Interpretation of the Key Points of the Amendment to the Anti monopoly Law

On June 24, 2022, the 35th meeting of the 13th Standing Committee of the National People's Congress passed the decision of the Standing Committee of the National People's Congress on revising the "Anti monopoly Law of the People's Republic of China", and the newly revised "Anti monopoly Law" will officially enter into force on August 1, 2022. The newly revised "Anti monopoly Law" is the first large-scale revision of the "Anti monopoly Law" that came into effect in 2008. From the perspective of content, the newly revised "Anti monopoly Law" is a comprehensive revision based on the experience of the past 14 years of anti monopoly law enforcement. The revised content is very rich, including not only the four pillars of the anti monopoly law, namely, concentration of operators, monopoly agreements, abuse of market dominance, and administrative monopoly, but also aspects such as anti monopoly administrative investigation and legal liability. The following is an explanation of the key issues involved in the newly revised "Anti monopoly Law".

1、 Concentration of operators

First, the impact on transactions that do not meet the reporting standards

According to Paragraph 2 of Article 26 of the newly revised "Anti monopoly Law", if a concentration of business operators fails to meet the reporting standards set by the State Council, but there is evidence that the concentration of business operators has or may have the effect of eliminating or restricting competition, the anti monopoly law enforcement authority of the State Council may require the business operators to report. This paragraph grants the State Administration of Market Supervision the right to investigate transactions that do not meet the reporting standards but may restrict or eliminate competition. Therefore, from a legal perspective, the State Administration of Market Supervision still has the power to investigate concentrations that do not meet the antitrust reporting standards, which is a bottom line clause. Although up to now, there have been no cases investigated for failing to meet the antitrust reporting standards, this backdoor clause is not meaningless.

On March 9, 2017, the Bundestag approved the Ninth Amendment to the Anti Restriction of Competition Law. The Ninth Amendment introduced a new reporting standard, transaction price. Similar to China's current antitrust reporting standard, Germany's revised antitrust reporting standard only relied on turnover as the basis for determining whether a declaration was required. The purpose of Germany's introduction of the new reporting standards is to ensure that those acquiring start-ups that may generate significant competitive concerns in the future, especially those related to the Internet, should also be subject to the review of Germany's merger control system when they have no or little turnover at the time of the transaction. Therefore, the Ninth Amendment introduced the consideration of transaction price on the basis of turnover, making the acquisition of target companies with small turnover also fall within the scope of review by the German Federal Cartel Office even if they reach a certain level of transaction price. We understand that the newly revised Paragraph 2 of Article 26 of the Anti monopoly Law serves as a cover clause, providing a basis for the enforcement of anti monopoly regulations by the State Administration of Market Supervision against start-ups that do not meet the reporting standards but can generate significant competitive concerns, especially those related to the Internet.

Second, the stop the clock system ("stop the clock")

Article 32 of the newly revised "Anti monopoly Law" stipulates a suspension system for the examination of concentration of undertakings. According to the current anti monopoly law, the first stage of anti monopoly review is 30 days, calculated from the date of filing, the second stage is 90 days in total, and the third stage is 60 days; For those cases that are tried according to ordinary procedures, especially those that may generate significant competitive concerns, the review period of the above 180 clauses is often insufficient. Therefore, in the actual case processing process, many applicants choose to withdraw their application before the review deadline expires, and then re file to avoid the 180 day review deadline.

In order to provide the State Administration of Market Supervision with sufficient and reasonable time for antitrust review, the newly revised "Anti monopoly Law" introduces an anti monopoly review suspension system, which means that the review time is not included in the above 180 day review period in the following circumstances: 1. The operator fails to submit documents and materials as required, resulting in the inability of the review process; 2. The occurrence of new situations and facts that have a significant impact on the review of concentration of business operators, which, without verification, will lead to the inability of the review process; 3. It is necessary to further evaluate the restrictive conditions attached to the concentration of business operators, and the business operators submit a request for suspension. In future practical operations, how long will the "stop watch" period last, whether the situation of calculating the review period during the stop watch period has not been eliminated, and whether the stop watch status has continued. These issues need to be further clarified by the State Administration of Market Supervision in practice.

Third, higher fines

The newly revised "Anti monopoly Law" adds a new Article 58, which deals with penalties related to concentration of business operators. According to the current anti monopoly law, the maximum fine for concentrations that should be declared but are implemented without declaration and those that are implemented without approval after declaration is 500000 yuan. In view of this small punitive measure, many transactions that should be filed with antitrust declarations have not been filed with law enforcement agencies in accordance with the law, or have chosen to implement a portion of the transaction before filing an antitrust declaration with law enforcement agencies. For example, in the case of Canon's acquisition of Toshiba Medical, Canon chose to file an antitrust declaration with the antitrust law enforcement agency after completing the first step of the transaction. At that time, the Ministry of Commerce finally imposed an administrative penalty of 300000 yuan on the declarant Canon, while in the same case, the European Commission imposed a fine of 28 million euros on the acquirer Canon in June 2019, with the difference between the two fines exceeding 700 times.

The newly revised "Anti monopoly Law" has changed this situation by adding Article 58. According to Article 58, if operators implement concentration in violation of the provisions of this Law and have or may have the effect of eliminating or restricting competition, the anti monopoly law enforcement agency of the State Council shall order them to stop the implementation of concentration, dispose of shares or assets within a time limit, transfer business within a time limit, and take other necessary measures to restore the state before concentration, Impose a fine of not more than 10% of the sales volume of the previous year; "If it does not have the effect of eliminating or restricting competition, it shall be fined not more than 5 million yuan.".

Therefore, for "preemptive" cases, ordinary cases that do not have the effect of eliminating or restricting competition will be fined up to 5 million yuan. For cases that have or may have the effect of eliminating or restricting competition, the maximum amount of fines can reach 10% of the operator's sales in the previous year. This new regulation is also very similar to the EU legislation on preemption [2], except that the EU legislation clearly stipulates that the calculation base of preemption fines is the aggregate turnover of the operator in the previous accounting year, and there is no distinction between the exclusions Cases that have the effect of restricting competition and do not have the effect of excluding or restricting competition. As for Article 58 of the newly revised "Anti monopoly Law", whether the sales volume of the operator in the previous year refers to the total turnover of the operator or the turnover within the relevant geographical market scope of the operator needs to be further clarified in subsequent cases.

Given that the draft greatly increases the amount of fines for potential preemptive transactions, and the economic costs of preemptive transactions will be higher. Therefore, for concentrations that meet the declaration standards, we recommend that an antitrust declaration be filed with the State Administration of Market Supervision before implementation.

2、 Monopoly agreement

First, vertical monopoly agreements

Article 18 of the newly revised "Anti monopoly Law" deals with the issue of vertical monopoly agreements. On the basis of the original provisions, two paragraphs have been added, namely, paragraphs 2 and 3 of Article 18. Agreements specified in the first and second paragraphs of the preceding paragraph, if the operator can prove that they do not have the effect of excluding or restricting competition, shall not be prohibited; "If an operator can prove that its market share in the relevant market is lower than the standards prescribed by the antimonopoly law enforcement agency of the State Council, and meets other conditions prescribed by the antimonopoly law enforcement agency of the State Council, it shall not be prohibited.".

The two new paragraphs make significant changes to the vertical monopoly agreement. First of all, the introduction of paragraph 2 of Article 18 indicates that legislators have taken a different position from horizontal monopoly prices in dealing with the legality of fixed resale prices (RPM), that is, RPM will no longer apply its own illegality principle in the future, but more apply the effect limitation principle. This legislative change provides greater operational space for enterprises to implement RPM in the future, as well as higher compliance requirements for internal antitrust compliance; From past cases, RPM has accounted for a large proportion of anti monopoly investigations by the State Administration of Market Supervision. We will also wait to see whether this trend has significantly changed after the new law takes effect.

Secondly, Article 18 (3) of the new law introduces the Safe Harbor Rule and applies it to vertical monopoly agreements. Given that horizontal monopoly agreements are largely core cartels and have strong anti-competitive characteristics, legislators have not applied the safe harbor rule to the issue of horizontal monopoly agreements. The Safe Harbor Rule is also a breakthrough in this antitrust legislation. Vertical monopoly agreements have been given greater implementation space in practical operations, and enterprises have clearer standards and guidance on vertical monopoly agreements, which is conducive to reducing compliance risks. The basis for the operation of safe harbor rules is market share. When an enterprise's goods fall below the standards specified by the State Administration of Market Supervision, the application of safe harbor rules will be triggered, and market share is the result of relevant market definition. Therefore, different relevant market definition methods often lead to different market share data, and differences in data may directly lead to the issue of whether the safe harbor rules can be applied. Therefore, in the application of the Safe Harbor Rules, the issue of defining the relevant market is crucial. It is recommended that enterprises pay more attention to this issue.

Article 19 of the new law stipulates that operators shall not organize other operators to reach a monopoly agreement or provide substantive assistance for other operators to reach a monopoly agreement. This provision is also one of the highlights of the new law, introducing the hub and spoke agreement into the legislation. Therefore, in practical operations, if an upstream supplier helps downstream distributors reach a monopoly agreement under the organization of the upstream supplier, the upstream supplier may be punished.

Second, higher fines

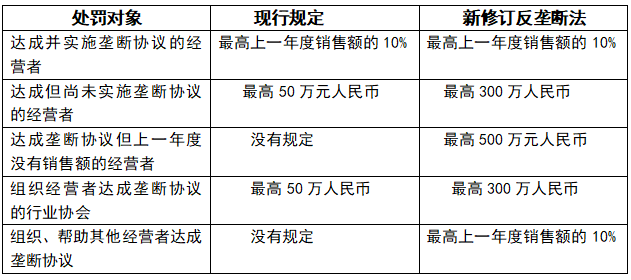

According to Article 56 of the new law, for monopoly agreements, legislators have introduced a higher penalty amount than the current anti monopoly law, as follows:

Table: Penalty provisions related to monopoly agreements

In addition, the new law also stipulates the legal liability of individuals involved in monopoly agreements, which is also one of the breakthroughs in this legislation. According to the first paragraph of Article 56 of the new law, the legal representative, principal responsible person, and directly responsible person of an operator who are personally responsible for concluding a monopoly agreement can be fined not more than 1 million yuan. Therefore, it is not only the enterprises involved but also the individuals who are personally responsible for reaching the monopoly agreement that will be punished under the monopoly agreement. This new provision will also become one of the key concerns of internal compliance of enterprises.

3、 Abuse of market dominance

Regarding the abuse of market dominance, the newly revised "Anti monopoly Law" does not contain much revised content, mainly adding Article 20, paragraph 2: Operators with market dominance shall not use data, algorithms, technology, platform rules, etc. to engage in the abuse of market dominance as specified in the preceding paragraph. This new provision reflects the focus of antitrust legislation on the platform economy and the Internet.

The current anti monopoly law on the abuse of market dominance is formulated under the traditional supply conditions of non digital goods and services. With the rapid development of the digital economy, it is clearly difficult to meet the current legislative needs. Compared to other industries, the determination of market dominance in the Internet field is more complex and has its own industry specificity. Therefore, the factor of market share is not necessarily the most critical factor in determining the existence of market dominance in the Internet field. For example, in the 360 v. Tencent monopoly case, when Tencent's market share in both the personal computer and mobile instant messaging services markets exceeded 80%, the Supreme Court still determined that Tencent did not have a dominant market position. The Supreme Court believed that the determination of market dominance was the result of a comprehensive evaluation of multiple factors and required case analysis. Therefore, for the Internet industry, the determination of its market dominance requires consideration of various factors, including network effects, economies of scale, lock-in effects, and the ability to master and process relevant data. Data and algorithms, technology, and platform rules are also one of the ways in which platform enterprises implement abusive behavior.

4、 Criminal responsibility

China's current anti monopoly law does not provide for criminal liability for monopolistic acts. Article 57 of the newly revised "Anti monopoly Law" stipulates that anyone who violates the provisions of this Law and constitutes a crime shall be investigated for criminal responsibility according to law. Therefore, the newly revised "Anti monopoly Law" for the first time introduced the criminal liability for monopolistic acts through legislation, and there is a possibility that company executives and employees may be sentenced for monopolistic acts. However, the newly revised "Anti monopoly Law" does not regulate what criminal liability is triggered by monopolistic behavior, so this part needs to be further defined and explained by the Criminal Law Amendment.

The United States' antitrust law has long criminalized monopolistic behavior. In terms of the European Union's competition law, the European Commission has no right to impose criminal penalties for monopolistic behavior because EU member states have not passed legislation authorizing the Commission to impose criminal penalties. However, EU member states have discretion on whether to impose criminal penalties for monopolistic behavior. In the case of the United Kingdom after Brexit, cartel actions may result in imprisonment or fines under British competition law. Therefore, the introduction of criminal liability in the newly revised "Anti monopoly Law" is in line with the trend of world anti monopoly law enforcement.

References and Notes:

[1] See: https://www.gesetze-im-internet.de/gwb/BJNR252110998.html

[2]“The Commission may by decision impose fines not exceeding 10% of the aggregate turnover of the undertaking concerned.”

Related recommendations

- Tax lawyers review the draft of the revised Tax Collection and Administration Law for soliciting opinions

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 3): "Height Limit" Single Release Mechanism

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 2): Grace Period System

- Interpretation of the Management Measures for Compliance Audit of Personal Information Protection - Feeling the Rhythm and Rhythm of Regulatory Flow