How to Hold Shareholders Responsible for Corporate Debts Series 5: Holding Shareholders Responsible for Accelerated Maturity of Capital Contributions (4)

——The situation where the company's bankruptcy proceedings have ended

At the end of the bay, there is no way out, but when the embankment returns, a bridge suddenly appears.

——Song, Zhao Yan

Previously, we mentioned three situations where a company is in debt and can pursue capital contributions to accelerate the maturity of shareholders. Today, let's talk about the final situation: the end of the company's bankruptcy proceedings.

Case Description

Once again, we would like to invite Xiao Wan, Li Ge, Wan Li Company, and Ah Wen:

A lawyer's investigation by Ah Wen found that the articles of association of Wanli Company stipulate that both Xiao Wan and Li Ge subscribe to 10 million yuan of capital and must fully pay 10 million yuan each by the end of 2099; When Arvin was collecting the payment, Xiaowan only paid 8 million yuan, while Ligo paid 10 million yuan.

At the same time, Arvin's lawyer also found that because Wanli Company was insolvency, the court accepted the creditor's bankruptcy liquidation application; After acceptance, the court ruled to terminate the bankruptcy proceedings of Wanli Company due to the discovery that the assets of Wanli Company could not even bear the remuneration and expenses of the bankruptcy administrator.

resolvent

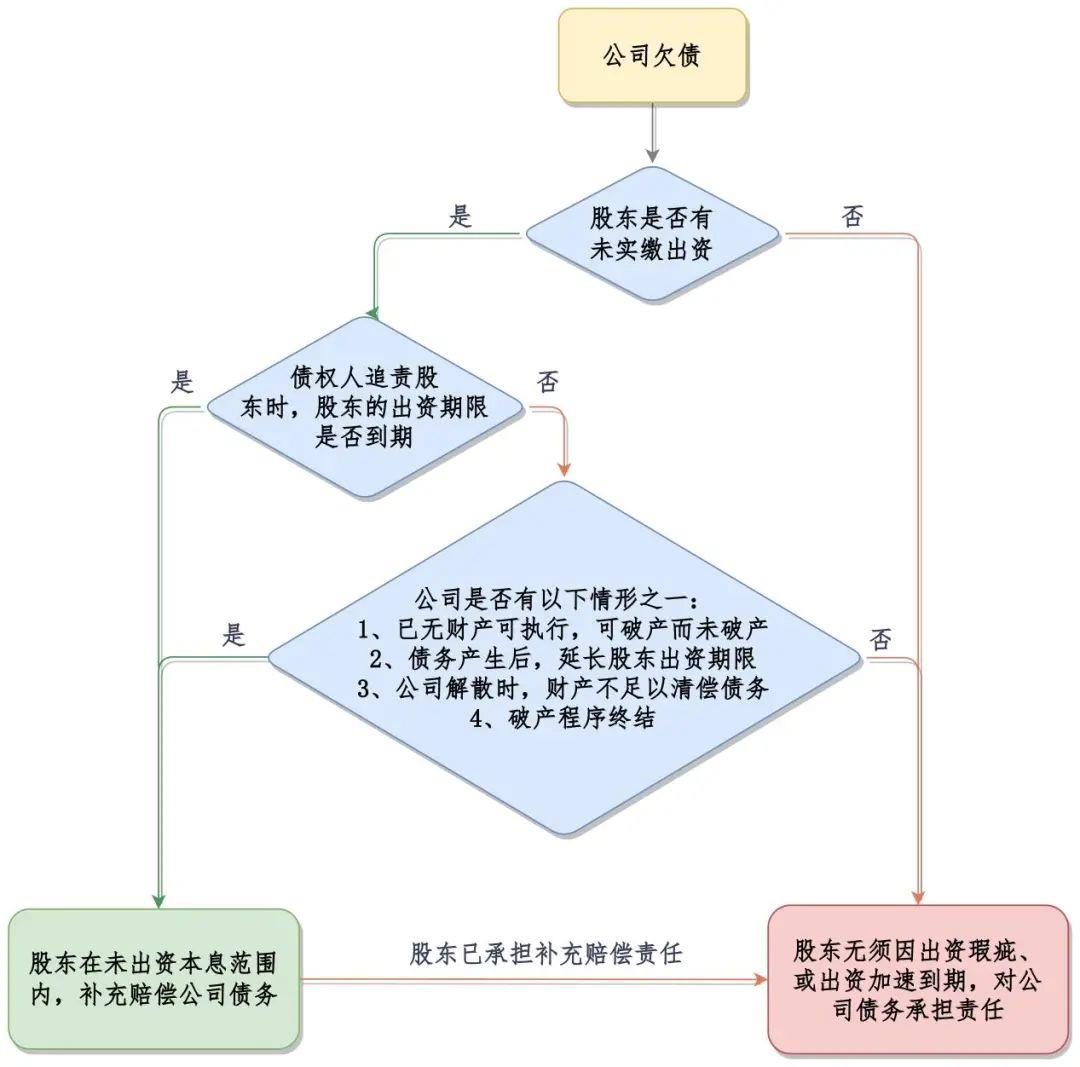

In this case, Arvin can also hold Xiaowan accountable, as shown in the following figure:

Why can Xiao Wan be held accountable? Because of the above case, three indispensable conditions are met:

1. Shareholders' paid in capital is less than their subscribed capital

The paid in capital of shareholder Xiaowan is only 8 million, which is less than his subscribed capital of 10 million.

2. When the creditor seeks accountability from the shareholder, the shareholder's actual contribution deadline has not yet arrived

Ah Wen's accountability to Xiao Wan was in June 2022, while the articles of association of Wanli Company stipulate that Xiao Wan and Li Ge only paid 10 million each before the end of 2099.

3. The bankruptcy proceedings of the company have come to an end

Due to the inability of Wanli Company's assets to cover the remuneration and expenses of its managers, the court terminated Wanli Company's bankruptcy proceedings.

What will be the outcome of this case?

Firstly, at this time, Xiaowan's remaining 2 million yuan needs to be paid in, which was originally due in 2099 but is now due.

Secondly, because Wanli Company has no property and the bankruptcy proceedings have ended, it is no longer meaningful to pursue payment from the company. Therefore, Arvin directly pursued responsibility from Xiaowan.

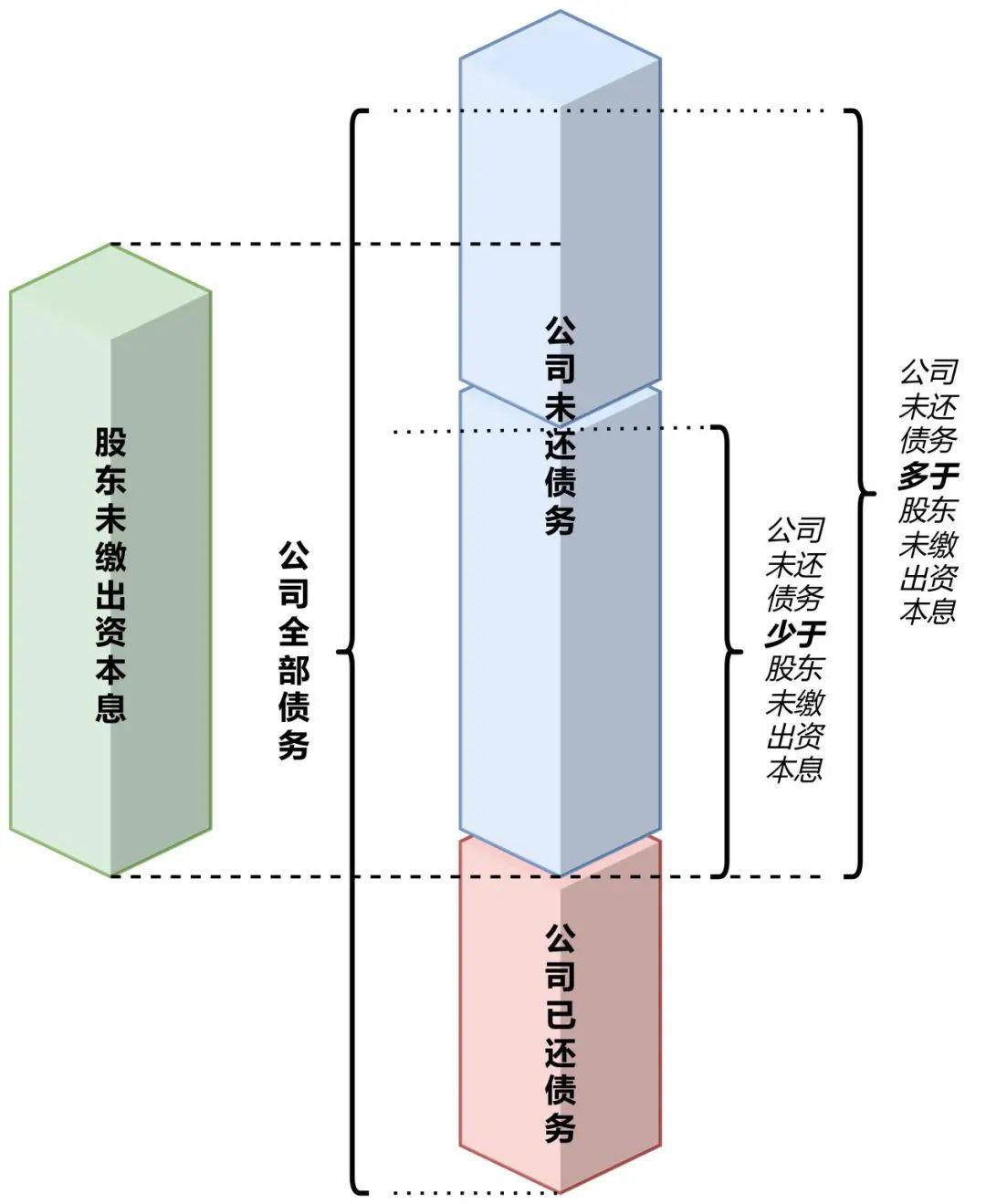

Thirdly, for the unpaid principal and interest of Awen's 8.88 million yuan loan, Wanli Company shall bear the responsibility of Xiaowan, but it shall be limited to the unpaid principal and interest of Xiaowan's 2 million yuan contribution (such as a total of 2.02 million yuan); Except for the 2020000 principal and interest, Xiaowan no longer has to bear any debts owed by the company, whether it is the remaining payment from Ah Wen or the debts owed by Wanli Company to others.

I don't understand? We will convert the above text into the following image:

Is there anything special about this situation?

The termination of the company's bankruptcy proceedings is not explicitly stipulated in laws and regulations such as the "Nine Minutes of the People".

However, based on the legal principles reflected in Article 6 of the "Nine Minutes of the People's Republic of China" and Article 35 of the "Enterprise Bankruptcy Law" (i.e., if there is a reason for bankruptcy or if the bankruptcy application has been accepted, the shareholder's contribution will be accelerated to maturity), and referring to the Supreme People's Court's (2016) Supreme Court Judgment No. 279, and combining with my practical experience in handling cases, this situation can also accelerate the maturity of shareholder contributions and hold shareholders accountable, And it's different from bankruptcy proceedings.

What if the court accepts a bankruptcy application against the company, but the bankruptcy proceedings have not yet been concluded and are stuck in the middle?

Good question! Let's take Wanli Company as an example.

At this point, although Xiaowan's contribution period has expired, it is the bankruptcy administrator designated by the court who will hold Xiaowan accountable, not Ah Wen.

Is it easier for Arvin to have someone hold him accountable? Let's look down.

On the one hand, in order for the manager to hold Xiaowan accountable, it is necessary for the creditors to reach a consensus first; On the other hand, even if the manager sued Xiao Wan, they eventually recovered some money, but! This amount needs to be distributed by all creditors! Fortunately, Arvin was able to receive several tens of thousands of shares; If you have bad luck, then you really don't know how much it is!

How many such shareholders are there? Is the probability of success in accountability high?

Narrow range, but high success rate! And whoever recovers the money belongs to whoever, there is no need for all creditors to share it like in bankruptcy liquidation!

Because in order to reach the end of the company's bankruptcy proceedings, there are many procedures to go through and relatively few that meet the conditions, so the scope is definitely relatively narrow.

However, the conditions for holding such shareholders accountable are very clear, which are that the shareholders have paid in less capital than their subscribed capital, the bankruptcy administrator has not sued the shareholders, and the court has issued a ruling to terminate the bankruptcy proceedings. Therefore, the probability of holding such shareholders accountable is still quite high.

And most importantly, when the path of pursuing the company is already blocked and other creditors may consider themselves unlucky, if a single creditor pursues shareholders, it is not only possible to recover some or all of the funds, but also the recovered money belongs to the creditor. There is no need for all creditors to be divided according to their debt ratio like in bankruptcy liquidation!

That's all for now about how to hold shareholders responsible for accelerating the maturity of their capital contributions when the company owes debts. Can shareholders who have fully paid in their registered capital be held accountable?

For more information on the future, please listen to the breakdown in the next section!

Based on and referenced laws, regulations, and cases:

Based on and referenced laws, regulations, and cases (slide down to view)

1. Article 6 of the "Minutes of the National Conference on Civil and Commercial Trial Work of Courts" (i.e. the "Nine Minutes of the People's Republic of China") 【 Should shareholder contributions be accelerated to maturity 】

Under the registered capital subscription system, shareholders enjoy term benefits in accordance with the law. If a creditor requests a shareholder who has not reached the deadline for capital contribution to bear supplementary compensation liability for the company's debts that cannot be paid off within the scope of capital contribution, on the grounds that the company cannot pay off its due debts, the people's court shall not support it. However, the following situations are excluded:

(1) In cases where the company is the subject of enforcement, the people's court exhausted the enforcement measures and had no property available for enforcement, and had already met the reasons for bankruptcy, but did not apply for bankruptcy;

(2) After the company's debt arises, the shareholders' (general) meeting of the company decides or extends the shareholder's contribution period in other ways.

2. Article 35 of the Enterprise Bankruptcy Law

3. Hainan Jinxia Construction Co., Ltd. and Agricultural Bank of China Shenzhen Branch Shareholders' Capital Contribution Dispute Reexamination Civil Judgment Letter [(2016) Supreme People's Court No. 279]

This court believes that... when the bankruptcy proceedings are concluded, the personal liquidation procedure is resumed, and the settlement plan proposed by the liquidation team in this case has not been approved by the majority of creditors, but has not exempted the debtor's debt. It only does not process this part of the property in the bankruptcy proceedings, nor does it prohibit creditors who claim compensation from pursuing false capital contributions or withdrawing capital contributions from shareholders of Peking University Zhongji Company after the bankruptcy proceedings are concluded

Our court believes that... in this case, Xunyu Company claims that the assets of Liyuan Company are insufficient to repay its debts, and Huang Yuqiang and Xiao Xiaoling should bear joint and several liability for the debts of Liyuan Company to the extent of their subscribed registered capital. According to the verified facts, Huang Yuqiang and Xiao Xiaoling, as shareholders, subscribed to the capital contribution to Liyuan Company, and their actual contributions were both 0. The two did not fulfill their investment obligations. However, the Intermediate People's Court of Guangzhou City, Guangdong Province accepted Alibaba Cloud Computing Co., Ltd.'s bankruptcy liquidation application against Liyuan Company on November 4, 2022. Therefore, Xunyu Company requested Huang Yuqiang and Xiao Xiaoling to assume supplementary compensation liability for Liyuan Company's debts, which is unfounded in law and not supported by this court

Related recommendations

- Tax lawyers review the draft of the revised Tax Collection and Administration Law for soliciting opinions

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 3): "Height Limit" Single Release Mechanism

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 2): Grace Period System

- Interpretation of the Management Measures for Compliance Audit of Personal Information Protection - Feeling the Rhythm and Rhythm of Regulatory Flow