How to Hold Shareholders Responsible for Corporate Debts Series 7: Holding Shareholders Responsible for Misidentification with Company Property (2)

Last time, it was mentioned that if the company owes money, it can be held accountable to shareholders whose assets are mixed with those of a single person company. Today, we will talk about the second situation where the accountability of shareholders is mixed with the company's assets: non one person company shareholders.

Before speaking, let's review the concept of property confusion and understand what non one person company shareholders are.

What is the confusion between shareholders and company assets?

Simply put, it means that the assets of the company and shareholders are mixed together and cannot be clearly distinguished; In fact, if assets are mixed together, personnel may also be highly overlapping, such as shareholders who are also directors or executives of the company; What the company wants to do is often decided by the shareholders, and the company becomes a puppet.

What are non one person company shareholders?

The so-called non one person company refers to a company with more than one shareholder, which is the most common among us; That non one person company shareholder refers to the shareholders of this company.

How can shareholders who mix assets with non one person companies be held accountable?

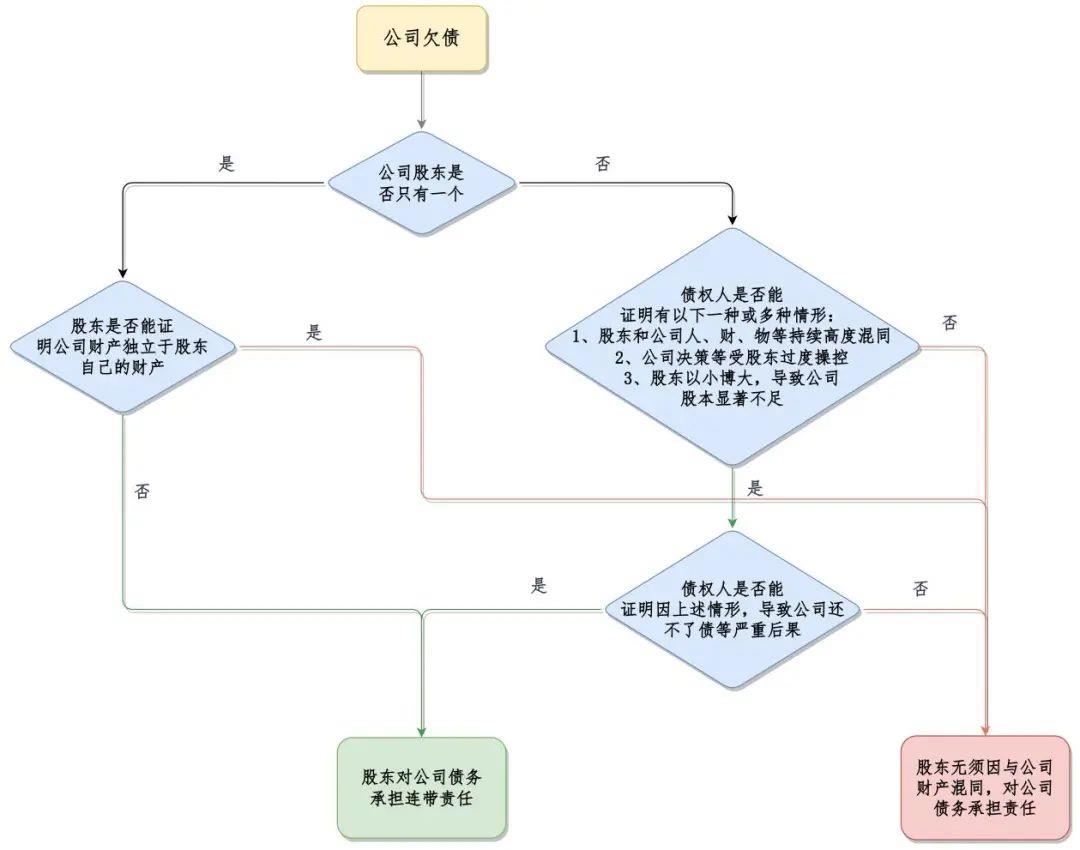

Let's take a picture to illustrate (this picture includes two situations: mixing property with one person company and mixing property with non one person company):

Next, we would like to invite our old friends Wanli Company, Xiaowan, Ligo, and Awen to join a Wanqian Company this time:

Arvin's lawyer found that the shareholders and equity ratio of Wanli Company are 99% of Wanqian Company, while Ligo is 1%; It was also discovered that although Wanli Company signed the contract and made the payment with Ah Wen, they required the supply to Wanqian Company's project; It was also found that both Wanli Company and Wanqian Company work together, with the legal representative, director, and general manager being Xiao Wan. The finance department is also from the same group, basically consisting of "two brands, one set of personnel".

After filing the case, Ah Wen's lawyer applied to the court to retrieve the bank accounts between Wanli Company and Wanqian Company; It was found that Wanqian Company transferred a total of 15 million yuan from Wanli Company through multiple operations in the past two years; The registered capital of Wanli Company is only 12 million yuan;

So, Arvin's lawyer applied to the court to order the two companies to submit their annual audit reports for the previous three years. After obtaining the above information, Ah Wen's lawyer found that the above-mentioned 15 million transfer was not reflected in the audit reports of the two companies.

During the trial, Wanli Company and Wanqian Company confirmed that all the goods provided by Ah Wen were used in Wanqian Company's projects, but were not reflected in the accounts.

Do you think Wanqian Company should bear joint and several liability in this situation? The key depends on whether the following two conditions are met, one of which is indispensable:

1. Creditors can fully prove that there is a continuous, high, and multifaceted confusion between shareholders and the company, especially in terms of property

There are three common situations of confusion, and in practice, there may be one or more of them:

(2) The company is excessively dominated and controlled by shareholders;

(3) The company's capital is clearly insufficient.

Returning to this case, Wanli Company and its shareholder Wanqian Company have mixed performances:

(2) Wanli Company signed the contract and made the payment with Alvin, but all the goods supplied by Alvin were used in the projects of Wanqian Company, which was not reflected in the accounts of the two companies;

(3) Both companies work together;

(4) The legal representatives, directors, and general managers of the two companies are both Xiao Wan, and the finance department is also the same group of people, basically "two brands, one set of personnel";

(5) Wanqian Company holds 99% of the equity of Wanli Company.

Based on this, it can be determined that Wanli Company and its shareholder Wanqian Company have sustained and high degree of confusion in terms of human, financial, and material aspects.

2. Creditors can fully prove that due to confusion, the company is unable to repay its debts and other serious consequences

On the other hand, Wanli Company has a registered capital of only 12 million yuan and still owes Awan 6.66 million yuan for goods. In addition, there are other debts that cannot be repaid.

It can be seen that the shareholder Wanqian Company's actions in this case actually hollowed out Wanli Company, and as a result, Wanli Company had no money to repay its debts, with serious consequences.

What is the outcome of this case?

Through the efforts of lawyers, Ah Wen has fully proven that there is property confusion between Wanli Company and its shareholder Wan Qian Company, which has resulted in Wanli Company being unable to repay Ah Wen's payment for goods.

Finally, the court ordered Wanli Company to pay the principal and interest of 6.66 million yuan to Ah Wen, while Wanqian Company must bear joint and several liability for all the principal and interest of Ah Wen's goods!

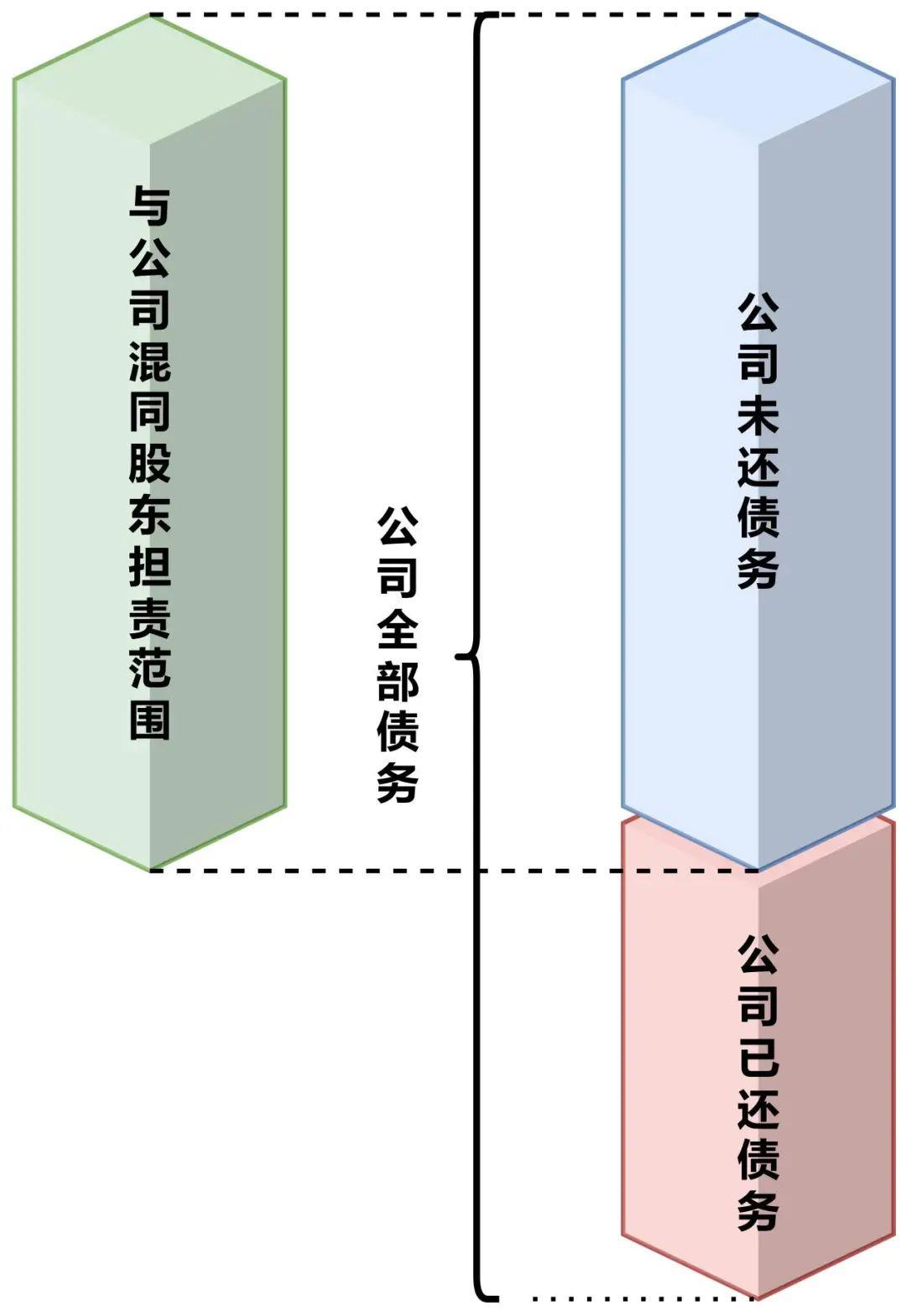

be careful! As shown in the above figure, such shareholders are jointly and severally liable for all principal and interest payments; Unlike shareholders who have issues with their capital contributions or have accelerated the maturity of their capital contributions, they are only responsible for the company's debts within the scope of the principal and interest that have not been contributed!

Are there many such shareholders? Is the probability of success in accountability high?

Although there are many such shareholders, the success rate of accountability is relatively low; However, the experience and legal skills of a lawyer in handling cases have a significant impact on the success rate of accountability!

In practice, the shareholders are two or more companies, accounting for the majority; It is not uncommon for a company and its shareholders to have mixed assets in fact.

Why is it that the success rate of holding shareholders accountable for property confusion is lower compared to holding shareholders accountable for a one person company?

The devil is all in the details.

Firstly, to hold such shareholders accountable, the burden of proof for creditors is heavy. It is not only necessary to fully prove the continuous, high, and multifaceted confusion between the company and shareholders, especially in terms of property, but also to fully prove the serious consequences of the company's inability to repay its debts, which is not an easy task; Unlike holding one person company shareholders accountable, where shareholders provide sufficient evidence to prove that there is no confusion, creditors have a lighter burden of proof.

For example, in this case, Arvin only proves that the two companies have mixed office locations and personnel, which is not enough. More importantly, he also needs to prove that the two companies have had a high degree of financial and property confusion for a period of time, which could be considered as a continuous, high, and multifaceted confusion, especially in terms of property; However, the actual misappropriation and occupation of Wanqian Company's funds and assets by Wanli Company must reach the level of hollowing out Wanqian Company and causing it to have no money to repay its debts, in order to claim that this has resulted in serious consequences.

Secondly, the evidence to prove the existence of confusion is mostly in the hands of the company and shareholders, and it is quite difficult for creditors to obtain evidence, and it may not be possible to obtain it yet; Secondly, after obtaining evidence, creditors need to eliminate the waste and organize the effective parts of scattered evidence to form a chain of evidence for argumentation. The above two points are relatively complex, which further tests the lawyer's case handling experience and legal skills, as well as the abilities of evidence collection, logical reasoning, sorting and induction.

For example, in this case, the bank transactions between the two companies, as well as the annual audit reports of the two companies for the first three years, need to be obtained after filing the case. The former obtains them by applying for court investigation, while the latter obtains them by requesting the court to order the other party to submit them. After obtaining these documents, it is necessary to extract key information such as the fact that Wanqian Company transferred a total of 15 million yuan from Wanli Company in the first two years without accounting, and combine it with other evidence to demonstrate the continuous, high, and multifaceted financial confusion between the two companies from multiple aspects and perspectives.

Once again, as stated in the "Nine Minutes of the People", such cases "have the phenomenon of being not good at or afraid to apply due to the relatively principled and abstract legal provisions, and the high difficulty of application". Courts are generally cautious about such cases; At the same time, such cases are greatly influenced by the subjective judgment of judges, and there may be similar situations, but the judgment results are vastly different.

However, the "Nine Minutes of the People" also mentioned that for such cases, "it is both prudently applied and applicable when applicable". Therefore, creditors can entrust experienced lawyers in this field to collect evidence from all aspects as much as possible, organize a complete chain of evidence, and conduct sufficient argumentation on this basis. They can also hold such shareholders accountable!

At this point, let's finish talking about how to hold shareholders who are confused with the company's assets accountable for the company's debts. So, are there any other ways to hold shareholders accountable?

For more information on the future, please listen to the breakdown in the next section!

Based on and referenced laws, regulations, and cases (slide down to view)

1. Article 20 of the Company Law (2018 Amendment)

If a company's shareholders abuse the independent status of the company's legal person and the limited liability of shareholders, evade debts, and seriously harm the interests of the company's creditors, they shall bear joint and several liability for the company's debts.

2. Minutes of the National Conference on Civil and Commercial Trial Work of Courts (i.e. "Nine Minutes of the People")

(4) On Denial of Corporate Personality

The independence of corporate personality and limited liability of shareholders are the fundamental principles of company law. Denying the independent personality of a company and assuming joint and several liability for company debts by shareholders who abuse the independent status of the company's legal person and limited liability of shareholders is an exception to the limited liability of shareholders, aiming to correct the imbalance in the protection of creditors under the limited liability system when specific legal facts occur. In judicial practice, it is necessary to accurately grasp the spirit of Article 20 (3) of the Company Law. One is that it can only be applied when shareholders have committed acts of abusing the independent status of the company's legal person and the limited liability of shareholders, and such acts have seriously harmed the interests of the company's creditors. Harming the interests of creditors mainly refers to the abuse of rights by shareholders that makes the company's assets insufficient to pay off the debts of the company's creditors. The second is that only shareholders who have abused the independent status of legal persons and limited liability of shareholders are jointly and severally liable for the company's debts, while other shareholders should not bear this responsibility. The third is that the denial of corporate personality is not a comprehensive, complete, and permanent denial of the company's legal personality, but rather a breakthrough in the general rule that shareholders are not liable for company debts based on specific legal facts and legal relationships in specific cases, and an exception is made to order them to bear joint and several liability. The Res judicata of the judgment of the people's court denying the company's personality in a case only binds the parties to the lawsuit, does not naturally apply to other lawsuits involving the company, and does not affect the survival of the company's independent legal personality. If other creditors file a lawsuit denying the company's personality, the facts determined by the effective judgment can be used as evidence. The fourth is the abuse behavior stipulated in Article 20, Paragraph 3 of the Company Law. Common situations in practice include personality confusion, excessive domination and control, and significant insufficient capital. When trying a case, it is necessary to make a comprehensive judgment based on the identified facts of the case, which should be applied prudently and applied appropriately. In practice, there is a phenomenon of abusing this exception system due to lax grasp of standards, as well as the phenomenon of not being good at or afraid to apply due to the relatively principled and abstract legal provisions, which are difficult to apply. All of these should be highly valued.

10. 【 Personality Similarity 】 The fundamental criterion for determining whether a company's personality and shareholder's personality are mixed is whether the company has independent will and independent property, and the main manifestation is whether the company's property and shareholder's property are mixed and indistinguishable. When determining whether it constitutes mixed personality, the following factors should be comprehensively considered:

(2) Shareholders use the company's funds to repay their debts, or use the company's funds for free by affiliated companies without making financial records;

(3) The company's accounting books are not separated from the shareholders' accounting books, resulting in the inability to distinguish between the company's assets and the shareholders' assets;

(4) The shareholders' own profits are indistinguishable from the company's profits, resulting in unclear interests between both parties;

(5) The company's assets are recorded in the name of shareholders and are occupied and used by them;

(6) Other situations of mixed personality.

In the case of personality confusion, the following confusion often occurs simultaneously: confusion between company business and shareholder business; The confusion between company employees and shareholder employees, especially financial personnel; The company's domicile is mixed with the shareholder's domicile. When trying a case, the key for the people's court is to examine whether it constitutes personality confusion, without requiring the presence of other aspects of confusion at the same time. Other aspects of confusion are often just reinforcement of personality confusion.

11. [Excessive Control and Control] The controlling shareholders of a company excessively control and control the company, manipulate the decision-making process of the company, and make the company completely lose its independence, become a tool or body of the controlling shareholders, seriously damage the interests of the company's creditors. The company's personality should be denied, and the shareholders who abuse the control power should bear joint and several liability for the company's debts. Common situations in practice include:

(2) Transactions between parent and subsidiary companies or subsidiaries, where the profits belong to one party but the losses are borne by the other party;

(3) Withdrawing funds from the original company first, and then establishing a company with the same or similar business objectives to evade the debts of the original company;

(4) Dissolve the company first, and then establish a new company based on the original company's premises, equipment, personnel, and the same or similar business purposes to evade the debts of the original company;

(5) Other situations of excessive domination and control.

If a controlling shareholder or actual controller controls multiple subsidiaries or affiliated companies, abuses control power and causes unclear property boundaries, financial confusion, mutual transmission of interests, loss of personal independence, and becomes a controlling shareholder evading debt, illegal business operations, and even illegal criminal tools, the legal personality of the subsidiary or affiliated company can be denied based on the facts of the case, and joint liability can be ordered.

Related recommendations

- Tax lawyers review the draft of the revised Tax Collection and Administration Law for soliciting opinions

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 3): "Height Limit" Single Release Mechanism

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 2): Grace Period System

- Interpretation of the Management Measures for Compliance Audit of Personal Information Protection - Feeling the Rhythm and Rhythm of Regulatory Flow