Overseas Financing Transaction Series | Interest Rate Chapter: Written on the eve of LIBOR interest rate conversion

In the past few decades, Interbank Offered Rate (LIBOR) has been the cornerstone of the global financial system, providing a reference for pricing various financial agreements, the most important of which is the London Interbank Offered Rate (LIBOR). By 2018, when the global market decided to shift from LIBOR, there were approximately $400 trillion worth of financial agreements around the world that were linked to LIBOR pricing (financial agreements included everything from derivative financial agreements to loan agreements and interest rate agreements). Currently, major global markets, including the Hong Kong Monetary Authority, the Bank of England, and the Federal Reserve Bank of New York, have made it clear that no LIBOR interest rate agreement can be entered into after December 31, 2021. Certain dollar denominated LIBOR agreements are valid until June 30, 2023, but are limited to legacy contracts. According to the "Best Practices for Completing the LIBOR Transition from LIBOR" and other guidance documents published by the Alternative Reference Rates Committee (ARRC), it is no longer recommended to use US dollar LIBOR as the reference interest rate for new commercial loan agreements signed after June 30, 2021; If market participants still insist on using US dollar LIBOR in loan agreements, they need to at least ensure the inclusion of fallback language, and ensure that there are other interest rate mechanisms that can replace LIBOR after the disappearance or loss of representativeness of US dollar LIBOR.

1、 The main reasons why the global market decided to shift from LIBOR

1. The natural flaws in the design of LIBOR interest rates lead to easy manipulation

LIBOR interest rates are calculated using non binding quotes reported by the panel bank and are not based on real transactions. In the description of "The Devil Trader", we can clearly see how quotation banks slap their heads and submit quotes to the Inter Bank Committee. Although there are different opinions in the industry on whether Barclays Bank utilizes the manipulated interest rate to make profits, whether this is the scandal and trigger that led to LIBOR's exit or not.

2. Significant decrease in interbank lending

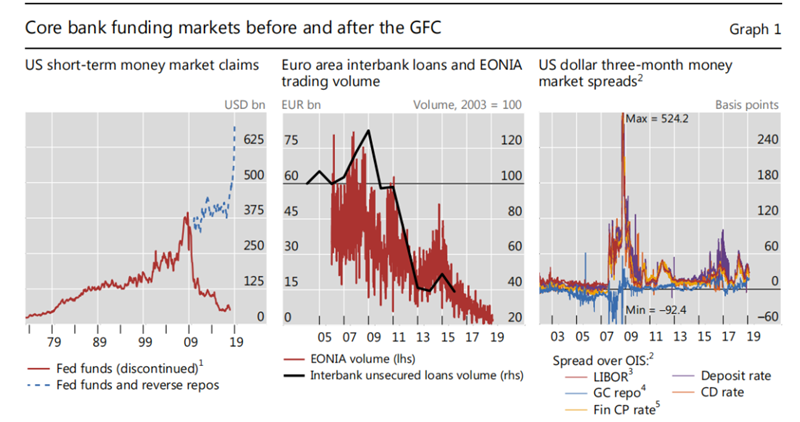

After the 2007 financial crisis, interbank lending activity in the interbank market significantly decreased, and the risk of unsecured interbank lending was repriced in accordance with new regulatory standards and higher balance sheet costs. As can be seen from the figure below, short-term US dollar lending, euro interbank lending, and US dollar three-month lending have all experienced significant declines since 2007, and have not been restored.

Source: Bloomberg website

3. LIBOR is increasingly losing accuracy

Especially after the 2007 financial crisis, the pricing of the money market has become increasingly sensitive to liquidity and credit risk. The trend of banks to significantly reduce the amount of financing disbanded in the interbank market and turn more to non bank financial institutions to obtain financing has led to a growing distinction between risk-free interest rates and interest rate standards that are extremely sensitive to credit and liquidity, such as LIBOR.

In addition to these changes in the money market, if we look at the futures and derivatives markets, we can see that over the past decade, standardized OTC operations have increasingly shifted to positions in OTC derivatives with collateral. Therefore, for swaps or other derivatives, they have shifted from LIBOR interest rates to OIS interest rates.

In summary, the institutional changes in the money market after the financial crisis have driven the market to leave LIBOR to seek new alternative interest rate benchmarks. We can see that new interest rate benchmarks have been launched in various major currency markets to replace LIBOR.

2、 Overview of Legal Work on Interest Rate Conversion

For legacy LIBOR priced financial agreements, as well as for derivatives and swaps, the International Swaps and Derivatives Association (ISDA) has vigorously led and promoted the conversion of relevant financial agreements to alternative interest rates. Currently, the focus of interest rate conversion work is on loan agreements in the huge banking market. Due to the COVID-19 and various reasons, the market failed to complete the interest rate conversion according to the schedule recommended by ARRC, but all participants were actively promoting the trend and work of LIBOR interest rate conversion. Loan agreements in major markets are being converted to new Risk Free Rates (RFRs). Considering that loan agreements are mainly confirmed through communication between lenders and borrowers, the interest rate conversion process of loan agreements is more complex than that of swap and derivative agreements. We divide the legal work on interest rate conversion into three main aspects:

(1) Review of the original loan agreement

The primary task in promoting interest rate conversion should be to review and sort out the provisions of the existing LIBOR pricing financing documents, and assess the extent and scope of possible legal risks.

1. Relevant provisions of the original agreement on amendments and supplements to the agreement

Considering that the LIBOR pricing mechanism is about to end, the standard loan agreement templates of Loan Market Association and Asia Pacific Loan Market Association have been revised and introduced with the "replacement of screen rate" clause since 2014. The main purpose of this clause is that when the original interest rate pricing mechanism (such as LIBOR) of the relevant contract no longer exists or is not applicable, the lending bank can choose to use the replacement benchmark as the new interest rate pricing mechanism. However, the scope and threshold of use of this clause still need to be negotiated and confirmed with the lender after review.

2. The impact of amendments to the original agreement on ancillary agreements such as security agreements

If there is a guarantee for relevant financing, the modification or substitution of the interest rate mechanism of the financing contract is likely to constitute a significant modification and have a negative impact on the effectiveness and stability of the guarantee, which is also one of the legal risk issues that the relevant lending bank needs to consider.

(2) Negotiation and determination of terms for interest rate conversion

In response to the current interest rate conversion, major markets have introduced their own alternative interest rates. The Secured Overnight Financing Rate (SOFR) is a recommended alternative to the US dollar LIBOR, which is mainly promoted by the Federal Reserve and has formed a certain influence in the international financial market. We take SOFR as an example to illustrate the following important aspects that need to be considered in determining new interest rates for US dollar loans:

1.Interest rate methodology

SOFR is the overnight repo interest rate for treasury bond as collateral. Since there is no loss due to default and the credit risk is low, there are two main problems for SOFR to replace LIBOR:

(1) SOFR is an overnight interest rate that requires calculating the term interest rate within tenor by selecting either back looking or forward looking;

(2) SOFR is an overnight interest rate and is not a suitable option for commercial term loans. It is necessary to calculate the required one month, three month, and six month term interest rates (Combined SOFR) based on the determined interest rate method;

(3) The SOFR interest rate needs to be adjusted for risk spreads to ultimately be approximately equal to the pricing of the LIBOR interest rate. Article 2 below will be detailed.

2.credit adjustment spread,CAS

Credit Adjustment Spread, which reflects the loan term premium and credit premium on an RFR basis. For example, the US dollar LIBOR Fallback protocol released by ISDA uses the California difference constant of the historical average of SOFR. We need to determine the following arrangements related to CAS and write them into the agreement during the negotiation:

(1) Calculation method

(2) One-time calculation or recalculation at the beginning of each interest period

(3) Is the interest margin the same with different lengths of interest periods

(4) Can interest margin be negative

However, the greater risk of this approach is that when the banking system faces systemic risks, LIBOR assets will not be able to obtain the high returns of the previous LIBOR era, because in this scenario, the risk-free interest rate will follow the downward trend of the central bank interest rate, making LIBOR assets high-risk assets. However, in general, this part of work will be mainly calculated and determined by colleagues from the bank structure. The main work of lawyers is to fully understand the mechanism of interest rate conversion and accurately write it into the loan supplementary agreement.

3.break cost

Another difficulty in the legal work of interest rate conversion is that the risk-free interest rate benchmark cannot accurately reflect the lender's marginal cost. So. If the borrower decides to prepay, the interest margin loss under the LIBOR mechanism can be determined by determining the prepayment date, but the interest margin loss using an alternative mechanism may face uncertainty. As an overnight interest rate, SOFR is calculated on a daily basis. Theoretically, the financing cost is not based on a specific time unit, so there are valid negotiating reasons for lenders to deny the loss of bank spreads. Therefore, we expect that the negotiations on break cost will also be the focus of interest rate conversion.

4.market disruption

Considering that the market disruption event clause has been specified in detail in the LIBOR agreement, we plan to adopt the same clauses as LIBOR in the interest rate conversion work. After negotiation and communication with the lender, we will determine. Taking the US dollar SOFR as an example, we plan to use the relevant interest rate published by the New York Federal Reserve first, and finally cover it with the Cost of Funds principle.

(3) Regulation

At the same time, the following factors need to be considered in the supplementary agreement signed for interest rate conversion:

1. Pay attention to possible approval/filing updates by the National Development and Reform Commission and the SAFE due to changes in interest rates.

At the host country level, pay attention to the corresponding reporting and updating requirements of the host country.

On the eve of the current interest rate conversion, the prevailing terms will gradually emerge through full communication and market testing between lenders and borrowers. For example, in the communication between the practitioners of foreign banks in the euro area and the author, they are also looking forward to the implementation of a dual track system in some sense. We will wait and see whether it is feasible.

Related recommendations

- Can I get a tax refund if my bet fails? ——Comment on the case of Wang and Shanghai Taxation Bureau's refusal to refund taxes

- How shareholders can withdraw their shares Series 2: Company merger, division, or transfer of major assets

- From the Xiao incident to see the complex impact of spousal reporting - a double-edged sword in divorce proceedings

- Analysis of Criminal Legal Risks in Low altitude Economy and Preliminary Exploration of the Road to Criminal Compliance in Low altitude Economy