Transcript of the lecture "Anti monopoly Guide in the Field of Platform Economy"

On November 10, 2020, on the eve of the Double 11th Day, the State Administration of Market Supervision issued the "Anti monopoly Guidelines on the Platform Economy (Draft for Comments).". On February 7, 2021, the Anti monopoly Committee of the State Council officially released the "Anti monopoly Guidelines for the Platform Economy". On November 30, 2020, Gaopeng Law Firm jointly held an online lecture with relevant scholars and industry insiders. The following is a transcript of the lecture, which was updated by the author and editor according to the final draft of the Guide before release.

Content Introduction:

Liu Xu (Shao Geng) Researcher, National Institute of Strategic Studies, Tsinghua University, "Returning the Platform Economy to Anti monopoly Compliance and Normal Law Enforcement"

The Regulation and Significance of Jiang Liyong Gaopeng Law Firm's Partner's "Guide" on Business Concentration and VIE Structured Enterprise Mergers and Acquisitions

The Regulation and Significance of the "Guide" for Partners of Gaoliang Gaopeng Law Firm on Monopoly Agreements

Zhou Qing, Chairman of China Light Industry Import and Export Technology Service Company, from an industry perspective, sees the significance of the introduction of the Guide

Lawyer Jiang Liyong (Moderator): I am very pleased to have this opportunity to organize such a lecture with you today on the "Anti monopoly Guidelines of the State Council's Anti monopoly Commission on the Platform Economy". This online lecture will be shared with you by Professor Liu Xu, Lawyer Gao Liang, myself, and President Zhou Qing.

The order is as follows: First, I will ask Mr. Liu to introduce the dominant market position, and then I will introduce the concentration of operators myself. Then, Lawyer Gao Liang will share the monopoly agreement. Mr. Zhou will share some of his ideas about the guide from the perspective of a market participant.

Before I begin, let me introduce the experts participating in the online lecture. Teacher Liu Xu, everyone is actually very familiar with it. Teacher Liu Xu's pen name is Shao Geng. I think anyone who cares about the anti monopoly law is familiar with Shao Geng or Liu Xu's name. I once joked that Mr. Liu wrote faster than I saw him. You can pay attention to his Zhihu, Sina Weibo, WeChat official account and articles about anti-monopoly law published by his circle of friends.

Teacher Liu is very outspoken. Although we disagree with some of his views, Mr. Liu has always promoted the progress of China's antitrust law practice in a way that does not forget his original intention.

The second lawyer is Gao Liang. Lawyer Gao Liang's qualifications and expertise in the field of antitrust law are also second to none in the industry. Lawyer Gao has studied in Germany and worked in various law firms in Brussels and China. Currently, he works as a partner at Gaopeng Law Firm. Lawyer Gao Liang is currently my colleague.

President Zhou Qing previously worked in the Foreign Trade Department of the Ministry of Commerce. During his time at the Ministry of Commerce, he led the research and formulation of national cross-border e-commerce policies. Currently, Zhou is always the chairman of China Light Industry Import and Export Technical Service Company, and he also serves as the secretary general of the China Cross-border E-commerce 50 Person Forum, as well as the poverty alleviation expert of the E-commerce Expert Committee of the Research Institute of the Ministry of Commerce. Currently, Mr. Zhou is also responsible for the entire digital transformation of China Light Industry Import and Export Group. I have also been very honored to participate in the seminar on cross-border e-commerce organized by President Zhou.

My name is Jiang Liyong, and I am currently a partner of Gaopeng Law Firm. Before that, I had worked in the Department of Legal Affairs of the Ministry of Commerce and Jindu Law Firm. After arriving at Gaopeng Law Firm, I have also been involved in anti monopoly law related businesses, and have basically witnessed the growth of anti monopoly law.

After the introduction of the anti monopoly guide for platform economy, it has received attention from all walks of life. Not only scholars, lawyers, and legal professionals have paid great attention, but even in the capital market, they have caused tremendous repercussions.

Today's time is very valuable. We hope that each speaker's introduction will not exceed 20 minutes, and then we have about half an hour left to ask you some more questions. First of all, let's invite Mr. Liu Xu to give our first speech.

Teacher Liu Xu shares "Returning the Platform Economy to Anti monopoly Compliance and Normal Law Enforcement"

It's a great pleasure to meet you and accept this invitation to share with you. Let me share the screen first, and then everyone can take a look at my PPT directly. "We have a tight schedule today, and I'm afraid that my first presentation will delay everyone's time and affect their future communication and lunch, so I'll start directly. If there are any issues then, we can focus on discussing them later.". I'll try to talk it over in about 20 minutes.

My theme is "Returning the Platform Economy to Anti monopoly Compliance and Normal Law Enforcement". I chose the background of PPT for half a day, and later I thought I liked it very much. "Because Chang'e 5 has just been launched on the moon, and it will be back in a while.".

Therefore, I am thinking that we are also facing a regression problem, which is that in our early days, we placed Internet companies in the universe like spacecraft, breaking away from the constraints of the Earth's gravity. However, sooner or later, one of the problems spacecraft will face is to return to the Earth and its gravitational field. Just like our platform economy, it ultimately needs to return to normal control, and we cannot keep it in a state of "out of control" all the time.

The Anti monopoly Law is actually a constraint on the platform economy.

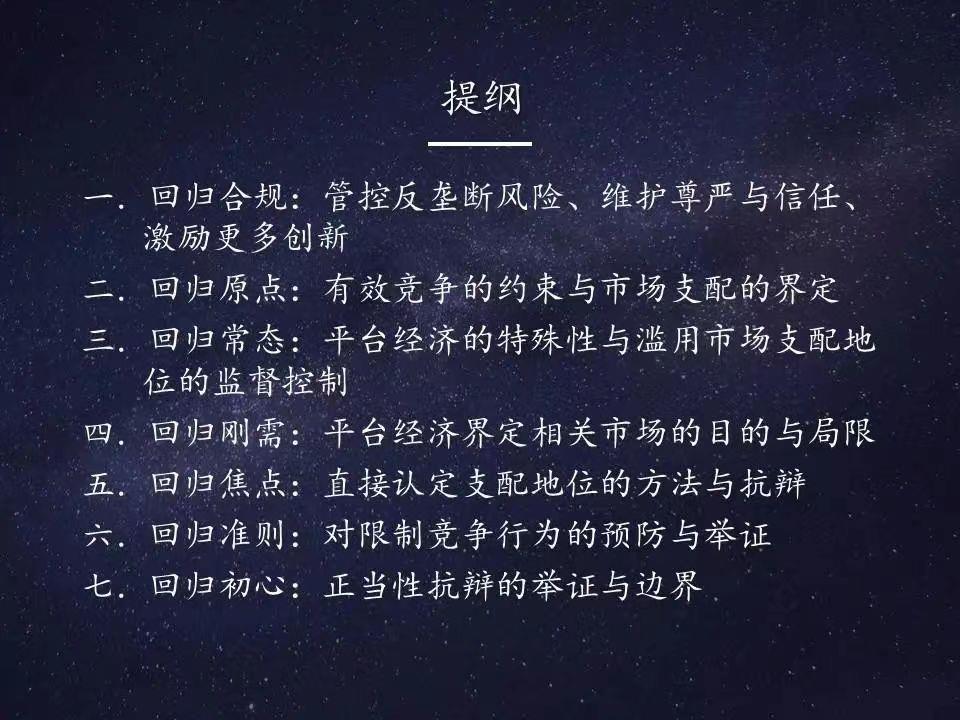

The content I share today has approximately seven parts. Each part focuses on "regression".

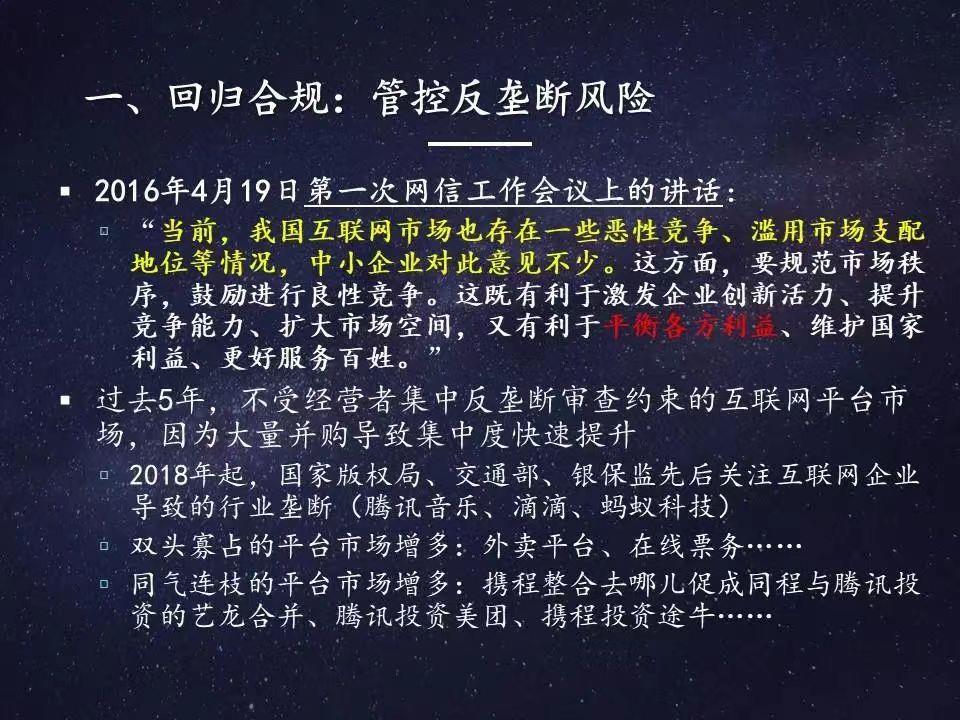

The first thing to talk about is managing risks.

When it comes to managing and controlling risks, we often consider them more from the perspective of the enterprise. In fact, from a national strategic perspective, there is also a need for risk management and control. At that time, in this programmatic speech on Internet governance, it was mentioned that "there are also some situations of vicious competition and abuse of dominant positions in the Internet market in China, and small and medium-sized enterprises have many opinions on this." In fact, the tone of this speech is still very gentle, and it is also very pertinent.

After the "April 19th" speech in 2016, we did not see any drastic antitrust law enforcement work in the internet industry. At the regulatory level, we are still more groping, accompanying, and waiting for internet companies to straighten out their own problems, adjust their status, and consciously achieve compliance.

However, we have also seen that in the past five years, there has been virtually no anti monopoly law enforcement in the internet industry, especially the lack of anti monopoly review of concentration of operators in the internet industry. If there are no basic pre emptive constraints such as concentration antitrust review, it will inevitably lead to a large number of mergers and acquisitions in many segments of our internet industry, leading to a very rapid increase in market concentration. Anti monopoly law enforcement lags behind, market concentration is too high, and market risks also accumulate, inevitably forcing industry regulators to intervene.

An obvious example is that since 2017, our National Copyright Administration has begun to focus on the potential impact of a large number of exclusive music copyright agreements signed by Tencent Music on the development of other competitors.

Recently, many people may have seen news reports that Alibaba's shrimp music may be closed next year. This is just a microcosm. Whether the rumors are true or not, there have been many music platforms that cannot continue to operate due to various reasons. One of the most important influencing factors is Tencent Music: On the one hand, it has acquired Ocean Music, on the other hand, it has signed a large number of exclusive music copyright licensing agreements, and does not grant sublicenses to third parties to a group of the most popular so-called "top stream" music resources, leaving other platforms facing a serious shortage of "top stream" music resources. Then, users will be more inclined to purchase Tencent Music's membership services, and purchasing the latest single or album of "top stream" musicians from Tencent Music's App has resulted in a widening gap between other online music platforms and Tencent Music in terms of the number of paid users, profitability, and investment return potential, making it difficult to form effective competitive constraints on them.

In 2018, two cases of rape and murder of Didi hitchhiker drivers led to the offline operation of Didi hitchhiker. At that time, when the Ministry of Transport stationed Didi to supervise the rectification, it was also mentioned that Didi was suspected of having an industrial monopoly in the online car rental industry.

In 2020, on the eve of Ant Technology's listing, relevant leaders of the China Banking and Insurance Regulatory Commission also mentioned the need to be vigilant against industry monopolies.

In addition, there are many markets where duopoly has emerged: takeout platforms, are there Meituan or hungry; Online ticketing platform, with cat's eyes and Taopiao. One of them is from Tencent, and the other is from Alibaba. In addition, there are some platforms that seem to have many competitors, but in fact they all have common investors. For example, Ctrip in the online travel market acquired Qunar, took a stake in Tuniu, and jointly controlled Tongcheng Yilong with Tencent. Meituan's main investment is also Tencent. Ant Technology, an affiliate of Alibaba, the parent company of Feizhu, also co founded Zhong'an Online with Tencent, which launched an online insurance service that is also in cooperation with the aforementioned online travel platform. This interconnected capital connection and complex cooperative relationship can easily induce certain behaviors that harm the legitimate rights and interests of consumers, forcing tourism authorities and consumer associations to intervene or warn, such as forced or disguised forced tying, big data killing, and other issues.

When we talk about "returning to compliance", the primary task is to maintain the dignity of the law, maintain the trust of consumers and investors in the enterprise, and also maintain the credibility of law enforcement agencies.

If anti monopoly law enforcement is not carried out for a long time, the dignity of the anti monopoly law will be violated, and the credibility of law enforcement agencies will be affected. Investors in internet companies may also worry about whether companies really value compliance and whether the restrictions imposed by antitrust laws on market operators really exist.

Anti monopoly law can stimulate innovation. This formulation seems to be a cliche. However, objectively, with more competitors, there will be more innovation. There is a view that the anti monopoly law will definitely restrict the development of large enterprises. Actually not.

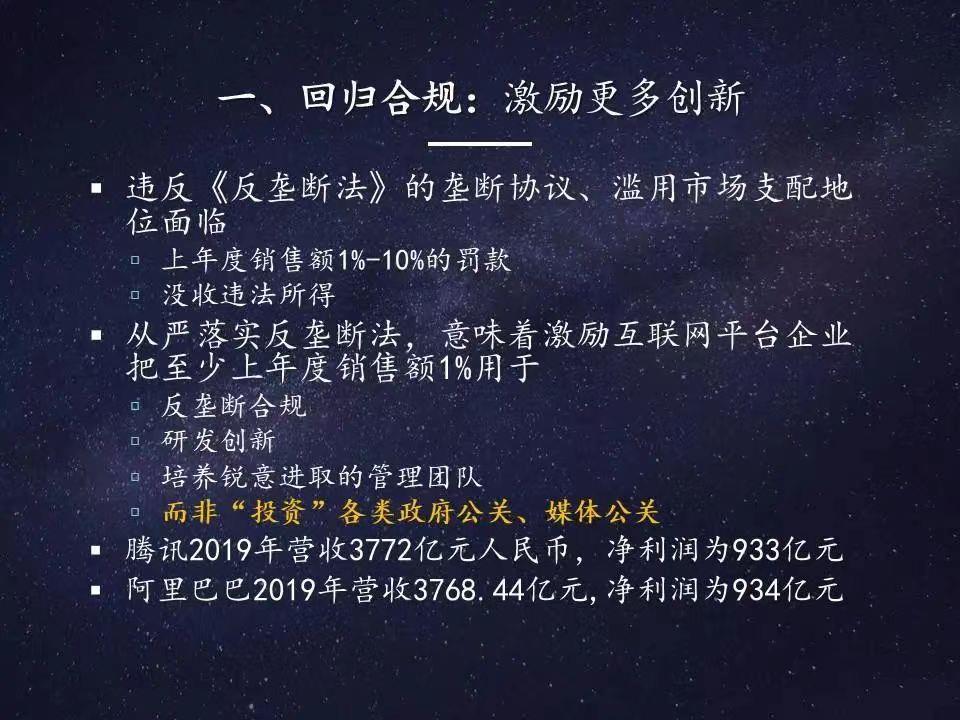

We can imagine that if a company carries out business activities at the risk of violating the Anti monopoly Law, it must make provision for the corresponding illegal costs, as it may be investigated and punished at any time. How high is the illegal cost of violating the Anti monopoly Law? For monopoly agreements and abuse of dominance, it is 1% to 10% of the sales volume of the previous year, and it may also face confiscation of illegal income. If the lower limit is calculated based on 1% of the sales volume of the previous year, it means that if Internet companies strictly implement the Anti monopoly Law, they may have to devote at least 1% of their sales volume to compliance each year, or invest in research and development to improve their management team, rather than investing in various types of government public relations, media public relations, and deliberately impeding anti monopoly law enforcement.

1% of sales is a significant number for large platform companies. Tencent's revenue in the 2019 fiscal year was 377.289 billion. Alibaba is similar to Tencent, with an estimated 376.8 billion. Taking 1% of the revenue is equivalent to taking 3.7 billion for compliance by each enterprise. Of course, antitrust law compliance certainly does not require 3.7 billion yuan, and perhaps 30 million yuan is sufficient. Then large Internet platform enterprises can use the remaining amount to invest heavily in research and development, and encourage them to improve their leading position in technological innovation, management mode innovation, business mode innovation, and service innovation, rather than making short-term profits through monopoly behavior in violation of the Anti monopoly Law and pushing up the market value foam.

Anti monopoly law can stimulate innovation. This formulation seems to be a cliche. However, objectively, with more competitors, there will be more innovation. There is a view that the anti monopoly law will definitely restrict the development of large enterprises. Actually not.

We can imagine that if a company carries out business activities at the risk of violating the Anti monopoly Law, it must make provision for the corresponding illegal costs, as it may be investigated and punished at any time. How high is the illegal cost of violating the Anti monopoly Law? For monopoly agreements and abuse of dominance, it is 1% to 10% of the sales volume of the previous year, and it may also face confiscation of illegal income. If the lower limit is calculated based on 1% of the sales volume of the previous year, it means that if Internet companies strictly implement the Anti monopoly Law, they may have to devote at least 1% of their sales volume to compliance each year, or invest in research and development to improve their management team, rather than investing in various types of government public relations, media public relations, and deliberately impeding anti monopoly law enforcement.

1% of sales is a significant number for large platform companies. Tencent's revenue in the 2019 fiscal year was 377.289 billion. Alibaba is similar to Tencent, with an estimated 376.8 billion. Taking 1% of the revenue is equivalent to taking 3.7 billion for compliance by each enterprise. Of course, antitrust law compliance certainly does not require 3.7 billion yuan, and perhaps 30 million yuan is sufficient. Then large Internet platform enterprises can use the remaining amount to invest heavily in research and development, and encourage them to improve their leading position in technological innovation, management mode innovation, business mode innovation, and service innovation, rather than making short-term profits through monopoly behavior in violation of the Anti monopoly Law and pushing up the market value foam.

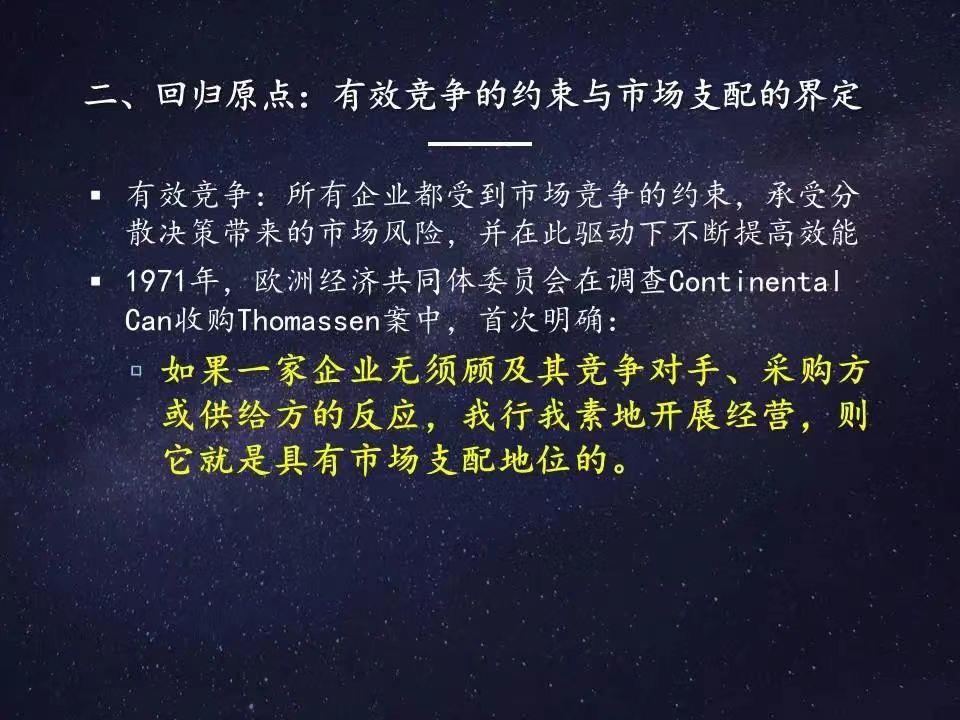

When discussing "returning to compliance", one of the core issues we need to discuss is, what exactly is protected by our antitrust law? We need to protect the market from constraints of effective competition. If all enterprises are constrained by market competition and bear the market risks brought about by decentralized decision-making, they will continuously improve their efficiency driven by this. This is an ideal state and a goal that we hope to achieve through the implementation of the anti monopoly law. In reality, there are scale effects in both the Internet industry and traditional industries. If there is a scale effect, there will be leading enterprises, and there may be market dominated enterprises. In the face of such market laws, competition law enforcement agencies around the world need to form consensus on the essence of recognizing market dominance. In this way, international law enforcement cooperation can be carried out, conflicts on the law enforcement scale can be avoided, and the governance of the global Internet economy and related bilateral and multilateral negotiations can be promoted.

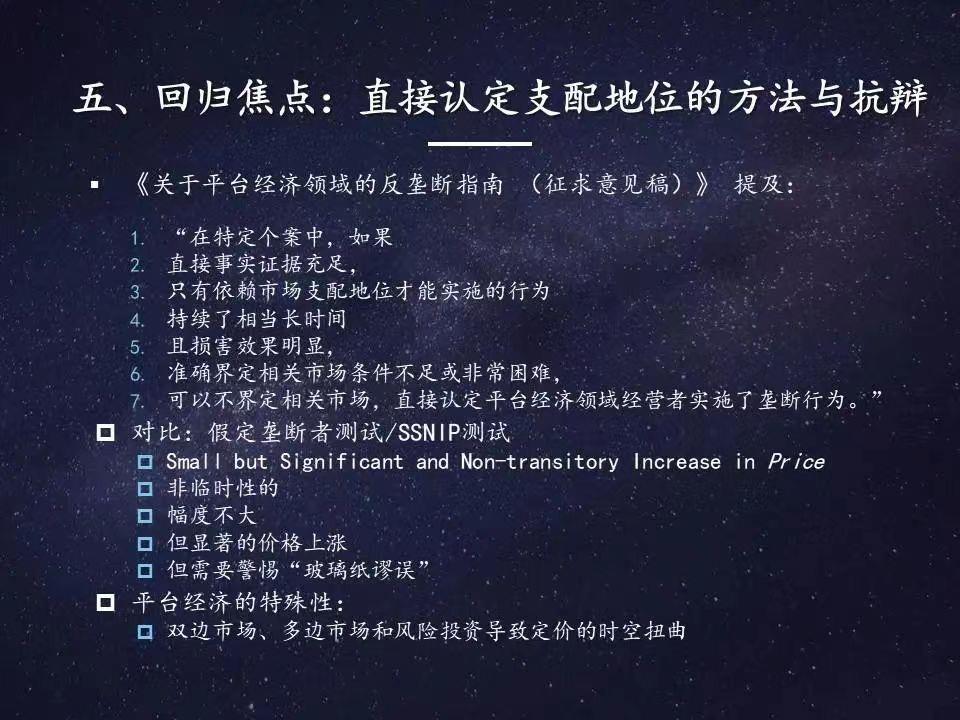

So how do we essentially recognize market dominance?

In the European Union, the original European Economic Community, there were landmark cases 50 years ago. At that time, the European Economic Community had not yet introduced a prior review system such as concentration review, and could only monitor the abuse of dominance. At that time, the European Economic Community and its member countries were collectively thinking about what market dominance was.

In 1971, the Commission of the European Economic Community made it clear for the first time in its investigation of the acquisition of Thomassen by Continental Can: "If a company does not have to consider the reactions of its competitors, purchasers, or suppliers, and operates as it pleases, then it has a dominant market position."

The above definition of market dominance has been repeatedly cited by law enforcers and the European Court of Justice in the practice of competition law in the European Economic Community and later in the European Union.

If we can understand the essence of market dominance from such a simple definition that every ordinary person can understand, many problems can easily be solved.

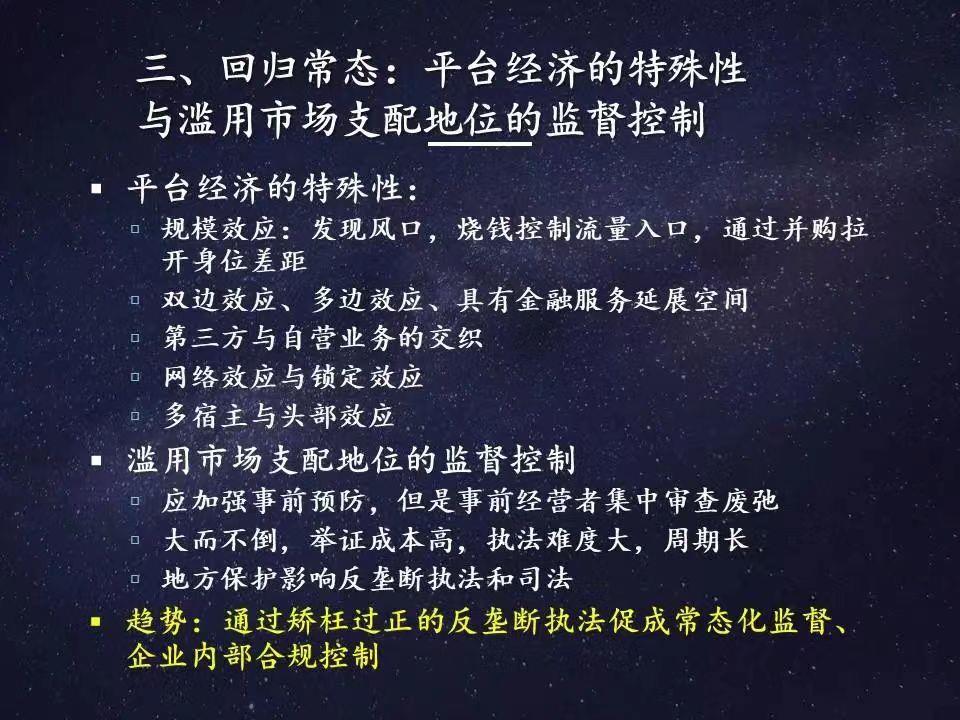

Next, let's take a look at the significant characteristics of the platform economy compared to the traditional economy.

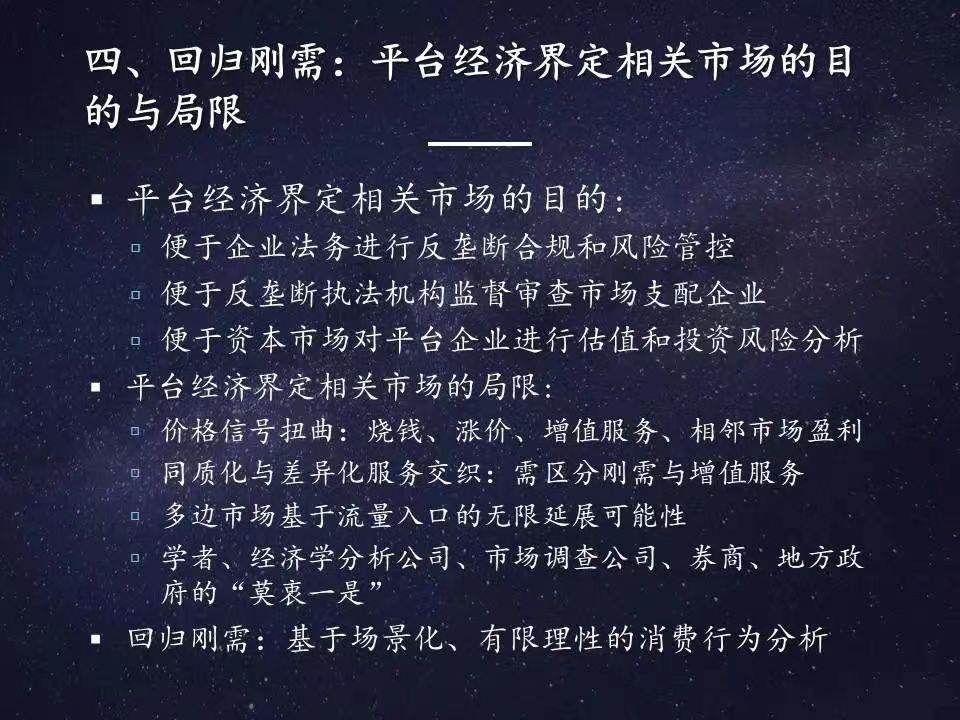

When hoping that antitrust law enforcement or judicial authorities can regulate restrictive competition in the field of platform economy, one of the issues often faced is how to define the relevant market, in order to calculate share and infer market dominance as traditional industries do. However, we will find that the platform economy is more difficult to define relevant markets and calculate market share than traditional economies.

Because the platform economy has a characteristic that its price signal is distorted: in the early stage, the platform even subsidizes consumers with money to attract everyone's attention, cultivate their usage habits, and tap into their potential needs. In the future, it may increase prices, or it may increase the fees for VIP members through value-added services, or it may make profits through neighboring markets. Because users' needs are diverse, sometimes an app can meet multiple needs. We see that in addition to taking a taxi, Didi can also rent a car, drive on behalf of others, or share a bicycle.

So what exactly does the platform economy mean to us? When we open Alipay, we also face such problems. In addition to payment, we have many other services that can also be realized on Alipay, such as financing and lending. At this point, it is necessary to distinguish between what is the core service that users are primarily concerned about and what is the user's immediate need?

Another important issue is that when defining relevant markets, we face the "noise of information": scholars, economic analysis companies, market research companies, securities companies, local governments, especially those that cultivate unicorns, have various understandings of the definition of relevant markets. Sometimes, before going public, platform companies will try to narrow the relevant market as much as possible, packaging themselves as a market leader, and pushing up their own valuation. After going public or facing antitrust investigations or lawsuits, they tend to define the relevant market as broadly as possible, thereby reducing their antitrust risks.

Therefore, when we specifically obtain evidence, if we simply define the relevant market from the traditional path, and then calculate the estimated market dominance of market share, we will face significant obstacles. Previously, we were familiar with the economic analysis method of assuming monopolistic testing. It is by assuming that there is such a small price increase, and then evaluating the market's response to determine whether it has a dominant position.

However, the problem facing the internet industry is: How should the hypothetical monopolist test be applied when factors such as bilateral markets, multilateral markets, and venture capital have led to pricing distortions?

For example, define a relevant market whose core needs and immediate needs are instant messaging. "It may be free, or it may be based on venture capital, which can be subsidized at a discount, resulting in an invisible or distorted relationship between the actual price and cost.".

For example, we are familiar with the fact that Didi and Uber subsidized online taxi applications in 2014. At this time, although taxi prices were originally set by the government, due to the existence of subsidies, we have no idea how the actual pricing was achieved.

In this case, it will be more difficult to continue using price testing.

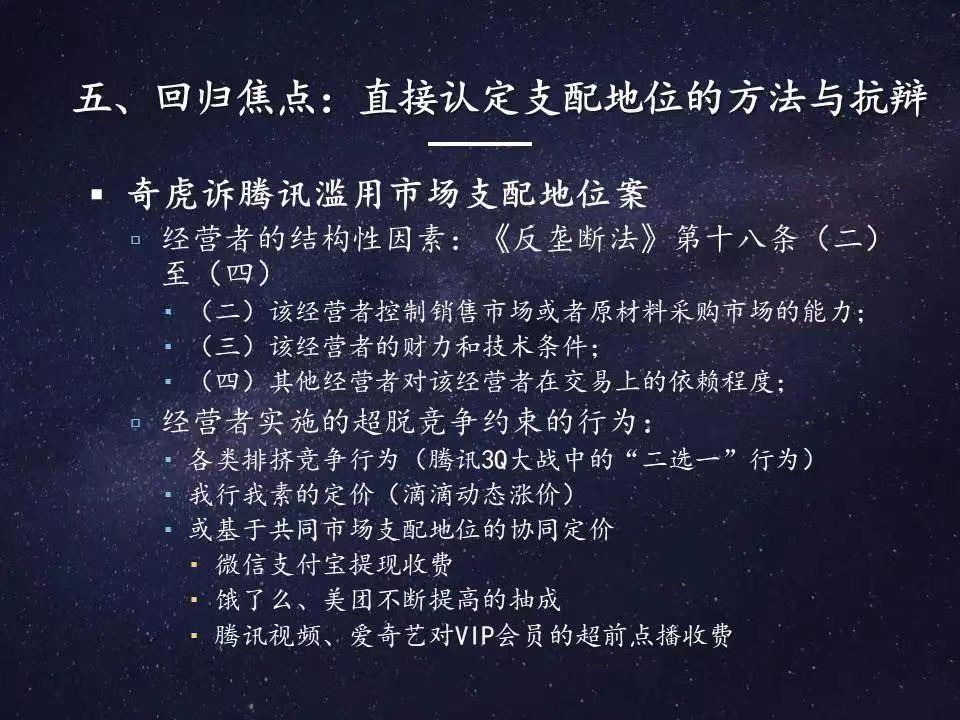

At present, we know of a relatively typical judicial case of antitrust in the Internet industry, which is Qihu v. Tencent's abuse of market dominance. In 2013, I published an article specifically analyzing the first instance judgment of Qihu v. Tencent's abuse of market dominance.

At that time, I considered identifying its dominance from two dimensions. Firstly, it is analyzed through the structural factors of the operator, and then from its behavior of breaking away from competition constraints. (For details, see Liu Xu: "Determination of Market Dominance in Qihu v. Tencent's Abuse of Market Dominance: A Brief Analysis of the First Instance Judgment of the Guangdong Provincial High Court with Reference to the Experience of Germany and the European Union", published in Electronic Intellectual Property, 2013, Issue 4, pp. 30-41.)

During the "3Q War" in 2010, Tencent's "one out of two" behavior itself brought little loss to it, because Tencent QQ had a large user base and had a strong locking effect. The second trial decision of the case revealed that Tencent's "one out of two" behavior led to a 10% decrease in Qihoo 360's market share in one day. Of course, at the same time, Tencent's own active users may also decrease, but the second trial decision shows a decrease of only 1%. But even this 1% is only a temporary loss of active users. Because Tencent QQ users need to log in continuously for 90 days before they can truly cancel their user accounts, formally resulting in substantial user losses. If the "3Q War" lasted for 90 days, Tencent would certainly have scruples, but if it did not last for 90 days, even if it lasted only for 9 days, Qihoo 360 might lose 90% of its share. At that point, it will not be able to continue to persist. Therefore, Qihu 360 mobilized various "off site resources" and finally stopped Tencent's "one out of two" behavior through the competent department. Of course, we can also find other similar examples, so I won't list them one by one.

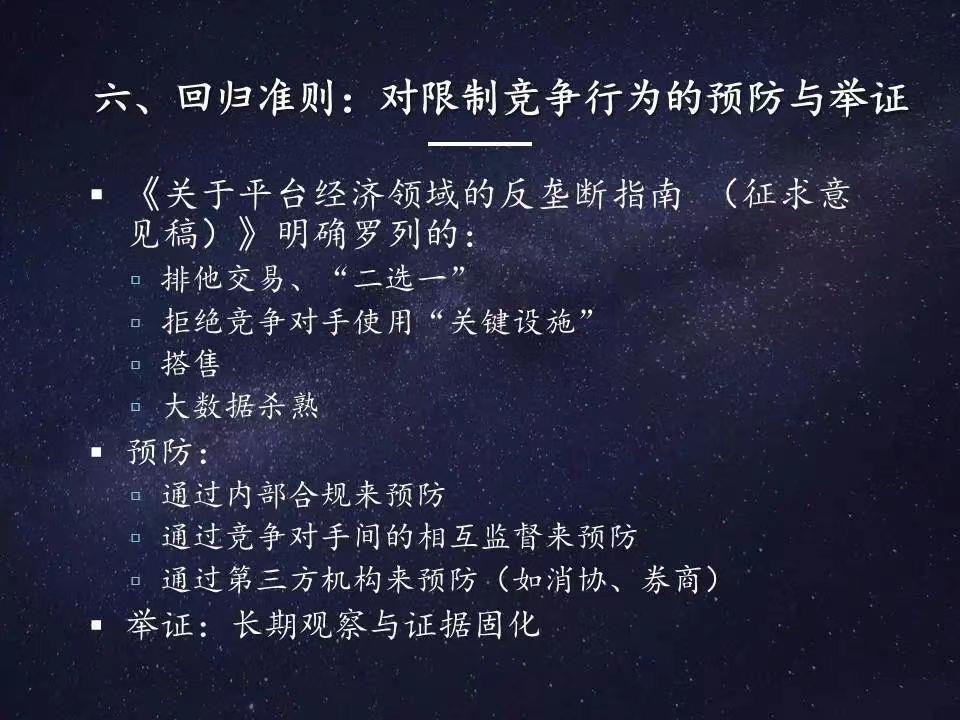

In preventing anti monopoly risks, many of our enterprises are faced with the problem of how to prevent themselves from violating the Anti monopoly Law in their business activities. Especially for market dominated enterprises, they are faced with either adopting government public relations or academic public relations to keep the Anti monopoly Law away from the Internet economy, or choosing to avoid violating the Anti monopoly Law in terms of business models or business strategies. In fact, the "Anti monopoly Guide on the Platform Economy" very kindly lists many of our common exclusive transactions: "one out of two", refusing competitors to use their own key facilities, their own network interface software, and big data fraud, which are a warning to platform companies.

So, for the compliance business of enterprises, we can do some analysis on the antitrust law risks of relevant business behaviors. At this time, on the one hand, this prevention comes from internal compliance prevention, including the analysis of risk investors in this regard. The other is mutual supervision between competitors. This kind of supervision can also be manifested as publishing reports through the media, or publicly pointing out what restrictive competitive influences competitors have on themselves. These can all serve to prevent the abuse of market dominance. There are also third-party institutions to prevent. Previously, the Zhejiang Consumer Association warned some platform companies not to engage in big data killing, which I think is a good attempt.

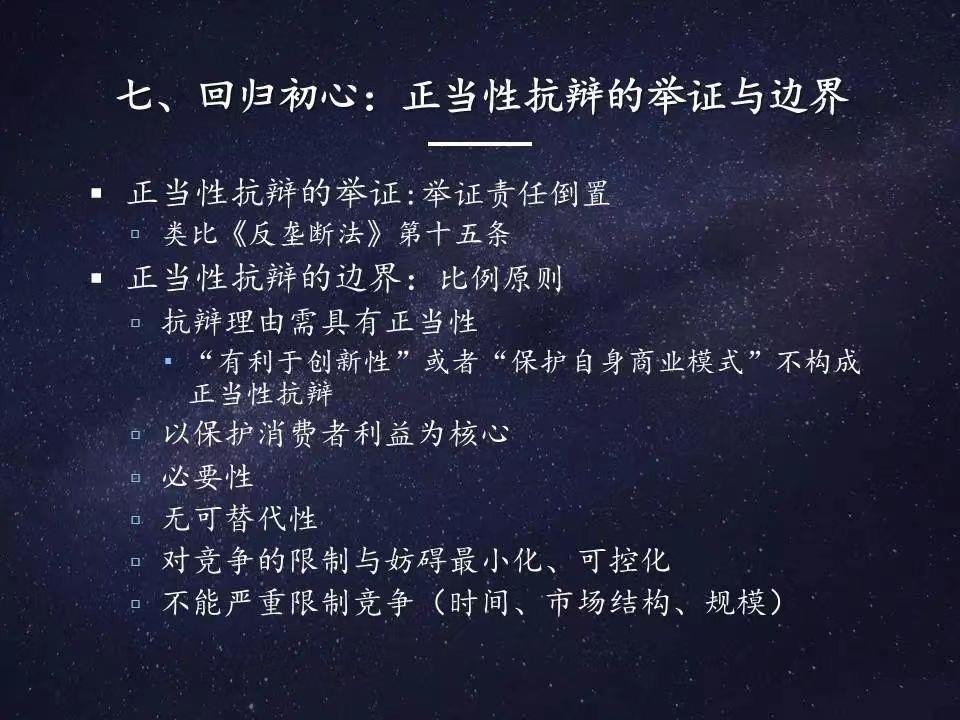

Finally, let me turn to the question of justifiability defences. In my feedback to the State Administration of Market Supervision and Administration, I also pointed out that the legislator was very "considerate" in listing a large number of justifications for operators suspected of violating the Anti monopoly Law, but did not set a boundary for justifications.

In my opinion, first of all, it should be made clear that the burden of proof for these justifiable defenses should be borne by the operators suspected of constituting abuse of dominance, rather than by antitrust law enforcement agencies. This should be consistent with the inversion of the burden of proof in Article 15 of the Anti monopoly Law, which we mentioned earlier. It should all be provided by platform companies.

The other is about the principle of proportionality. The principle of proportionality is involved in our study of public law, constitution, and administrative law. These laws require that the specific administrative actions of the government comply with the principle of proportionality. The government should comply with the principle of proportionality when actively acting, while the government should also comply with the principle of proportionality when negatively acting, and when not interfering in the market economy. Whether the antimonopoly law enforcement agency decides to intervene or not to intervene in acts suspected of abusing dominance, it is necessary to follow the principle of proportionality. When proving the legitimacy of their actions to law enforcement agencies, operators also need to prove that their actions comply with the principle of proportionality. Otherwise, antitrust law enforcement agencies face a new dilemma, because when they choose to determine which actions are not illegal, they may also violate the principle of proportionality, constituting a de facto omission, and may therefore be sued by another party for their inaction.

The principle of proportionality is explicitly written in the EU and Germany, as well as in relevant competition law norms or guidelines. China has no clear regulations in this regard. But we definitely need to address this issue when defending legitimacy. "Platform operators may claim that their restrictive competitive actions are implemented to protect innovation and their business model, but this in itself does not constitute a legitimate defense.". The defense of legitimacy should focus on protecting the interests of consumers, and if it is necessary to prove that such controversial measures, such as the "one out of two" adopted by the platform, are aimed at protecting the interests of consumers, it must also prove that such measures are necessary and irreplaceable. Not only that, but as part of the justification defense, it must also be demonstrated that its damage to competition is minimal and cannot severely restrict competition, such as not lasting too long or causing a serious imbalance in this market structure, nor can it be too large in scale to cause public resentment to boil.

Therefore, when comprehensively considering antitrust law enforcement cases, it is necessary to consider the principle of proportionality. This is something that antitrust law enforcement agencies are relatively good at, and the public is relatively receptive and capable of monitoring. Because when it comes to truly justifying defenses, operators often have an information advantage. At this time, it is difficult for law enforcement agencies to refute. The question of whether the legitimate defense of the operator's disputed behavior conforms to the principle of proportionality is a logical analysis at a common sense level, where law enforcers can make judgments at a lower cost and gain public understanding and support.

Whether it's law enforcement agencies or ordinary consumers, they all have a steelyard in their hearts. For investors and internal compliance personnel, when discussing with technical personnel the justification defense of restricting competitive behavior, they can also propose such questioning of certain controversial behaviors based on the principle of proportionality:

Is it necessary or not,

Is it irreplaceable,

Is the harm and hindrance to competition the smallest,

Does it need to last that long,

Is it necessary to influence such a large range

Leaving these issues aside, business departments will consider whether they can have better alternatives, innovate in business models, technical solutions, and so on. In this way, we can return to a benign compliance mentality, keep the bottom line of corporate legal affairs, and become a safety valve for antitrust risk management. At the same time, we can force business departments to carry out more competitive and friendly technological innovation and business model innovation.

Thank you for listening. If you have any questions, I can focus on answering them later. Thank you all.

Okay, thank you, Mr. Liu Xu, for your wonderful sharing. Next, we will invite lawyer Gao Liang to share the monopoly agreement with you.

Lawyer Gao Liang Shares: The Regulation and Significance of the Guide to Monopoly Agreements

I am Gao Liang from Gaopeng Law Firm, and what I am sharing with you this time is the monopoly agreement part of the "Anti monopoly Guide in the Field of Platform Economy" (draft for comment).

I will explain to you one by one according to the relevant provisions of the guide. The first part is about the form of monopoly agreements. According to the relevant provisions of the guide, monopoly agreements in the field of platform economy refer to agreements, decisions, or other collaborative actions by operators to exclude restrictions on competition. The agreement or decision may be in writing or orally.

"Other collaborative behaviors refer to behaviors that operators have not explicitly entered into agreements or decisions, but are substantially coordinated through data, algorithms, platform rules, or other means, with the exception of parallel behaviors such as price following made by relevant operators based on independent representations of intent.". On the basis of the "Draft for Comments", the "Guide" adds two points here: "through data, algorithms, platform rules, or other methods" and "except for parallel actions such as price following made by relevant operators based on independent representations of intent.". In terms of this added content, legislators tend to further clarify the specific methods of coordinated behavior. In the field of platform economy, data, algorithms, and platform rules are important means of generating coordinated behavior; In addition, it provides an important defense idea for coordinated behavior, that is, parallel behavior made by "independent expression of will" can be exempted from punishment; However, there is no further explanation and explanation on how the operator is defined as "independent expression of will". The provision for other collaborative actions, to some extent, presumes the existence of conscious communication between the parties, which in fact greatly enhances the discretion of the antitrust law enforcement agencies. In other words, in principle, as long as there is coordination between platform operators or operators within the platform, or even as long as there is objective awareness of coordination, it meets the requirements of coordination behavior, unless the operator provides evidence to prove that there is an "independent declaration of intent.". For law enforcement enforcement, it only needs to provide evidence to prove that the operator has coordinated and consistent behavior, and the operator needs to bear the burden of proof to prove that there is an "independent expression of intent" in its behavior.

This is a very important point to consider for platform operators and operators within the platform, which means that more factors need to be considered in business activities.

The form of the monopoly agreement just mentioned. Next, let me talk about the identification of collaborative behavior. According to the provisions of this clause, identifying collaborative behavior in the platform economy field can be determined through direct evidence to determine whether there is collaborative behavior. If there is no direct evidence, it is possible to determine the knowledge of relevant information by operators based on logically consistent indirect evidence to determine whether there is collaborative behavior between operators; At the same time, the operator can provide evidence to the contrary to prove that there is no collaborative behavior. This statement actually means that regulators only need to provide logically consistent indirect evidence to infer the existence of collaborative behavior.

Therefore, in determining the burden of proof for cooperative behavior, the burden of proof of regulatory agencies is relatively low, and it does not even require direct evidence, only indirect evidence.

Moreover, for Internet platforms, if they want to refute this point, they need to bear the burden of proof to prove that there is no collaborative behavior, while providing evidence to prove that there is no collaborative behavior is very difficult. How can you prove that there is no collaborative behavior?

The relevant provisions of the Guide on collaborative behavior can greatly facilitate the supervision of Internet platforms by regulatory agencies.

Next, we will talk about horizontal monopoly agreements. According to the guidelines, horizontal monopoly agreements refer to monopoly agreements that can be reached by operators in the competitive platform economy through the following methods: fixing prices, dividing the market, restricting production or sales, restricting new technologies and products, or boycotting. This is known as cartel behavior.

The specific ways to reach a horizontal monopoly agreement include:

First, use the platform to collect and exchange sensitive information such as prices, sales, costs, and customers.

The second is to use technical means to communicate ideas.

The third is to use data, algorithms, and platform rules to achieve coordination and consistency.

Fourth, other behaviors that are conducive to achieving synergy.

As for the first point, the prices mentioned here are not only limited to commodity prices, but also include commissions, handling fees, membership fees, promotion fees, and other service fees charged by operators.

The highlight of this section is the collection of sensitive information. When I participated in the internal discussion meeting of the "Draft for Comments" earlier, many platform representatives questioned this point, namely, whether the collection of sensitive information by the platform itself should also constitute a monopoly agreement issue. In the final version of the Guide, legislators changed the phrase "using platforms to collect or exchange sensitive information such as prices" to "using platforms to collect and exchange sensitive information such as prices." This legislative modification eliminated the vague interpretation in the Draft for Comments that unilateral flat platform collection does not constitute a monopoly agreement. In the market, it is very normal business behavior for competitors to inquire about their prices and sales information. These behaviors themselves do not violate the anti monopoly law, and are normal business behavior. Because inquiring and collecting information itself is a unilateral act, there is no communication of intentions between the two parties, nor is there any consensual coordination between the two parties. Whether it is a horizontal agreement or a vertical agreement, it requires at least two parties to participate in order to be able to meet the conditions that constitute an agreement monopoly agreement.

According to my understanding of this, the reason why legislators include the collection of information indicates that the collection behavior itself may lead to the formation of horizontal monopoly agreements. In other words, given the characteristics of the platform economy, collection behavior may also lead to horizontal actions such as achieving fixed price segmentation of the market. For enterprises, the difficulty of this clause lies in the burden of proof, which is very difficult for enterprises to prove that there is no suspected contact.

In other words, although his collection is a unilateral act, and the unilateral act itself is not sufficient to constitute a monopoly agreement, your collection itself leads to the emergence of cartel behavior, leading to horizontal monopoly behaviors such as fixed prices and market segmentation. My understanding is that although the collection behavior is unidirectional, unilateral behavior can also generate horizontal monopoly agreements.

Next, let's look at the issue of vertical monopoly agreements. The relevant provisions of the platform guide state that operators and trading counterparties in the platform economy may enter into vertical monopoly agreements such as fixed resale prices and limited minimum resale prices through the following methods.

The first is to use technical means to automate price setting. I understand that automatic setting is actually an algorithm, belonging to algorithm collusion. The second point is to unify prices using platform rules; The third point is to use data and algorithms to directly or indirectly limit prices. The fourth point is to use technical means, platform rules, data, algorithms, and other methods to limit other trading conditions and eliminate restrictive competition.

According to my understanding of computer technology, algorithms themselves are an automated processing method, called automatic system in English. The anti-competitive effect is caused by algorithmic collusion.

For platform operators, vertical monopoly agreements are more concerned with reaching a certain vertical fixed resale price or limiting the minimum resale price through algorithms and automated data processing methods.

Next, let me tell you about the issue of MFN treatment. The issue of MFN treatment is an antitrust concept introduced into China from the EU competition law. The Draft for Comments has also been included, but the final version of the Guide has deleted the concept of MFN treatment, but the Guide has added a specific description of MFN treatment, That is, "the behavior of platform operators requiring operators within the platform to provide them with trading conditions equal to or superior to other competitive platforms in terms of commodity prices, quantity, etc. may constitute a monopoly agreement or an abuse of market dominance." According to the Guide, the most favored nation treatment clause may constitute a vertical monopoly agreement or an abuse of market dominance. Based on my understanding of this clause, regulators should conduct a case study to determine whether it constitutes a vertical monopoly agreement and/or abuse market dominance.

A typical anticompetitive effect produced by MFN treatment is the blockade effect.

For example, when suppliers are unable to provide lower prices on other competitive platforms due to MFN agreements, consumers will have to continue to pay higher prices, which is detrimental to consumer protection. At the same time, the blocking effect generated by this clause also has adverse effects on some small platforms. Due to its relatively weak competitiveness, small Internet platforms cannot compete with large platforms if they cannot provide a lower price, which may have some anti-competitive effects.

Next, let me talk about a relatively important topic - the hub and spoke agreement, which is also a clause that everyone pays attention to.

The Guide basically continues the statement in the Draft for Comments, with the main changes being to change the "operator" to "operator within the platform" to clarify the boundaries of operators. According to the Guide, a hub and spoke agreement refers to a hub and spoke agreement that has the effect of a horizontal monopoly agreement that may be reached by a competitive platform operator through a vertical relationship with the platform operator, or organized and coordinated by the platform operator. Conceptually, the hub and spoke agreement is actually a horizontal agreement, but the horizontal monopoly agreement section of the guide is not mentioned. It is specifically described as a separate clause, which also indicates that legislators attach great importance to this issue itself. The concept of the Hub Spoke Agreement was borrowed and translated from the United States. Its English name is Huband Spoke, where Hub is the hub and Spoke is the spoke. The axis and spoke agreement itself is a horizontal agreement, but it achieves the goal of horizontal collusion through the vertical tool. In a platform economy, a platform is a hub, and the operators within the platform are spokes.

The complexity of the hub and spoke protocol is that it achieves horizontal goals through vertical relationships.

During our discussion on the issue of hub and spoke protocols, many professionals have raised the question of whether the platform can be exempted from liability if it is passive and exploited by downstream platform operators without the subjective knowledge of the platform.

The last part will tell you about the definition of relevant markets in monopoly agreements. Generally speaking, the definition of the relevant market is the starting point for the review and investigation of antitrust cases. Whether in China or abroad, especially in the EU, almost all of its antitrust cases have undergone the definition of the relevant market, whether in terms of monopoly agreements or investigations into the abuse of market dominance or the review of concentration of operators.

Relevant market definition is the starting point of antitrust cases. In China, whether it was the original National Development and Reform Commission, the Ministry of Commerce, or the current State Administration of Market Supervision, they almost invariably conduct relevant market definition in the first step of case investigation and review. However, relevant market definition often occupies a considerable workload of investigation agencies, and is also a highly technical part of antitrust.

Taking into account the characteristics of the internet industry, the "Draft for Comments" proposes some breakthrough operational methods in defining relevant markets. According to the relevant provisions of the "Draft for Comments", in determining the illegality of horizontal and vertical monopoly agreements reached between operators in the platform economy field and in cases of abuse of market dominance, if the relevant market conditions are insufficient or difficult to define, the antitrust enforcement agency may not clearly define the relevant market. However, the final version of the Guide deleted the above practice of not defining relevant markets, and continued to insist on defining relevant markets as an indispensable operation in the antitrust law enforcement of the platform economy. This indicates that legislators take a cautious position in defining the relevant market. In addition, in terms of the definition of commodity markets related to the platform economy, the Guidelines have made some revisions and supplements to the Draft for Comments, In particular, it proposes methods and ideas for defining relevant commodity markets: "You can define relevant commodity markets based on the commodities on one side of the platform; you can also define multiple relevant commodity markets based on the multilateral commodities involved in the platform, and consider the interrelationship and impact between various relevant commodity markets. When the cross-platform network effects of the platform can impose sufficient competitive constraints on platform operators, you can define relevant commodity markets based on the platform as a whole."

This is my interpretation of the monopoly agreement. If you have any questions, you can discuss them together. Thank you all.

Lawyer Jiang Liyong's Sharing: The Regulation and Significance of the Guide on Mergers and Acquisitions of Business Concentration and VIE Structured Enterprises

Thank you very much for lawyer Gao's wonderful speech. Next, let me introduce the business concentration section to you.

I believe that concentration of operators is a very important and distinctive development in the antitrust guidelines in the field of platform economy. I think its significance lies in two aspects. Firstly, in all documents, whether they were previously issued by the Ministry of Commerce or the current State Administration of Market Supervision and Administration, it is the first time that enterprises that have clarified the VIE structure must declare (Editor: The final draft has deleted the word VIE, but retained the agreement control, and the essence remains unchanged). The second aspect is that the General Administration has given itself greater power to intervene in mergers and acquisitions that do not meet the concentration declaration standards, but may have the effect of excluding and restricting competition in the market.

Chapter IV of the Guide has a preamble as a hat clause that emphasizes that the platform economy is not an extralegal place. In the past few years, I think there has been a lot of debate among people about what attitude the legislative and law enforcement agencies should adopt towards the platform economy and Internet companies? In fact, the public, including Mr. Liu, has raised a lot of reports about Internet enterprises that should be declared but not declared. I have also noticed that some of Mr. Liu's reports are not only published on his various official account, but also sent to the General Administration by e-mail. Currently, if you look at the announcement form of simple cases of concentration of business operators published on the website of the State Administration of Market Supervision and Administration, you will see an interesting feature. The transactions related to consumers that occur around us, such as these, do not appear on the list. What are the large number of cases reported? Mainly some Tob transactions. According to statistics in the past few years, about half of all transactions involve foreign factors, that is, one or both parties to the transaction are foreign companies, because foreign companies have higher compliance requirements for reporting. Of all foreign companies, which country has the most companies reporting? I feel like a Japanese company. Domestic lawyers engaged in Japanese business, including Gao Peng's Japanese business team, have a profound understanding of and research on antitrust law, which also reflects the relatively high compliance requirements of Japanese companies.

We have also heard a voice that internet companies are a new economic format, so we should give them more tolerance. However, we have seen that even in foreign countries, the Internet is not outside the law. Firstly, transactions by Internet companies also need to be reported. Secondly, some monopolistic behaviors on Internet platforms, whether horizontal, vertical, or abusive, have been investigated by foreign antitrust authorities.

Personally, I believe that the failure to declare is mainly a matter of competitive arbitrage. Enterprises compete in the market. If an enterprise in a traditional industry makes declarations, but a new economy enterprise does not, it can actually enjoy some benefits, such as institutional arbitrage such as shorter delivery times and faster transactions. However, it is not a fair act, so the hat clause in Chapter IV of the Guide establishes the principle that platform companies should also declare.

Article 18 of the Guide sets out the reporting standards. The first paragraph mentions that in the field of platform economy, the calculation of turnover may vary depending on the business model of the operator. For example, the platform only provides information matching and collects commissions. Our understanding is roughly the Taobao model. Another mode is the Tmall Supermarket mode or the JD proprietary mode. Is this distinction important or not? Personally, I think it may not be that important, why? For lawyers, these two models have made some distinctions, which is also the first time that they have been clearly defined in the regulations. However, accountants actually recognize income at present, and have already recognized income according to different models. Therefore, regardless of whether the guide makes such a distinction, it will not have any substantive impact on the current method of calculating turnover. "The General Administration may consider this to be necessary from its own perspective, but in accounting, it is not really a problem.". For example, in 2019, Taobao's GMV (total merchandise trading volume) was at 7 trillion yuan, but the confirmed operating revenue was only 500 billion yuan, so there was a huge difference between 500 billion yuan and 7 trillion yuan.

We also made a comparison. What is the concept of 7 trillion yuan? Guangdong Province ranks first among all provinces in China with a GDP of 10 trillion yuan. In other words, Taobao's total commodity trading volume has accounted for 70% of Guangdong's GDP. What is the concept of 500 billion yuan? "We also compared the financial revenue of all provinces in China with that of 500 billion yuan, which is approximately ranked after Beijing and before Shandong Province.". Beijing should be ranked fifth in 2019. Therefore, the operating revenue recognized by Alibaba is before the financial revenue of Shandong Province. Therefore, from the above data, Taobao has become a platform that can rival the wealth of a province. So what about platform based enterprises? Is it necessary to regulate? I think it may be self-evident.

The second paragraph of Article 18 stipulates that concentration of undertakings involving an agreed control structure falls within the scope of anti monopoly review of concentration of undertakings. If the declaration criteria are met, declaration should be made first, and those that have not been declared shall not be subject to concentration.

"We have also made a small comment to the Anti monopoly Bureau, for example, its first sentence is actually a bit wordy. There is a parenthesis (VIE) behind the agreement control, but VIE is an English abbreviation for a variable interest entity. The VIE structure is a type of agreement control, and the agreement control includes VIE. Therefore, we suggest that for the sake of accuracy, should it be changed to: VIE (variable interest entity) is a type of agreement control, as long as it meets the declaration standards,", Declaration is required.

So far, many transactions involving VIE structured enterprises have not been reported, so what should be done? Should administrative penalties be imposed on them? If there is no administrative penalty, is it differential law enforcement? "If there is an administrative penalty, at that time I may not be able to pass it.". Due to these platform companies, I estimate that the merger has reached the threshold of concentration of operators, with at least a few hundred transactions or more. Of course, we have also proposed whether to solve the problem in an open manner. For example, use a reconciliation method and deal with it once.

Regarding the issue of the vie structure, it should be said that the attitude of the administration's leaders has always been clear, which means that the government has never said at any time that there is no need to declare concentration of operators.

In fact, I didn't declare at the beginning. I think it probably came from the transaction of Focus buying Sina, because the Ministry of Commerce requested Focus to submit a compliance document issued by relevant departments to prove that the VIE structure complies with Chinese laws and regulations, including foreign investment. However, it is impossible for the Ministry of Industry and Information Technology to issue such a compliance certificate. Therefore, the application was not accepted by the Anti monopoly Bureau of the Ministry of Commerce. From then on, VIE enterprises will no longer conduct antitrust declarations, as it is understood that declarations will not be accepted.

It has become a state in which the people do not lift their hands and the officials do not correct their mistakes. But I think this state will come to an end with the promulgation of the "Guide".

Article 19 stipulates that anti monopoly law enforcement agencies can actively investigate transactions that do not meet the reporting standards. For example, when one of the concentrated operators is a start-up or emerging platform.

Chinese giants are worried, as are foreign giants. The emergence of some start-ups will suddenly subvert the giants. So, let me buy it for you first. This way of purchasing may stifle some new competitors from entering the market,

The second mode is to adopt free and low-cost modes with low turnover. Not only do I have no income, but I also provide subsidies? "Fees are high, costs are high, but there is no income or very little income. Where does the money come from?"? Money comes from investors. For example, some taxi software and takeaway software used this strategy in their early promotion. However, according to the Guide, in the future, when this situation occurs, the Anti monopoly Bureau can intervene when it wants to.

I think there are two commendable points. The first point is that the "Guidelines" give the Anti monopoly Bureau a great deal of power, but also give the market a greater degree of uncertainty, because there needs to be a standard for whether transactions should be reported.

For lawyers and securities companies, there is a need for a standard, which cannot be absent. Currently, the standard is 400 million and 2 billion.

But now the problem arises, and transactions below the standard may also be reviewed in the future.

This brings us to a deeper level of thinking, which means that there will be more tools in our toolbox in the future. I have been talking about this point, which means that the improvement of legislation lies in providing us with many tools in our toolbox.

For example, in the current Sino US trade war, the US government has adopted sanctions such as 301 tariffs, 201 tariffs, and export controls. What does China have? China is now tightening legislation. The same goes for antitrust. With the guidelines in place, for transactions that do not meet the reporting standards, if there is an impact on the market to exclude or restrict competition, even if they do not meet the standards, they can also intervene.

For competitors, the Anti monopoly Bureau can also be asked to intervene actively. Of course, whether the Anti monopoly Bureau is willing to control it is another matter. But the Guide provides a tool. Although this creates some uncertainty for transactions, it gives more opportunities for stakeholders to play games.

Let me finish here first. Let's welcome President Zhou to make a statement.

Zhou Qing: The significance of the introduction of the Guide from an industry perspective

Zhou Qing: Good morning, experts and industry comrades. At the invitation of Lawyer Jiang from Gaopeng Law Firm, I am honored to participate in this morning's discussion.

Currently, I am the Secretary General of the China Cross-border E-commerce 50 Person Forum and the head of a state-owned enterprise. The well-known e-commerce companies in China, including logistics suppliers and payment companies, are all members of our forum. At the same time, my own enterprise also has some business cooperation with Tmall and JD.com. Therefore, as an industry representative, I have my own understanding of discussing the "Anti monopoly Guide in the Platform Economy" with you here.

If the discussion just now was from the perspective of technology and legal professionals, I would like to share some of my own views with you from the perspective of the industry.

Why should policies be introduced first? "Just now, I thought the discussions were very professional and technical, but I probably did some policy research while working in government departments before, and I also participated in a lot of preliminary research, including the Electronic Commerce Law issued at the end of last year. I also participated in some related preparatory work, so I probably have some thoughts on these.".

I believe that the policies issued by government departments are definitely not on the spur of the moment. You can see a lot about the layout made by relevant government departments in this field on the internet. It should be said that it is very concentrated, and also very intensive. In addition, it is highly oriented. In other words, the Internet economy has developed to a highly developed level at the current level. However, after the development, there have been some situations where, as everyone has just mentioned, there are two choices for some super platforms. I believe that this has seriously affected the sustainable development of the industry, and the government also believes that it is necessary to put forward a higher level of normative requirements for them.

In addition, you can note that digitization has become a strategy of our country, and as an indispensable infrastructure platform for digitization, it has become a commanding point for various enterprises to compete for construction and occupation, including a state-owned enterprise like mine, which should be a state-owned enterprise with a history of nearly 70 years. We are now also based on the management of a simple ERP system in the early stage, In doing digital transformation, we are also building our own special supply chain management platform, and an e-commerce platform that can be said to have proprietary functions and third-party service functions. It should be said that at such a historical point, the introduction of the Guide has far-reaching significance in preventing excessive monopoly and restricting competition in the field of platform economy. I have also been engaged in the research and drafting of cross-border e-commerce policies in government departments before. It should be said that previous policies were often supportive policies. "I have also studied this platform antitrust guide several times myself, and I think it is a normative policy.".

The purpose of the policy is to prevent and suppress monopolistic behavior in the economic field of Internet platforms, reduce administrative law enforcement and operator compliance costs, protect fair market competition, safeguard consumer and social equity interests, and promote the sustained and healthy development of the platform economy. I think reducing the level of industry monopoly is more conducive to the innovative development of small and medium-sized enterprises. Especially at a historical moment when our country has successively proposed mass entrepreneurship and innovation, and proposed moving towards a new stage of digital development as a whole. I believe that reducing the monopoly level of the Internet economy or platform economy to a certain extent is conducive to promoting the international competitiveness of our entire country's Internet economy, forming a situation of plate opening.

As a participant in the Internet economy, I myself, including my company, will honestly feel the strict requirements put forward by the super platform in terms of transaction conditions, including such credit sales, advances, credit transactions, and so on, in the process of cooperating with these large Internet platforms. It does bring some difficulties and challenges to our business.

I also have a communication circle where I often hear complaints from small and medium-sized sellers about the policies of a well-known foreign e-commerce platform that frequently adjust store opening rules, increase the margin ratio, and improve the conditions for placing goods on the shelves. This situation should be said to be relatively common in large domestic Internet platforms.

In the final analysis, my own understanding is that the formation of a monopoly position on a platform is a result of the traffic game between the platform and upstream and downstream, including between the platform and the platform. I believe that only when the upstream and downstream of the platform are sufficiently dispersed can the platform's traffic have a realized value. Otherwise, when the upstream is large enough, it is likely that there will be a flow of traffic going downstream by itself, causing the platform to actually lose control of the transaction. Therefore, in order to form a monopoly position, our platform has also made great efforts to control it through very precise algorithmic controls. Just now, lawyer Gao Liang also proposed that the algorithm for this platform is actually very meticulous and meticulous. Indeed, the technological content of such algorithms on technology platforms is also very high. Through this sophisticated algorithm, they screen a variety of partners and adopt a differentiated cost standard, ultimately weakening the comparative advantage between buyers and sellers, forming a profit generation model that is most beneficial to the platform itself.

"Their careful calculation is beneficial to themselves, but it is not easy or reasonable to optimize the allocation of resources in the entire society.". I won't go into this question too much.

I think everyone can reflect on whether our own policy is reasonable or not, and also take a look at the experiences and experiences of other countries.

Moreover, I personally believe that this discussion about the monopoly of this super platform in our country should be said to have accumulated for a long time and experienced a dormant period or a preliminary preparatory period. As for the discussion of the pros and cons of this super platform on the domestic economy and the development of domestic Internet companies, I think there will be a clearer understanding of whether the platform is reasonable or not, and where improvements are needed. This is the first question I discussed.

Secondly, I would like to talk about the impact of policies on the industry. Of course, everyone has just discussed a lot. From a corporate and industry perspective, I have a piece of data to share with you. What is the value of the Chinese market in 2019, and the number of digital platform companies with a market value of over $1 billion in China at the end of 2019? There are 193 digital platforms, which means that the total transaction value of which exceeded $1 billion in 2019 is at least close to $200 billion. "I think if you include those super giants, you should multiply them by another ratio, which is a dimension.".

Another dimension that everyone has just noticed is that these super e-commerce platforms, their GMV, and their operating revenue are all at record highs. Compared to our current economic development, it would be quite remarkable if we could achieve positive growth this year, but these platforms are expected to achieve 30-50% or even 100-200% growth rates.

Therefore, I think it is opportune to discuss the antitrust issues in the field of platform economy at such a node. Last time I discussed some developments in recent years at our China Cross-border E-commerce Forum 50, I made a summary myself. In my opinion, it embodies three characteristics.

First, the Matthew effect of the stronger is more prominent, mainly reflected in relatively mature Internet companies, such as several third-party platforms or proprietary platforms that everyone is familiar with, including some logistics companies.

Secondly, for industries that do not have giants, that is, those that do not have such monopolies and have a high proportion, there are also some enterprises that are growing very fast. I believe that their growth rate exceeds the already mature e-commerce brands just mentioned, so there can be many unicorn enterprises in a year or two, so don't worry.

Third, in fact, within our members, there is a very serious division. Some of the enterprises that come to meetings every year no longer participate. In the past year, many of these enterprises have felt that they may either go bankrupt or face significant operational difficulties, making them feel unnecessary to participate in such important forum activities in China. On the other hand, some other enterprises, indeed, have made significant achievements in their respective fields due to their relatively rapid growth rate, and have gained recognition from everyone. They hope to gain more influence and publicity, so they can also appear frequently in some occasions in various forums. I say this also to tell you from a phenomenal perspective that the current platform economy or major e-commerce platforms, or digital platforms, indicate their competition and their rapid development and change.

In addition, after receiving the invitation for this event, I also conducted a simple survey of several of our key enterprises. Everyone's attitude towards the current guidelines is actually quite different. Generally speaking, large companies with a certain scale that have already been listed do have certain concerns, so you can also see that since the publication of the consultation draft, there has been a significant fluctuation in the stock prices of these companies listed in the United States and Hong Kong. However, despite the correction in recent days, it can be seen that these large Internet companies do have concerns about policies.

However, at the same time, for some small and medium-sized enterprises, especially those with unique core competitiveness in some technologies and services, their current market share is still small. They feel that if they control and restrict large-scale platforms, it is actually a rare window period for their development. This is the result of a simple survey I did.

In addition, I have noticed that before and after the issuance of this opinion, the State Administration of Market Supervision has issued a large number of policies, including regulating promotional activities, and supervising online transactions. I believe that although everyone believes that the introduction of this policy has a significant impact, in fact, I believe that this is only a step in the layout. I believe that in the near future, there will be more policies that have a profound impact on the Internet economy that will be implemented in succession, and we will wait and see. This is the second aspect.

Thirdly, I would like to make a judgment on the next step of this policy. Based on my previous work experience, I believe that from the current progress, there is no possibility of making a disruptive adjustment to the draft guide for comment. "I think it is possible to make some minor adjustments to specific indicators such as the identification of some standards mentioned earlier, as well as some considerations. (Editor: The official draft has slightly adjusted the draft for comment, but the substantive content is basically consistent.)".

I also hope to see the major monopolistic Internet digital platforms contribute to the development of the national economy in a more fair and standardized manner.

At the same time, under the historical background of the country's proposal to build a new dual cycle development pattern, it can also make due contributions to the development of a large number of small and medium-sized enterprises, as well as to solve major issues such as national taxation and employment. I would also like to make a small suggestion here. I hope that for the antitrust work in the platform economy field, it is necessary to strengthen top-level design.

First, it is necessary to solve the problem of inconsistent understanding among departments. "Because I know that this work is not just the work of the General Administration of Market Supervision, but also involves the cooperation of other departments. However, different departments may have incomplete or incomplete understanding of this work.". Therefore, I believe that in terms of top-level design, it is necessary to strengthen consensus and unify everyone's understanding.

In addition, it is necessary to eliminate the phenomenon of policy depressions between regions due to different enforcement standards, in order to create a more powerful and fair development environment, improve the allocation efficiency of market resources, and truly guide the sustained and healthy development of industries and industries. Thank you for your brief communication.

Ok, thank you very much for Mr. Zhou's wonderful speech. Due to the time constraints, I think we will soon open our questions as soon as possible.

Question 1: The platform's antitrust guidelines are different from those for the automotive industry, APIs, and intellectual property rights. There is no safe harbor setting, so what do you think of the absence of a safe harbor? Do you suggest a safe harbor?

Teacher Liu Xu's answer:

First of all, thank you very much for asking me this question first. I have also considered this issue. As mentioned in the "Anti monopoly Guide on the Platform Economy", the market definition of the platform economy itself is very complex. The setting of a safe harbor is often based on a clear definition of the relevant market. If a certain economic sector, such as the automotive industry and pharmaceutical industry, can clearly see how the relevant market is defined and accurately calculate market share, it is suitable to set a safe harbor, and operators themselves can relatively easily conduct self-assessment.

If there is a dispute about the definition of the market itself, there is also a dispute about the calculation criteria for market share, such as: Is it based on click volume, traffic, and user penetration, or is it based on revenue or net profit? If it becomes a problem to calculate market share based on any standard, then establishing a safe harbor based on the market share standard will have poor operability. So I think the practical significance of setting up a safe harbor in the field of platform economy is limited.

And even establishing a safe harbor, including the automobile or API market, is more meaningful for small and medium-sized enterprises. However, the main issue in the internet industry now is the compliance of large enterprises. If a large enterprise wants to comply, then considering a safe harbor often has limited significance. Whether it's Tencent, Alibaba, or Ant Technology, a safe haven with a market share of 30% or 15% must have been reached, right? The problem now is that large internet companies need to have the motivation to recognize the importance of compliance and be able to consider the impact of their actions on market competition from the national and national perspectives.

I think the advice given by President Zhou just now is very good, and it requires enterprises to be able to understand some of the central government's considerations. This consideration should be said to be epoch-making, or to view the issue of antitrust law compliance from a new historical perspective.

China has an aging problem, and we are facing the integration of globalization. Moreover, we have objectively given Internet companies a period of roughly 20 years of barbaric growth. Today, large Internet companies should also take their due stance in terms of taxation, employment, competitive environment, and encouraging innovation by small and medium-sized enterprises.

That is to say, we should encourage entrepreneurs to exert their social value, not only by focusing on market value, but also by persuading them to consider their own life value more comprehensively. Some of our internet entrepreneurs have reached the top positions in this field, and they should have a more long-term and profound ultimate concern. They should be able to think more about how to truly make themselves famous in human history through embracing competition, technological innovation, overseas expansion, and public welfare leadership.

Question 2: Regarding the application for VIE, BAT has not seen a series of Internet mergers and acquisitions reported recently. Will the General Administration attach importance to it in the future? Is it possible that the final thunder, rain, and dot will be small?

Gao Liang's reply:

Lawyer Gao: The issue of VIE declaration is a highly controversial issue. When we discussed it with some internal professionals, everyone also had different views on this issue.

According to my personal understanding, many Internet platforms, including Baidu, JD, Alibaba, and others, have conducted a lot of mergers and acquisitions in the past. According to publicly disclosed information, it is not uncommon for these Internet platforms to file antitrust filings with antitrust reporting agencies for mergers and acquisitions, which means that many mergers and acquisitions involving VIEs have not filed antitrust filings, and the estimated number is very large.

The guidelines now clearly stipulate that transactions involving VIEs should be subject to antitrust reporting. If, after the guidelines come into effect, the General Administration conducts investigations into previously unreported cases, the workload and impact of such investigations will be significant.

"I understand that for mergers and acquisitions involving VIEs that were not filed with antitrust filings before the guidelines came into effect, the possibility of the General Administration initiating an investigation on them is not too high for the time being. We will also see how to proceed in the future, as the workload is too large and the standards for China's antitrust filings are very low. For example, any acquisition by Alibaba,", As long as the turnover of the target company under acquisition reached 400 million yuan in the previous fiscal year, this transaction needs to be reported, as the turnover of Alibaba Group itself is large enough. Of course, the aforementioned merger and acquisition transactions are based on the premise that Alibaba has sole or joint control over the acquisition of the target company.

In fact, now that the draft guide is out, many mergers and acquisitions transactions on domestic Internet platforms have not been subject to antitrust reporting. In response to this issue, I have had many exchanges and communications with the former officials of the Anti monopoly Bureau of the Ministry of Commerce. The feedback position given to us is that the Anti monopoly Bureau has never said that transactions involving vie do not require antitrust reporting.

However, the actual fact is that a large number of transactions involving VIEs have indeed not been reported. I have previously provided relevant legal advice to clients on a number of VIEs. If such transactions are reported and the Anti monopoly Bureau does not file a case, then whether this transaction has been done or not will it die, right? Due to the emergence of this guide now, we can believe that there is no doubt that future transactions involving vie structures need to be reported or not.

"I also believe that after the official entry into force of the Guidelines, transactions involving the vie structure will also be filed by the Anti monopoly Bureau. As long as the case is filed, it will be easy to handle. Filing means that the transaction will be formally reviewed. As for whether it will not affect competition and thus impose conditions or prohibit this transaction, that is another issue. It is a competition concern, not a vie issue.".

Reply from Lawyer Jiang Liyong:

You said that you have not seen any internet mergers and acquisitions reported recently because the draft for comment issued on November 10, 2020 has not yet taken effect. (Editor: The official draft was released on February 7th, 2021.) So I think everyone is considering this guide. If the official draft cancels the mandatory requirements for VIE declaration, now declaration will suffer. So I think we'll first wait and see if the final version is still available. I think VIE is the biggest highlight of the Guide and should not be adjusted or cancelled.

Secondly, in fact, we can also look at some particularly large transactions recently, such as Baidu's acquisition of YY Live. You can go and see if the transaction has been declared. If a transaction has been declared or if there have been similar or larger transactions reported recently, I think the answer is certain.

Question 3: What is the current situation of axial amplitude agreements in practice? Are there any practical cases of the situations mentioned in the guide.

Gao Liang's reply: