpetrator cause the person with disciplinary authority in the bank or financial institution to make a mistake in understanding and granting loans, it is considered a fraudulent act in the sense of criminal law.

In practice, the following three situations are common: (1) bank staff instructs, assists, and instructs actors to modify and adjust relevant financial statement data required for loan declaration; (2) The staff of the financial institution have been aware of the fraud of the lender, but still insist on lending based on completing the lending targets or other considerations of interest; (3) When borrowing new funds to repay old ones, financial institutions in disguised form designate the use of funds as "repayment of old accounts", in fact knowing that the name of the loan contract does not match the reality. In these circumstances, it is obvious that the staff of financial institutions such as banks are not deceived, and the perpetrator did not obtain the loan due to fraudulent means. Even if the loan information and the purpose of the fund are not true, it should not be considered that the perpetrator has fraudulent behavior. Financial institutions should be responsible for relevant risks in accordance with the legal principles of objective liability theory, and should not draw a guilty conclusion towards the perpetrator.

(2) Debate on the Objective Result Requirement - The bank has not yet formed a final and realistic loss, which does not meet the objective result requirement of obtaining loans through fraud

According to Article 175-1 of the Criminal Law, the constitution of the crime of defrauding loans must be based on the objective result of causing significant or particularly significant losses to financial institutions. According to Article 5 of the "Guidelines on the Classification of Loan Risks" (CBRC No. 54 (2007)), banks classify loans into five categories: normal, concerned, subordinated, suspicious, and loss. The latter three categories are referred to as non-performing loans. The so-called loss refers to the fact that after taking all possible measures or all necessary legal procedures, the principal and interest still cannot be recovered, or only a small portion can be recovered. "The Reply of the Economic Investigation Bureau of the Ministry of Public Security on the Issues of Prosecution Standards for the Crimes of Obtaining Loans by Deception and Illegally Issuing Loans (2009)" also points out that if banks or other financial institutions only issue a conclusion that "the amount of non performing loans formed", it should not be recognized as "the amount of significant economic losses.". "Non performing loans, although" non performing ", do not necessarily result in established losses. Therefore," non performing loans "are not equal to" economic losses ", nor can" the amount of non performing loans formed "be equal to" significant economic losses. ".

Therefore, if the case is still undergoing civil litigation, compulsory execution, and the investigation of the guarantor's liability, it indicates that all possible measures or necessary legal procedures have not been exhausted, and it is not yet possible to determine that the bank has formed a final and realistic loss, which does not meet the objective outcome requirements of the crime of defrauding loans. Loan losses cannot be simply and rudely recognized directly by the amount overdue. However, this is precisely a serious problem in current judicial practice, and a large number of judicial organs still have significant misconceptions on this point, leading to the direct determination of loan losses based on the amount that cannot be repaid. This requires the insistence of criminal defense lawyers, as well as the upgrading of judicial personnel's concepts and the updating of their knowledge structure.

Of course, it should also be noted that the provisions on circumstances have been deleted from the first sentence of this crime. However, in terms of the statutory penalty for upgrading to the second sentence, the applicable conditions are still two situations, namely, causing particularly significant losses to financial institutions or having other particularly serious circumstances. To accurately apply the second sentence, it is necessary to correctly understand the meaning of "having other particularly serious circumstances" in practice. Some people believe that if the perpetrator fraudulently obtains a particularly large amount of loans by falsifying the loan information, even if the loan has been fully repaid, it should be recognized as constituting this crime and subject to the provisions of an increased legal penalty. This approach is obviously to bypass the "preceding paragraph" of this article and directly determine "other particularly serious circumstances" based on the amount theory when it is difficult to determine that a financial institution has significant losses and cannot directly apply the first sentence. We believe that this approach is not consistent with the spirit of legislation, and runs counter to the legal principle of aggravated crime, which is obviously inappropriate.

(3) Debate on the Time and Cause of the Result -- Look at whether there is a causal relationship between the perpetrator's fraudulent behavior and bank losses

Typical situations such as loan extension: Although the perpetrator provided false guarantees during the application for loan extension, the bank's losses were already formed when the loan expired. There is no criminal causal relationship between defrauding the loan and the losses caused and the perpetrator's providing false guarantees during the extension, and it cannot be determined that the perpetrator constitutes the crime of defrauding the loan. For example, the Intermediate People's Court of Jiaozuo City, Henan Province (2020) Yu 08 Xing Zhong 140 case.

(4) Debate on the Object of Crime - Acts that do not substantially cause the safety of bank credit funds should not be considered as crimes

From the perspective of the meaning and legislative evolution of Article 175-1 of the Criminal Law, the main legal benefit protected by the crime of defrauding loans is the safety of credit funds of financial institutions such as banks. In other words, as long as the fraudulently obtained loan behavior implemented by the perpetrator does not infringe upon the ownership of the loan funds by the financial institution, no matter how large the loan amount, it is not appropriate to identify it as constituting the crime of fraudulently obtained loan.

Typically, there are situations where there are sufficient or excessive loan mortgages, and old loans are repaid with real new loans. In the case of full mortgage, the bank can fully realize the mortgage right by auctioning the collateral. In the case of repaying the old loan with a real new loan, the part of the old loan is normally repaid and settled. In both cases, even if there is some fraud or material misrepresentation at the beginning of the loan declaration, it is unlikely to cause substantial danger or loss to the bank's credit fund security, and should not be considered as constituting this crime.

(5) Debate on Objective Evidence - Is the evidence on record sufficient to prove that the perpetrator committed an objective act of defrauding loans

In the crime of fraudulently obtaining loans from units, false financial statements and audit reports submitted by companies, enterprises, and other units to banks are often the crucial objective evidence. At this point, it is necessary to pay special attention to whether the documented evidence can truly and fully prove that the audit report provided by the actor is false, or participate in the production of a false audit report.

For example, in the (2020) Jin 01 Xing Zhong No. 121 case, the court of first instance held that the defendant company provided false financial reports and two false Jin Hui Yi Yuan (2016) No. 0018 and (2017) No. 0125 audit reports to the agricultural commercial bank in the loan. However, the court of second instance found through investigation that there were only a few information notes issued by the accounting firm and the testimony of Song Mou, the director of the accounting firm's office, regarding the issue of the falsehood of the two audit reports. However, both of these audit reports are stamped with the official seal of the accounting firm and the signature and signature of the certified public accountant. It is impossible to judge with the naked eye how the signature and signature differ from those in previous audit reports. Without verifying the authenticity of the company seal and the signature and signature of the certified public accountant in the two audit reports with the accountant or conducting judicial authentication, it is determined that the two audit reports are false based solely on the testimony of interested witnesses and statements of circumstances, which constitutes insufficient evidence.

(6) Debate on the purpose of loan - Those who have changed the purpose agreed in the loan contract but have not been squandered or used for illegal or venture capital activities, mainly for normal production and operation, should be prosecuted with caution

In practice, in cases suspected of defrauding loans, it is common for the purpose of the loan to be fictitious. From numerous cases of loan fraud or loan fraud, it can also be found that after obtaining a loan, most of the perpetrators will not use it according to the agreed purpose, but instead use it for other purposes. However, we believe that as long as it is necessary for normal production and operation, even if a small portion is used for other purposes such as repaying personal debts, while the majority is used for production and operation activities, caution should also be exercised in the issue of conviction. Here, it is necessary to correctly grasp and rationally understand the multiple contradictions between loan issuance and the reality of enterprise operation.

One is that under targeted payment requirements, there is often a contradiction between the uncertainty of the lending time and the performance period. In working capital loans or purchase and sales loans, banks may require that the recipient of the loan be specified in advance, but the time of loan issuance is uncertain. It is possible that the loan approval time is relatively long, but the contract performance time is determined. What if the bank loan has not yet come down after the contract performance time has expired? Therefore, in this situation where there is a requirement for targeted payment, the borrower often finds a company that can control or have a good relationship, pays the loan to this company, and then flexibly uses the funds. If this behavior is directly identified as the crime of defrauding loans, it is clearly a serious departure from the reality of transactions.

The second is the contradiction between the fracture of the enterprise's capital chain and the compliance with the bank during the renewal of loans. When a borrower applies for a loan for the first time, the contract regarding the purpose of the loan may be true, but after the loan expires, when it is necessary to apply for a new loan from the bank to repay the old loan, it does not happen that there will be a transaction of the same amount that needs to be carried out. What should be done at this time? Based on bank compliance requirements, an enterprise may submit a purchase and sales contract that does not have a real transaction when handling an extension. In this case, the borrower's credit standing and repayment ability are still the same as before, and there has actually been no change. The bank's funds should be said to be safe. If this situation is also recognized as a crime, it is also a practical contradiction.

The third is the situation where it is difficult to determine the whereabouts of funds for a mortgage loan. The most common is in consumer loans and business loans. Actors often place funds in a company and then withdraw the funds for other purposes. If such a situation where sufficient collateral is provided is also considered a fraudulent loan, it is obviously not consistent with common sense.

Fourth, we should fully consider the practical difficulties and survival and development issues of private enterprises. Financing is difficult and expensive, which has been, is, and will be the biggest challenge for the development of private enterprises in China for a long time to come. In order to promote the top-level design of high-quality economic and social development, the central government has repeatedly requested that the financing threshold be lowered to guide and encourage the development of private enterprises. This kind of encouragement and support must not only rest on shouting slogans, the key lies in the adjustment and implementation of administrative and judicial aspects, otherwise everything will be empty talk. The rule of law emphasizes localization, and all aspects of legislation, justice, law enforcement, and compliance should be integrated with Chinese elements. In the specific stage of national development, in the face of such historical and practical problems, it is not appropriate to treat enterprises that change the use of funds for the sake of production and operation development as crimes.

(7) Debate on applicable legal procedures - Criminal prosecutions should not be initiated until all possible measures or necessary legal procedures have been exhausted

The criminal law criminalizes fraudulent lending on the grounds that it has the social harmfulness of endangering the loan interests of financial institutions, which is beyond reproach and should be upheld. However, as a country governed by law, it is more important to correct the balance of law and the fairness of justice. From the perspective of the modesty of criminal law, any act can only be punished if it cannot be remedied through civil and administrative means. The act of defrauding loans can be completely remedied through normal civil and commercial channels such as strict pre examination and post litigation, and is not necessarily the application of criminal penalties.

In reality, disputes over overdue loans may still be in the civil trial stage, may still be in the enforcement stage, may be subject to final enforcement due to difficulties in the disposal of collateral, or may have new opportunities to resume enforcement after the final enforcement. Under these circumstances, criminal proceedings should not be initiated or pursued simultaneously, and a situation where criminal and civil proceedings are conducted simultaneously, which is clearly inconsistent with basic legal principles and legal provisions, should be resolutely avoided.

(8) The Debate of Joint Crime -- The Identification and Sentencing of Adjuvants

Debate on the objective behavior of an accessory - whether the evidence on record can fully prove that the perpetrator participated in the production and submission of false materials

From applying for a loan to issuing a loan, it often takes a long time, ranging from one or two months to half a year or even longer. During this period, relevant materials are usually submitted and supplemented to the bank multiple times. In the case of corporate loans, there are more false materials, and depending on the division of labor between various departments of the company, different people may be responsible for the production and submission of different materials. In this case, then, it is necessary to carefully examine who actually produced the false material and whether the evidence on record can truly and fully prove that the perpetrator participated in this part of the fact. If there is no evidence or the facts are unclear or insufficient, there is naturally no joint crime.

2. Argument on the Subjective Intention of an Accomplice - Can the documented evidence fully prove that the perpetrator has the subjective intent to help others defraud loans

As mentioned in the sixth argument above, due to various contradictions between loan issuance and the reality of business operations, borrowers often find a company that can control or have a good relationship to sign a "Purchase and Sales Contract" as entrusted payment. These people are generally relatives or very close friends of the borrower. In the face of this situation, it is necessary to carefully examine whether the borrower informed them when arranging for their signatures or seals to be used to defraud bank loans, and whether they could recognize that they were helping to defraud loans. It is necessary to carefully examine whether the evidence on record can prove that both parties engaged in collusive behavior in advance. If there is no joint intent, of course, it cannot be considered a joint crime.

3. The status and role of accessory offenders - specific analysis and differential treatment are required

In the case of constituting a joint crime, the role and importance of different accomplices are certainly different. To determine the status and role of an actor, comprehensive consideration should be given to factors such as the company's organizational structure, job hierarchy, job responsibilities, and the specific position and implementation behavior of the actor.

In practice, when a company borrows loans from a bank, it is often because the company's leaders have already contacted and communicated with the bank's staff with decision-making power in advance, even with the approval of the government and relevant departments, which means that the final approval of the loan is almost inevitable. All that needs to be done next is to go through the loan process. At this time, all the submitted materials are more of a formal and procedural significance, rather than having a substantive decisive role. In this case, the financial personnel of the company accept the arrangement of the company's leaders, and under the guidance of the bank staff, submit and improve the materials required for the loan process to the bank, which can be said to have a relatively small impact. Think about it. If I change to another employee in the company, will I categorically refuse the arrangement of the leader? Objectively speaking, there are indeed omissions, errors, and even violations of laws and regulations in this way of working for employees. However, based on the specific situation, it is not appropriate to be too harsh on such subordinate and auxiliary company employees.

Other circumstances affecting the sentencing of accessory offenders

Voluntary surrender, a good attitude towards confession, voluntary confession of guilt and punishment, whether to obtain additional benefits, the length of participation, the degree of participation, and the likelihood of expectation are all important circumstances that affect the sentencing of accessory offenders. They need to be analyzed and considered based on the specific circumstances of the case, and will not be discussed here. In short, the identification and sentencing of accessory offenders should not only adhere to the unity of criminal responsibility and punishment, but also reflect the criminal justice policy of combining leniency with severity.

3、 Conclusion

Social reality is developing and changing, legislation is developing and changing, and our country's criminal justice policies are also changing. When handling criminal cases such as fraudulent loan obtaining, it is necessary to fully consider the actual situation of the enterprise's "difficulty in financing" and "high cost in financing", and pay attention to reasonably judge the harmfulness of the borrower's behavior from the following aspects: whether the fraudulent means adopted by the borrower are clearly fictitious facts or conceal the truth, whether they conspire with or are instructed by bank staff, whether they illegally affect bank lending decisions, endanger the safety of credit funds, and whether they cause significant losses, Not demanding of borrowers such as enterprises. "For borrowers who violate regulations during the loan process due to production and operation needs, but do not cause actual losses, they should not generally be treated as crimes.". Whether judicial personnel or defense lawyers, we should summarize practical experience, seek theoretical support, and correctly apply legal norms in various ways, striving to handle each case in accordance with the expectations of the people, adapt to the reality of social life development, and reflect the essence of fairness and justice.

Related recommendations

- Tax lawyers review the draft of the revised Tax Collection and Administration Law for soliciting opinions

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 3): "Height Limit" Single Release Mechanism

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 2): Grace Period System

- Interpretation of the Management Measures for Compliance Audit of Personal Information Protection - Feeling the Rhythm and Rhythm of Regulatory Flow