How to Hold Shareholders Responsible for Corporate Debts Series 8: Holding Shareholders Responsible for Negligent Performance of Liquidation Obligations

The path turns and there is no doubt, the forest suddenly opens and there is a day.

——Ming · Lu Longyun

Last time, it was mentioned that if the company owes money, shareholders who are mixed with the company's assets can be held accountable. Today, we will talk about shareholders who are held accountable for failing to fulfill their liquidation obligations.

What is liquidation and what are shareholders who are negligent in fulfilling their liquidation obligations?

Liquidation refers to the process of terminating all legal relationships of a company and disposing of the remaining assets of the company. When a company is dissolved or goes bankrupt, it must undergo liquidation.

Shareholders who are negligent in fulfilling their liquidation obligations, in simple terms, are shareholders of a company who, due to a resolution of the shareholders' meeting to dissolve or the revocation of the company's business license, result in the dissolution of the company. There are one of the following situations:

1. Failure to establish a liquidation team and initiate liquidation in a timely manner after the dissolution of the company;

2. The liquidation group was established, but the shareholders did not clear up the company's main assets, manage the company's accounting books and important documents, or did not allow the liquidation group to do the above;

3. If the company has been deregistered, shareholders either fail to liquidate but falsely promise that the company has no debts or debts have been paid off, or directly cancel the company without liquidation, resulting in the company being unable to liquidate, or use false liquidation reports to fill in the amount and fraudulently obtain deregistration.

I'll put in a digression here. The usual saying of a company being revoked does not mean that it has disappeared, but rather that the company has its business license revoked due to illegal activities, and cannot operate according to the law, but the company is still in existence; The company needs to go through deregistration before it truly disappears.

How can shareholders who are negligent in fulfilling their liquidation obligations be held accountable?

Let's take the following case to illustrate one of the situations where shareholders are held accountable for failing to fulfill their liquidation obligations.

In other words, Alvin supplied Wanli Company and signed a supply contract, with a total payment of 10 million yuan. Later, Wanli Company owed 6.66 million yuan for the goods and did not repay it.

Alvin checked and found that Wanli Company has been deregistered, and the company is gone! Who can I ask for this debt? It's a waste of money? So Alvin invited a lawyer to see if there were any other ways.

Ah Wen's lawyer conducted an investigation and found that Wanli Company had been deregistered, but it followed a simple deregistration procedure, which means that when the shareholders make a commitment during the deregistration, they can proceed with the deregistration registration without providing a company liquidation report.

Therefore, Alvin sued the shareholders Wanqian Company and Ligo together, demanding that both shareholders bear compensation responsibility for the 6.66 million principal and interest owed by Wanli Company to Alvin.

In this situation, do you think the two shareholders, Wanqian Company and Ligo, should take responsibility?

Yes! In recent years, in order to optimize the business environment and solve the problem of enterprise deregistration, various regions have implemented simplified procedures for enterprise deregistration. Enterprises that meet the relevant conditions can quickly handle enterprise deregistration as long as they provide corresponding commitments, without mandatory submission of liquidation reports. However, it does not mean that enterprises and shareholders can evade or abandon debts through this means. The liquidation responsibility still exists, and the debts that should be repaid still need to be repaid.

In this case, Wanli Company went through a simplified corporate deregistration procedure for deregistration without a liquidation report; But when Wanli Company still had outstanding debts, shareholders falsely promised that the company had no debts, otherwise the shareholders would be held responsible. Therefore, the two shareholders of Wanli Company, Wanqian Company and Ligo, should bear corresponding responsibilities for the 6.66 million principal and interest owed by Wanli Company to Ah Wen!

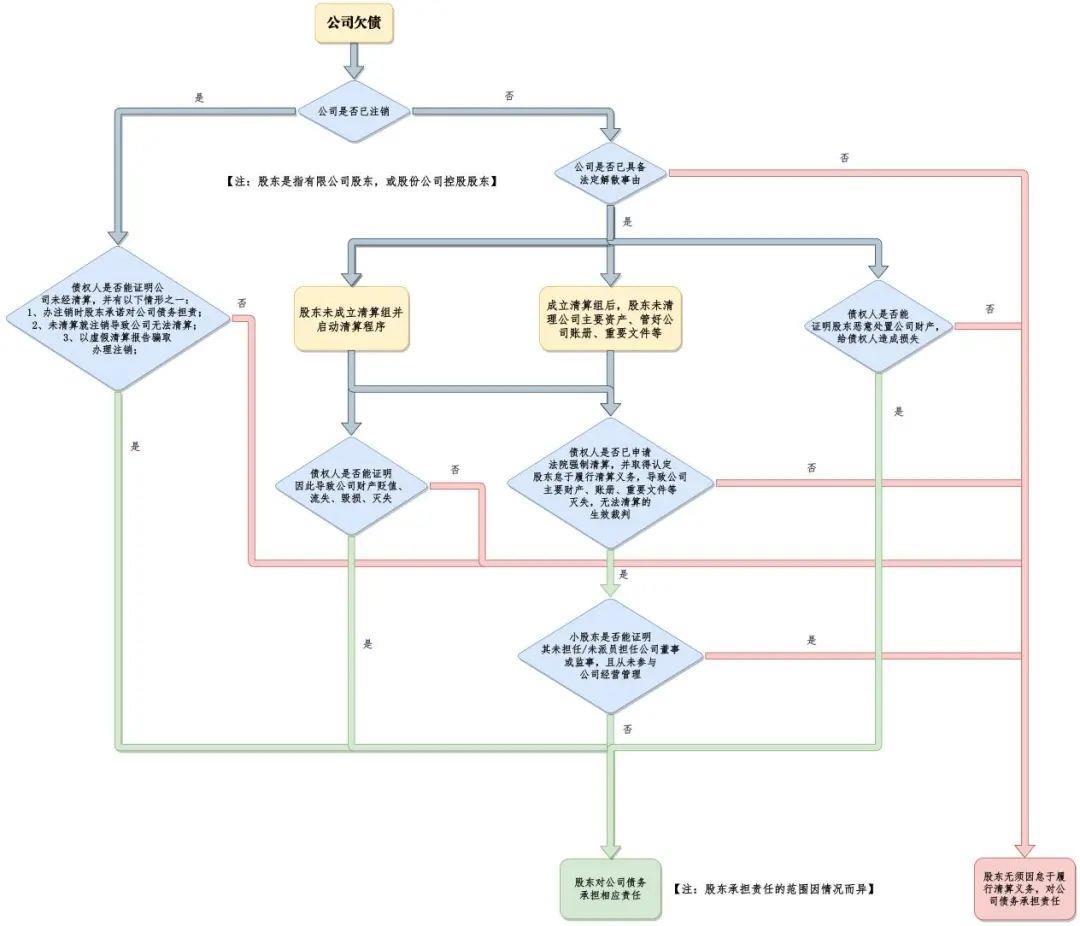

Due to space limitations, we have only discussed one situation where such shareholders are held accountable today. There are actually many other situations, and the corresponding accountability paths are also different, as shown in the following figure:

Are there many such shareholders? Is the probability of success in accountability high?

The companies held by such shareholders are either dissolved but not deregistered, or have been deregistered.

On the one hand, it is not uncommon for a company to be dissolved or liquidated in accordance with the law due to revocation of its business license, but the company has not yet started liquidation/completed liquidation and cancellation, and has remained "frozen but not dead".

On the other hand, especially due to the simplified deregistration procedures promoted in various regions in recent years, deregistration no longer requires mandatory liquidation, making it easier for companies to deregister; Attempts to evade debt through fraudulent cancellation of the company are not uncommon.

Therefore, such shareholders are not uncommon.

However, due to the various situations of such shareholders, their corresponding accountability paths are difficult and varied.

For example, in practical operation, if a company adopts a simplified procedure to cancel its registration, the market supervision and management department usually requires shareholders to make a commitment that there is no debt or the debt has been cleared, otherwise they will be held responsible. In this case, if the debt of the company's creditors is not actually paid off when the company is deregistered, then the shareholder commitment mentioned above is suspected of being false, and the success rate of creditors holding shareholders accountable is higher.

If the company has reasons for dissolution, but has not initiated/completed liquidation and deregistration, and has been "frozen but not dead", the success rate of holding shareholders accountable for their negligence in fulfilling liquidation obligations is relatively low. Why?

Firstly, in order to hold such shareholders accountable, creditors not only need to prove that the shareholders have acted negligently in fulfilling their liquidation obligations, but also need to prove that this has resulted in the loss of the company's main assets, accounting books, important documents, etc., making it impossible for the company to liquidate. In this way, the burden of proof for creditors is not only heavy, but also the argumentation process is more complex.

Secondly, in judicial practice, directly suing shareholders often leads to a loss, and it is usually necessary to first apply to the court for compulsory liquidation of the company, in order to obtain an effective judgment that the shareholders are negligent in fulfilling their liquidation obligations, which leads to the loss of the company's main assets, accounting books, important documents, etc., and the company is unable to settle; Afterwards, the above-mentioned judgment documents will be used as evidence to sue the shareholders. In this way, the time cost of litigation is relatively high.

Once again, as long as shareholders can prove that they have taken positive measures to fulfill their liquidation obligations, or small shareholders can prove that they have not served/dispatched personnel as directors or supervisors of the company, and have never participated in the company's operation and management, creditors cannot be held accountable for their negligence in fulfilling their liquidation obligations.

Therefore, the success rate of holding such shareholders accountable varies depending on the circumstances.

The above is our sharing of the company's debt and how to hold shareholders accountable for failing to fulfill their liquidation obligations. Next time, we will talk to you about how to hold accountable the shareholders who withdrew their capital contributions.

For more information on the future, please listen to the breakdown in the next section!

Based on and referenced laws, regulations, and cases (slide down to view)

1. Civil Code of the People's Republic of China

Article 70: If a legal person dissolves, except in the case of merger or division, the liquidation obligor shall promptly form a liquidation team for liquidation.

The directors, directors, and other members of the executive or decision-making bodies of the legal person are liquidation obligors. If there are other provisions in laws and administrative regulations, such provisions shall prevail.

If the liquidation obligor fails to fulfill its liquidation obligations in a timely manner and causes damage, it shall bear civil liability; The competent authority or interested parties may apply to the people's court to designate relevant personnel to form a liquidation team for liquidation.

2. Company Law of the People's Republic of China (2018 Amendment)

Article 180 【 Reasons for dissolution of the company 】 The company is dissolved due to the following reasons:

(1) The expiration of the business term specified in the company's articles of association or the occurrence of other dissolution reasons specified in the company's articles of association;

(2) The shareholders' meeting or shareholders' meeting resolves to dissolve;

(3) Dissolution is required due to the merger or division of the company;

(4) The business license has been revoked, ordered to close down or revoked in accordance with the law;

(5) The people's court shall dissolve it in accordance with the provisions of Article 182 of this Law.

Article 183: If a company is dissolved due to the provisions of Article 180 (1), (2), (4), and (5) of this Law, a liquidation group shall be established within 15 days from the date of the occurrence of the cause of dissolution to begin liquidation. The liquidation team of a limited liability company is composed of shareholders, while the liquidation team of a joint stock limited company is composed of directors or personnel determined by the shareholders' meeting. If a liquidation team is not established within the prescribed time limit for liquidation, creditors may apply to the people's court to designate relevant personnel to form a liquidation team for liquidation. The people's court shall accept the application and promptly organize a liquidation team to carry out liquidation.

3. Minutes of the National Conference on Civil and Commercial Trial Work of Courts

13

(5) On the Liability of Liquidation Obligators of Limited Liability Companies

Regarding the determination of the liquidation responsibility of shareholders in limited liability companies, the handling results of some cases have inappropriately expanded the liquidation responsibility of shareholders. In particular, some professional creditors appeared in practice. After they bought the "old accounts" of zombie enterprises at a large amount at a very low price from other creditors, they filed a lawsuit for compulsory liquidation of a large number of zombie enterprises. After the people's court recognized the loss of the company's main property, account books, important documents, etc., according to the provisions of paragraph 2 of Article 18 of the judicial interpretation (II) of the Company Law, Requesting the shareholders of a limited liability company to bear joint and several liability for the company's debts. Some people's courts fail to accurately grasp the application conditions of the above provisions, and judge small shareholders who have not "failed to fulfill their obligations" or small shareholders who have "failed to fulfill their obligations" but have no causal relationship with the loss of the company's main assets, accounting books, important documents, etc., to bear the responsibility for the company's debts far exceeding the amount of their capital contributions, resulting in a significant imbalance of interests. What needs to be clear is that the nature of the provisions of the above judicial interpretation on the liquidation liability of shareholders of limited liability companies is the tort liability that the company cannot bear due to shareholders' negligence in performing liquidation obligations. When determining whether shareholders of a limited liability company should bear liability for infringement compensation to creditors, attention should be paid to the following issues:

14. [Determination of Delay in Performing Liquidation Obligation] The "Delay in Performing Obligation" specified in Paragraph 2 of Article 18 of the judicial interpretation (II) of the Company Law refers to the negative behavior of the shareholders of a limited liability company who deliberately delay or refuse to perform liquidation obligations, or fail to carry out liquidation due to negligence, when they can perform liquidation obligations after the occurrence of legal liquidation causes. If a shareholder provides evidence to prove that they have taken positive measures to fulfill their liquidation obligations, or if a minority shareholder provides evidence to prove that they are neither a member of the company's board of directors or supervisory board, nor have they selected personnel to serve as members of the agency, and have never participated in the company's operation and management, claiming that they should not bear joint and several liability for the company's debts on the grounds that they do not constitute "negligence in fulfilling their obligations", the people's court shall support them in accordance with the law.

15. [Defense of Causal Relationship] If the shareholders of a limited liability company provide evidence to prove that there is no causal relationship between their negative inaction in "neglecting to fulfill their obligations" and the result of "the loss of the company's main assets, accounting books, important documents, etc., which cannot be liquidated", and claim that they should not be jointly and severally liable for the company's debts, the people's court shall support it in accordance with the law.

4. Provisions of the Supreme People's Court on Several Issues Concerning the Application of the Company Law of the People's Republic of China (II) (Revised in 2020)

Article 18: If the shareholders of a limited liability company, the directors and controlling shareholders of a joint stock limited company fail to establish a liquidation team within the statutory time limit to commence liquidation, resulting in the depreciation, loss, damage or loss of the company's assets, and the creditors claim that they are liable for compensation for the company's debts within the scope of the losses caused, the people's court shall support them in accordance with the law.

If shareholders of a limited liability company, directors and controlling shareholders of a joint stock limited company fail to fulfill their obligations, resulting in the loss of the company's main assets, accounting books, important documents, etc., and are unable to carry out liquidation, and creditors claim joint and several liability for the company's debts, the people's court shall support them in accordance with the law.

The above situation is caused by the actual controller, and if the creditor claims that the actual controller shall bear corresponding civil liability for the company's debts, the people's court shall support it in accordance with the law.

Article 19: If a shareholder of a limited liability company, a director and controlling shareholder of a joint stock limited company, or an actual controller of the company maliciously disposes of the company's assets after the dissolution of the company, causing losses to creditors, or fraudulently obtains the company's registration authority to cancel the registration of a legal person through false liquidation reports without going through liquidation in accordance with the law, and creditors claim that they bear corresponding compensation responsibilities for the company's debts, the people's court shall support them in accordance with the law.

Article 20: The dissolution of a company shall apply for deregistration after the completion of liquidation in accordance with the law. If a company undergoes deregistration without liquidation, resulting in the inability of the company to proceed with liquidation, and creditors claim that the shareholders of a limited liability company, directors and controlling shareholders of a joint stock limited company, as well as the actual controller of the company, are responsible for paying off the company's debts, the people's court shall support them in accordance with the law.

If a company undergoes deregistration without being liquidated in accordance with the law, and a shareholder or a third party promises to be responsible for the company's debts when deregistrating with the company registration authority, and a creditor claims to bear corresponding civil liability for the company's debts, the people's court shall support it in accordance with the law.

5. Provisions of the Supreme People's Court on Several Issues Concerning the Change and Addition of Parties in Civil Execution (Revised in 2020) (Fa Shi [2020] No. 21)

Article 21: If a company, as the subject of enforcement, undergoes deregistration without liquidation, resulting in the inability of the company to proceed with liquidation, and the applicant for enforcement applies to change or add shareholders of a limited liability company, directors and controlling shareholders of a joint stock limited company as the subject of enforcement, and assumes joint and several liability for the company's debts, the people's court shall support it.

Article 23: If a legal person or unincorporated organization, as the subject of enforcement, undergoes deregistration without legal liquidation, and a third party promises in writing to bear the debt repayment responsibility of the subject of enforcement when the registration authority handles deregistration, and the applicant for enforcement applies to change or add the third party as the subject of enforcement, and assumes the repayment responsibility within the scope of the commitment, the people's court shall support it.

6. Notice of the Supreme People's Court on Issuing the Minutes of the Symposium on the Trial of Company Compulsory Liquidation Cases (Fa Fa [2009] No. 52)

29. If the creditors apply for compulsory liquidation, and the people's court decides to terminate the compulsory liquidation procedure on the ground that it is impossible to liquidate or cannot fully liquidate, it shall be stated in the final ruling that the creditors may require the shareholders, directors, actual controllers and other liquidation obligors of the respondent to bear the liability for repayment of their debts in accordance with the provisions of Article 18 of the judicial interpretation II of the Company Law. If a shareholder applies for compulsory liquidation and the people's court terminates the compulsory liquidation procedure on the grounds of inability to liquidate or inability to fully liquidate, it shall be stated in the termination ruling that the shareholder may claim relevant rights from the controlling shareholder and other entities that actually control the company.

7. Regulations of the People's Republic of China on the Administration of Market Entity Registration

Article 33: If a market entity has not incurred any debt or debt, or has completed the repayment of debt or debt, and has not incurred or settled the repayment fees, employee wages, social insurance fees, statutory compensation, or taxes payable (late fees, fines), and all investors have made a written commitment to assume legal responsibility for the authenticity of the above situations, the registration may be cancelled in accordance with a simplified procedure.

Market entities should publicize the commitment letter and deregistration application through the national enterprise credit information publicity system, with a publicity period of 20 days. If no relevant departments, creditors, or other interested parties raise objections during the public notice period, market entities may apply to the registration authority for deregistration within 20 days from the expiration of the public notice period.

If an individual industrial and commercial household applies for deregistration according to a simplified procedure, there is no need to make it public. The registration authority shall push the application for deregistration of the individual industrial and commercial household to relevant departments such as taxation. If the relevant departments do not raise any objections within 10 days, they can directly handle the deregistration.

If the cancellation of a market entity requires approval in accordance with the law, or if the market entity has its business license revoked, is ordered to close or be revoked, or is included in the list of abnormal operations, the simplified cancellation procedure shall not apply.

8. Integration of Judicial Opinions of the Supreme People's Court (New Edition) · Civil Litigation Volume III, September 2017 edition, page 1712, viewpoint number 1029

It is relatively easy to judge the fact that shareholders of a company promise to be responsible for the company's debts in the industrial and commercial registration materials when the company's legal person is deregistered. Therefore, adding shareholders as executors is not easy to cause disputes. For the sake of efficiency, on the basis of ensuring the defense rights of the added party through the hearing procedure, additional shareholders can be added as the executed party. In addition, if a company's legal representative is deregistered without legal liquidation, creditors can demand that the shareholders and other responsible parties of the company bear corresponding compensation responsibilities through litigation.

Related recommendations

- Tax lawyers review the draft of the revised Tax Collection and Administration Law for soliciting opinions

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 3): "Height Limit" Single Release Mechanism

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 2): Grace Period System

- Interpretation of the Management Measures for Compliance Audit of Personal Information Protection - Feeling the Rhythm and Rhythm of Regulatory Flow