Transactions involving VIE structure are filed for concentration of undertakings, and VIE anti-monopoly filing should enter the new normal

Recently, a low-key transaction has attracted the attention of competition law practitioners, which indicates that the anti-monopoly filing of enterprises involved in VIE structures has achieved a breakthrough. It also means that the policy position of the anti-monopoly law enforcement authorities on the declaration of VIE-related enterprises may have occurred or will change.

First, the background

The name of the transaction is "Shanghai Mingcha Zhegang Management Consulting Co., Ltd. and Huansheng Information Technology (Shanghai) Co., Ltd. New Joint Venture Case". The former is a subsidiary of a domestic company engaged in artificial intelligence and big data analysis, while the latter is part of the parent company of KFC, Yum Group. The purpose of the joint venture between the two parties is to engage in the informatization business of the catering industry.

The transaction was originally unremarkable, but it attracted the attention of antitrust lawyers because the simple case disclosure form disclosed by the State Administration for Market Regulation contained the words VIE structure. AS MENTIONED IN THE PUBLICITY FORM, THE ULTIMATE CONTROLLER OF THE FORMER IS LEADING SMART HOLDINGS LIMITED (HUIZHI HOLDINGS LIMITED), A CAYMAN-REGISTERED COMPANY THAT CONTROLS THE COMPANY THROUGH RELATED ENTITIES BASED ON A SERIES OF CONTRACTUAL ARRANGEMENTS.

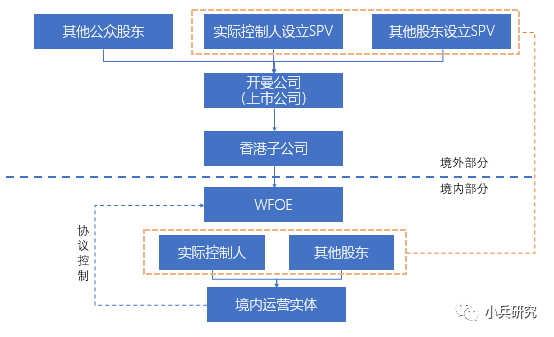

Through public information, we can know that the Chinese company belongs to Shanghai Mingluo Artificial Intelligence (Group) Co., Ltd. and indirectly belongs to Beijing Mingluo Software System Co., Ltd. Beijing Mingluo's shareholders pledged their shares to another wholly foreign-owned enterprise, Miaozhen Information Technology Co., Ltd. The shareholder of Miaozhen Information is a Hong Kong company with the same name as the Cayman company, Huizhi Holdings Limited. The aforementioned architecture conforms to the general pattern of VIE architecture, that is, the following figure (the figure is quoted from VIE architecture construction and case analysis):

2. The reasons for the declaration of this transaction are speculated

The threshold for filing an anti-monopoly filing in China is simple and straightforward, and only control and turnover need to be judged. Since the counterparty to the joint venture is Yum Group, foreign investors have higher compliance requirements for anti-monopoly filing, and generally do not choose not to declare when the threshold is clearly met. In Sino-foreign transactions, foreign parties often become the main promoters of declarations. Therefore, we speculate that this transaction may fall into a similar situation.

3. The reasons why VIE declarations were often not declared in the past

In the past, transactions involving VIEs were often not reported, mainly because one of the main reasons was that one of the merger declaration forms required both parties to the transaction to determine the compliance of the transaction and the compliance of the parties to the concentration in China. The foreign investment law does not dispute the legality of the VIE structure, making it a gray area. Therefore, on the one hand, it is difficult for enterprises to reach "clean" conclusions on the aforementioned issues; On the other hand, the anti-monopoly review authorities are very cautious about the acceptance of enterprises involving the VIE structure, and there is no lack of concerns that the anti-monopoly examination and approval can be misinterpreted as the endorsement of the VIE structure by the law enforcement authorities. Therefore, after the Sina/Focus transaction was aborted because the anti-monopoly filing was not filed, a number of VIE structure enterprises finally chose not to file a file, thus forming a distinctive dammed lake.

Baidu CEO Robin Li put forward a proposal at the 2013 CPPCC meeting, specifically involving VIE and concentration of undertakings. According to media reports, Li Yanhong pointed out in the proposal: "Taking domestic investment and M&A as an example, when an enterprise invests in an enterprise with an annual turnover of more than RMB 400 million, it needs to apply to the Ministry of Commerce for a concentration of undertakings review in accordance with regulations, and once VIE issues are involved, they cannot be accepted normally." ”

There is considerable criticism about the aforementioned situation. For example, scholar Liu Xu (pen name Shao Geng) has repeatedly criticized the phenomenon of VIE-related enterprises not making declarations in his blog (see: Anti-monopoly law enforcement should not condone Internet oligarchs). In addition, Zhang Weihua (pen name Zhang Leslie), a legal practitioner, also criticized this in his blog post (see: Why does Tencent Holding Huya Chinese government don't care - can VIE be special?). )。

4. Whether VIE enterprises need to declare

In fact, it is not difficult to answer the question of whether VIE enterprises need to declare. As mentioned above, the threshold for anti-monopoly filing in China is simple and clear, and enterprises with VIE structure should also file when both turnover and control reach the threshold.

In fact, our past negotiation experience also shows that the anti-monopoly enforcement authority emphasized that it has never indicated that VIE enterprises can be exempted from filing.

We believe that the VIE issue should be delinked from anti-monopoly filings. The main reasons are the following:

1. VIE issues are more complex, with historical reasons and multiple levels of foreign exchange, foreign investment, taxation and securities. The Law on Foreign-Invested Enterprises also chose to circumvent this, which shows the complexity of the issue. Therefore, it may be more practical for law enforcement agencies to choose decoupling rather than linkage;

2. The threshold of the Anti-Monopoly Law is simple and clear, which does not involve VIE issues, nor does it involve compliance issues in other aspects of the enterprise;

3. In the context of decentralization, each law enforcement agency should perform its own duties without having to act as a gatekeeper for other authorities, and it seems that enterprises should not be required to prove that they do not have other compliance problems, or to issue relevant certificates from other authorities.

4. The declaration of compliance in the anti-monopoly declaration form is a self-declaration of the enterprise, and if it is false, the enterprise shall bear its own responsibility. If it is later proved to be false information (assuming that a VIE that circumvents industry access is declared illegal by the relevant authorities in the future), the anti-monopoly law enforcement authority can pursue responsibility after the fact, revoke the decision already made, or impose administrative penalties, but can move forward and retreat freely.

5. Anti-monopoly review focuses on preventing enterprises from gaining a monopoly position through mergers and acquisitions and possibly eliminating or restricting competition. For the review of VIE structure enterprises, it is conducive to comprehensively assessing the impact of the operators participating in the concentration under the control of the ultimate controller on the market.

5. The reasons for the filing of this transaction are speculated

Some industry insiders believe that it remains to be seen whether this transaction (Mingcha Zhegang/Huansheng Information) represents a significant change in the policy attitude of anti-monopoly enforcement authorities, mainly because:

1. The business operators participating in the concentration in this transaction are not the operating entities themselves in the VIE structure, but their holding subsidiaries;

2. The undertakings participating in the concentration may not be involved in industries that restrict or prohibit foreign investment.

We speculate that the filing of this transaction may have been fortuitous. In our experience, this transaction may have been filed because:

1. The parties voluntarily chose to declare;

2. The party may have made a clean conclusion on its compliance, that is, it is considered that it does not have any non-compliance problems;

3. The law enforcement authorities did not require the reporting parties to submit information that they could not obtain, such as requiring them to obtain a certificate from the industry and information technology department to prove their legal compliance;

4. Since simple cases have little impact on the market, the pre-filing review promotion procedure is relatively fast, and there is a post-filing publicity procedure, perhaps VIE issues have not become the focus of the review at the pre-filing review stage.

Therefore, we believe that the acceptance of this transaction does not exclude certain contingency factors, but there is undoubtedly a precedent significance for this transaction to be filed, namely:

1. Transactions involving VIE structure that meet the reporting threshold shall be reported;

2. Compliance issues involving VIE structure enterprises will not constitute an obstacle to obtaining a case.

1. Pay close attention to the progress of Mingcha Zhegang/Huansheng Information

The acceptance of this case, and if approved, has certain precedential significance, indicating that the VIE structure is no longer or should not be an obstacle to antitrust filing. In particular, if Mingcha Zhegang/Huansheng Information can still be approved quickly and smoothly after attracting industry attention, it may indicate that the anti-monopoly enforcement authorities have become clear about this. Enterprises involved in VIE structure should take the initiative to declare future transactions.

2. Handling of transactions that should have been reported in the past but not declared.

In our view, the enterprises involved may wish to consider reporting future transactions on the one hand, and properly handling past undeclared transactions on the other hand. In this regard, more pioneering approaches may be needed. For example, can an undeclared enterprise adopt a packaged approach to solve the problem at one time and choose to make a supplementary report to the anti-monopoly law enforcement authority at one time? Since the VIE structure may involve a large number of unreported cases, individual investigations will consume more administrative resources. Anti-monopoly enforcement authorities may wish to consider some groundbreaking solutions: for example, can a stricter interpretation method be adopted for retrospective of the limitation of administrative penalties? Can administrative settlements be used to resolve multiple cases at once, without the need to investigate each case? These questions have yet to be answered in practice. (This article is the author's personal views and does not constitute legal advice, please contact the author for consultation).

(This article is translated by software translator for reference only.)

Related recommendations

- Tax lawyers review the draft of the revised Tax Collection and Administration Law for soliciting opinions

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 3): "Height Limit" Single Release Mechanism

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 2): Grace Period System

- Interpretation of the Management Measures for Compliance Audit of Personal Information Protection - Feeling the Rhythm and Rhythm of Regulatory Flow