Deep Dive into the Seven Key Points of the New Regulations: The Implementing Measures for Company Registration Management Supporting the New Company Law Take Effect Today

2025 02/10

On December 20,2024,the State Administration for Market Regulation(SAMR)officially released the Measures for the Administration of Company Registration(hereinafter referred to as the"Measures"),which will come into effect on February 10,2025.The introduction of these measures represents a key step in improving the administration of company registration.Together with the Company Law of the People's Republic of China revised in 2023(hereinafter referred to as the"New Company Law")and the Regulations of the State Council on the Implementation of the Registered Capital Registration Management System of the Company Law of the People's Republic of China issued in 2024(hereinafter referred to as the"Regulations of the State Council"),they jointly form the"troika"that standardizes the administration of company registration,creating a complete closed loop of the policy system.

When the New Company Law was revised in 2023,it underwent drastic reforms,with the number of articles deleted,added,and substantially modified exceeding two-thirds of the total number of articles.Among them,the improvement of the subscribed registration system for the registered capital of companies became a key adjustment.The Measures closely focus on this core adjustment,further clarify and refine a series of institutional measures regarding company establishment,change,and withdrawal,and effectively connect with the New Company Law and the Regulations of the State Council.

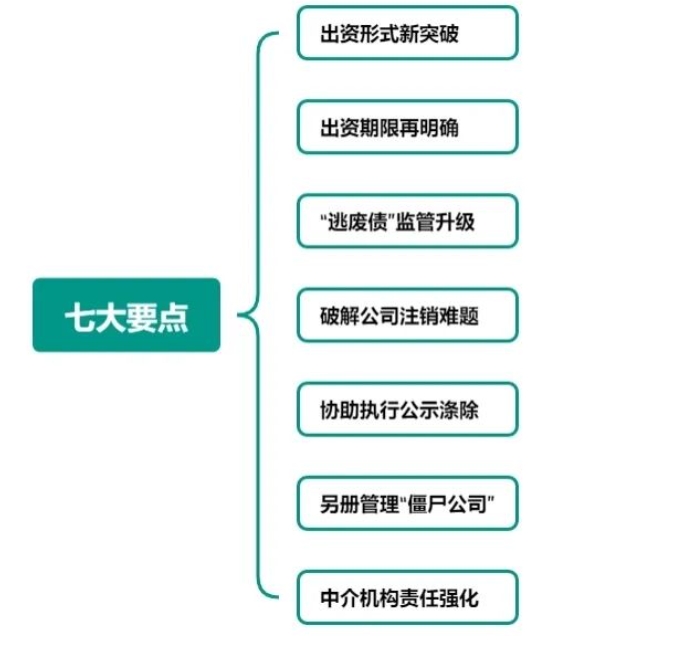

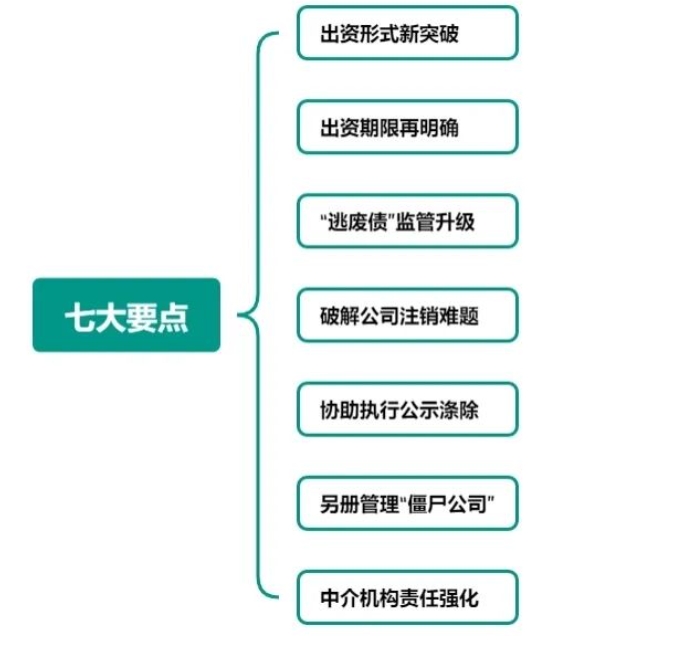

1.In-depth Interpretation of Seven Key Points of the Measures

The Measures consist of 29 articles,closely following the regulatory design of the New Company Law,proposing numerous institutional innovations,providing practical methods from the top-level design perspective,and elaborating on specific regulations regarding the actual contribution period of shareholders,forms of contribution,how to deregister a company when a shareholder dies,is deregistered or revoked,the separate management measures for"zombie companies",and the responsibilities of intermediary institutions.

(1)New Breakthrough in Forms of Contribution-Officially Confirming for the First Time that Data and Virtual Online Property Can Be Used for Paid-in Contributions

The forms of contribution stipulated in Article 48 of the New Company Law include currency,physical objects,intellectual property rights,land use rights,equity,claims,etc.,using a non-exhaustive list.Article 6 of the Measures further expands the scope of non-monetary contributions to include data and virtual online property,clearly stating that"where laws have provisions on the ownership of data and virtual online property,etc.,shareholders may contribute with data and virtual online property at a value specified by the law".

On August 1,2023,the Ministry of Finance issued the Interim Provisions on the Accounting Treatment of Enterprise Data Resources,which provided detailed regulations on how to account for,present,and disclose data assets,leading to ongoing discussions about the inclusion of data assets in financial statements.This time,the Measures officially clarify for the first time that data assets and virtual online property can be used for paid-in contributions.This regulation is a positive response to the development needs of the digital economy era,providing a legal basis for Internet enterprises to conduct capital operations using their own data assets,helping to stimulate market vitality and promote the circulation and value realization of data assets.

(2)Reconfirmation of Contribution Period-Refining the Relevant Requirements for Shareholders'Paid-in Contributions

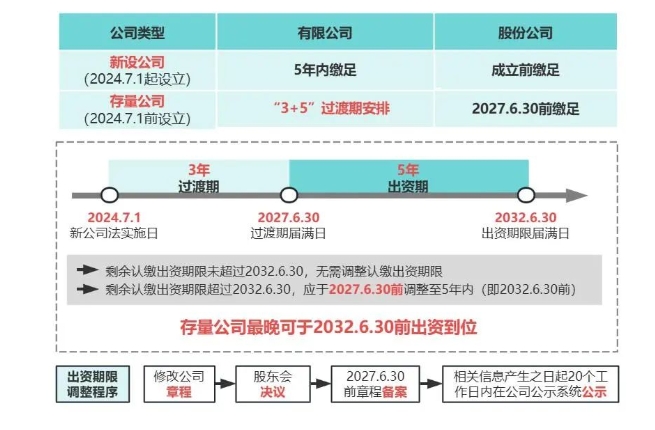

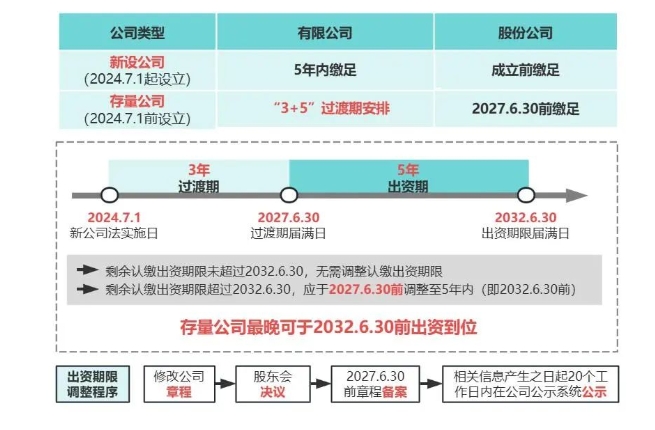

The Regulations of the State Council,which were released and implemented on July 1,2024,provided principled regulations regarding the registered capital registration management of the New Company Law revised in 2023.Article 8 of the Measures,however,provides more detailed regulations on the contribution time.Specifically:

Organized according to Article 8 of the Measures

Then the question arises:Can the contribution period of existing companies be adjusted to June 30,2032,if the adjustment is made now?

The answer is no.If the adjustment is made now,it means adding five years from the current time.In summary,if the subscribed contribution period of existing companies is earlier than June 30,2032,there is no need for adjustment;if it is later than June 30,2032,then the contribution period should be adjusted to within five years as soon as possible before the end of the transition period(that is,July 1,2027).As for existing joint-stock companies,they need to make paid-in contributions before the end of the transition period.

In addition,regarding existing companies whose production and operation involve national interests or major public interests,Article 9 of the Measures also makes exceptions to the adjustment of the contribution period,stating that"opinions may be put forward by relevant competent departments of the State Council or provincial people's governments,and with the consent of the SAMR,the contributions may be made according to the contribution period determined before June 30,2024".

(3)Enhanced Supervision of"Debt Evasion"-New Provisions on Refusing to Handle Registration and Filing for"Debt Evasion"

Article 20 of the Measures stipulates that if there is evidence to prove that the applicant clearly abuses the independent status of the company's legal person and the limited liability of shareholders,and maliciously transfers property,evades debts or circumvents administrative penalties through means such as changing the legal representative,shareholders,registered capital or deregistering the company,which may endanger the public interest,the company registration authority shall,in accordance with the law,refuse to handle the relevant registration or filing,and revoke the registration or filing that has been made.

In actual operation,if creditors discover that a company is engaging in such debt evasion behavior,they can provide evidence to the company registration authority to prevent the company's improper behavior,thereby safeguarding their legitimate rights and interests and market order.This regulation strengthens the supervision of company registration behavior and can,to a certain extent,curb the occurrence of malicious debt evasion.

However,in actual operation,there are still major questions regarding how the company registration authority verifies the authenticity of evidence,determines the degree of abuse and harm,and refines the supervision in practice.We will wait and see.

(4)Solving the Difficulty of Company Deregistration-New Provisions for Solving the Problem of"Difficulty in Company Deregistration"

In practice,after a company's shareholder dies,is deregistered or revoked,the company often falls into a"deregistration dilemma"because it cannot meet the legal deregistration conditions.

Article 22 of the Measures stipulates that"if a company's shareholder dies,is deregistered or revoked,resulting in the company being unable to handle the deregistration,all the legal successors of the shareholder's equity or all the investors of the shareholder may handle the relevant matters of the deregistration on behalf of the company in accordance with the law,and state the relevant circumstances of handling the deregistration on the deregistration resolution".This regulation is of great practical significance as it clarifies the legal basis and effective solutions to the"deregistration dilemma"of companies caused by special circumstances of shareholders.

(5)Assistance in Execution and Removal of Publicity-Addition of Provisions on Assistance in Execution and Removal of Publicity Information

Article 23 of the Measures stipulates that"if a company fails to perform its legal obligations related to the registration and filing matters specified in the effective legal documents on time and in accordance with the law,the people's court may directly serve a notice of assistance in execution to the company registration authority,requiring assistance in removing the information of the legal representative,directors,supervisors,senior management,shareholders and other relevant personnel".

Before the introduction of this regulation,although some localities had already introduced relevant measures and regulations,such as the Work Measures of the Beijing Municipal Administration for Market Regulation on Carrying out"One Standard,Four Dimensions"Registration to Promote the High-Quality Development of Business Entities[1]introduced by the Beijing Municipal Administration for Market Regulation on July 17,2024,and the Several Measures of the Shanghai Municipal Administration for Market Regulation to Deepen the Reform of the Registration and Administration of Business Entities and Optimize the Business Environment[2]introduced by the Shanghai Municipal Administration for Market Regulation on February 23,2024,both of which clearly defined the assistance and execution obligations of the registration authority for removal of registration.This time,the Measures raise the assistance in execution and removal of registration publicity by the company registration authority to the level of departmental regulations,which helps to improve the execution efficiency and the connection of removal procedures,ensuring the authority of effective legal documents and safeguarding the legitimate rights and interests of relevant parties.

(6)Separate Management of"Zombie Companies"-Clarifying the Implementation Path of the Separate Management System

Regarding the management of"zombie companies",Article 24 of the Measures clarifies the implementation path of the separate management system.For companies registered before June 30,2024,if they are included in the list of abnormal operations due to being revoked of their business licenses,ordered to close down,revoked,or being unable to be contacted through their registered domiciles or business premises,resulting in their contribution periods and registered capitals not complying with legal regulations and being unable to be adjusted,the company registration authority will manage them separately,make special markings on the National Enterprise Credit Information Publicity System and publicize them to the public.Companies included in the separate management will no longer be statistically counted and registered as regular registered companies.After they adjust their contribution periods and registered capitals in accordance with the law,the company registration authority will restore their registered status.

The Measures correspond to Article 7 of the Regulations of the State Council,clarifying that the company registration authority can adopt separate management measures to specially mark and manage"zombie companies".Through separate management,it is possible to effectively distinguish between normally operating companies and"zombie companies",improve market transparency and supervision efficiency,and optimize the allocation of market resources.

(7)Strengthened Responsibility of Intermediary Institutions-Focusing on Strengthening the Responsibility of Intermediary Institutions for False Registration

Intermediary institutions play an important role in the process of company registration.Article 26 of the Measures focuses on strengthening the responsibility of intermediary institutions for false registration.If an intermediary institution knows or should know that the applicant submits false materials or uses other fraudulent means to conceal important facts in the company registration,and still accepts the entrustment to handle it on behalf of the applicant or assists in the false registration,the company registration authority will confiscate the illegal gains and impose a fine of not more than 100,000 yuan;if an intermediary institution submits false materials or uses other fraudulent means to conceal important facts in the company registration in its own name or in the name of others,it will be severely punished in accordance with the law for the company and the directly responsible persons in charge and other directly responsible personnel in accordance with Article 250 of the New Company Law.

This article is the only penalty provision among the 29 provisions of the Measures.This regulation aims to strengthen and standardize the behavior of intermediary institutions,ensure the authenticity and legality of company registration materials,and maintain market order and a fair competition environment.

In addition to the above key points,the Measures closely integrate with the new provisions of the New Company Law and the new requirements for building a unified national market,and refine and supplement other basic matters of company registration management,such as specific regulations on the business scope of companies,the filing of members of the company's audit committee,the filing of registration contact persons,and the filing of the removal of directors,supervisors and senior management.

2.Practical Suggestions

Since the promulgation of the New Company Law,the revision of the registered capital system has become a hot topic of discussion among major companies,entrepreneurs,the legal profession and academia.Public information shows that after the New Company Law was released,a large number of enterprises carried out industrial and commercial deregistration[3],and more than 100 listed companies issued capital reduction announcements[4].Moreover,many companies have consulted me about measures to deal with capital reduction and paid-in contributions,indicating the great influence of the new regulations.

Combined with the key points of the new regulations in the Measures,I put forward the following practical suggestions:

(1)From the Perspective of Company Compliance

Compliance Management of Registered Capital

The registered capital and contribution period should be reasonably determined to avoid blindly subscribing to an excessively high registered capital.

"Existing companies"should promptly adjust their registered capital and contribution periods.If the subscribed registered capital amount is too high or the contribution period is too long,they should,based on their actual situations,properly dispose of it within the specified transition period(from July 1,2024 to June 30,2027)by means of reducing the registered capital,adjusting the form of contribution,equity transfer or deregistration.

Strictly abide by the contribution publicity system.The company should ensure that the information on the subscribed and paid-in capital contributions,forms of contribution,and contribution periods of shareholders is publicized to the public through the National Enterprise Credit Information Publicity System within 20 working days,and ensure the truthfulness,accuracy and completeness of the publicized information.

Corporate Governance Structure

Optimize the corporate governance mechanism:According to the provisions of the New Company Law,improve the corporate governance structure,clarify the responsibilities and authorities of the board of directors,board of supervisors,audit committee and other institutions,and improve the level of corporate governance.

Information Disclosure and Compliance Management

Establish an internal information management system:The company should designate a person responsible for information disclosure to ensure that information is publicized within the specified time limit,and regularly check the publicized content to verify the accuracy of the information.

Strengthen compliance management:The company should establish and improve a compliance management system,strengthen the training and management of internal personnel,and ensure that the company and its shareholders,senior management and others strictly abide by the requirements of the New Company Law and the Regulations to avoid legal risks caused by violations of regulations.

(2)From the Perspective of Shareholders'Contribution Responsibilities

Reasonable Subscription of Contributions:When subscribing to contributions,shareholders should fully consider their own contribution capabilities and the actual needs of the company to avoid blindly subscribing to an excessively high amount of contributions.

Timely Fulfillment of Contribution Obligations:Shareholders should pay their contributions in full and on time in accordance with the contribution dates and methods specified in the company's articles of association.If it is impossible to make contributions on time due to special reasons,they should promptly communicate with the company and other shareholders to seek solutions.

Ensure the Legality and Compliance of Non-monetary Contributions:For example,commission a professional evaluation institution in advance to evaluate the value of non-monetary assets,properly retain the evaluation report as strong evidence of the contribution value;actively improve the ownership certification documents,clarify the ownership of the contributed property and complete the contribution transfer procedures to avoid disputes over ownership and contribution defects and responsibilities.Avoid situations where overvaluation or undervaluation leads to subsequent liability disputes.

(3)From the Perspective of Intermediary Institutions

Enhance Professional Capabilities:Intermediary institutions should strengthen their study and understanding of the New Company Law and its supporting regulations,enhance their professional capabilities,and provide accurate and professional consulting services to companies.

Standardize Operational Procedures:Intermediary institutions should strictly follow the new regulations on company registration,standardize the operational procedures for company registration and filing,and ensure the compliance of intermediary services and the authenticity,legality and effectiveness of the submitted materials.

Strengthen Communication with Enterprises and Clearly Define the Boundaries of Responsibilities:Intermediary institutions should maintain close communication with enterprises,promptly understand the actual situations and needs of enterprises,and provide personalized solutions for them.Moreover,it is necessary to clearly define the boundaries of responsibilities between the two parties in the service agreement,especially to clearly define the legal responsibilities caused by false materials or other illegal acts of enterprises.

Conclusion

The new regulations such as the New Company Law,the Regulations of the State Council and the Measures of the SAMR force enterprises to operate in compliance through"strict supervision+strong responsibility".Companies and their shareholders should prioritize solving the problem of excessive registered capital,and senior management should strengthen the documentation of their duties.It is recommended that companies and their shareholders,directors,supervisors and other relevant responsible persons pay close attention to the trends of the new laws,as well as the specific systems and implementation measures of the local company registration authorities,conduct a comprehensive compliance review within the transition period,and,if necessary,rely on legal advisers to design personalized rectification plans to avoid the risks of administrative penalties and civil claims.

When the New Company Law was revised in 2023,it underwent drastic reforms,with the number of articles deleted,added,and substantially modified exceeding two-thirds of the total number of articles.Among them,the improvement of the subscribed registration system for the registered capital of companies became a key adjustment.The Measures closely focus on this core adjustment,further clarify and refine a series of institutional measures regarding company establishment,change,and withdrawal,and effectively connect with the New Company Law and the Regulations of the State Council.

1.In-depth Interpretation of Seven Key Points of the Measures

The Measures consist of 29 articles,closely following the regulatory design of the New Company Law,proposing numerous institutional innovations,providing practical methods from the top-level design perspective,and elaborating on specific regulations regarding the actual contribution period of shareholders,forms of contribution,how to deregister a company when a shareholder dies,is deregistered or revoked,the separate management measures for"zombie companies",and the responsibilities of intermediary institutions.

(1)New Breakthrough in Forms of Contribution-Officially Confirming for the First Time that Data and Virtual Online Property Can Be Used for Paid-in Contributions

The forms of contribution stipulated in Article 48 of the New Company Law include currency,physical objects,intellectual property rights,land use rights,equity,claims,etc.,using a non-exhaustive list.Article 6 of the Measures further expands the scope of non-monetary contributions to include data and virtual online property,clearly stating that"where laws have provisions on the ownership of data and virtual online property,etc.,shareholders may contribute with data and virtual online property at a value specified by the law".

On August 1,2023,the Ministry of Finance issued the Interim Provisions on the Accounting Treatment of Enterprise Data Resources,which provided detailed regulations on how to account for,present,and disclose data assets,leading to ongoing discussions about the inclusion of data assets in financial statements.This time,the Measures officially clarify for the first time that data assets and virtual online property can be used for paid-in contributions.This regulation is a positive response to the development needs of the digital economy era,providing a legal basis for Internet enterprises to conduct capital operations using their own data assets,helping to stimulate market vitality and promote the circulation and value realization of data assets.

(2)Reconfirmation of Contribution Period-Refining the Relevant Requirements for Shareholders'Paid-in Contributions

The Regulations of the State Council,which were released and implemented on July 1,2024,provided principled regulations regarding the registered capital registration management of the New Company Law revised in 2023.Article 8 of the Measures,however,provides more detailed regulations on the contribution time.Specifically:

Organized according to Article 8 of the Measures

Then the question arises:Can the contribution period of existing companies be adjusted to June 30,2032,if the adjustment is made now?

The answer is no.If the adjustment is made now,it means adding five years from the current time.In summary,if the subscribed contribution period of existing companies is earlier than June 30,2032,there is no need for adjustment;if it is later than June 30,2032,then the contribution period should be adjusted to within five years as soon as possible before the end of the transition period(that is,July 1,2027).As for existing joint-stock companies,they need to make paid-in contributions before the end of the transition period.

In addition,regarding existing companies whose production and operation involve national interests or major public interests,Article 9 of the Measures also makes exceptions to the adjustment of the contribution period,stating that"opinions may be put forward by relevant competent departments of the State Council or provincial people's governments,and with the consent of the SAMR,the contributions may be made according to the contribution period determined before June 30,2024".

(3)Enhanced Supervision of"Debt Evasion"-New Provisions on Refusing to Handle Registration and Filing for"Debt Evasion"

Article 20 of the Measures stipulates that if there is evidence to prove that the applicant clearly abuses the independent status of the company's legal person and the limited liability of shareholders,and maliciously transfers property,evades debts or circumvents administrative penalties through means such as changing the legal representative,shareholders,registered capital or deregistering the company,which may endanger the public interest,the company registration authority shall,in accordance with the law,refuse to handle the relevant registration or filing,and revoke the registration or filing that has been made.

In actual operation,if creditors discover that a company is engaging in such debt evasion behavior,they can provide evidence to the company registration authority to prevent the company's improper behavior,thereby safeguarding their legitimate rights and interests and market order.This regulation strengthens the supervision of company registration behavior and can,to a certain extent,curb the occurrence of malicious debt evasion.

However,in actual operation,there are still major questions regarding how the company registration authority verifies the authenticity of evidence,determines the degree of abuse and harm,and refines the supervision in practice.We will wait and see.

(4)Solving the Difficulty of Company Deregistration-New Provisions for Solving the Problem of"Difficulty in Company Deregistration"

In practice,after a company's shareholder dies,is deregistered or revoked,the company often falls into a"deregistration dilemma"because it cannot meet the legal deregistration conditions.

Article 22 of the Measures stipulates that"if a company's shareholder dies,is deregistered or revoked,resulting in the company being unable to handle the deregistration,all the legal successors of the shareholder's equity or all the investors of the shareholder may handle the relevant matters of the deregistration on behalf of the company in accordance with the law,and state the relevant circumstances of handling the deregistration on the deregistration resolution".This regulation is of great practical significance as it clarifies the legal basis and effective solutions to the"deregistration dilemma"of companies caused by special circumstances of shareholders.

(5)Assistance in Execution and Removal of Publicity-Addition of Provisions on Assistance in Execution and Removal of Publicity Information

Article 23 of the Measures stipulates that"if a company fails to perform its legal obligations related to the registration and filing matters specified in the effective legal documents on time and in accordance with the law,the people's court may directly serve a notice of assistance in execution to the company registration authority,requiring assistance in removing the information of the legal representative,directors,supervisors,senior management,shareholders and other relevant personnel".

Before the introduction of this regulation,although some localities had already introduced relevant measures and regulations,such as the Work Measures of the Beijing Municipal Administration for Market Regulation on Carrying out"One Standard,Four Dimensions"Registration to Promote the High-Quality Development of Business Entities[1]introduced by the Beijing Municipal Administration for Market Regulation on July 17,2024,and the Several Measures of the Shanghai Municipal Administration for Market Regulation to Deepen the Reform of the Registration and Administration of Business Entities and Optimize the Business Environment[2]introduced by the Shanghai Municipal Administration for Market Regulation on February 23,2024,both of which clearly defined the assistance and execution obligations of the registration authority for removal of registration.This time,the Measures raise the assistance in execution and removal of registration publicity by the company registration authority to the level of departmental regulations,which helps to improve the execution efficiency and the connection of removal procedures,ensuring the authority of effective legal documents and safeguarding the legitimate rights and interests of relevant parties.

(6)Separate Management of"Zombie Companies"-Clarifying the Implementation Path of the Separate Management System

Regarding the management of"zombie companies",Article 24 of the Measures clarifies the implementation path of the separate management system.For companies registered before June 30,2024,if they are included in the list of abnormal operations due to being revoked of their business licenses,ordered to close down,revoked,or being unable to be contacted through their registered domiciles or business premises,resulting in their contribution periods and registered capitals not complying with legal regulations and being unable to be adjusted,the company registration authority will manage them separately,make special markings on the National Enterprise Credit Information Publicity System and publicize them to the public.Companies included in the separate management will no longer be statistically counted and registered as regular registered companies.After they adjust their contribution periods and registered capitals in accordance with the law,the company registration authority will restore their registered status.

The Measures correspond to Article 7 of the Regulations of the State Council,clarifying that the company registration authority can adopt separate management measures to specially mark and manage"zombie companies".Through separate management,it is possible to effectively distinguish between normally operating companies and"zombie companies",improve market transparency and supervision efficiency,and optimize the allocation of market resources.

(7)Strengthened Responsibility of Intermediary Institutions-Focusing on Strengthening the Responsibility of Intermediary Institutions for False Registration

Intermediary institutions play an important role in the process of company registration.Article 26 of the Measures focuses on strengthening the responsibility of intermediary institutions for false registration.If an intermediary institution knows or should know that the applicant submits false materials or uses other fraudulent means to conceal important facts in the company registration,and still accepts the entrustment to handle it on behalf of the applicant or assists in the false registration,the company registration authority will confiscate the illegal gains and impose a fine of not more than 100,000 yuan;if an intermediary institution submits false materials or uses other fraudulent means to conceal important facts in the company registration in its own name or in the name of others,it will be severely punished in accordance with the law for the company and the directly responsible persons in charge and other directly responsible personnel in accordance with Article 250 of the New Company Law.

This article is the only penalty provision among the 29 provisions of the Measures.This regulation aims to strengthen and standardize the behavior of intermediary institutions,ensure the authenticity and legality of company registration materials,and maintain market order and a fair competition environment.

In addition to the above key points,the Measures closely integrate with the new provisions of the New Company Law and the new requirements for building a unified national market,and refine and supplement other basic matters of company registration management,such as specific regulations on the business scope of companies,the filing of members of the company's audit committee,the filing of registration contact persons,and the filing of the removal of directors,supervisors and senior management.

2.Practical Suggestions

Since the promulgation of the New Company Law,the revision of the registered capital system has become a hot topic of discussion among major companies,entrepreneurs,the legal profession and academia.Public information shows that after the New Company Law was released,a large number of enterprises carried out industrial and commercial deregistration[3],and more than 100 listed companies issued capital reduction announcements[4].Moreover,many companies have consulted me about measures to deal with capital reduction and paid-in contributions,indicating the great influence of the new regulations.

Combined with the key points of the new regulations in the Measures,I put forward the following practical suggestions:

(1)From the Perspective of Company Compliance

Compliance Management of Registered Capital

The registered capital and contribution period should be reasonably determined to avoid blindly subscribing to an excessively high registered capital.

"Existing companies"should promptly adjust their registered capital and contribution periods.If the subscribed registered capital amount is too high or the contribution period is too long,they should,based on their actual situations,properly dispose of it within the specified transition period(from July 1,2024 to June 30,2027)by means of reducing the registered capital,adjusting the form of contribution,equity transfer or deregistration.

Strictly abide by the contribution publicity system.The company should ensure that the information on the subscribed and paid-in capital contributions,forms of contribution,and contribution periods of shareholders is publicized to the public through the National Enterprise Credit Information Publicity System within 20 working days,and ensure the truthfulness,accuracy and completeness of the publicized information.

Corporate Governance Structure

Optimize the corporate governance mechanism:According to the provisions of the New Company Law,improve the corporate governance structure,clarify the responsibilities and authorities of the board of directors,board of supervisors,audit committee and other institutions,and improve the level of corporate governance.

Information Disclosure and Compliance Management

Establish an internal information management system:The company should designate a person responsible for information disclosure to ensure that information is publicized within the specified time limit,and regularly check the publicized content to verify the accuracy of the information.

Strengthen compliance management:The company should establish and improve a compliance management system,strengthen the training and management of internal personnel,and ensure that the company and its shareholders,senior management and others strictly abide by the requirements of the New Company Law and the Regulations to avoid legal risks caused by violations of regulations.

(2)From the Perspective of Shareholders'Contribution Responsibilities

Reasonable Subscription of Contributions:When subscribing to contributions,shareholders should fully consider their own contribution capabilities and the actual needs of the company to avoid blindly subscribing to an excessively high amount of contributions.

Timely Fulfillment of Contribution Obligations:Shareholders should pay their contributions in full and on time in accordance with the contribution dates and methods specified in the company's articles of association.If it is impossible to make contributions on time due to special reasons,they should promptly communicate with the company and other shareholders to seek solutions.

Ensure the Legality and Compliance of Non-monetary Contributions:For example,commission a professional evaluation institution in advance to evaluate the value of non-monetary assets,properly retain the evaluation report as strong evidence of the contribution value;actively improve the ownership certification documents,clarify the ownership of the contributed property and complete the contribution transfer procedures to avoid disputes over ownership and contribution defects and responsibilities.Avoid situations where overvaluation or undervaluation leads to subsequent liability disputes.

(3)From the Perspective of Intermediary Institutions

Enhance Professional Capabilities:Intermediary institutions should strengthen their study and understanding of the New Company Law and its supporting regulations,enhance their professional capabilities,and provide accurate and professional consulting services to companies.

Standardize Operational Procedures:Intermediary institutions should strictly follow the new regulations on company registration,standardize the operational procedures for company registration and filing,and ensure the compliance of intermediary services and the authenticity,legality and effectiveness of the submitted materials.

Strengthen Communication with Enterprises and Clearly Define the Boundaries of Responsibilities:Intermediary institutions should maintain close communication with enterprises,promptly understand the actual situations and needs of enterprises,and provide personalized solutions for them.Moreover,it is necessary to clearly define the boundaries of responsibilities between the two parties in the service agreement,especially to clearly define the legal responsibilities caused by false materials or other illegal acts of enterprises.

Conclusion

The new regulations such as the New Company Law,the Regulations of the State Council and the Measures of the SAMR force enterprises to operate in compliance through"strict supervision+strong responsibility".Companies and their shareholders should prioritize solving the problem of excessive registered capital,and senior management should strengthen the documentation of their duties.It is recommended that companies and their shareholders,directors,supervisors and other relevant responsible persons pay close attention to the trends of the new laws,as well as the specific systems and implementation measures of the local company registration authorities,conduct a comprehensive compliance review within the transition period,and,if necessary,rely on legal advisers to design personalized rectification plans to avoid the risks of administrative penalties and civil claims.

Related recommendations

- Tax lawyers review the draft of the revised Tax Collection and Administration Law for soliciting opinions

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 3): "Height Limit" Single Release Mechanism

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 2): Grace Period System

- Interpretation of the Management Measures for Compliance Audit of Personal Information Protection - Feeling the Rhythm and Rhythm of Regulatory Flow