Overseas M&A Transaction Series | Box Lock or No Lock, from the practical observation of the the Belt and Road

In the past few years, I have participated in M&A transactions, and I feel that Chinese companies are increasingly using lockbox mechanisms (or de facto lockbox mechanisms) to complete M&A transactions in the process of overseas M&A. This is also consistent with the trend observed by practitioners in other regions of the world (Ireland, the United Kingdom, South Africa, and other places). As a Chinese practitioner, I would like to make some observations on this trend.

1、 What is the closing account mechanism

If you want to explain clearly what a lockbox transaction is, you should first describe the logic and process of traditional M&A transactions: Generally speaking, after the completion of due diligence, the buyer and seller agree on the enterprise value (EV) of the acquisition target and write it into the SPA. The calculation of EV is based on the assumption that the target company has zero liabilities and zero cash. At the time of delivery, the enterprise value confirmed by both parties minus the liabilities on the financial statements plus normal working capital is the actual acquisition price to be paid after adjustment. Therefore, the traditional delivery adjustment mechanism usually involves adjusting the purchase price agreed upon by the SPA after delivery. This process of verifying and adjusting the amount determined by the delivery audit after delivery and the estimated amount at the time of signing is called a true up. The enterprise value of the target company may change between the signing date and the delivery date, resulting in significant differences between the predicted net debt and working capital and the actual net debt and working capital. When the predicted figure is higher than the actual figure, it is necessary to reduce the purchase price. When the predicted figure is higher than the actual figure, it is necessary to increase the purchase price.

In addition, in the traditional delivery adjustment mechanism, the economic benefits of the target enterprise are transferred to the buyer on the delivery date, and the profits generated by the target enterprise during the transition period are usually distributed to the buyer, and any cash profits generated on the book are deducted from the transfer price after being determined in the delivery audit. This part also needs to be determined in the adjustment work after the closing audit.

The adjustment process is relatively complex in practice, involving a large amount of work, and may also lead to a deadlock where the buyer and seller cannot reach an agreement. A tightly regulated SPA will clarify the relevant mechanisms for preparing, challenging, and negotiating delivery audits in considerable detail to minimize the possibility of disputes or irreconcilable disputes after delivery, thereby reducing the uncertainty brought about by the transaction.

Taking an international merger and acquisition for which the author was responsible as an example, during the negotiation stage, the financial teams of both parties conducted a difficult verification, discussion, and confirmation process on the determination of working capital. The two parties reached an agreement on which items can be included in the operating cost and which should be excluded from the operating cost. After careful discussion, they reached an agreement and verified that there were no items that were repeatedly calculated. When preparing for the delivery audit, it is necessary to conduct another audit and verify the consistency of the following items:

Each item in the above list contains a large amount of work, which the buyer needs to prepare and the seller needs to verify. When both parties cannot reach an agreement, they should also mediate their conflicts according to the mediation mechanism agreed upon by both parties in the SPA. If the mediation mechanism set up by both parties in advance cannot resolve the dispute, the wedding may become a graveyard, and both parties may fail to settle the dispute and bring a lawsuit to the court.

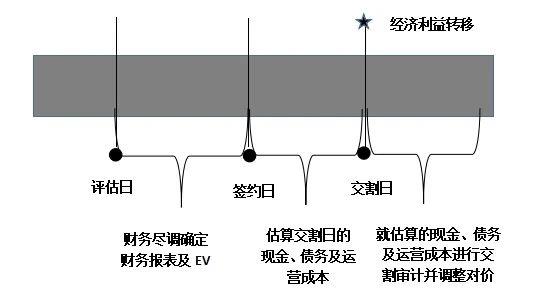

The transaction process of the aforementioned delivery adjustment mechanism can be illustrated in the following figure

:

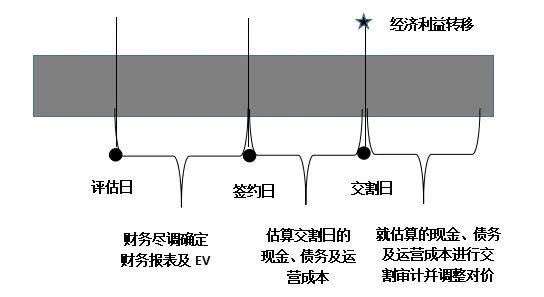

2、 From delivery adjustment mechanism to locked-box mechanism

It is precisely because of the complexity of the delivery adjustment process that slow lockbox trading has been widely used in the practice of mergers and acquisitions. In lockbox transactions, the seller and buyer determine the value of the subject matter based on the audit results of the lockbox date (LBD), and transfer the economic value of the subject matter enterprise to the buyer on the lockbox date. From the lockbox date to the delivery date, the value of the subject matter enterprise is ensured not to escape through strictly defined lockbox obligations. The transaction process is shown below:

From the comparison between the two tables above, it can be seen that delivery adjustment transactions address transaction risks during the transition period by adjusting prices, while lockbox transactions essentially allocate transaction risks during the transition period through price locking and lockbox obligations. In some transactions, lockbox transactions may also require comparison and adjustment between normal working capital/agreed working capital and actual working capital, but this true-up is made by comparing the adjustments made during the lockbox day audit and the signing day audit, and the transaction price will not be adjusted after the agreement is signed. Therefore, we believe that lockbox trading and delivery adjustment trading are very similar in nature, and both require clear agreements on the factors that affect the transaction price. The only difference is that in the delivery adjustment mechanism, the buyer and seller complete the work before and after delivery, while in lockbox trading, this work needs to be completed before signing the contract.

3、 Key trading points in the delivery adjustment mechanism

The many trading mechanisms and terms used in price adjustment mechanisms have evolved over the years, and there are industry-recognized content and forms, such as who will prepare for delivery audits, relevant dispute resolution mechanisms, and acceptable accounting policies. However, there are certain terms that the buyer and seller should communicate in detail and clarify:

Evaluation value of fixed assets: Generally, we will use the historical cost method, market value method, or economic value method to evaluate the subject matter mainly composed of fixed assets. In the range range obtained from the evaluation, the seller wants to take the maximum value, while the buyer wants to take the minimum value. Therefore, both parties need to agree on different accounting policies that may lead to changes in the evaluation value, such as asset impairment policies.

Inventory or construction in progress: The cost or income method is usually used to evaluate the value of inventory, but it is still necessary to clarify the details that can be included in the cost to avoid disputes. At the same time, both parties should reach an agreement on the concept and composition of slow-moving inventory or expired inventory, so that both parties can reach an agreement on impairment or accrual.

Cash and liabilities: Especially when we adopt a zero cash and zero liability evaluation mechanism, it is important to agree on the definition of cash and liabilities. Generally, cash includes currency and "cash equivalents," but we often need to exclude "restricted cash.". When calculating bank loans, it is generally accepted in the market to calculate the principal, interest, and other related costs. However, for the financial treatment of financial leases, prepayment fees for swap contracts, and other mark-to-market transaction costs, it is still necessary for the buyer and seller to negotiate and clarify item by item.

Debt accrual: There may also be differences in the accrual policies for non-performing debts between the two parties. The seller wants to accrue at the lowest cost, while the buyer does not want to pay consideration for debts that ultimately cannot be repaid. Especially when the debtor of the target enterprise is unable to repay its debts due to bankruptcy or reorganization after the delivery date.

Normalized working capital: If the acquisition price is to be adjusted based on the level of working capital, the actual working capital is determined based on the delivery audit. Both parties need to reach an agreement on the normal working capital level agreed in the SPA or related projects that benchmark the actual working capital.

4、 Key transaction points in lockbox mechanism

1. Locked-box obligation

In a lockbox transaction, both parties agree to calculate and determine the transaction consideration based on the lockbox day audit. During the transition period from the lockup date to the delivery date, the buyer's greatest concern is that the value of the underlying enterprise has not escaped. Therefore, the core of the lockbox mechanism is the seller's obligation to the buyer not to disclose the value of the underlying enterprise from the lockbox date to the delivery date. Common value escapes include dividends or payments, reducing capital, repaying shareholder or inter group borrowings, and purchasing services. For this reason, a carve-out sale is not suitable for using a lockbox transaction mechanism, because the financial data of the target enterprise is not independent, and value escape is relatively easy to occur during the lockbox period. In addition, the lockbox mechanism is not suitable for enterprises with more connected transactions, as it is also easy for the target enterprise to escape value after lockbox.

Correspondingly, the seller's lockbox obligation is limited through Permitted Leakage, which is determined through specific negotiations between the buyer and seller based on industry characteristics. Specifically, the buyer will hope that the scope of application of this clause will be closely limited and that all allowable escapes will be clearly defined. However, from the seller's perspective, it is hoped that all normal or predictable payments will not be interrupted by the acquisition, nor will their lockbox obligations detract from the value of the enterprise. Common allowable escapes include paying employee salaries, paying interest on shareholder borrowings, and paying dividends.

The buyer usually requires the buyer to bear the responsibility for locking the box on the basis of compensation. If there are multiple sellers, typically the buyer would expect them to be jointly and severally liable for the escape of the underlying enterprise value, but the seller typically wishes to compensate only for the escape value it accepts. At the same time, the buyer hopes that the seller's liability limitation clause does not unduly limit the lock box liability it should bear.

Accuracy of locked box accounting

Considering that the transaction price is determined based on the lockbox financial report, in addition to the lockbox obligation, buyers usually strive for the seller to make a commitment and guarantee for the data quality of the lockbox financial report, thereby protecting the transaction price they have promised, and thus protecting the risks they bear in the transaction. Generally speaking, through the following aspects:

◆ The buyer usually requires that the lock box report be audited, and in some large transactions, they will directly write in the SPA and require the four major accounting firms (big four) to conduct an audit. This ensures the quality of audit data to some extent through independent third-party auditors.

◆ The lockup date is usually not too far from the delivery date to ensure that the status of the target company does not undergo significant and uncontrollable changes. In extreme cases, it is possible that the signing date and delivery date occur on the same day.

◆ The buyer usually requires the seller to provide a certain warranty for the lockbox report, while striving for the seller to compensate for some important warranty items. For example, if the transaction price is determined on the premise of zero cash and zero liability, and if the cash or liability is found in the lockbox report to be inconsistent with the agreement, the seller is agreed to assume the full compensation obligation.

3. Locked-box interest

As the economic value of the subject matter is transferred to the buyer on the lockup date, the buyer fully enjoys the profits generated by the subject matter enterprise during the transition period, and the seller has not received the transfer price paid by the buyer at this time point, which means the seller is bearing the risk of transaction delivery. Therefore, generally, if the seller requires the buyer to pay a previously agreed interest rate during the transition period, it can be considered that the seller bears the risk premium that has not yet received the transfer price during the transition period, or requests to obtain the profits generated by the target enterprise during the transition period at a previously agreed interest rate. Whether it is a risk premium or a revenue sharing requirement, this indicator reflects the seller's requirements for the cash profits generated by the target company during the transition period.

5、 Characteristics compared to the two mechanisms

1. Price certainty

The lockbox mechanism allows buyers and sellers to trade at a more determined price on the signing date, thereby avoiding the use of regulatory accounts or balance retention mechanisms after delivery. The delivery adjustment mechanism adjusts the transaction price based on the delivery report after delivery, which can cause both parties to feel some uncertainty on the signing date. However, usually, both parties reduce this uncertainty through the cap of the increase in the transaction price or the lower limit of the decrease in the transaction price. It is also for this reason that in the bidding process of many transactions, sellers will more welcome bids with a lockbox mechanism, as sellers can more easily compare the prices of different potential buyers. For the same reason, many PE investors tend to prefer lockbox trading when exiting.

2. Simplification of transaction process

From the comparison of the above schematic diagrams, it can be seen that the transaction process of lockbox transactions is greatly simplified compared to delivery adjustment transactions. Without complex delivery audits and adjustments, disputes and potential disputes between buyers and sellers have been avoided. Therefore, transaction costs have also decreased.

3. Requirements for the Buyer

If the delivery adjustment mechanism is essentially a one-handed delivery transaction mode - the economic value or corresponding control rights of the target enterprise are transferred to the buyer on the delivery date, and the seller receives the agreed transaction consideration on the delivery date, then the lockbox transaction enables the buyer to obtain the economic value or control rights of the target enterprise on the lockbox date, and the seller will only obtain its transaction consideration for a period of time thereafter. During the transition period, the buyer needs to have a sufficient understanding of the target enterprise to enable it to have a full understanding of the differences in the selection of a lockbox mechanism or delivery adjustment mechanism with respect to its rights, obligations, and risks.

6、 Practical observation

As mentioned above, in the the Belt and Road M&A projects that the author has participated in in recent years, more and more Chinese enterprises are willing to use the lock-in mechanism for transactions, especially in projects with transaction volume below 500 million yuan. In particular, the author has observed in several small M&A projects that both parties tend to adopt a de facto lockbox transaction mode: the transaction price is determined on the audit day, the buyer significantly reduces the obligation requirements for the seller during the delivery period, and the seller does not require the buyer to pay lockbox interest. Both parties transfer and pay the price on the delivery day, and no delivery audit is conducted after the delivery.

According to the communication between the author and entrepreneurs, the main considerations for Chinese enterprises to adopt lockbox trading mode in the the Belt and Road are:

In the context of increasingly tense geopolitical conflicts, in order to strengthen their position in the international supply chain, entrepreneurs actively invest abroad and are willing to bear corresponding political and commercial risks. However, their tolerance for transaction risks and related legal risks has sharply decreased, and they hope to invest in an extremely clear and non exposed manner.

2. Many investment projects along the the Belt and Road are resource investments, and the target enterprises are mostly mines, oilfields or franchise enterprises that need large investment or are still losing money. The value of the target enterprises is mainly assessed by the discounted cash flow method or the cost method. The buyer and seller do not pursue economic interests for the target enterprise during the transition period, so their obligations to both parties during the transition period are not high.

Chinese entrepreneurs have misunderstandings about the transition period and the seller's obligation to lock the box. Some entrepreneurs believe that price adjustment will lead to changes in the price they promise to the buyer, which is dishonest; "Or the obligation to lock the box is a distrust of the seller or an interference with its normal operations, which is extremely inconsistent with the relevant contractual terms.".

epilogue

The the Belt and Road Initiative has been going on for eight years, and Chinese enterprises have made great progress in overseas investment and accumulated rich experience. We hope to accompany Chinese enterprises to deepen their understanding of the transaction process in the process of going global, choose the most appropriate transaction scheme for themselves and counterparties, and realize the business pursuit of Chinese enterprises under the the Belt and Road Initiative.

Related recommendations

- Can I get a tax refund if my bet fails? ——Comment on the case of Wang and Shanghai Taxation Bureau's refusal to refund taxes

- How shareholders can withdraw their shares Series 2: Company merger, division, or transfer of major assets

- From the Xiao incident to see the complex impact of spousal reporting - a double-edged sword in divorce proceedings

- Analysis of Criminal Legal Risks in Low altitude Economy and Preliminary Exploration of the Road to Criminal Compliance in Low altitude Economy