"Although it's too late, it's bound to arrive!"!

At 19:55 p.m. on June 2, 2022, the China Securities Investment Fund Association (hereinafter referred to as the Association) released the Notice on Matters Related to the Registration and Filing of Private Fund Managers (ZJXZ [2022] No. 203, hereinafter referred to as the Notice on Registration and Filing) on its official WeChat official account. The Registration and Filing Work Notice has issued a total of four documents. On the one hand, it updated the "List of Application Materials for Registration of Private Fund Managers" (hereinafter referred to as the 2022 List or the 2020 List, which is divided into two categories of managers: securities and equity) issued in 2020, and on the other hand, it has newly issued the "Points of Attention for Filing of Private Investment Funds" (hereinafter referred to as the "Points of Attention for Filing", which is divided into two categories of funds: securities and equity). Given that the "Registration and Filing Work Notice" is an important regulatory policy document of the Association in recent years, major law firms have conducted many interpretations and explanations of the document No. 203. "A good meal is never too late. After participating in the training organized by the association to further master and clarify regulatory standards, we conducted a practical interpretation of the specific content of this change, combined with market operations, and provided relevant analysis opinions. We hope to be helpful to the compliance management of private fund managers.".

Due to space constraints, our interpretation will be divided into three parts: a list of registration application materials, key points of attention for securities fund filing, and key points of attention for equity fund filing. This article will first analyze the registration application material list.

1、 Sorting out the Association's recent regulatory policies

Since the outbreak, the Association's regulatory policies have been improved and developed in response to the new situation, mainly aimed at improving regulatory efficiency and improving regulatory effectiveness in the following three aspects:

1. Improve the transparency of work

On February 1, 2020, the Association issued the "Notice on Relevant Work Arrangements for Registration and Filing of Private Equity Funds during the Epidemic Prevention and Control Period". On May 26, 2022, based on the previous notice, the Association issued the "Q&A on Optimizing Private Fund Registration and Filing Related Services during the Epidemic Period", which announced the optimization measures for private fund registration and filing related services during the epidemic period.

2. Publish registration case publicity and clarify regulatory standards in case form

In September 2021, the Association established a private investment fund filing case publicity mechanism and issued the first batch of private investment fund filing cases publicity. The Association has rejected the filing of employee equity investment platforms as private equity funds, general limited partnership enterprises after transformation as private equity funds, and employee stock ownership plans as private equity funds.

On the evening of April 15, 2022, the Association released the Notice on Publishing Private Fund Manager Registration Cases on its official WeChat official account, which was the first time to publish case publicity in the manager's registration business, summarized and sorted out the first batch of suspended and non registered cases and made them public;

On the evening of April 18, 2022, the Association issued the "Notice on Publishing Private Equity Fund Filing Cases", which is the second time that the Association has released private equity fund filing cases. The second batch of cases includes six situations, including providing "pull page" filing materials, filing "shell funds," non-compliance with the raising and supervision agreement, weak association between the general partner and the manager, mismatching of the fund investment period, and the manager's transfer of investment decision-making power becoming a "channel.".

3. Optimize the registration process

On September 29, 2021, the Association issued the "Notice on Adjusting the Filling and Reporting of Major Changes to Private Fund Managers" on the asset management business comprehensive reporting platform (hereinafter referred to as the "Ambers system"). Based on industry feedback and business practices, the Association optimized the functions of significant changes to managers and updates to manager information in the Ambers system, Adjust some fields of the manager's major event change module to the manager's information update module, adjust some major event changes to information updates, and cancel the limit on the number of times the manager's information is updated to facilitate the timely submission of information by the manager. It can be seen that within the established regulatory system and the regulatory scope covering the entire chain of private placement business, the Association has been providing feedback and improving work based on practical feedback and practical work.

2、 Sorting out the context of this modification

Against the aforementioned background, the Association collected industry opinions and feedback, and found and summarized the following situations in the registration application materials list of Version 2020 in regulatory practice:

● Some material requirements need to be integrated, mainly reflected in commitment letters distributed on different tabs and requiring multiple signatures. Industry feedback requires too much detail in material details.

Some material requirements need to be detailed, mainly reflected in the investment ability materials of senior executives and materials matching their performance ability. The 2020 version of the list does not specify specific matters such as the size and duration of their managed funds.

● Some material requirements need to be improved. Due to the rapid development and change of private placement practices, the Association has discovered new situations and problems in the industry during supervision, mainly reflected in the establishment of private placement by personnel who have been punished in financial institutions such as banks and securities companies, or by sales personnel in the asset management industry who have no professional experience in investment.

In response to the above specific circumstances, the Association continued to use the original version of the 2022 list, modified specific provisions, and made the following four major changes:

1. Merge the four commitment letters and unify them under the registration commitment letter.

Refine and strengthen material requirements for professional competence. Strengthen professional requirements from both positive and negative conditions, and strengthen the requirements for the applicant institution's ability to perform its duties. For example, for securities investment funds, emphasis is placed on information obligations and clear requirements for extending the length of time in securities industry.

3. Strengthen the stability requirements for applicants. Guide the applicant institution to establish a long-term incentive and restraint mechanism, and require the provision of personnel stability materials.

Strengthen risk prevention, fill in the information of investors and actual controllers, and take regulatory measures to consult relevant departments for major project risks.

3、 Analysis of the content of this change

(1) Registration Commitment Letter on the Basic Information Tab of the Institution

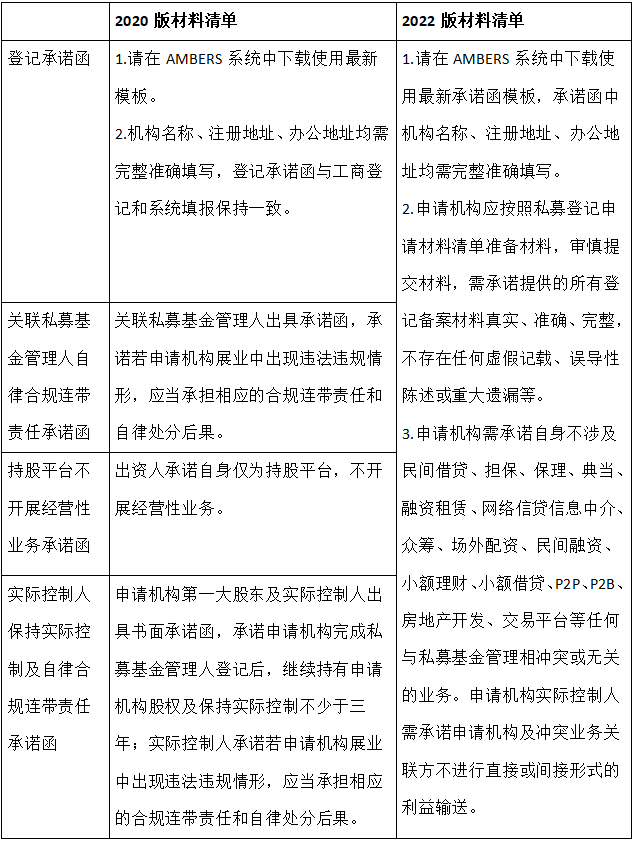

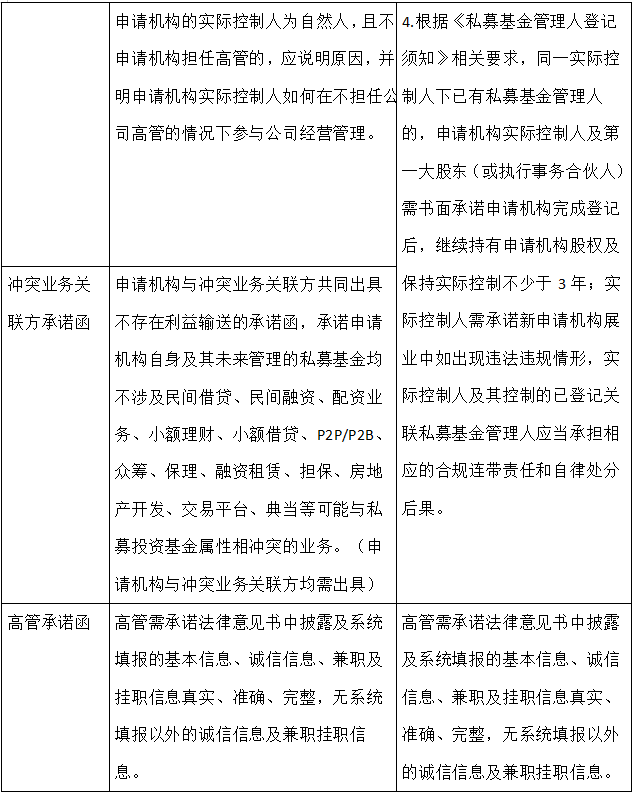

In the 2020 version of the list, a total of 6 commitment letters need to be submitted by the applicant, distributed on different tabs and signed by different responsible entities. This deletion and merger will retain two commitment letters, namely, the registration commitment letter and the senior management commitment letter, respectively on the basic information tab and the senior management personnel tab of the institution. To facilitate a direct understanding of the revised criteria of the Association, we compare the requirements of the 2020 commitment letter with the requirements of the 2020 commitment letter as follows:

The regulatory points to be noted regarding the commitment letter in this revision are:

1. Conflict and unrelated business supervision

(1) Definition and regulation of "conflict and unrelated business"

Private equity funds engaged in businesses that conflict with the attributes of private equity funds have always been the focus of regulatory oversight by the Association. We have summarized the regulatory caliber of the Association as follows:

According to the "Answers to the Registration and Filing of Private Equity Funds (VII)", the association replied, "For application agencies concurrently engaged in private lending, private financing, capital allocation business, microfinance, micro lending, P2P/P2B, crowdfunding, factoring, guarantees, real estate development, trading platforms, and other businesses, these businesses conflict with the attributes of private equity funds and are prone to mislead investors.". "In order to prevent risks, the China Fund Industry Association will not register the above-mentioned institutions engaged in conflicts with private fund business.".

In the 2020 version of the list, the regulatory criteria of the Association are that the applicant institution itself and its future managed private equity funds "do not involve private lending, private financing, capital allocation business, microfinance, microfinance, P2P/P2B, crowdfunding, factoring, financial leasing, guarantees, real estate development, trading platforms, pawns, and other businesses that may conflict with the attributes of private equity investment funds.". Related parties engaged in conflict businesses such as small loans, financial leasing, commercial factoring, financial guarantees, Internet finance, and pawnbroking (except for real estate) need to provide formal permission documents from relevant competent authorities.

Article 4 of the "Provisions on Strengthening the Supervision of Private Equity Investment Funds" (hereinafter referred to as the "Provisions") issued by the China Securities Regulatory Commission on December 30, 2020 stipulates that private equity fund managers shall not directly or indirectly engage in private lending, guarantees, factoring, pawning, financing leases, online lending information intermediaries, crowdfunding, over-the-counter funding, or any other business that conflicts with or is unrelated to the management of private equity funds.

The list in version D.2022 expands the scope of supervision to the extent that the applicant institution shall not directly or indirectly engage in "private lending, guarantees, factoring, pawning, financial leasing, online credit information intermediary, crowdfunding, over-the-counter funding, private financing, microfinance, microfinance, P2P, P2B, real estate development, trading platforms, and any other business that conflicts or is unrelated to private fund management.". The related parties of the applicant institution engaged in conflict businesses such as small loans, financial leasing, commercial factoring, financial guarantees, internet finance, pawnbroking, etc., need to provide formal permission documents from relevant competent authorities.

As can be seen from the changes in the above regulatory rules, the Association clarified the scope of conflict and unrelated business in the 2022 edition, integrating the specific content of "Question Answers VII" and "Several Provisions.". It is worth noting that in the current regulatory framework, unrelated businesses do not include fund sales.

(2) Commitment subject and obligor

The commitment subjects of the conflict business commitment letter in the 2020 list are the applicant institution and the related parties of the conflict business. In order to reduce the administrative workload of the applicant institution, the commitment subject of the conflicting business commitment letter in the 2022 list has been changed to the applicant institution. The actual controller of the applicant institution generally promises that the applicant institution and related parties of the conflict business will not directly or indirectly transfer benefits, although the substantive responsible person remains the actual controller and related parties.

2. Group operation supervision

(1) Responsibility subject and commitment subject

In the 2020 version of the list, the applicant institution with group operation needs to issue a separate commitment letter, promising that if the actual controller has violations of laws and regulations in the exhibition industry, the related parties will bear joint liability, and all related parties need to affix their seals. In the 2022 list, in order to reduce the burden, the actual controller summarizes the commitment in the registration commitment letter. The responsible party has not changed, just for the convenience of the applicant institution, and has been changed to a general commitment by the actual controller.

(2) Rationality Statement and Compliance Risk Control Arrangements

The Association's requirements for reasonableness statements are new to the 2020 version of the list, requiring applicants to explain "the purpose and reasonableness of establishing multiple fund managers of the same type, how to distinguish business directions, and how to avoid horizontal competition.". Last year, Article 5 of the Several Regulations further clarified this, requiring that "if the same entity or individual controls or actually controls two or more private fund managers, it should have the rationality and necessity to establish multiple private fund managers, comprehensively, timely, and accurately disclose the business division of each private fund manager, and establish a complete compliance risk control system.". On the basis of the 2020 version of the list and in combination with the deepening of the "Several Regulations", the 2022 version of the list has deepened the explanation responsibilities required for group operation. The relevant instructions require the signature and seal of the actual controller to ensure that the actual controller of the private equity fund manager in a group operation can speak clearly, control well, and afford responsibility.

In general, the Association believes that the risk externalities and publicity of private fund managers operating in groups are relatively small, but the possibility and harmfulness of risks to group managers are greater, so it should pay more regulatory attention. The Association requires all managers of the Group to provide explanations based on the actual situation according to the Association's template, including the selection of risk control personnel, the robustness of financial operations, risk response mechanisms, and accountability mechanisms.

(2) Other relevant supporting documents

The tenth item of other relevant supporting documents has only been updated for securities funds: an explanation letter has been updated for the Ambers system of funds that engage in debt investment or provide debt investment business, or have previously engaged in debt investment.

(3) Concept of main contributors and relevant review standards

1. Main contributors and their obligations

This amendment adds the legal concept of major contributors and does not use the expression of shareholders because it considers the contributors of limited partnership fund managers. The main contributors have also been included in the scope of verification, and the following reviews have been conducted:

● Must not have engaged in or currently engage in conflict businesses (unrelated businesses are not mentioned here, and whether they can be engaged in unrelated businesses will be explained by the Association's subsequent cases);

● Conduct integrity information verification;

● The total contribution ratio of other contributors involved in conflict businesses shall not exceed 25%.

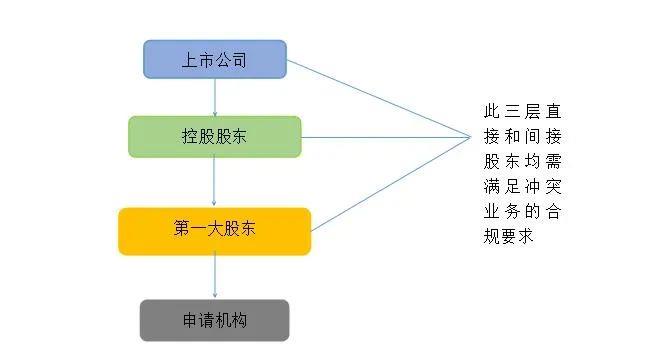

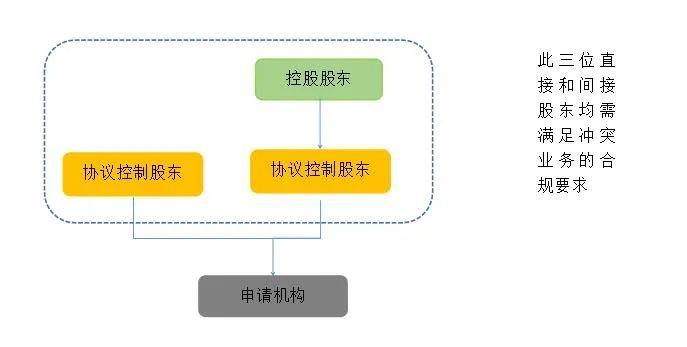

Penetration Verification Practice

The verification requirements for the 2022 version of the list need to clarify how to penetrate the verification and calculate the shareholding ratio of conflicting business contributors. We will provide detailed instructions on how to penetrate verification in accordance with the training spirit of the Association:

(1) Penetration verification of the actual controller

For limited partnership funds, the actual controller is identified by the general partner. There are two types of applicants for corporate fund managers:

① Through equity control:

② Controlled through entrustment or agreement:

(2) Verification of major contributors

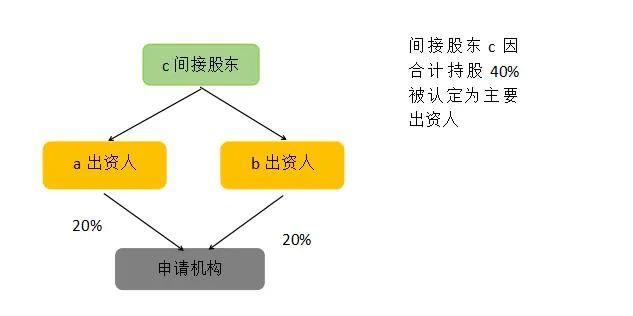

① The consolidated calculation of the equity penetration of the main contributors is shown in the following figure as an example:

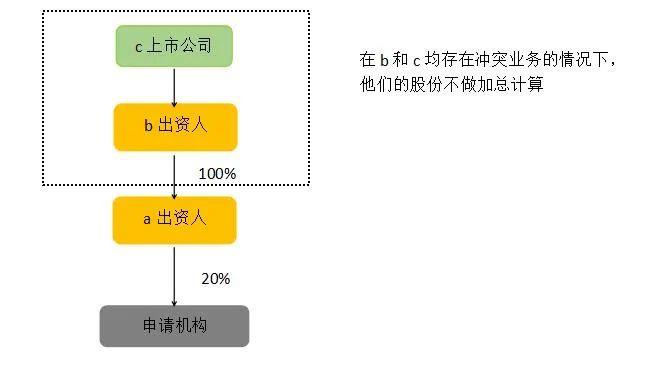

② However, if different shareholders have conflicting businesses, no aggregation calculation will be made. The following figure is an example:

3. Interval

The association found that individuals engaged in certain continuity of business during supervision, so the isolation of conflict business for natural persons is set at 5 years, requiring the actual controller and main contributor of the applicant institution, as well as senior executives, not to engage in conflict business within the past 5 years. Currently, there is no clear definition of "engaging", but the Association states that senior executives and general business personnel involved in conflict businesses are included in the scope of engagement, and clearly states that employees in real estate development business are not recommended to be funders or executives. The Association subsequently clarified the applicable situation through case publicity.

(4) Good faith information

1. Information submission subject

As mentioned in (III) 1 above, the 2022 version of the list adds the requirements for filling in the integrity information of major contributors and actual controllers.

2. Contents

In order to prevent private fund management from becoming a depression in the management of the financial industry, and prudently handle the registration business of fund managers, the following changes have been made to the filling content of integrity information this time:

(1) The 2020 version of the list mainly examines criminal, administrative, self-discipline measures or litigation related situations in the past three years. The 2022 version mainly adds property crimes such as corruption, bribery, misappropriation of property, or crimes against the socialist economic order, as well as crimes of deprivation of political rights, without setting a fixed period requirement, and requires filling in and reporting.

(2) In response to the penalties imposed by the Securities Regulatory Commission, market entry bans have been added, and they must be completed for three years before they can be declared. This is linked to the "Regulations on the Prohibition of Entry into the Securities Market" implemented by the Securities Regulatory Commission on June 1, 2021;

(3) The legal representatives and senior executives of institutions that have been deregistered or not registered by the Fund Industry Association, as well as the actual controllers and major contributors, need to fill in and report. We understand that fund managers that have been deregistered herein do not include institutions that have voluntarily cancelled their registration;

(4) The time frame for litigation and arbitration has been shortened from 3 years to the latest 1 year;

(5) In the past three years, those who have been included in the list of those who have been executed due to dishonesty, and those who have been included in the list but have been removed, should also be filled in and reported;

(6) For those who have serious public opinion or poor management, the Association can seek opinions from relevant departments or strengthen consultation.

(5) Investor Information

1. Subject qualification certification documents

In addition to the requirements of the 2022 version of the list, the regulatory framework of the "Question Answers 10" still applies, requiring foreign securities fund managers to provide overseas approval or license documents, and there are no similar requirements for foreign equity fund managers. For joint venture private fund managers, the proportion of foreign investors holding more than 25% of the shares is that of foreign private fund managers.

2. Education documents

According to practical feedback, this part of the requirements is too detailed. In the 2022 version, it is changed to only require the submission of the highest academic degree certificate.

3. Rationality of the architecture

(1) Rationality of equity structure: Changing from a prohibitive requirement not to set up a structure with more than three layers to a positive one should be concise and clear, and should not evade regulation. It is speculated that in practice, due to employee stock ownership plans or state-owned enterprise investment structures, there is an increasing number of application agencies with equity structures exceeding three layers, which has driven the Association to change its regulatory strategy.

(2) Removed the requirement that investors issue a commitment letter when they are local government financing platforms;

(3) Case 2 and Case 4 of the second batch of cases announced by the Association on April 15 can be used as practical applications of structural rationality.

4. Proof of capital contribution ability of the investor

The proof of capital contribution ability has always been the focus of association supervision, and associations prevent proxy holding through the inspection of capital contribution ability. This modification has strengthened the requirements for investment capacity and has been optimized based on industry opinions. In the future, the Association will introduce new regulatory requirements for investors who are obviously incompetent or have the potential to hold shares, such as newly graduated college students.

(6) Senior Management Tab Professional Competency Material Item

1. Senior management personnel's work experience and professional ability materials

The two core standards that the Association has been focusing on are professional competence review and funding capability certification. Here, the Association has also made significant changes to this item of professional competence materials. This is also one of the four major changes in this revision, which should be focused on. The Association divided the 2020 version of the investment management experience certification item into two parts: "work experience" and "professional competence materials", clarifying the scale requirements, appropriately lengthening the tenure requirements, clarifying the types of materials that are not acceptable, and clarifying practical operations. The requirements of the 2022 version of the checklist for the applicant institution on professional competence and performance certification are summarized as follows:

(1) Securities investment fund

A. Senior executives responsible for investment need to prepare traceable performance certification materials for more than two years, which do not emphasize continuity and can be calculated cumulatively;

B. This modification clearly no longer accepts personal investment performance as proof of professional competence, but its own funds do not include the funds of securities companies; The resignation audit report or the net custody value report of the private placement product, the fund contract, and the on-the-job certificate can be used as proof materials; For assets involving overseas investment, a translation should be provided, and lawyers should verify whether they are regulated by the country and provide relevant opinions;

C. The scale of private placement products managed is calculated on a per capita basis. For example, if an executive has managed 18 million private placement products with two other people, the corresponding management scale for this executive is 6 million.

D. Does not require an annualized positive return on assets under management.

(2) Equity investment fund

A. This modification clearly requires the submission of two investments in unlisted equity, mainly angel investments or early stage investments, excluding listed real debt or repurchase projects; In principle, the initial investment amount shall not be less than 10 million yuan;

B. Senior executives should play a leading role in investment, participate in due diligence and investment decision-making, and play a key role; Projects that participate as investors and cannot reflect their leading role will not be accepted; However, if FOF fund investment can prove to have played a leading role, the association can also accept it if it can prove to have played a leading role; The investment experience of government guided funds is also recognized by the government;

C. The initial investment amount is not the amount at the time of exit, nor does it refer to the registered capital, but rather the total investment amount entered into the registered capital including the capital reserve at the time of investment;

D. Proof that the investment amount of the project should not be less than 10 million yuan. If the total amount of two investments is insufficient, a third investment can be provided;

E. The supporting materials should fully reflect all aspects of the entire investment chain, from investment to industrial and commercial rights confirmation and project exit; The exit link is not mandatory; Everyone who participates in a link is recognized.

(7) Materials for personnel stability

This item is a new item in this revision, as the Association has found that many institutions have adopted personnel affiliation measures in order to meet the registration standards for private fund managers, resulting in corresponding risks. The Association specifically adds this item, but there are no mandatory requirements in this item:

1. Encourage shareholding in application institutions to mobilize the enthusiasm of professionals, but it is not mandatory;

2. Clarification of institutional arrangements and incentive arrangements is required to maintain the stability of the applicant institution and strengthen corporate governance and investor protection. However, there are no standards for what institutional arrangements or incentive arrangements are.

It is expected that the Association will strengthen regulatory measures for post event testing in the future, introduce regulatory measures for managers who frequently change or change senior executives after registration, and may introduce policies requiring new executives to provide corresponding materials.

4、 Transitional arrangements

The Registration Material List sets a transition period of three months, which is applicable to private fund manager applications and significant changes from September 3, 2022. However, the Association recommends that applicants submit materials in accordance with the 2022 version of the checklist during the transition period. "For those who have started to prepare their applications, prepare the materials and apply according to the new version.". If the application institution has submitted registration application materials or received rectification requirements from the association, there will be no requirements for the application materials, but rectification shall be carried out according to the requirements of the new version.

This revision continues the consistent requirements of the Association to strengthen the professional operation of fund managers, and reflects the development trend of mutual promotion and virtuous circle between supervision and practice. The Association is currently updating the relevant templates and entry points in the Amber system. We look forward to working with our fund industry colleagues to update the compliance operation of the registration of private fund managers in practice.

Related recommendations

- Can I get a tax refund if my bet fails? ——Comment on the case of Wang and Shanghai Taxation Bureau's refusal to refund taxes

- How shareholders can withdraw their shares Series 2: Company merger, division, or transfer of major assets

- From the Xiao incident to see the complex impact of spousal reporting - a double-edged sword in divorce proceedings

- Analysis of Criminal Legal Risks in Low altitude Economy and Preliminary Exploration of the Road to Criminal Compliance in Low altitude Economy