One committee and two courts, half a year of game, lawyer Gao Peng successfully urged the proposed listed company to pay more than 7 million yuan to five investors

Recently, Chen Tianhao, a lawyer from Gaopeng Law Firm, represented a series of cases involving refunds for listed investments. After going through the Beijing Haidian Court, Beijing Arbitration Commission, and Beijing Fengtai Court, a group company that plans to go public finally agreed to refund investors a total of approximately RMB 7.7 million in listed investment principal, investment income, and investment losses, and bear the full cost of litigation and rights protection for investors, paying overdue interest to investors.

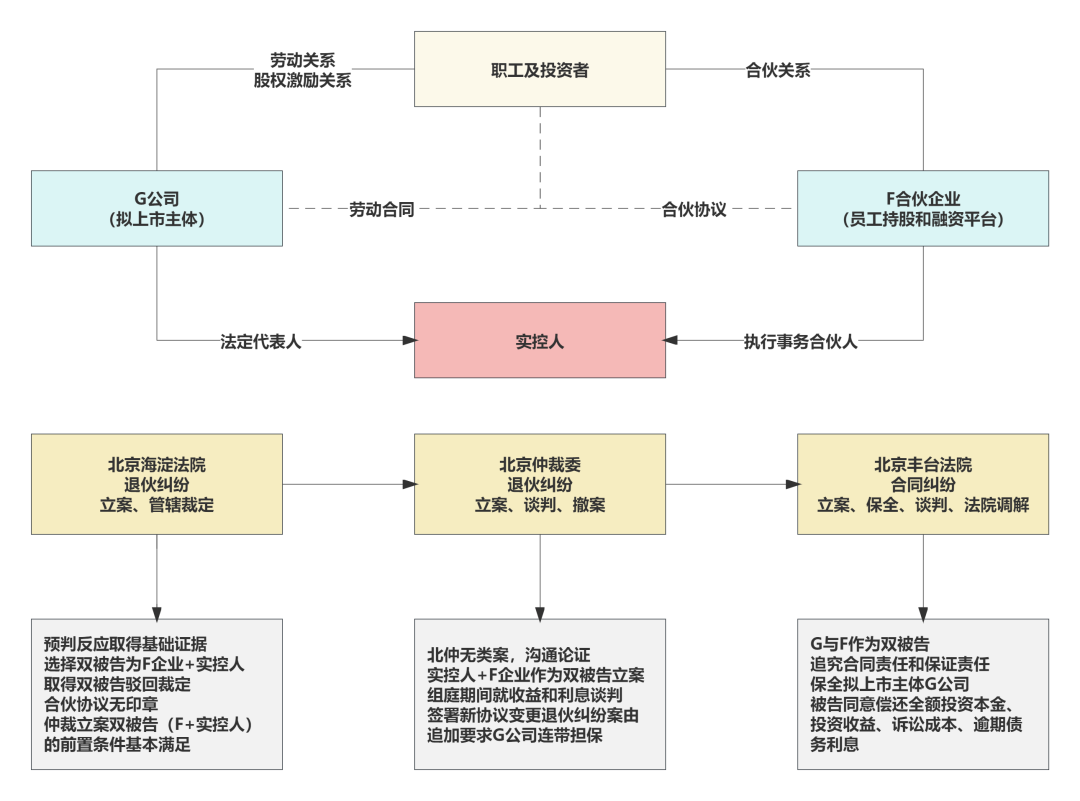

Since 2016, under the pretext of equity incentives, investing in F Partnership Enterprise and then investing in G Company, which is planned to be listed within the group, to obtain future high investment returns, a group company in Beijing has successively raised hundreds of millions of yuan from its numerous employees and natural person investors. Among them, the group company raised a total of approximately 5.7 million yuan from the client in this case. During the financing process, the controlling shareholder of the group company committed to the annual investment return ratio and the exit mechanism and rules after investing in F Partnership Enterprise. However, the path of G company's listing within the group has been repeatedly hindered, and investors have no guarantee of their original investment principal and expected returns.

Mode Introduction

Experience 1: In the case of severe lack of basic materials, it is possible to consider "promoting through war" and extract necessary evidence from the opponent's response

In determining that the other party is likely to hold a delaying and evasive attitude, with the bottom line of stripping the actual controller of responsibility, and without the original and copy of the partnership agreement (the partnership agreement is uniformly kept by the group company, not kept by investors, only signed on a blank page), due to unclear jurisdiction, they chose to file a withdrawal dispute in the Haidian Court in Beijing based on basic materials such as payment receipts and email information, List the F partnership enterprise and its executing partners who actually received payments as co defendants. During the process, G Company, in order to delay the process and address jurisdictional issues, had no choice but to submit necessary partnership agreements to the court for subsequent investor rights protection.

From then on, this case obtained a partnership agreement, determined the jurisdiction of Beizhong, and obtained a rejection ruling from the defendant, including F Partnership Enterprise and its executing partners. Choosing to list the executing partner as a co defendant is a necessary prerequisite for the successful filing of subsequent arbitration cases and for them to be listed as a defendant again.

Lesson 2: When there is a connection between litigation and arbitration proceedings, it is necessary to consider their interrelationships and supporting evidence in advance

There are few cases of withdrawal disputes in the database of the Beijing Arbitration Commission, and filing has been hindered. They have twice refused to file the executing partner as a joint defendant, but they are not related to the actual controller, making it difficult to substantially hit the other party's soft spot.

After repeated communication with Beizhong, it was originally believed that, in the absence of a seal in the partnership agreement, the absence of signatures from executing partners in the partnership agreement, and the absence of signatures from investors in the partnership agreement, although the dispute resolution method was specified as Beizhong arbitration, it could not be confirmed that the three parties had reached a legal and effective arbitration agreement. Therefore, they did not agree to file a withdrawal dispute with F Partnership and its executing partners as joint defendants, and went to Beizhong three times to provide legal basis After explaining the model of the partnership enterprise, the nature of the partnership agreement, and the actual situation of the case, Beizhong ultimately chose to reject the ruling based on the jurisdiction of F Partnership Enterprise and the executing partner as co defendants in the Haidian Court, and successfully filed F Partnership Enterprise and the executing partner as co defendants.

Lesson Three: Negotiation conditions should be considered to provide necessary support for the path of safeguarding rights, and it is advisable to increase credibility

During the arbitration tribunal, Lawyer Chen represented the investors in multiple rounds of negotiations with the responsible personnel of the group company and F Partnership Enterprise. Finally, both parties drafted a new written agreement aimed at confirming clear and explicit amounts of debt and debt, as well as investment return ratios. In addition, based on the successful association of the actual controller in the arbitration procedure, the other party agrees to assume joint and several guarantee liability in the new and clear legal relationship of creditor and debtor, with the proposed listed entity G company in the group as the guarantor. After the signing of the new agreement, the withdrawal dispute between investors and F Partnership Enterprise corresponding to the partnership relationship has been changed to a concise and clear contractual dispute based on debt and debt. In order to minimize the cost of safeguarding rights to the greatest extent possible, after the arbitration procedure chose to withdraw the case and refund fees, according to the new jurisdiction clause, the Beijing Fengtai Court quickly filed and accepted the case.

Lesson 4: After the case is accepted, property preservation cannot be extended to the respondent's branch office

After filing the case with the Fengtai Court in Beijing, based on learning about the high-quality cash flow on the books of G Company's branch, they planned to carry out necessary property preservation on the assets of the branch. However, multiple communications were unsuccessful. On this issue, Lawyer Chen believes that as a branch of G Company, it does not have legal personality, and civil liability is borne by G Company as the parent company. The property should be considered as G Company's property. Therefore, when G Company is involved in a lawsuit as the head office, in order to ensure the realization of creditor's rights and prevent the use of hidden assets of branch offices, the people's court should agree to preserve the property of the legal person's branch offices. Under the premise of full or excessive preservation, G Company, as the head office, can apply for the unsealing of branch property through the property preservation objection procedure. Therefore, the act of preserving the property of the legal person's branch will not harm the interests of the preserved person. In the end, necessary property preservation measures were taken against Company G as the guarantor of joint and several liability. Furthermore, in order to avoid affecting the key projects currently being operated by the proposed listed G company and reduce the impact on future planning, G company and F partnership enterprise ultimately agreed to refund the listed investment principal, investment income, and investment losses to investors, bear the full litigation and rights protection costs of investors, and pay overdue interest to investors.

Experience 5: Snake Wounds Seven Inches, Key Points of Case Strike

Related recommendations

- Tax lawyers review the draft of the revised Tax Collection and Administration Law for soliciting opinions

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 3): "Height Limit" Single Release Mechanism

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 2): Grace Period System

- Interpretation of the Management Measures for Compliance Audit of Personal Information Protection - Feeling the Rhythm and Rhythm of Regulatory Flow