What should the payee enterprise do after receiving a tax document requesting "transfer out of input and make up tax"?

With the technical support of tax big data, the state has made greater efforts and breadth in investigating and handling tax violations than ever before. "For transactions that have been completed many years ago, the ticketing party's enterprise was suddenly subject to tax inspections, and it is also inevitable that it was panicked and at a loss.".

For the recipient enterprise, the value-added tax special invoice obtained many years ago due to "real transactions" was suddenly characterized as "unqualified invoice" or "abnormal voucher" or "acceptance of falsely issued invoice". The enterprise does not know how to handle and respond.

Here, the author uniformly analyzes the origin, risk points, and solutions of such problems for readers' reference.

1、 Why do enterprises receive tax documents that "require input transfer out"

"If the invoiced enterprise is notified by the tax authority to transfer in and out, it indicates that the invoicing party that issued the invoice for it has" had a problem ". There are two possibilities for this problem: one is that the enterprise has" fled and lost contact ";"; One is "being characterized by virtual opening".

(1) Upstream enterprises are characterized as "fleeing and losing contact enterprises", and the invoices issued are listed as "abnormal vouchers"

According to Article 1 of the Announcement of the State Administration of Taxation on Issues Related to the Recognition and Handling of Special VAT Invoices Issued by Evading (Lost) Enterprises (Announcement No. 76 of the State Administration of Taxation in 2016), "According to the relevant regulations on tax registration management, if the tax authorities still find the enterprise and its related personnel unaccounted for through on-site investigation, telephone inquiries, tax related matters handling and verification, and other collection and management methods, or if they can contact the enterprise's agent bookkeeping and tax declaration personnel, but they do not know or can not contact the actual controller of the enterprise, they can determine that the enterprise is a fugitive (lost contact) enterprise." (As shown in the figure)

Article 2 of this article stipulates that for enterprises that have fled and lost their association, the invoices within the corresponding period shall be recorded, If yes "1. The name of the goods purchased or sold by a commercial enterprise is seriously deviated; the production enterprise has no actual production and processing capacity and no commissioned processing, or the production energy consumption is seriously inconsistent with the sales situation, or the purchased goods cannot directly produce the goods it sells and no commissioned processing. 2. Direct evasion of the tax declaration is not allowed, or although the declaration is made, the relevant columns of the value-added tax declaration form are filled in to avoid the review and comparison of the tax authorities, and false declaration is made." "Declared." In both cases, they will be listed as abnormal vouchers.

According to Article 3 (1) of the Announcement of the State Administration of Taxation on Issues Related to the Management of Abnormal VAT Deduction Certificates (Announcement No. 38 of the State Administration of Taxation in 2019), "Unless otherwise specified, those who have declared to deduct VAT input tax shall be subject to the processing of transferring out the input tax amount."

According to the above regulations, after receiving the "Assistance Letter" and "Formal False Notice" from the inspection bureau where the upstream enterprise is located, the inspection bureau will send a "Tax Matters Notice" to the invoiced enterprise within the jurisdiction, requiring the enterprise to "transfer out the input, make up the tax, and pay a late fee", and even file a case for inspection of local enterprises. If it is identified as "tax evasion", the enterprise will also bear a fine; If the enterprise is suspected of a criminal offence of "accepting false opening", it will also be transferred to judicial processing by the Inspection Bureau.

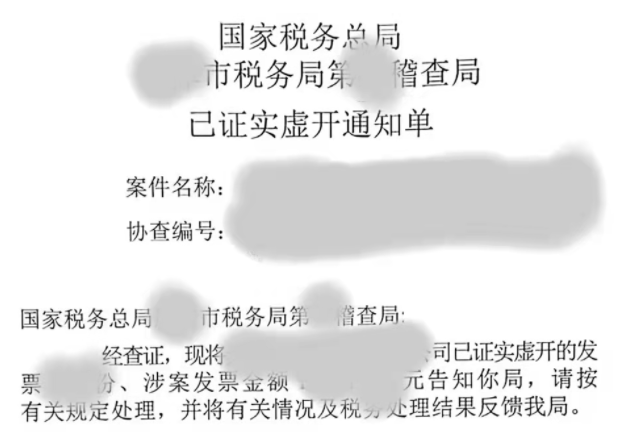

(2) Invoices issued by upstream enterprises are characterized as "fraudulent" due to judicial decisions or tax treatment, resulting in invoices obtained by the recipient "not meeting the deduction criteria"

In addition to the aforementioned cases where the enterprise has lost contact with the downstream payee due to flight, if the invoice issued by the upstream enterprise is characterized as "falsely issued" by the local tax authority, or the judicial authority determines in the form of a judgment that the invoice is "falsely issued by the enterprise or individual.". According to Article 9 of the Provisional Regulations on Value-Added Tax and Article 19 of the Detailed Rules for the Implementation of the Provisional Regulations on Value-Added Tax, the tax authorities of the payee may determine that the invoice belongs to an invoice that "does not comply with laws, administrative regulations, or relevant regulations of the competent tax department of the State Council," and require the enterprise to transfer out the input. (As shown in the figure)

来源:裁判文书网西藏自治区高级人民法院刑事裁定书(2021)藏刑终30号

It should be noted here that if the upstream tax authority issues a letter of assistance to the inspection bureau to which the enterprise belongs, it has confirmed that a false notice has been issued, and relevant evidence is attached to prove that the invoiced party's enterprise is suspected of violating the law, the inspection bureau will also conduct a case filing inspection on the enterprise in accordance with the provisions of Article 23, paragraph 4, of the Notice of the State Administration of Taxation on Printing and Distributing the "Measures for the Administration of Tax Inspection Sources (for Trial Implementation)" (SZF [2016] No. 71).

2、 What tax treatment may be involved after the payee enterprise receives the tax document "requiring input transfer out"

After being implicated in tax violations by upstream enterprises, the recipient enterprise does not necessarily need to pay taxes, late fees, or even fines. The tax authorities usually have the following treatment methods:

(1) Input deduction is allowed without paying taxes, delays, and penalties

According to the provisions of Article 3 (4) of the Announcement of the State Administration of Taxation on Issues Related to the Management of Abnormal VAT Deduction Certificates (Announcement No. 38 of the State Administration of Taxation in 2019), "Taxpayers with Grade A tax credit who have obtained abnormal vouchers and have applied for VAT deduction, export tax refund, or consumption tax deduction can apply to the competent tax authority for verification within 10 working days from the date of receiving the notification from the tax authority. After verification by the tax authority, if they comply with the current provisions on VAT input tax deduction, export tax refund, or consumption tax deduction, they may not be required to transfer out input tax, recover the refunded tax, or offset the amount of input tax." "Processing of allowable deduction of consumption tax during the period."

According to this article, if the invoice issued by an upstream enterprise is characterized as an "abnormal voucher", but the downstream enterprise has sufficient evidence to prove the authenticity of the transaction, it should file an application with the tax authority and provide corresponding evidence to cooperate with the verification, striving to avoid transferring out the input tax, and minimizing losses.

(2) The enterprise is recognized as "acquired in good faith" without late fees or fines

According to the provisions of the "Reply of the State Administration of Taxation on the Issue of Taxpayers Obtaining False VAT Special Invoices in Good Faith to Deduct Tax and Charge Late Payment Penalties" (GSH [2007] No. 1240), "Taxpayers who obtain falsely issued VAT special invoices in good faith are allowed to deduct input tax if they can obtain a legal and valid special invoice again. If they cannot obtain a legal and valid special invoice again, they are not allowed to deduct input tax or pursue the deducted input tax. Taxpayers are not required to pay late payment fines.".

In other words, if an enterprise can obtain a legal and valid special invoice again after being characterized as "obtained in good faith" by the tax authorities, it can be normally deducted; If it cannot be obtained, only input transfer out and supplementary VAT payment can be made, without the need to pay late fees and fines.

(3) Enterprises are required to pay taxes and late fees, but there are no fines

As mentioned above, due to the unqualified invoice, the tax authorities may, in accordance with Article 9 of the Provisional Regulations on Value-Added Tax and Article 10 of the Detailed Rules for the Implementation of the Provisional Regulations on Value-Added Tax, determine that the invoice belongs to a situation where the value-added tax deduction certificate does not comply with laws, administrative regulations, or relevant regulations of the competent tax department of the State Council, and require the enterprise to transfer out its input.

However, under this determination, the tax authorities will, in accordance with Article 32 of the Law of the People's Republic of China on the Administration of Tax Collection (2015 Revision) and Article 75 of the Detailed Rules for the Implementation of the Law of the People's Republic of China on the Administration of Tax Collection (2016 Revision), require the payee enterprise to impose a late payment penalty of 5% of the overdue tax on a daily basis.

(4) Enterprises are characterized as "tax evading", paying value-added tax, additional tax, corporate income tax, and imposing overdue fines and fines

According to Article 3 of the Supplementary Notice of the State Administration of Taxation on the Handling of Taxpayers Obtaining Falsely Issued VAT Special Invoices (Guo Shui Fa [2000] No. 182), "There is other evidence indicating that the buyer knowingly obtained the VAT special invoice by the seller through illegal means, namely, the situation where the payee uses the special invoice falsely issued by others to declare tax deduction to the tax authorities for tax evasion as stipulated in Article 1 of Document 134."

Article 1 of the Notice of the State Administration of Taxation on the Handling of Taxpayers Obtaining Falsely Issued Special Invoices for Value Added Tax (Guo Shui Fa [1997] No. 134) stipulates that "if the payee uses the Falsely Issued Special Invoices of others to declare and deduct tax to the tax authorities for tax evasion, the tax shall be recovered in accordance with the Law of the People's Republic of China on the Administration of Tax Collection and relevant regulations, and a fine of not more than five times the amount of tax evasion shall be imposed.".

In other words, if the payee enterprise fails to prove "the authenticity of the transaction" for sufficient reasons during the tax inspection process, and once it is identified as "tax evasion" by the tax authorities, in addition to the value-added tax and surcharges, the enterprise income tax of the current year will also be required to be supplemented and paid due to the unqualified deduction voucher. In addition to late fees and fines, enterprises are bound to bear significant losses.

(5) The enterprise was transferred to the public security organ for handling due to suspected false opening

According to Article 3 of the Provisions on the Transfer of Suspected Criminal Cases by Administrative Law Enforcement Agencies (Revised in 2020), "During the process of investigating and punishing illegal acts in accordance with the law, administrative law enforcement agencies have discovered the amount involved in the illegal facts, the circumstances of the illegal facts, and the consequences caused by the illegal facts. In accordance with the provisions of the Criminal Law on crimes such as disrupting the order of the socialist market economy, crimes of disrupting social management order, and the judicial interpretations of the Supreme People's Court and the Supreme People's Procuratorate on crimes such as disrupting the order of the socialist market economy, and crimes of disrupting social management order "In accordance with the provisions of the Supreme People's Procuratorate and the Ministry of Public Security on the prosecution standards for economic crime cases, those who are suspected of constituting a crime and need to be investigated for criminal responsibility according to law must be transferred to the public security organ in accordance with these provisions."

Article 48 of the Regulations on the Procedures for Handling Tax Inspection Cases stipulates, "If a tax violation is suspected of committing a crime, a transfer letter for the suspected criminal case shall be filled out and approved by the director of the tax bureau before being transferred to the public security organ in accordance with the law."

According to the above regulations, if the tax authorities find clues of "false opening" in the process of inspecting a case they have filed for inspection (such as fund return, no real goods transaction), etc. Then, the enterprise and relevant responsible persons of the ticketing party will be handed over to the public security organ for handling according to law.

3、 Ways for the recipient enterprise to resolve tax risks

Rather than "defusing risks", it is better to "prevent risks". "Resolving" is already a relief path, but if enterprises pay attention to preventing such problems in their daily operations, "preventing problems before they occur" is the best way. Here, we propose suggestions for the enterprise from the two levels of prevention and resolution.

(1) Focus on daily tax compliance management and preserve evidence for "real transactions"

Of the five tax treatment methods mentioned above, the latter two are the most risky for enterprises. The biggest risk of a drawee enterprise being characterized as "tax evasion" or "fraudulent opening" lies in the inability to verify the occurrence of a true transaction. When conducting daily transactions with upstream and downstream enterprises, enterprises should pay attention to preserving relevant evidence, such as contracts, payment records and vouchers, delivery orders, warehousing orders, acceptance orders, logistics information, and handler information. When subsequent risks occur, timely hire professionals to submit relevant evidence to the inspection authority, cooperate with inquiries and investigations, and provide written opinions to assist the inspection authority in identifying facts to resolve tax risks.

(2) Misuse of relief channels to reduce tax risks

The above mentioned five types of tax risks ranging from light to heavy, but in practice, tax authorities rarely apply the first and second types of "bona fide acquisition" to solve such problems, and most cases are handled in the following three situations. However, for taxpayers, if they truly "received the goods in good faith" or actually received them, even if the tax authorities are willing to recognize them as "obtained in good faith", they still feel "wronged" and should be provided with the following legal remedies.

1. At the beginning of filing the case, the Inspection Bureau applied to the tax authority for verification

According to Article 3 (4) of Announcement No. 38 of the State Administration of Taxation in 2019, if the input tax receipt is verified to meet the deduction requirements, it will be allowed to be deducted. Therefore, it is recommended that the enterprise prepare a verification application and apply to the relevant departments for verification at the beginning of the inspection by the Inspection Bureau.

2. During the inspection process, the Inspection Bureau actively provides evidence and communicates in written and informal forms

During the inspection process, taxpayers are obliged to provide evidence in accordance with regulations to cooperate with the investigation. However, in fact, due to the long history of the transaction or the company's neglect of management, the company is unable to provide one by one according to the material list provided by the Inspection Bureau. In this case, the enterprise should seek other supporting materials based on the evidence it lacks to indirectly prove the "true transaction". At the same time, the enterprise employs professionals to actively communicate with inspectors on the application, understanding, and evidentiary power of the law to resolve risks.

3. Unauthorized use of hearing, reconsideration, litigation, and other procedures after the inspection by the Inspection Bureau

These three approaches are important for taxpayers to safeguard their rights, but the hearing process is often ignored. During the hearing process, taxpayers can provide opinions on the qualitative nature, evidentiary strength, and procedural legality of the case by the Inspection Bureau. According to the author's experience, the rules and procedures of the tax hearing process have all matured, especially to help enterprises resolve tax risks at the front end, which is the lowest cost path for enterprises.

Administrative reconsideration and administrative litigation are already the second half of the relief path. If an enterprise has already reached this stage, it should effectively use the rule of "the burden of proof rests with the administrative authority" to provide effective rebuttals to the qualitative nature, legal application, and evidentiary power of the tax authority in depth, in order to achieve the desired purpose.

Summary

Currently, various inspection bureaus have handled their enterprises in different ways after confirming the false issuance of notification letters and assistance letters sent by different inspection bureaus. Enterprises should actively seek the assistance of professionals, prepare evidence, written explanations, and other materials after the Inspection Bureau sends the Inspection Notice, actively meet and communicate with the inspectors, and cooperate with the inspection agency while minimizing risks.

Related recommendations

- Tax lawyers review the draft of the revised Tax Collection and Administration Law for soliciting opinions

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 3): "Height Limit" Single Release Mechanism

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 2): Grace Period System

- Interpretation of the Management Measures for Compliance Audit of Personal Information Protection - Feeling the Rhythm and Rhythm of Regulatory Flow