How to Hold Shareholders Responsible for Corporate Debts Series 10: Holding Shareholders Responsible for Illegal Capital Reduction

——Song Dynasty, Ye Yuanhe

As mentioned last time, if the company owes money, creditors can hold shareholders responsible for evading their capital contributions. This time, I will tell you how to hold shareholders responsible for illegal capital reduction.

The so-called capital reduction, in simple terms, refers to a company reducing its registered capital. What about illegal capital reduction?

Some officials may have this question: Our company's capital reduction is based on the preparation of materials according to the requirements of the Industrial and Commercial Bureau. The Industrial and Commercial Bureau has already submitted everything it needs, and even published newspaper announcements. This way, the capital reduction will not be illegal, right?

Don't worry, let's talk slowly. As usual, let's start with the case.

Case Description

In January 2020, Alvin signed a supply contract with Wanli Company and began supplying goods. In June 2022, Wanli Company owed 8.88 million yuan for the goods but did not repay it. Ah Wen then hired a lawyer to help him recover the payment.

A lawyer's investigation by Ah Wen found that in January 2020, when Ah Wen signed a contract with Wanli Company and began supplying goods, the old articles of association in effect at that time stipulated that Wanli Company's registered capital was 10 million, including 5 million for Xiao and 5 million for Li Ge.

In April 2022, the registered capital of Wanli Company decreased from 10 million yuan to 8 million yuan, with Xiaowan decreasing from 5 million yuan to 3 million yuan and Ligo remaining unchanged at 5 million yuan.

Wanli Company has published an announcement in accordance with the requirements of industrial and commercial registration regarding the aforementioned capital reduction, but has not notified Ah Wen in writing.

So Alvin sued Wanli Company and Xiaowan, demanding that Wanli Company pay the principal and interest of 8.88 million yuan owed for the goods; And require Xiaowan to bear supplementary compensation liability for the above-mentioned principal and interest within the scope of illegal capital reduction.

Solution

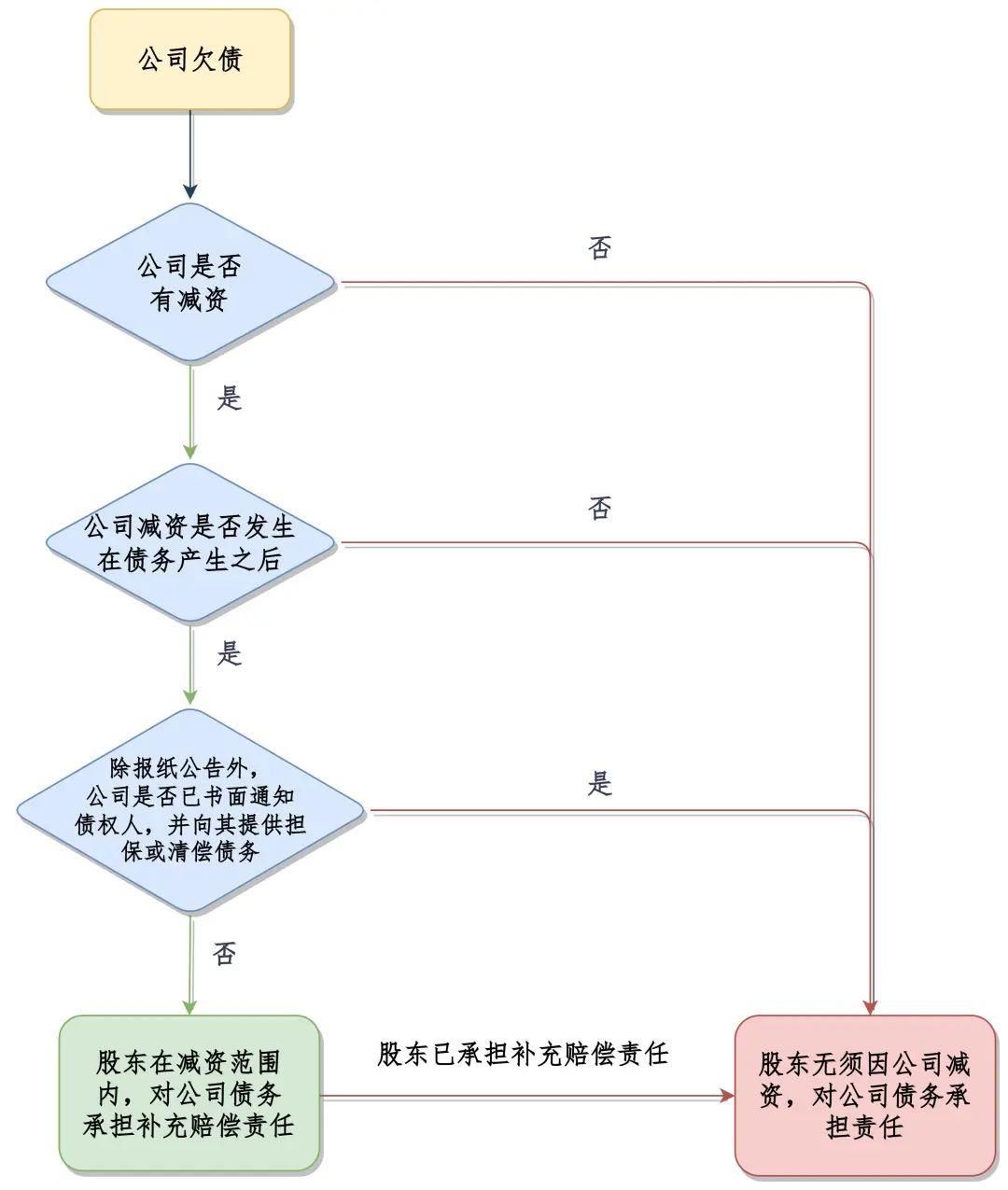

Based on existing laws and regulations as well as judicial practice, the conditions to be met for holding shareholders responsible for illegal capital reduction are summarized as follows:

Let's analyze the above cases:

Firstly, Wanli Company did indeed reduce its capital, which meets the first condition for holding such shareholders accountable.

Secondly, Wanli Company's capital reduction occurred in April 2022, after Arvin signed a contract with Wanli Company and began supplying goods in January 2020. This met the second condition, which is that the company's capital reduction occurred after the debt was incurred.

Finally, although Wanli Company made a public announcement in accordance with the requirements of industrial and commercial registration regarding the aforementioned capital reduction, it did not notify Ah Wen in writing, let alone provide guarantees or repay debts to Ah Wen. This meets the third condition, which is that the company has not notified creditors in writing and provided them with guarantees or paid off debts.

What is the responsibility to bear? The responsibility is that shareholders shall bear supplementary compensation liability for the principal and interest of the company's debts within the scope of illegal capital reduction.

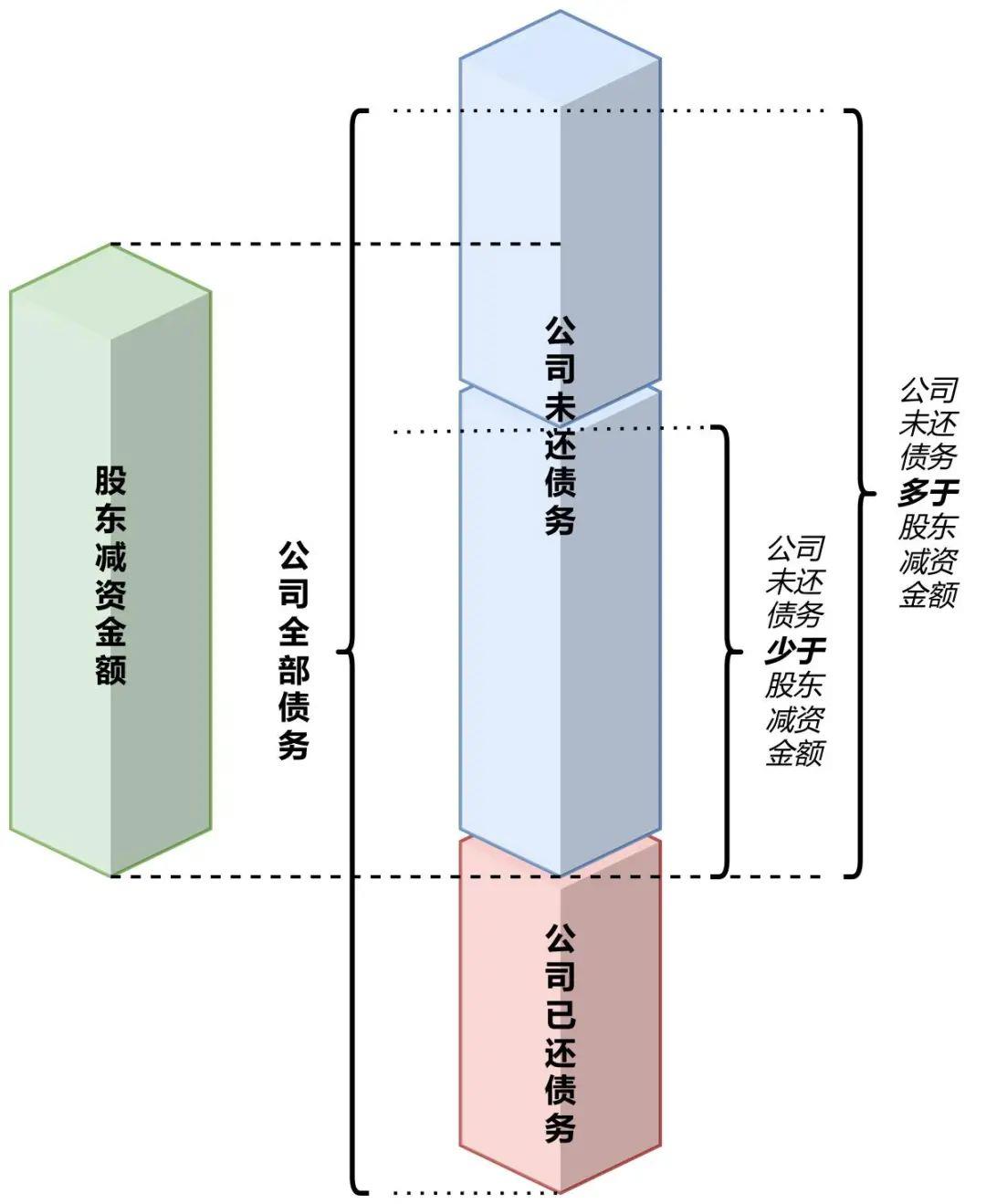

Let's use the above case as an example: Wanli Company owes Alvin a principal of 8.88 million yuan for the goods, with an assumed interest of 120000 yuan. Therefore, the total principal and interest of the goods is 9 million yuan; Assuming Wanli Company has given 300000 yuan, there is still 8.7 million left that cannot be paid; The 8.7 million yuan that Wanli Company cannot pay, Xiaowan will have to pay it back; However, the maximum scope of responsibility that Xiaowan bears is the illegal reduction of 2 million yuan and its interest, and Xiaowan does not bear the extra part.

The responsibilities undertaken are shown in the following figure:

Are there many such shareholders? Is the probability of success in accountability high?

Shareholders who illegally reduce their capital are not as common as those who do not contribute or accelerate the maturity of their capital contributions due to the fact that the company's capital reduction is not very common.

However, in actual capital reduction operations, there are differences between the requirements for industrial and commercial registration changes and the requirements stipulated by law, and the problem often arises here.

Specifically, in the process of industrial and commercial change registration for capital reduction, on the one hand, the market supervision and management department generally requires enterprises to provide shareholder meeting resolutions, capital reduction newspaper announcements, shareholder commitments to the company's debts, and new articles of association or amendments to the articles of association after capital reduction; However, for companies required by the Company Law to prepare balance sheets and property lists, as well as the most critical materials for companies to notify creditors in writing and repay debts or provide corresponding guarantees as required by creditors, they are not required to be provided in the industrial and commercial change registration procedures for capital reduction. On the other hand, the companies involved often do not want the industrial and commercial registration procedures for capital reduction to be "unnecessary", and thus do not have the motivation to notify creditors in writing, provide guarantees, or settle debts. Therefore, whenever a company reduces its capital, it is likely that the company has not notified its creditors and has not paid off its debts or provided corresponding guarantees as required by the creditors.

If such a situation occurs, although the specific legal provisions regarding the liability of shareholders for illegal reduction of capital are not clear, in judicial practice, the court usually refers to the situation of shareholder capital defects in Article 13 of the Interpretation 3 of the Company Law or the situation of shareholder withdrawal of capital in Article 14, requiring shareholders to bear supplementary compensation liability for the debts owed by the company to creditors within the scope of capital reduction. At the same time, due to the fact that the company's capital reduction is relatively easy to detect and convenient to apply, the success rate of accountability is still quite high.

The above is our sharing on how the company owes debts and how creditors can hold shareholders responsible for illegal capital reduction. At this point, how to hold current shareholders accountable will be shared.

If there is an official, there is a question again: what you are talking about is chasing after the current shareholders, so for the original shareholders who have already "come out of their shell", are they at a loss?

For more information on the future, please listen to the breakdown in the next section!

Based on and referenced laws, regulations, and judicial viewpoints (slide down to view)

Article 177: When a company needs to reduce its registered capital, it must prepare a balance sheet and an inventory of assets.

The company shall notify its creditors within ten days from the date of making a resolution to reduce its registered capital, and make a public announcement in a newspaper within thirty days. Creditors have the right to demand the company to repay their debts or provide corresponding guarantees within 30 days from the date of receiving the notice, or within 45 days from the date of announcement if they do not receive the notice.

Article 179: In the event of a merger or division of a company and any change in the registered items, the company shall handle the change registration with the company registration authority in accordance with the law; If a company is dissolved, it shall handle the cancellation of company registration in accordance with the law; If a new company is established, it shall be registered in accordance with the law.

If a company increases or decreases its registered capital, it shall apply for change registration with the company registration authority in accordance with the law.

Article 204 If a company fails to notify or publicly announce its creditors in accordance with the provisions of this Law during merger, division, reduction of registered capital, or liquidation, the company registration authority shall order it to make corrections and impose a fine of not less than 10000 yuan but not more than 100000 yuan on the company.

If a company conceals its assets, makes false records in its balance sheet or inventory of assets, or distributes its assets before paying off its debts during liquidation, the company registration authority shall order it to make corrections, and impose a fine of not less than 5% but not more than 10% of the hidden assets or the amount of company assets distributed before paying off its debts on the company; The directly responsible supervisor and other directly responsible personnel shall be fined not less than 10000 yuan but not more than 100000 yuan.

2. Provisions of the Supreme People's Court on Several Issues Concerning the Application of the Company Law of the Company Law of the People's Republic of China (III) (revised in 2020)

Article 13: If a shareholder fails to fulfill or fails to fully fulfill their investment obligations, and the company or other shareholders request that they fully fulfill their investment obligations to the company in accordance with the law, the people's court shall support it.

If creditors of the company request shareholders who have not fulfilled or fully fulfilled their investment obligations to bear supplementary compensation liability for the part of the company's debts that cannot be repaid within the scope of the unpaid principal and interest, the people's court shall support it; Shareholders who have not fulfilled or fully fulfilled their capital contribution obligations have already assumed the above-mentioned responsibilities, and if other creditors make the same request, the people's court shall not support it.

If a shareholder fails to fulfill or fully fulfill their investment obligations when the company is established, and a plaintiff brings a lawsuit in accordance with the first or second paragraph of this article, requesting that the initiators of the company and the defendant shareholders bear joint and several liability, the people's court shall support it; After the initiators of the company assume responsibility, they may seek compensation from the defendant shareholders.

If a shareholder fails to fulfill or fails to fully fulfill their capital contribution obligations when increasing the company's capital, and the plaintiff brings a lawsuit in accordance with the first or second paragraphs of this article, requests that the director or senior management who fails to fulfill their obligations under the first paragraph of Article 147 of the Company Law bear corresponding responsibilities due to the failure to fully pay their capital contributions, the people's court shall support it; After assuming responsibility, directors and senior management personnel may seek compensation from the defendant shareholders.

Article 14: If a shareholder withdraws its capital contribution, and the company or other shareholders request it to return the principal and interest of the capital contribution to the company, or other shareholders, directors, senior management personnel, or actual controllers who assist in withdrawing the capital contribution shall bear joint and several liability for this, the people's court shall support it.

If the company's creditors request that the shareholders who withdraw their capital contributions bear supplementary compensation liability for the portion of the company's debts that cannot be repaid within the scope of withdrawing capital interest, and other shareholders, directors, senior management personnel, or actual controllers who assist in withdrawing their capital contributions bear joint and several liability for this, the people's court shall support it; The shareholders who have withdrawn their capital contributions have already assumed the above-mentioned responsibilities, and if other creditors make the same request, the people's court will not support it.

3. Integration of Judicial Opinions of the Supreme People's Court (New Edition) · Commercial Volume I · September 2017 Edition · Page 105 · Opinion No. 55

The equity withdrawal agreement that has not fulfilled the legal procedures and has been registered with changes shall be deemed as a capital reduction, which is actually a withdrawal of capital contribution.

4. Integration of Judicial Opinions of the Supreme People's Court (New Edition) · Civil and Commercial Supplement Volume II, October 2018 edition, page 831, viewpoint number 342

When a company reduces its capital, it cannot directly replace the obligation to notify known or expected creditors by publishing a newspaper announcement without prior notice.

5. Integration of Judicial Opinions of the Supreme People's Court (New Edition) · Civil and Commercial Supplement Volume II, October 2018 edition, page 832, viewpoint number 343

If the company fails to fulfill its obligation to notify known or expected creditors in accordance with the law when reducing its capital, and the company is unable to repay its debts before the reduction, shareholders shall bear supplementary compensation liability for such debts.

6. Bulletin case: Shanghai Delixi Group Co., Ltd. v. Jiangsu Boen Shitong High tech Co., Ltd., Feng Jun, and Shanghai Boen Shitong Optoelectronics Co., Ltd. dispute over the sales contract

The court of second instance held that excerpt (1)

According to the current Company Law, shareholders have the obligation to effectively fulfill their full capital contribution in accordance with the company's articles of association, and are also responsible for maintaining the substantial registered capital of the company. Although the Company Law stipulates that the notification obligor for a company's capital reduction is the company, whether or not the company's capital reduction is the result of a resolution of the shareholders' meeting, whether or not to reduce capital, and how to carry out the reduction entirely depends on the will of shareholders. Shareholders are also aware of the legal procedures and consequences of the company's capital reduction. At the same time, the company needs the cooperation of shareholders to handle the capital reduction procedures, and shareholders should also exercise reasonable care in fulfilling the company's notification obligation. On August 10 and September 27, 2012, the shareholders of the appellant Jiangsu Boen Company formed shareholder meeting resolutions regarding the company's capital reduction. At this time, the creditor's rights of the appellant Delixi Company had already been formed. As shareholders of Jiangsu Boen Company, the appellant Shanghai Boen Company and Feng Jun should have been aware of it. However, in this situation, Shanghai Boen Company and Feng Jun still agreed to Feng Jun's capital reduction request through a resolution of the shareholders' meeting, and did not directly notify Delixi Company. This not only damages the solvency of Jiangsu Boen Company, but also infringes on Delixi Company's creditor's rights. Therefore, they should bear corresponding legal responsibilities for the debts of Jiangsu Boen Company. When the company fails to provide a capital reduction notice to known creditors, this situation is essentially no different from the essence of shareholders illegally withdrawing their capital contributions and the impact on the interests of creditors. Therefore, although Chinese law does not specifically stipulate the liability of shareholders in the event that a company fails to comply with the statutory procedures for capital reduction, resulting in damage to the interests of creditors, it can be determined by referring to the relevant principles and provisions of the Company Law. Due to flaws in the capital reduction behavior of Jiangsu Boen Company, if the company's debts formed before the capital reduction cannot be repaid after the capital reduction, Shanghai Boen Company and Feng Jun, as shareholders of Jiangsu Boen Company, should bear supplementary compensation responsibility for the debt that cannot be repaid within the scope of the company's capital reduction amount.

7. Liuxun 2019 Reference Case No. 18

Regarding the equity ratio of Gao Wenjie. According to the resolution of the joint meeting of shareholders of Xihai Company on June 20, 2006, 28 people including Sun Jinshan signed an equity transfer agreement with Xihai Company and received corresponding withdrawal funds and interest, as well as 19 people including Zhang Weizhong who previously received the investment funds. The above-mentioned withdrawal of shares is due to the withdrawal of shares by Xihai Company, which is a capital reduction of the company. Although Gao Wenjie believes that Zhang Rufeng and others are not withdrawing shares and should belong to equity transfer, and the corresponding equity transfer funds are paid from their personal accounts, due to the non-standard operation and management of Yu Xihai Company, Gao Wenjie's personal loans, company operation needs, as well as capital transactions such as shareholder participation and withdrawal, mostly occur in Gao Wenjie's personal bank account. In fact, this has caused the company account to be confused with Gao Wenjie's personal account, Payment through their account alone cannot be considered as a transfer of equity between shareholders, and according to the resolution of the shareholders' joint meeting, Zhang Rufeng and others should be considered as withdrawal of shares, that is, a reduction in the company's capital, and not a transfer of equity. According to the principle of maintaining corporate capital, a company should maintain assets equivalent to its capital amount during its existence to prevent a substantial reduction in its capital, maintain its solvency, and protect the interests of creditors. Regarding this, Article 177 of the Company Law stipulates that: When a company needs to reduce its registered capital, it must prepare a balance sheet and a list of assets. The company shall notify its creditors within ten days from the date of making the resolution to reduce its registered capital, and make a public announcement in a newspaper within thirty days. Creditors shall have the right to demand the company to repay their debts or provide corresponding guarantees within thirty days from the date of receiving the notice, or within forty-five days from the date of announcement if they have not received the notice, The company's capital reduction needs to follow legal procedures. Article 35 of the Company Law also stipulates that after the establishment of a company, shareholders shall not withdraw their capital contributions. Based on this, the act of refunding the share capital to some shareholders at the beginning of the establishment of Xihai Company resulted in a decrease in the actual capital of Xihai Company. This reduction of capital did not go through legal procedures, and the registration of Xihai Company with the industry and commerce department has not been changed since its establishment. When shareholders withdraw their shares, the corresponding industry and commerce change registration has not been carried out. Therefore, the equity ratio of Gao Wenjie should be determined based on 47.4% of the industry and commerce registration.

Related recommendations

- Tax lawyers review the draft of the revised Tax Collection and Administration Law for soliciting opinions

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 3): "Height Limit" Single Release Mechanism

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 2): Grace Period System

- Interpretation of the Management Measures for Compliance Audit of Personal Information Protection - Feeling the Rhythm and Rhythm of Regulatory Flow