How to Accountable Shareholders for Corporate Debts Series 3: Accountable Shareholders with Accelerated Maturity of Capital Contributions (2)

As mentioned in the previous section, the first scenario where a company is in debt and can be held accountable for accelerating the maturity of its capital contributions is for shareholders. Today, let's talk about the second scenario: after a company's debt arises, the company extends the shareholder's contribution period.

Case Description

We still invite Xiao Wan, Li Ge, Wan Li Company, and Ah Wen to provide us with their personal experiences:

In January 2020, Alvin signed a supply contract with Wanli Company and began supplying goods. In June 2022, Wanli Company owed 8.88 million yuan for the goods but did not repay it. Ah Wen then hired a lawyer to help him recover the payment.

A lawyer's investigation by Ah Wen found that in January 2020, when Ah Wen signed a contract with Wanli Company and began supplying goods, the old articles of association in effect at that time stipulated that Xiao Wan and Li Ge should each pay in 10 million capital by December 31, 2021.

But later, in April 2022, the old articles of association of Wanli Company were changed, and the new articles stipulated that Xiaowan and Lige would only pay 10 million yuan each by the end of 2099. When I went to Arwen to collect the payment, Xiaowan only paid 8 million yuan in full, while Ligo paid 10 million yuan in full.

So in June 2022, Alvin sued Wanli Company and Xiaowan together, demanding that Wanli Company pay the principal and interest of 8.88 million yuan for the goods, and demanded that Xiaowan bear supplementary compensation liability for the above-mentioned principal and interest of the goods.

resolvent

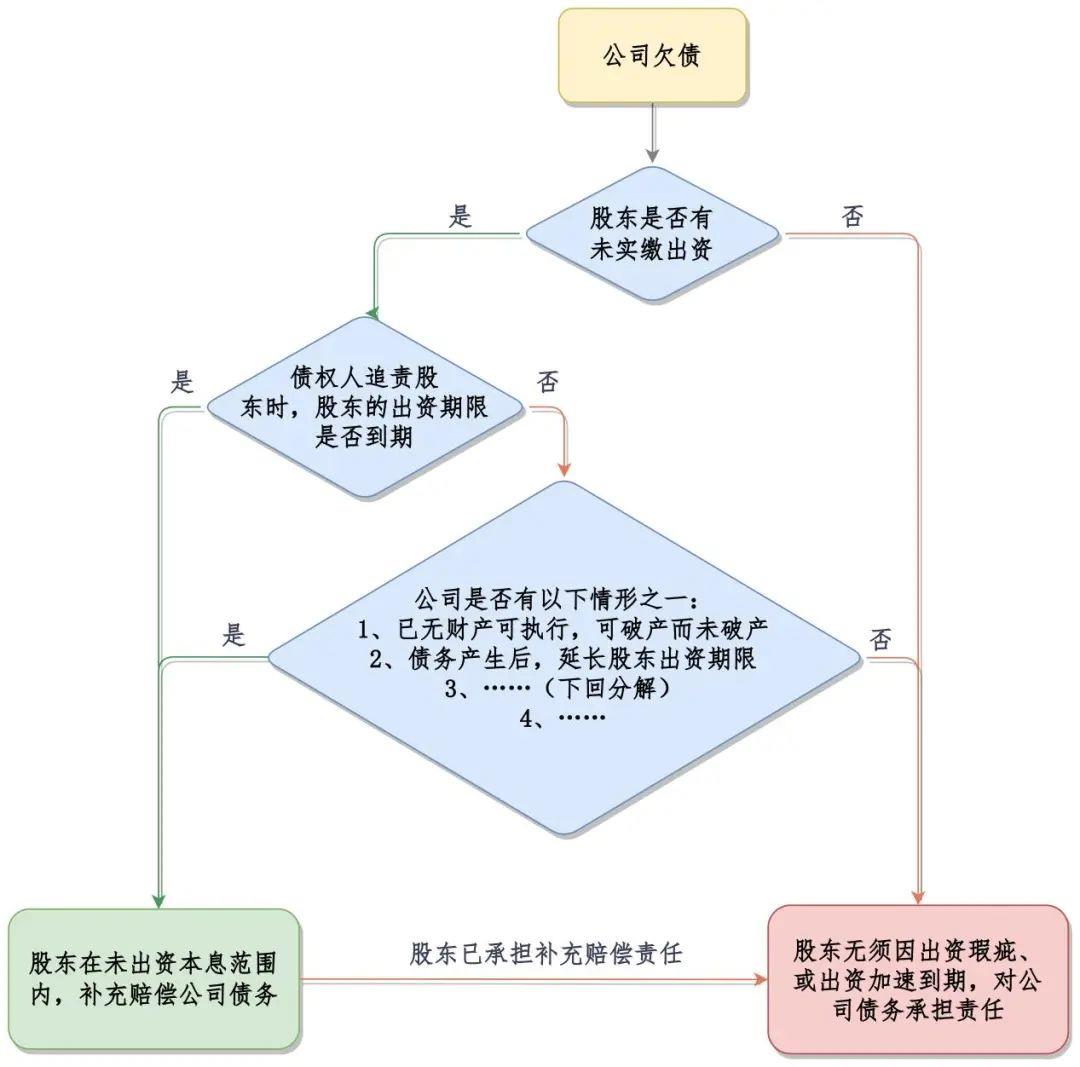

So what will be the outcome of this case? Let's take this picture for a look:

Wanli Company owes Awen the payment for goods, and whether Awen can hold Xiaowan or Ligo accountable depends on whether the following three indispensable conditions have been met:

1. Shareholders' paid in capital is less than their subscribed capital

The paid in capital of shareholder Xiaowan is only 8 million, which is less than her subscribed capital of 10 million. (Regarding the concepts of paid in capital and subscribed capital, please refer to my previous book "How to hold shareholders accountable for company debts (1)")

And Li Ge has already paid in 10 million yuan, which is the same amount as his subscribed capital of 10 million yuan, so Ah Wen cannot pursue responsibility from Li Ge.

2. When creditors hold shareholders accountable, the shareholder's paid in capital contribution deadline has not yet expired

Ah Wen's accountability to Xiao Wan was in June 2022, when the articles of association of Wanli Company stipulated that Xiao Wan and Li Ge would only pay 10 million each by the end of 2099.

3. After the company's debt arises, if the company does not extend the shareholder's contribution period, then the shareholder's contribution period has already expired when the creditor recovers the debt

In January 2020, when Ah Wen signed a supply contract and began supplying goods (which was a typical time for the company's debt generation), the old articles of association of Wanli Company at that time stipulated that both Xiao Wan and Li Ge would pay a deadline of 10 million yuan, which was December 31, 2021.

However, in April 2022, the old articles of association of Wanli Company were changed, and the new articles stipulated that Xiao Wan and Li Ge would only pay 10 million yuan each by the end of 2099.

At this point, you only need to look at the old articles of association instead of the new ones; The old articles of association of Wanli Company stipulated that the actual payment deadline was December 31, 2021, which had already passed when Arvin was collecting debts in June 2022.

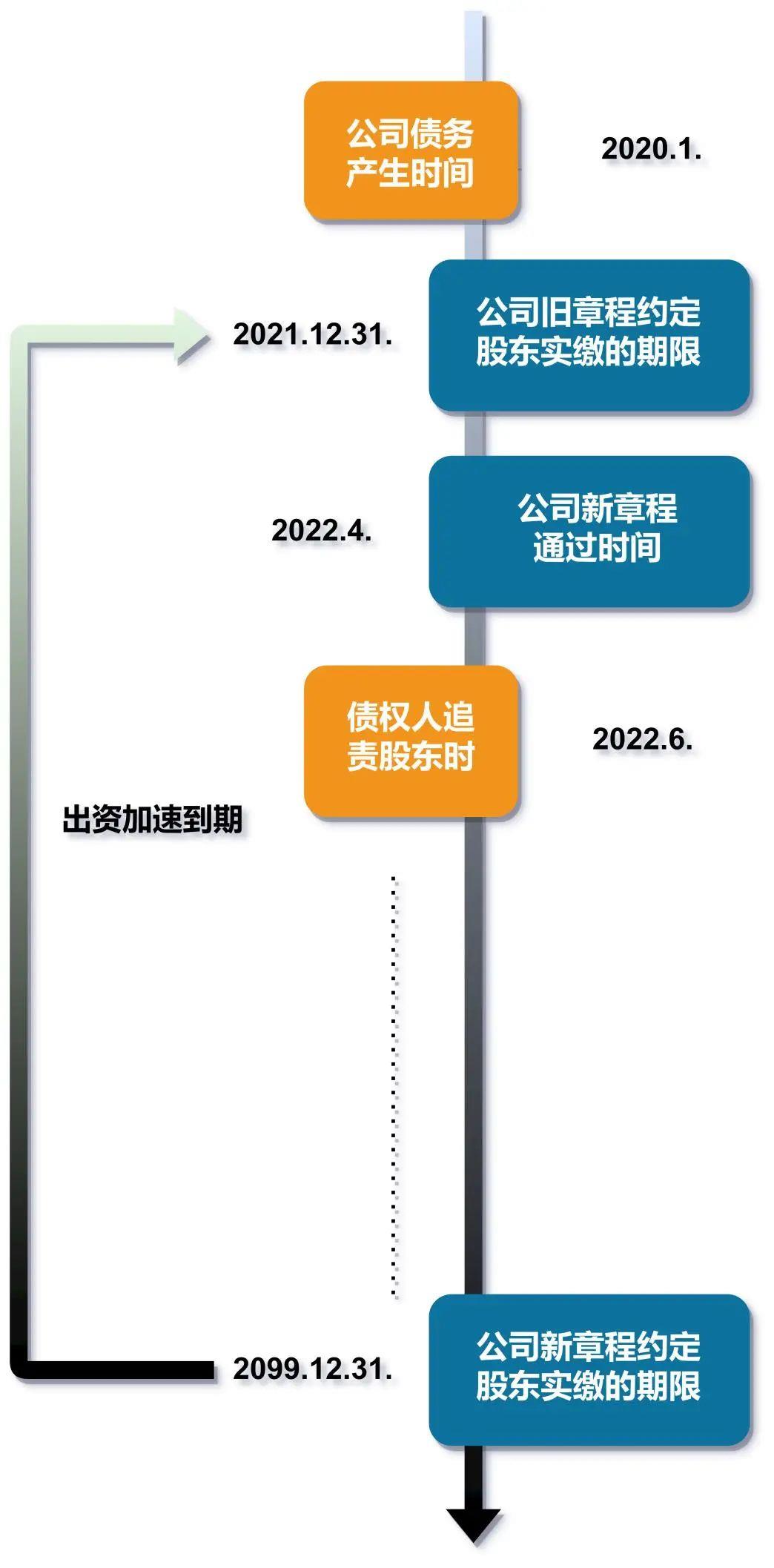

Haven't you understood yet? We will convert the above text into the following image:

So what will happen to this case?

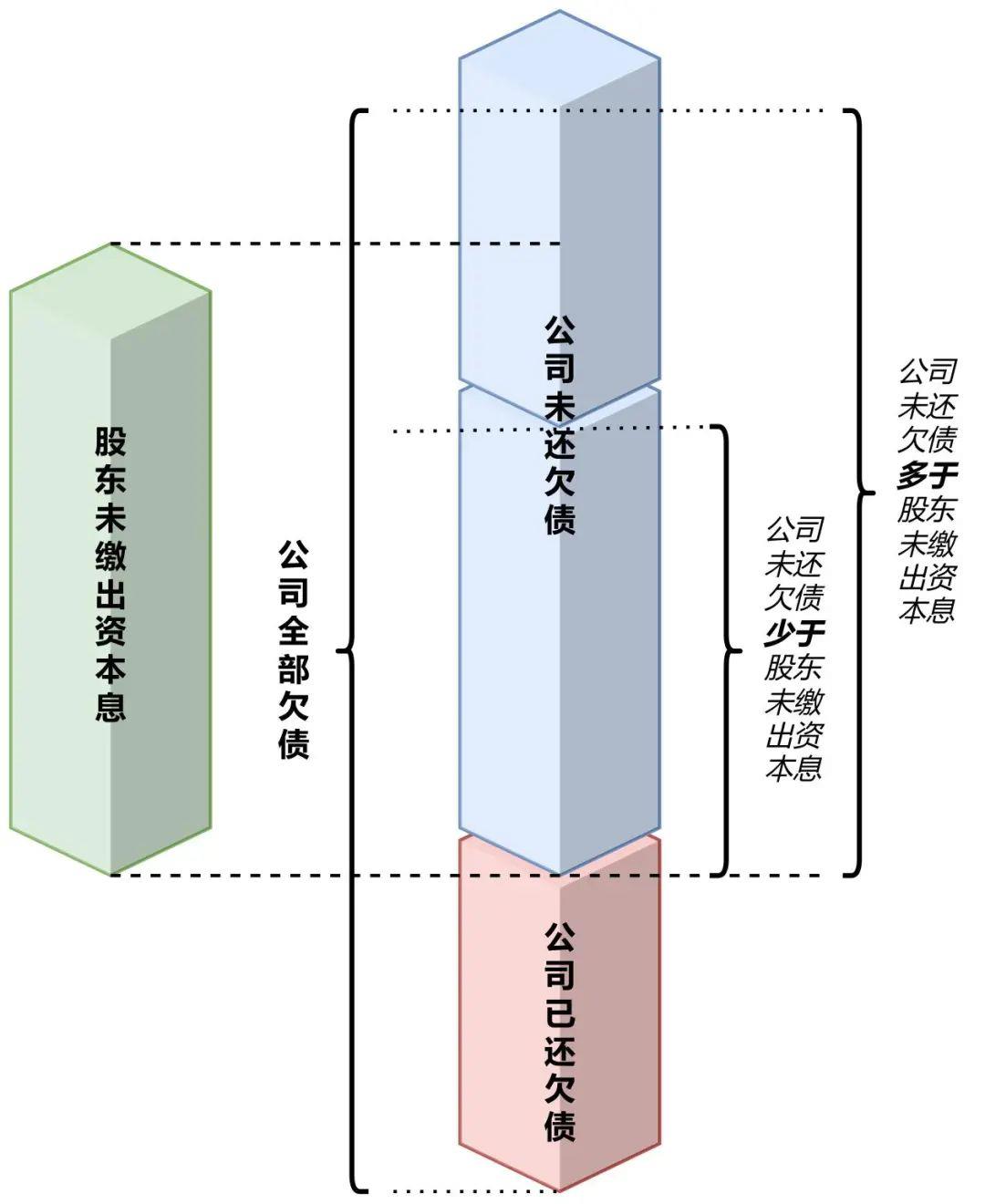

Firstly, Xiaowan's remaining 2 million yuan of paid in capital will expire now and there is no need to wait until 2099.

Secondly, the principal and interest of 8.88 million yuan should be repaid by Wanli Company, while Xiaowan shall bear supplementary compensation responsibility for the unpaid portion of Wanli Company. What is supplementary liability? If Wanli Company only repays 1 million yuan, Xiaowan will have to pay the remaining principal and interest, but there are restrictions.

Thirdly, the principal and interest of the payment to be borne by Xiaowan shall be limited to the 2 million principal and interest that Xiaowan has not actually contributed (for example, a total of 20.2 million); Except for the 2020000 principal and interest, Xiaowan no longer has to bear any debts owed by the company, whether it is the remaining payment from Ah Wen or the debts owed by Wanli Company to others.

Still not understanding? We will convert the above text into the following image:

Wide range and high success rate!

Compared to shareholders with problematic capital contributions, the scope of accountability for such shareholders is actually similar and relatively broad.

Due to the daily operation of the company, it is inevitable to sign contracts with external parties, and corresponding debts will also arise from time to time; The revision of the capital contribution period in the company's articles of association and the timing of the company's debts at any time require some effort to perfectly match, but there will always be mismatches or errors. Therefore, there are quite a few such shareholders.

At the same time, in order to hold such shareholders accountable, both conditions mentioned above must be objective and can be directly reflected through the company's articles of association, without the need for too much subjective judgment by the court. Therefore, it is also relatively easy to apply.

Because of this, the probability of holding such shareholders accountable is still quite high.

This time, we talked about how to hold accountable shareholders who have accelerated the maturity of their capital contributions due to the company's extension of shareholder contribution deadlines after the company's debts arose. Next time, we will talk about the third scenario for shareholders who accelerate the maturity of their capital contributions - how to hold shareholders accountable when the company is dissolved and their assets are insufficient to repay debts.

For more information on the future, please listen to the breakdown in the next section!

References and annotations:

Swipe down to view

Article 6 of the Minutes of the National Conference on Civil and Commercial Trials of Courts 【 Should Shareholders' Contributions Accelerate Maturity 】

Under the registered capital subscription system, shareholders enjoy term benefits in accordance with the law. If a creditor requests a shareholder who has not reached the deadline for capital contribution to bear supplementary compensation liability for the company's debts that cannot be paid off within the scope of capital contribution, citing the company's inability to pay off its due debts, the people's court shall not support it. However, the following situations are excluded:

(1) In cases where the company is the subject of enforcement, the people's court exhausted the enforcement measures and had no property available for enforcement, and had already met the reasons for bankruptcy, but did not apply for bankruptcy;

(2) After the company's debt arises, the shareholders' (general) meeting of the company decides or extends the shareholder's contribution period in other ways.

Related recommendations

- Tax lawyers review the draft of the revised Tax Collection and Administration Law for soliciting opinions

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 3): "Height Limit" Single Release Mechanism

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 2): Grace Period System

- Interpretation of the Management Measures for Compliance Audit of Personal Information Protection - Feeling the Rhythm and Rhythm of Regulatory Flow