Analysis of the appropriateness, obligations and risk prevention of banking "sell-side institutions" in light of the Minutes of the Nine Citizens (1)

On November 8, 2019, the Notice of the Supreme People's Court on Printing and Distribution

The fifth part of the Minutes is "On the Trial of Disputes over the Protection of the Rights and Interests of Financial Consumers", which reiterates the appropriateness obligation of the "seller's institution" of financial products and provides specific guidance on its concept, applicable rules, responsible subjects, allocation of burden of proof, obligation to inform and explain, amount of damages, and reasons for exemption, etc., re-emphasizes the principle of "the seller is responsible, the buyer is responsible", and strengthens the protection of financial consumers from the perspective of trial guidance.

Coincidentally, before the promulgation of the Minutes of the Nine People, the author had the privilege of handling a dispute over a financial service contract between a financial consumer and a banking financial product distributor and successfully safeguarded the legitimate rights and interests of financial consumers in a non-litigation manner, and achieved the good effect of "full loss of principal and interest" of a banking financial product distributor.

The author will once again "refresh" the appropriateness obligations and risk prevention issues of "seller-side institutions" of financial products in the Minutes of the Nine People's Minutes in light of this practice.

1. The legal basis for the "suitability obligation" of bank-type seller-side institutions before the promulgation of the Minutes of the Nine People

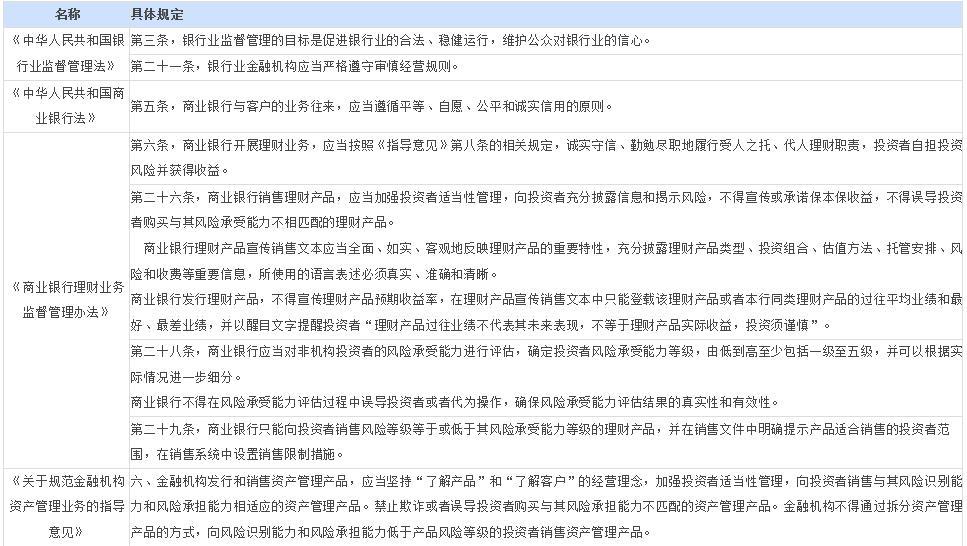

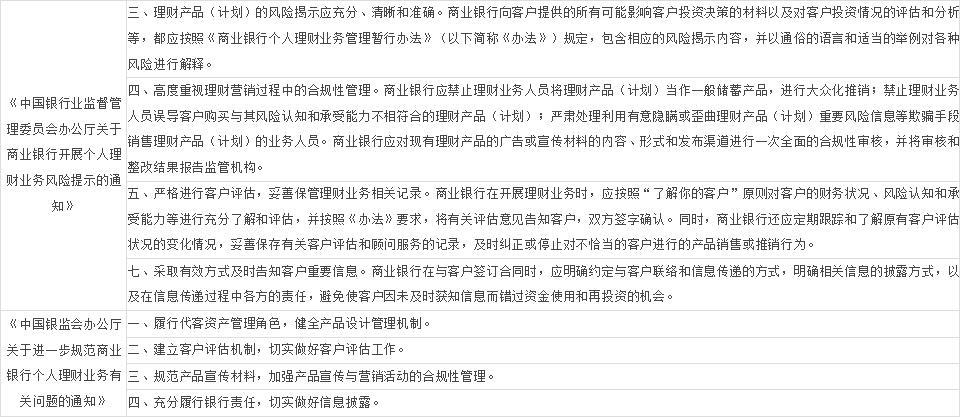

Prior to the promulgation of the Minutes of the Nine People, the relevant laws, regulations and guiding opinions on the "suitability obligation" of banking seller-side institutions were as follows:

Note: The Interim Measures for the Administration of Personal Wealth Management Business of Commercial Banks, the Guidelines for Risk Management of Personal Wealth Management Business of Commercial Banks, the Notice of the General Office of the China Banking Regulatory Commission on Risk Warnings for Commercial Banks Carrying out Personal Wealth Management Business and the Notice of the General Office of the China Banking Regulatory Commission on Issues Related to Further Regulating the Personal Wealth Management Business of Commercial Banks have been replaced by the Measures for the Supervision and Administration of Wealth Management Business of Commercial Banks in 2018, but due to the earlier occurrence of more disputes. There will still be an impact on existing cases.

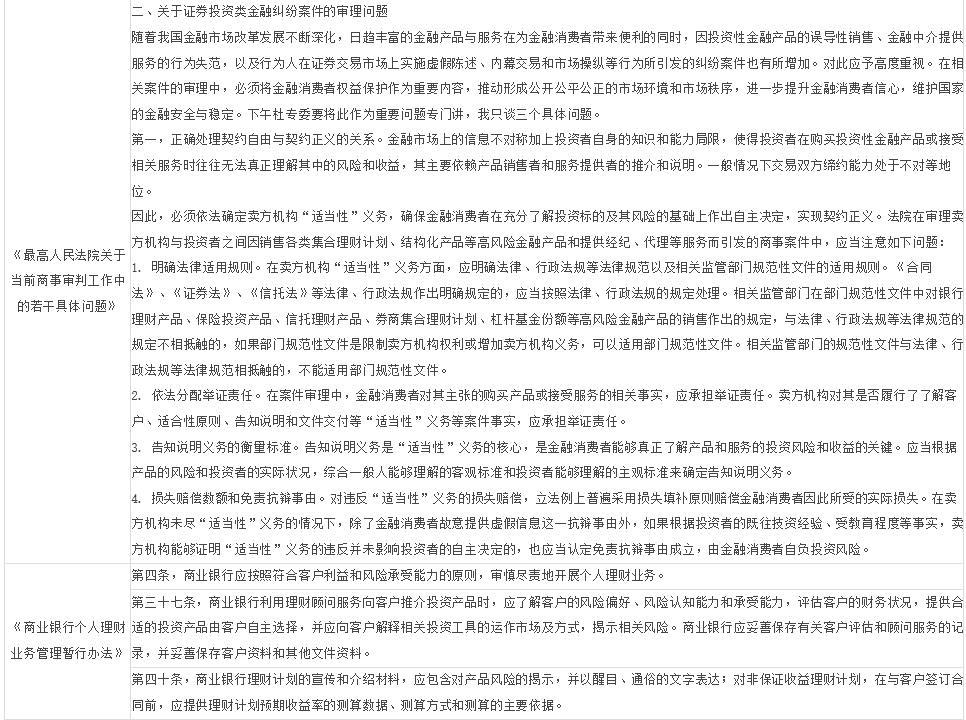

2. Judicial practice on the "appropriateness obligation" of bank-type seller-side institutions before the promulgation of the Minutes of the Nine People

At the time of the author's handling of the investment product dispute, the Minutes of the Nine People had not yet been promulgated and the property damage compensation dispute between Wang Xiang and Beijing Enji Branch of China Construction Bank Co., Ltd. had not yet aroused far-reaching discussion and impact, and there were still different judgments in judicial trial practice on the loss of wealth management products:

Category 1: The judgment is that the financial institution is not liable for compensation

(1) (2016) Hu 01 Min Zhong No. 3348 case

Reason for judgment: Financial consumers voluntarily purchase products with a risk level higher than their tolerance.

(2) (2017) Su 01 Min Zhong No. 2305 case

Reason for decision: The financial institution has fulfilled the appropriateness obligation and the financial consumer has no evidence to the contrary.

The second category: the judgment results in the financial institution to bear part of the liability for compensation

(1) (2016) Su 01 Min Zhong No. 1563 case

Reasons for the judgment: The financial institution failed to fulfill its obligation of reasonable warning, and there is a causal relationship between the wrongful act and the actual loss of the financial consumer.

(2) (2016) E01 Min Zhong No. 1177 case

Reason for judgment: The staff of financial institutions artificially reduced the purchase process of wealth management products and did not provide sufficient and clear risk warnings.

The third category: the judgment results in the financial institution to bear all the liability for compensation (mainly the principal or the loss of principal and interest)

(1) (2015) Hu Yi Zhongmin Liu (Shang) Zhong Zi No. 198 case

Reasons for the judgment: The financial institution has not assessed the financial consumer, the financial consumer is a prudent financial consumer, and the wealth management product is a non-principal-protected wealth management product, although the financial consumer signs to confirm that it is aware of the relevant risks during the contract process, it cannot exempt the financial institution from the obligation of appropriate promotion.

(2) (2017) Su 01 Min Zhong No. 10111 case

Reasons for adjudication: The risk disclosure obligation of financial institutions should be specific and substantive, not only formal meaning... Interest losses are both available and consequential losses, which are supported as appropriate.

(3) (2018) Jing 01 Min Zhong No. 8761 case

Reasons for the judgment: Financial institutions have obvious improper promotion behaviors and major mistakes in the process of promoting products, and violate the appropriateness obligation that they should bear as a sales agency, and should bear liability for damages.

(To be continued)

(This article is translated by software translator for reference only.)

Related recommendations

- Tax lawyers review the draft of the revised Tax Collection and Administration Law for soliciting opinions

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 3): "Height Limit" Single Release Mechanism

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 2): Grace Period System

- Interpretation of the Management Measures for Compliance Audit of Personal Information Protection - Feeling the Rhythm and Rhythm of Regulatory Flow