Trial Practice of the Crime of Insider Trading and Disclosing Insider Information

In recent years, with the continuous development of China's capital market, insider trading and disclosure of insider information have emerged in an endless stream. With the development of technology and innovation in trading methods, insider trading and disclosure of insider information cases have shown an increasing number, increasingly covert means, and increasingly complex forms. This article will take the crime of insider trading and disclosing insider information as the research object, and combine with judicial practice to introduce the specific behaviors, criminal amounts, and sentencing of insider trading and disclosing insider information, with a view to revealing the problems existing in judicial practice.

1、 Overview of the Crime of Insider Trading and Disclosure of Insider Information

The crime of insider trading and divulging insider information was added to the Criminal Law in 1997. Article 4 of the Criminal Law Amendment in 1999 amended the counts of this crime and added provisions on futures crimes. In 2009, Article 2 of the Criminal Law Amendment (VII) once again revised the counts of this crime, adding the count of "explicitly or implying that another person is engaged in the above-mentioned trading activities.". On March 29, 2012, the two high schools jointly issued the "Interpretation on Criminal Cases of Handling Insider Trading and Disclosing Insider Information" (FSJ [2012] No. 6, hereinafter referred to as the "Interpretation"), clarifying guiding principles for the development trend of securities and futures crimes and prominent issues in judicial practice. The new "Securities Law" implemented on March 1, 2020 has further improved the basic system of the securities market, made some changes and connections in securities crimes, and implemented the supervision of the capital market to the criminal level.

Article 180 of the Criminal Law stipulates that a person who has insider information about securities and futures trading or who illegally obtains insider information about securities and futures trading, before the issuance of securities, securities and futures trading, or other information that has a significant impact on the prices of securities and futures trading has been made public, purchases or sells the securities, engages in futures trading related to the insider information, or divulges the information, "Or explicitly or implying that another person engages in the above-mentioned trading activities, if the circumstances are serious, shall be sentenced to fixed-term imprisonment of not more than five years or criminal detention, and shall also, or shall only, be fined not less than one time but not more than five times the illegal income;"; "If the circumstances are especially serious, he shall be sentenced to fixed-term imprisonment of not less than five years but not more than 10 years, and shall also be fined not less than one time but not more than five times the illegal gains.".

"Where a unit commits the crime mentioned in the preceding paragraph, it shall be fined, and the persons directly in charge and other persons directly responsible for the crime shall be sentenced to fixed-term imprisonment of not more than five years or criminal detention.".

2、 Top 10 Highlights of Insider Trading and Disclosure of Insider Information Cases

Case selection: The author conducted a search through tools such as China Judicial Documents Network and Wicko Advance. During the case selection process, the key words were identified as insider trading and the crime of divulging insider information, the subject matter of the case was selected for criminal cases, the trial procedure was selected for first instance, and the document type was selected for judgment. After searching, a total of 149 first instance judgments on insider trading and the crime of divulging insider information were obtained nationwide from 2006-22, excluding duplicate and invalid samples, There are a total of 74 effective first instance adjudication documents, involving 116 defendants (including 4 units).

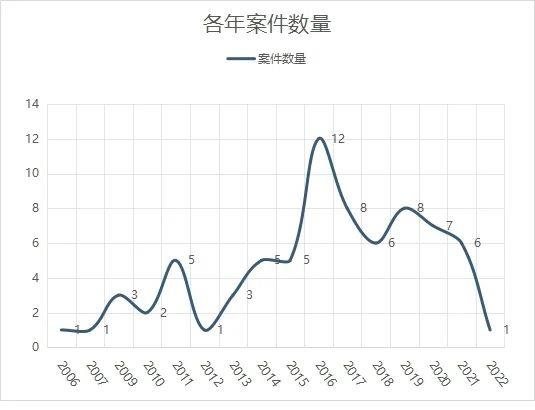

(1) Annual distribution of cases of insider trading and disclosure of insider information

According to the search results, there were 74 cases of insider trading and disclosure of insider information during 2006-22, with the number of cases in each year as shown in the figure below. It is not difficult to find that from 2015 to 2016, the number of cases increased sharply, which should be closely related to the sharp fluctuations in the securities market in 2015. After 2016, the number of cases decreased somewhat. The overall number of cases from 2015 to 2021 showed a steady increase compared to 2006 to 2015.

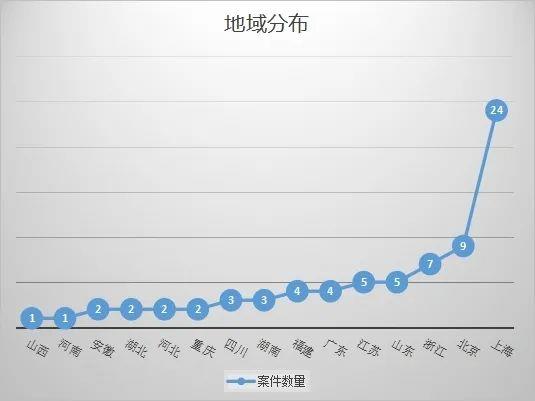

(2) Regional distribution of cases of insider trading and disclosure of insider information

As shown in the figure below, cases of insider trading and disclosure of insider information are concentrated in provinces and cities such as Shanghai, Beijing, and Zhejiang. The number of cases in these three provinces and cities has reached 54% of the total number of cases.

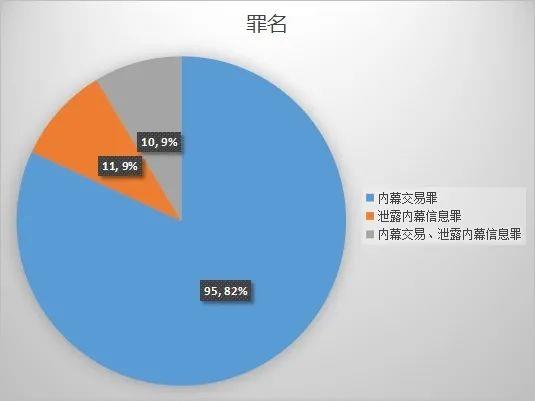

(3) Distribution of crimes of insider trading and disclosure of insider information

The crime of insider trading and disclosing insider information is a selective crime. According to the search results, a total of 116 defendants (including 4 units) were involved in 74 judgments, of which 95 were convicted of insider trading, 11 were convicted of divulging insider information, and 10 were convicted of insider trading and divulging insider information。

(4) Types of Inside Information

Based on 74 cases of insider trading and disclosure of insider information, statistical analysis of the types of insider information identified in the judgment found that there were 41 cases involving significant asset restructuring insider information, accounting for 55.41%; A total of 7 cases involving insider information on equity acquisitions, accounting for 9.46%; A total of 5 cases involving insider information on major investment matters, accounting for 6.76%; There were 4 cases involving annual profit distribution plans and insider information on non-public offerings of stocks, accounting for 5.41%; Three cases involving insider information on equity cooperation, accounting for 4.05%; There were 2 cases involving major litigation matters and insider information related to performance growth, dividends, and significant contract benefits, accounting for 2.7%; One case involving the split share structure reform, capital increase and share expansion, equity transfer, scheme of debt offset by rent, mergers and acquisitions, and inside information about significant progress made in the development of COVID-19 Pharmaceutical.

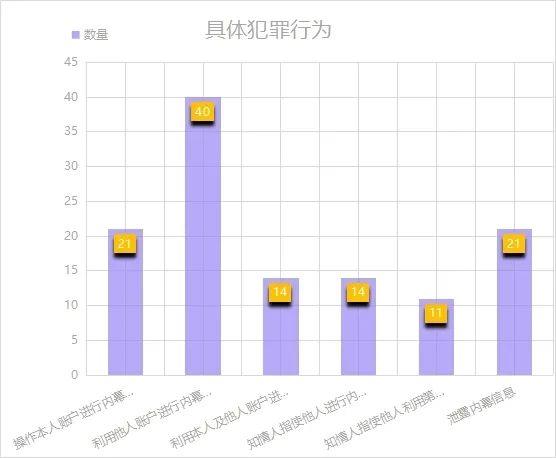

(5) Classification of Specific Criminal Behaviors in Cases of Insider Trading and Disclosure of Insider Information

Taking the specific behaviors of 111 defendants (excluding 4 criminal subjects from the unit and 1 innocent person) as the research object, a total of 121 data were obtained because 10 of them were involved in two criminal acts: insider trading and disclosure of insider information. The specific behaviors include: operating my account for insider trading, using someone else's account for insider trading, using my and someone else's account for insider trading, and an insider instructing others to conduct insider trading, Insiders instruct others to use a third person's account for insider trading and disclose insider information. Among them, insider trading using other people's accounts is the most common, involving 40 people, accounting for 35.71%.

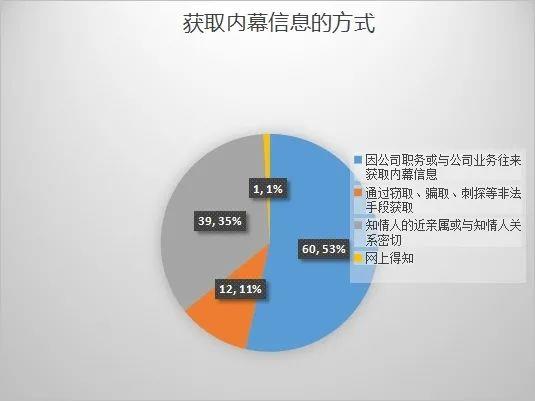

(6) Ways for insiders to obtain inside information

Taking 112 defendants (excluding 4 units) as the research object, statistical analysis found that the ways in which insiders obtained insider information mainly include the following four categories: a total of 60 people obtained insider information due to their company positions or business dealings with the company, accounting for 53.57%; A total of 39 people (34.82%) obtained insider information due to close relatives or close relationships with insiders; 12 people obtained insider information through illegal means such as theft, fraud, and espionage, accounting for 10.71%; One person obtained insider information from the internet, accounting for 0.89%.

(7) Crime amount statistics

The amount of crime involved in insider trading and disclosure of insider information specified in Articles 6 and 7 of the Interpretation mainly includes the amount of securities trading transactions, profits or losses avoided. Therefore, this article conducts statistics and research on the amount of crime based on the amount of securities trading transactions, profits or losses avoided. Since the vast majority of the cases involved in this article are cases before 2022, the new provisions on the crimes of insider trading and disclosure of insider information in the "Provisions on the Standards for Filing and Prosecution of Criminal Cases under the Jurisdiction of Public Security Organs (II)" issued by the Supreme Procuratorate and the Ministry of Public Security on April 29, 2022 are temporarily not applicable to this article.

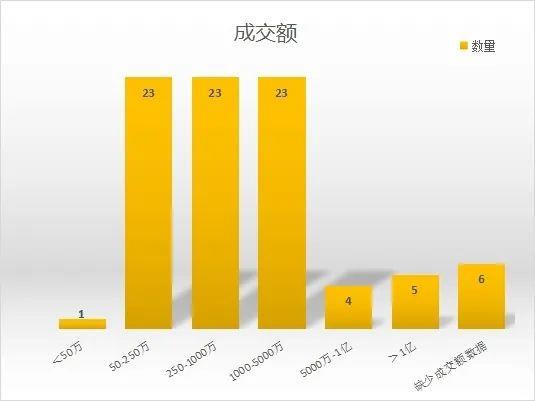

1. Transaction volume.

According to the provisions of Articles 6 and 7 of the "Interpretation", if the transaction volume of securities transactions is more than 500000 yuan, it is considered a serious case; "If the transaction volume of a securities transaction is more than 2.5 million yuan, the circumstances are particularly serious.". Due to the existence of individual crimes, joint crimes, and non complicity cases, a total of 85 data were extracted for the statistics of securities transaction turnover. As shown in the figure below, the turnover was mainly concentrated in the range of 500000 to 50 million, accounting for 81.18%.

2. The amount of profit or loss avoidance (illegal gains).

According to the provisions of Articles 6 and 7 of the Interpretation, if the amount of profit or loss avoided is more than 150000 yuan, the circumstances are serious; "If the amount of profit or loss avoidance exceeds 750000 yuan, the circumstances are particularly serious.". Continue to use 85 data as the basis, as shown in the figure below, with the largest profit amount in the range of 15-750000, accounting for 23.53%; The profit amount in the range of 1-5 million takes the second place, accounting for 22.35%.

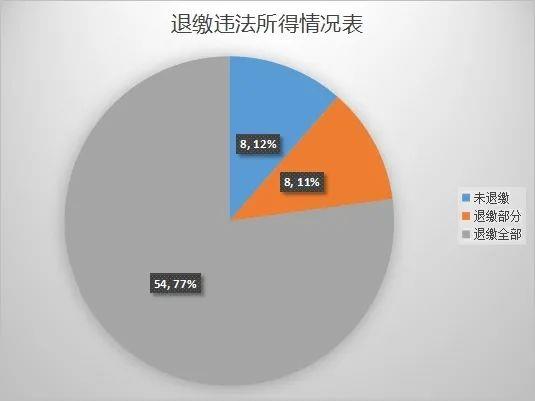

(8) Refund of illegal income

Based on the case where there are no losses and the conviction includes the crime of insider trading, 70 data were extracted to study the return of illegal income by the defendant. It is not difficult to find that among the defendants with illegal income, the vast majority of them have returned their illegal income, of which 77.14% have fully returned their illegal income, 11.43% have partially returned their illegal income, and 11.43% of the defendants have not returned their illegal income.

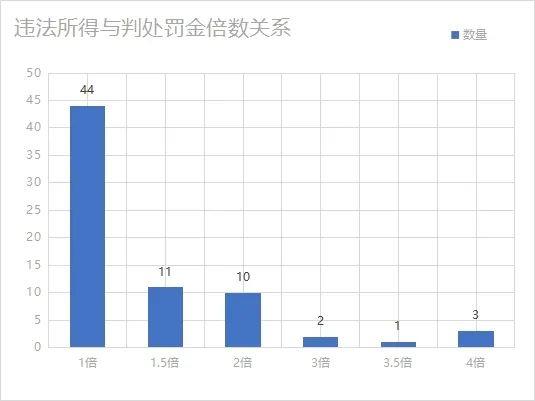

(9) Statistics on the relationship between illegal income and penalty multiples

1. Penalties imposed in insider trading cases.

Based on cases where there are no losses and the conviction includes the crime of insider trading, a total of 71 data were extracted. By comparing the penalties imposed with the multiple of illegal gains, the study investigated the sentencing of fines in judicial practice. As shown in the figure below, the most cases of being fined twice as much, accounting for 61.97%.

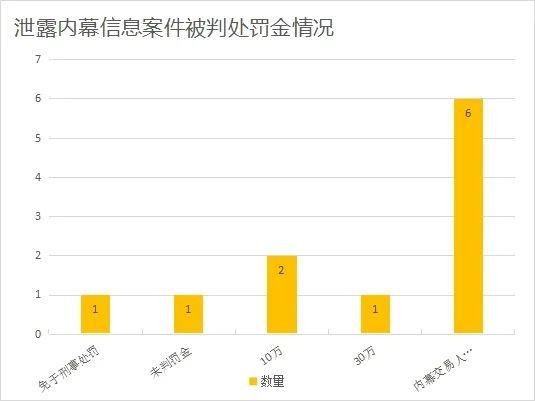

2. Penalties imposed in cases of disclosing insider information.

According to the search results, there are a total of 11 cases sentenced to the crime of disclosing insider information in 74 cases, including 9 cases where the defendant of insider trading has made profits and 2 cases where the defendant has made losses. In six of the nine cases where insider trading profited, the defendant who disclosed insider information was fined at one time the illegal income of the defendant in the relevant insider trading; One case was fined 100000 yuan, one case was not fined, and one case was exempted from criminal punishment. In two cases involving insider trading losses, one was fined 100000 yuan and the other was fined 300000 yuan.

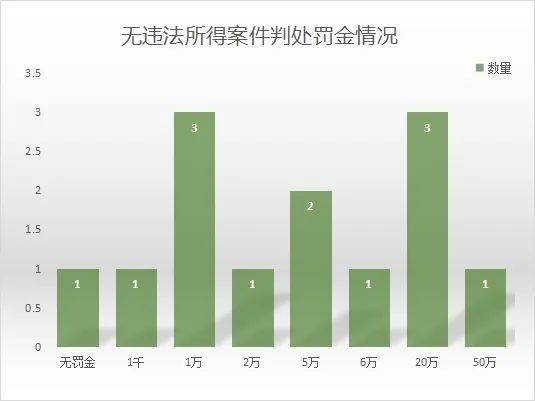

3. There are no illegal gains (losses) cases where fines have been imposed.

There were 13 cases in which there were no illegal gains and the conviction included the crime of insider trading, of which 12 were sentenced to fines ranging from 1000 to 500000 yuan.

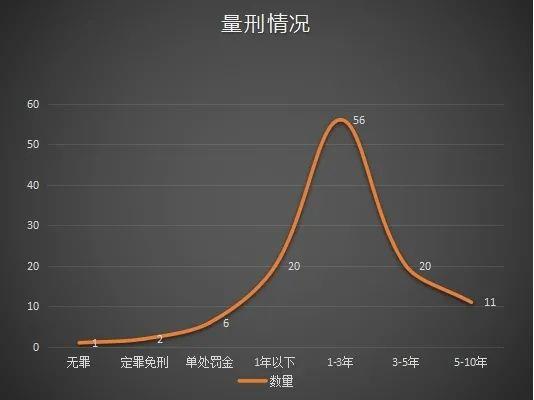

(10) Sentencing situation

According to statistics on the sentencing of 116 defendants, one person was found not guilty; 2 persons who have been sentenced to immunity from criminal punishment; 6 persons (including 4 units) who have been fined a single penalty; 20 persons sentenced to fixed-term imprisonment or criminal detention of not more than one year; 56 persons sentenced to 1-3 years' imprisonment; 20 persons sentenced to 3-5 years' imprisonment; 11 persons sentenced to 5-10 years' imprisonment. A total of 62 persons were suspended.

Related recommendations

- Tax lawyers review the draft of the revised Tax Collection and Administration Law for soliciting opinions

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 3): "Height Limit" Single Release Mechanism

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 2): Grace Period System

- Interpretation of the Management Measures for Compliance Audit of Personal Information Protection - Feeling the Rhythm and Rhythm of Regulatory Flow