The boundary of responsibility of the custodian of the private fund

01/ Background

In July 2018, the Pudong branch of Bank of Shanghai, a custodian bank, was besieged by investors due to the disappearance of the private equity fund manager of Fuxing Group, which triggered extensive discussion on the boundaries of custodian liability. Interestingly, at that time, the official website of the Banking Association also "frightened" the Asset Management Association and expressed different opinions, and the impact of this incident on the bank's acceptance of custody business is still far-reaching.

02/ Review

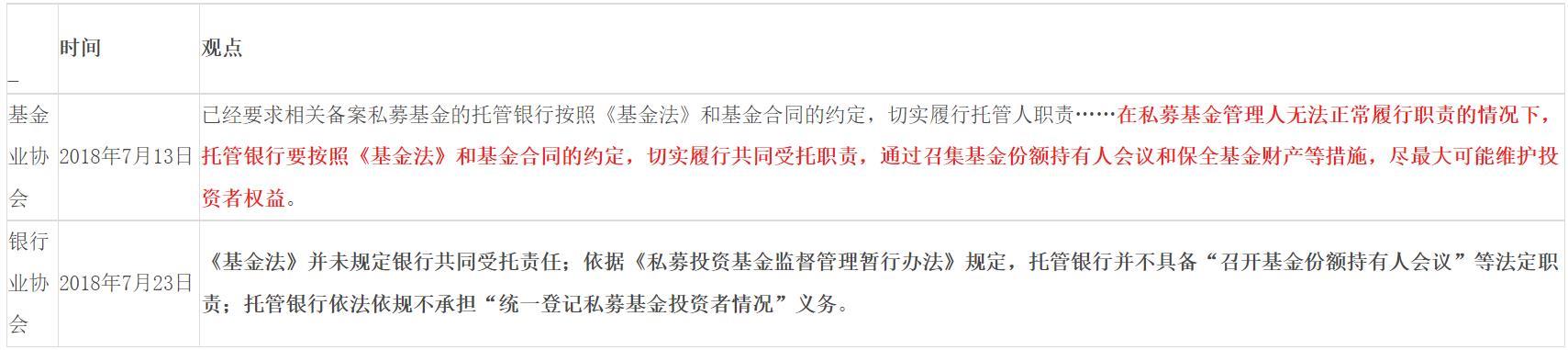

First, let's review the different attitudes of the Asset Management Association and the Banking Association to this incident:

03/ Contrast

On 18 March 2019, the Association of Banks (CBA) issued the Guidelines for the Asset Custody Business of Commercial Banks, which, although not highly effective, is still regarded as a positive response to the scope of custodian responsibilities of bank custodians. On March 20, 2020, AMAC issued the Administrative Measures for the Custody Business of Securities Investment Funds. Although it is not the same level of effectiveness, we still compare the relevant provisions on the duties of custodians in the Fund Law, the Guidelines for the Custody Business of Commercial Banks and the Measures for the Administration of Securities Investment Fund Custody Business:

The part marked in red in the above table is the part of the Guidelines for Asset Custody Business of Commercial Banks that is reduced compared with the Fund Law, and the provisions of the Measures for the Administration of Securities Investment Fund Custody Business are relatively simple in principle.

The following three points need to be explained:

First, "different fund assets set up different accounts" should be applied to any fund product, and the Guidelines for Asset Custody Business of Commercial Banks, even if not clear, should be strictly implemented in practice;

Second, the scope of application of the Fund Law is also one of the widely controversial issues, and due to historical reasons, there is still some controversy in practice whether the scope of application of the Fund Law is only "securities funds" or "all types of funds including securities funds".

Third, financial institutions (in a broad sense) have inherited the "calf protection complex" of the "central mother", and the custodian of private equity funds is generally banks and securities companies, and the scope of application of the "Guidelines for Asset Custody Business of Commercial Banks" issued by the Banking Association is "banks" that carry out asset custody business, not "securities companies" supervised by the CSRC, in other words, the "Guidelines for Asset Custody Business of Commercial Banks" is not applicable to securities companies acting as custodians of private equity funds; The scope of application of the Measures for the Administration of Securities Investment Fund Custody Business is clearly defined as "commercial banks or other financial institutions established in accordance with the law and qualified for fund custody".

04/ Controversy and consensus

Judging from the attitude of the Asset Management Association towards the Bank of Shanghai incident, the Association believes that the custodian and the fund manager are "co-trustees", and the custodian should earnestly perform the joint fiduciary duties. We know that the legal system for private equity funds is not yet complete, and the current legal level is still only the Securities Investment Fund Law, and the scope of application of the law is still controversial, while the Interim Regulations on the Administration of Private Investment Funds at the regulatory level have not been followed since the release of the consultation draft in 2017. According to the Guiding Opinions on Regulating the Asset Management Business of Financial Institutions (the "New Asset Management Rules"), "where the asset management business carried out by other financial institutions constitutes a trust relationship, disputes between the parties shall be handled in accordance with the Trust Law and other relevant provisions", combined with the Draft of the Interim Regulations on the Administration of Private Investment Funds, "Private equity fund managers and private equity fund custodians shall be honest and trustworthy in managing and using private fund assets, and private equity fund service institutions engaged in private equity fund service activities. We understand that the formation of a trust legal relationship between investors, managers and custodians of private equity funds should have reached a relatively broad consensus in theory and practice.

As we know, the concept of "joint trustee" is derived from the Trust Law, "if there are two or more trustees of the same trust, they are joint trustees" and "the joint trustee shall bear joint and several liability for liquidation of debts owed to third parties in handling trust affairs." An expression of intention made by a third party to one of the co-trustees is equally valid for the other trustees. If one of the co-trustees disposes of the trust property in violation of the purpose of the trust or causes the loss of the trust property due to breach of management duties or improper handling of trust affairs, the other trustees shall bear joint and several compensation"...The joint and several liability of the co-trustees under the Trust Law shall mean that the consequences of the management and disposal of the trust property by one of the co-trustees are extended to the other co-trustees, regardless of whether the other co-trustees have mishandled the trust property. From the perspective of the concept of "joint trustee" and the way of assuming responsibility, the AMAC's conclusion that "custodian and fund manager are co-trustees" seems to have room for defense.

05/ Case analysis

Let's analyze two cases:

Case one

China Minsheng Bank Co., Ltd. and Li Lingjie Contract Dispute Case (Shenzhen Intermediate People's Court (2018) Yue 03 Min Zhong No. 16126, judgment date October 24, 2019)

The focus of the dispute in this case

For focus 1:

Under the circumstance that the duration of the fund has expired, the total subscription amount delivered by fund investors is still far below the standard of 35 million yuan, the establishment conditions of the fund have not been fulfilled, the fund custodian cannot perform its duties, and the fund manager should return the funds paid by investors according to the agreement. However, as a fund custodian, Minsheng Bank knew or should have known that the conditions for the establishment of the fund were far from being fulfilled, but failed to perform its supervisory duties in accordance with the provisions of laws, departmental rules and contractual agreements, promptly remind the fund manager of the risk of non-compliance, perform procedures such as notifying the fund manager in accordance with the law, and did not follow up the follow-up handling of the fund manager, and still executed the investment instructions of the fund manager in accordance with the situation that the fund had been established normally, so Minsheng Bank neglected to perform its legal and contractual obligations, constituting a breach of contract.

For Focus 2:

As the custodian of the fund, Minsheng Bank has a legal and contractual supervision and management relationship with the operation of the fund involved in the case, and has certain faults for the non-performance of the debts of the fund manager, the main responsible person, so that losses that could have been avoided or reduced can occur or expand, so Minsheng Bank is a supplementary responsible person and should bear supplementary compensation for the losses of investors. However, Article 145 of the Securities Investment Fund Law of the People's Republic of China stipulates that "whoever violates the provisions of this Law and causes damage to fund property, fund quota holders or investors shall be liable for compensation according to law." Where fund managers and fund custodians violate the provisions of this Law or the provisions of the fund contract and cause damage to fund property or fund quota holders in the course of performing their respective duties, they shall separately bear compensation for their respective acts in accordance with law; Where a joint act causes damage to the property of the fund or the holders of fund shares, they shall bear joint and several compensation. "Since there are clear provisions and agreements on the duties of fund managers and fund custodians in both legal provisions and fund contracts, fund managers and fund custodians who violate their duties and cause damage to fund property shall be liable for compensation for fund property according to law, and for damage to fund quota holders according to law." Considering that the main duties of fund custodians lie in the custody, liquidation and delivery, investment supervision, information disclosure, etc. of fund assets, and do not participate in the investment operation of fund assets, the scope of responsibility borne by fund custodians should also be different from that of fund managers, and while protecting the legitimate rights and interests of investors as much as possible, the responsibilities of custodians should not be excessively increased. Therefore, in order to implement the principle of fairness under civil law and the general principle that rights and obligations, fault and liability are consistent, and comprehensively consider the degree of fault of Minsheng Bank and other parties, the impact on the losses caused and the causal relationship with the losses suffered by the investor, the court determined that Minsheng Bank shall bear 15% supplementary liability for the investor's loss.

Case 2

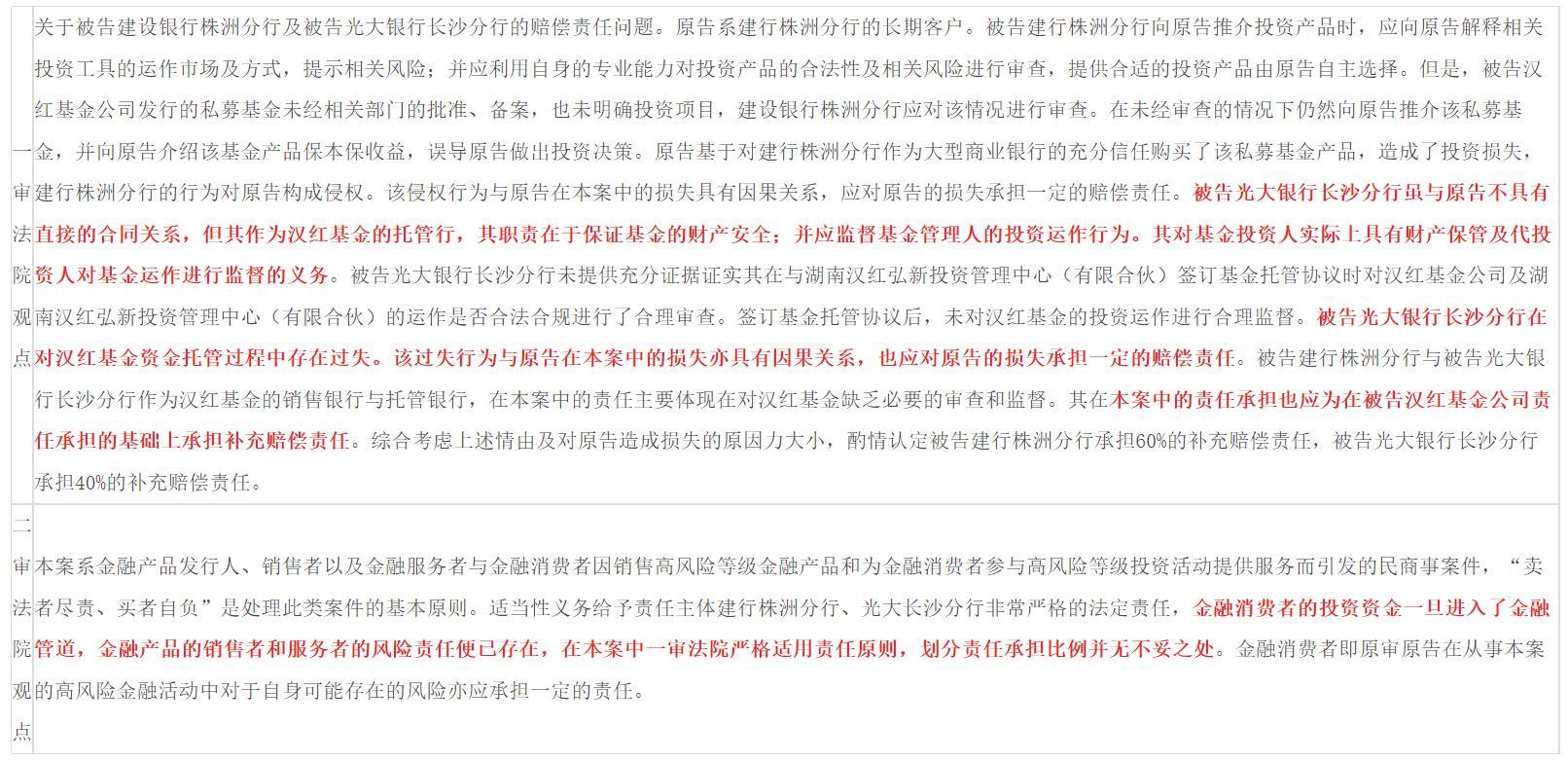

Yi Ruofang, China Construction Bank Co., Ltd., Zhuzhou Branch, etc., and Chenzhou Hanhong Equity Investment Fund Management Co., Ltd. and Tang Taiping tort liability dispute (Zhuzhou Intermediate People's Court (2019) Xiang 02 Min Zhong No. 2409, judgment date November 21, 2019)

The focus of the dispute in this case: the assumption of civil liability

Based on the above cases and the understanding of relevant legal provisions, we come to the following conclusions:

First, the relationship between the custodian and the administrator is not a joint fiduciary relationship under the Trust Law;

Second, the plaintiff generally chooses to file an action for breach of contract or tort based on whether it has signed a relevant contract with the custodian;

Third, the court mostly considers the liability borne by the fund custodian based on whether it has breached its statutory obligations and contractual obligations, and whether it has caused losses to investors;

Fourth, in principle, fund custodians or fund managers are only liable for losses caused by their respective acts, and only jointly and severally liable if there is joint misconduct between the two parties.

(This article is translated by software translator for reference only.)

Related recommendations

- Tax lawyers review the draft of the revised Tax Collection and Administration Law for soliciting opinions

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 3): "Height Limit" Single Release Mechanism

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 2): Grace Period System

- Interpretation of the Management Measures for Compliance Audit of Personal Information Protection - Feeling the Rhythm and Rhythm of Regulatory Flow