Cross border Insurance Trust "Pitfall Avoidance" Guide

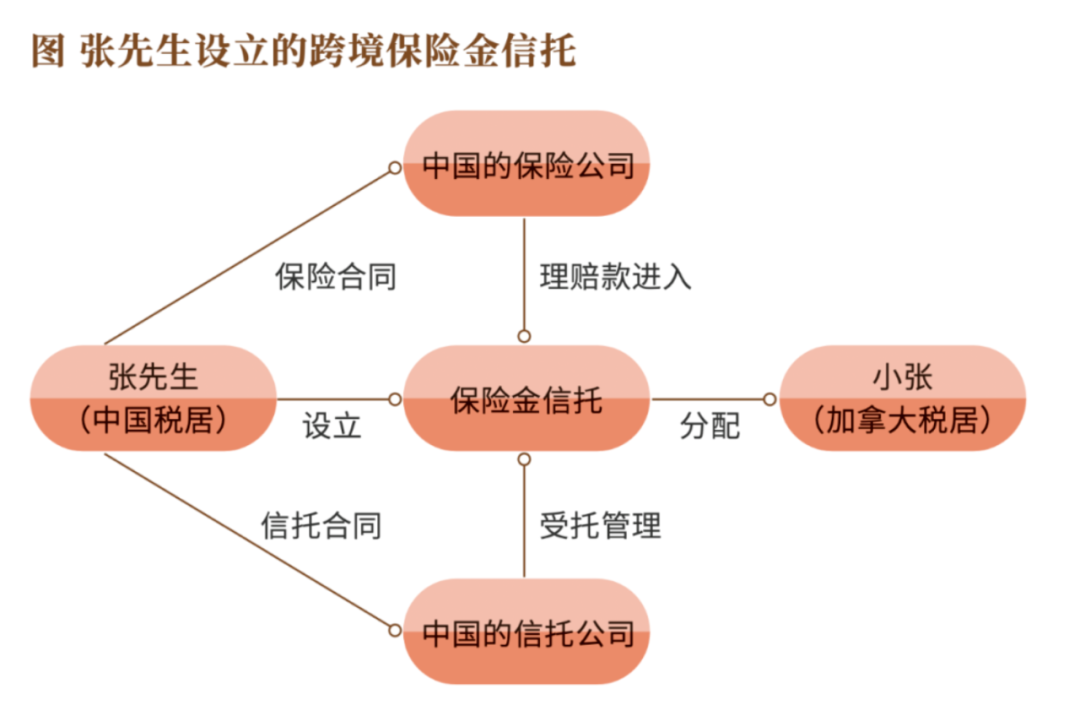

Mr. Zhang is a senior executive of a large private enterprise and a Chinese tax resident. He has a "pearl in his hand" named Xiao Zhang, who is 21 years old and currently studying at a university in Canada. After graduation, he plans to settle in Canada. After discussing with his wife, Mr. Zhang plans to transfer his bank deposit to his only daughter. After multiple considerations, Mr. Zhang has decided to pass on the bank deposit to his daughter through an insurance trust. But the beneficiaries of this insurance benefit trust involve Canadian tax residents, so there will be more factors to consider when designing. This article will combine cases to sort out the elements that need to be considered in the design of cross-border insurance fund trusts. It should be emphasized that the "cross-border insurance benefit trust" referred to in this article specifically refers to insurance benefit trusts where the beneficiaries of the trust are overseas tax residents.

Tax risk

Planning and inheriting property through insurance deposit trusts requires consideration of tax risks both domestically and internationally, mainly those related to inheritance tax and personal income tax, as it involves overseas children. In this case, as the beneficiary and tax resident of Canada, daughter Xiao Zhang needs to confirm the tax burden of her daughter's trust distribution in Canada.

1. Consideration of estate tax

Currently, more than 100 countries (regions) around the world have levied inheritance taxes. Most economically developed countries have introduced inheritance tax, but many of them have also stopped collecting inheritance tax, such as Canada, Australia, Singapore, and so on. Most developing countries and economically underdeveloped countries have not yet imposed inheritance taxes, and some countries, such as India and Egypt, have also abolished them after the introduction. For insurance fund trusts, it depends on the attitude of various countries towards levying inheritance taxes on insurance and trust assets.

Generally speaking, after the death of the insured, the insurance benefits paid to the beneficiary do not fall within the scope of inheritance tax, which is a common practice in most countries. But not all insurance compensation is not included in the scope of taxation. Taking the United States as an example, whether the life insurance claims after the insured person's death are included in the estate tax calculation of the insured person is not related to the designated beneficiary, but depends on who the policy belongs to at the time of the insured person's death. Therefore, once the insurance policy enters the trust and is held by the trust, estate tax can be avoided in contemporary times, but it does not mean that generational transfer tax can be avoided. Therefore, considering estate tax requires careful study of the estate tax law of the tax resident jurisdiction where the beneficiary is located, in order to ultimately determine a reasonable insurance trust planning plan. Of course, there is no estate tax in Canada, so Mr. Zhang does not need to consider the issue of Canadian estate tax.

2. Consideration of personal income tax

The personal income tax of beneficiaries of cross-border insurance benefit trusts varies from country to country. Taking Canada as an example, most insurance income needs to be taxed, even the benefits obtained from social insurance, such as employment and unemployment insurance benefits, pension insurance benefits, etc., need to be taxed, only enjoying a certain amount of exemption, not completely exempt; Commercial life insurance income also belongs to tax income. Life insurance income mainly reports the accumulated income on specific insurance policies, and only insurance compensation received by the beneficiary due to someone's death (i.e. death type life insurance) does not need to be reported for personal income tax. But whether the beneficiary declares and pays personal income tax after the insurance funds enter the trust needs to be determined based on the provisions of personal income tax on trust income.

Therefore, the application and design of cross-border insurance fund trusts need to carefully consider the impact of taxation. In practice, if the beneficiary involves tax residents outside the jurisdiction of mainland China, trust companies generally require additional legal and tax opinions.

Foreign exchange control risks

China adopts a relatively strict foreign exchange control system, adopting different management methods for current account foreign exchange receipts and expenditures and capital account receipts and expenditures. Current account foreign exchange management refers to various transactions under current accounts, including importing goods, paying transportation fees, insurance premiums, labor services, outbound tourism, investment profits, loan interest, dividends, bonuses, etc., which are not restricted when purchasing foreign exchange from banks or making payments from bank foreign exchange accounts. But can the distribution of benefits to beneficiaries of insurance fund trusts be managed through current account management?

The Hebei Branch of the State Administration of Foreign Exchange mentioned in its knowledge Q&A in November 2019 that currently, personal accident insurance and disease insurance purchased by domestic individuals for overseas travel, study abroad, and business activities belong to service trade transactions. Under the framework of current foreign exchange management policies, it is allowed and supported for their income to be transferred back to China. However, the life insurance and investment return dividend insurance purchased by domestic individuals overseas belong to financial and capital transactions, and the current foreign exchange management policies have not yet been opened. Therefore, dividends and interest related to these insurance projects that have not yet been opened cannot be transferred back to China.

From the above Q&A, it can be seen that for cross-border transfer of insurance benefits, if it is personal accident insurance or disease insurance, it belongs to regular projects and is not subject to significant management restrictions. But if it is life insurance and investment insurance, it also belongs to financial and capital management. If the beneficiary wants to remit abroad, it needs to be approved by the Foreign Exchange Administration.

Therefore, if Mr. Zhang, as the policyholder, has taken out a life insurance policy in China and the beneficiary is designated as his daughter, and during the insurance period, his daughter becomes a Canadian citizen, can the portion of the insurance claim received by his daughter after Mr. Zhang's death be purchased and exported? In this case, the compensation received by the daughter should belong to the legitimate income of an overseas individual under the capital account within China, and should be approved by the State Administration of Foreign Exchange in accordance with the management regulations of the capital account.

In addition, if Xiaozhang obtains the trust income distribution of the insurance fund trust in the future, foreign exchange control issues also need to be considered. The distribution of trust property income does not belong to regular international payments and transfers, and it is also difficult to classify it as a certain category of capital accounts. Therefore, there is currently no clear direct channel under China's current foreign exchange management system for distribution by directly applying for foreign exchange purchase and transferring funds to overseas accounts from a trust property special account opened in the name of a trust company.

Therefore, there are risks and obstacles in foreign exchange management for future beneficiaries of insurance fund trusts to directly remit their benefits overseas. If approved by the State Administration of Foreign Exchange, it is also necessary to plan and collect evidence such as legal sources of property in the early stage, otherwise obstacles may arise during the approval process.

Property source risk

To establish a cross-border insurance fund trust, it is necessary to provide initial trust assets from legal sources. Compared to pure domestic insurance fund trusts, the requirements for property sources are higher. Especially in the future cross-border transfer of beneficiary distribution funds, the parties involved must provide proof of property source. Taking Announcement No. 16 of the People's Bank of China [2004] on the Interim Measures for the Administration of Personal Property Transfer, Sale, and Payment in Foreign Exchange as an example, this measure clearly states that the property applied for external transfer by the applicant should be the legitimate property owned by the applicant and should not have any disputes over the rights and interests of others; The foreign exchange management department shall not accept applications for external transfer of property restricted by judicial, supervisory and other departments in accordance with the law, as well as applications for external transfer of property that is not allowed to be transferred according to legal provisions, property that cannot prove its legal origin, or property involving unresolved criminal or civil litigation cases.

Article 8 of the Measures stipulates that three items in the applicant's application for immigration transfer are related to the source of property:

(1) The written application includes a detailed explanation of the source of property income and the realization of property. (5) Proof of property rights of the applicant. Such as a copy of the property ownership certificate, real estate sales contract, demolition compensation and resettlement agreement, and other supporting documents. (6) The tax certificate or tax payment voucher issued by the competent tax authority in the place where the property is located or the source of income is applied for transfer.

The legitimate source of personal property can be proven through the following methods:

(1) Work certificate or individual business account book proof. If an individual has salary income, they can obtain a work certificate from their own employer. If they are self-employed or a partnership enterprise, they can obtain proof through the company's business account book.

(2) The personal income tax payment form is the most important way to prove that one's source of income is legitimate. You can apply to the local tax bureau or online to issue a proof of personal income tax payment. It is best to provide tax records from the past five years to prove the legitimate source of personal property.

(4) The sale of movable, immovable, and intangible property proves that income can be obtained after the sale of movable, immovable, and intangible property. Therefore, contracts are also important proof of the legitimate source of property. For real estate and intangible assets, transfer registration certificates and transfer certificates are generally required.

(5) Inheritance or gift notarization can prove the legal source of the gift, but in order to prevent money laundering, the donor needs to provide written documents explaining the reason for giving the money to the recipient and explaining the source of the gift funds, and it is best to have a family relationship between the donor and the recipient. If there is no family relationship, it is also easy to be questioned by anti money laundering.

Risk of tax related information exchange such as CRS

CRS is the English abbreviation for Common Reporting Standard, meaning "Unified Reporting Standard". It is a part of the Automated Exchange of Tax Related Information in Financial Accounts (AEOI Standard) released by the Organization for Economic Cooperation and Development (OECD) in July 2014.

In cross-border insurance benefit trusts, it involves the exchange of bank account information between tax bureaus of participating CRS countries for tax residents in the other country's jurisdiction, including trust accounts and insurance benefit accounts. As of June 2023, the OECD has initiated over 4900 bilateral exchange relationships in over 110 jurisdictions dedicated to CRS. Mainland China began conducting CRS exchanges in 2018. As of June 2023, there are 78 jurisdictions that have established information exchange outbound relations with China, and 106 jurisdictions that have established exchange back to China relations. The information reporting entities of CRS are reporting financial institutions (hereinafter referred to as "financial institutions"), which are divided into four categories: depository institutions, custodial institutions, investment institutions, and specific insurance institutions. Specific insurance institutions refer to insurance companies (or holding companies of insurance companies) that carry out or pay related cash value insurance contracts or annuity contracts.

The implementation of CRS does not necessarily mean an increase in tax costs, but rather the submission of relevant information. But in the implementation of CRS, if the beneficiary is an overseas tax resident, after distribution to the overseas tax resident, the trust company has to report the relevant information of the beneficiary to the State Administration of Taxation, and then the State Administration of Taxation exchanges the relevant information to the tax resident according to the exchange rules. This may bring tax risks to the beneficiaries. In the case at the beginning of this article, Mr. Zhang's daughter, Xiao Zhang, is studying at a university in Canada and is preparing to settle in Canada after graduation. If Xiaozhang becomes a beneficiary of an insurance benefit trust in the future, he will need to face the issue of CRS exchange and fully consider the relevant risks.

It should be noted that the United States has not joined the CRS, but instead requires financial institutions from various countries to report financial asset information of US tax residents overseas to the US tax bureau through the domestic Foreign Account Tax Compliance Act (FATCA). Therefore, insurance benefit trusts involving US beneficiaries need to consider the impact of FATCA.

Source: Family Business Magazine August 2023

Related recommendations

- Tax lawyers review the draft of the revised Tax Collection and Administration Law for soliciting opinions

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 3): "Height Limit" Single Release Mechanism

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 2): Grace Period System

- Interpretation of the Management Measures for Compliance Audit of Personal Information Protection - Feeling the Rhythm and Rhythm of Regulatory Flow