Interpretation of the main points of the revised draft of the Anti-Monopoly Law

On 2 January 2020, the State

Administration for Market Regulation (SAMR) published the Draft for Comments on

the Amendments to the Anti-Monopoly Law (the "Draft for Comments"),

which is the first large-scale revision of the Anti-Monopoly Law that came into

effect in 2008. From the content point of view, the consultation draft is a

comprehensive revision based on the past 11 years of experience in anti-monopoly

law enforcement, and the revision content is very rich, including not only the

three pillars of the Anti-Monopoly Law, namely concentration of undertakings,

monopoly agreements and abuse of dominant market position, but also

anti-monopoly administrative investigation and legal liability. Although the

Draft does not have legal effect now, it plays a very important role in

enlightening the future direction of anti-monopoly law enforcement.

First, concentration of undertakings

First, control

Article 23 of the Anti-Monopoly Law, which is currently in force, only

stipulates the form of concentration of undertakings, and does not explain the

concept of control, which itself is of great significance in determining

whether a concentration of undertakings has arisen. Article 23 of the Draft

adds a new paragraph on right of control, which provides a general explanation

of the concept of right of control. According to the content of this paragraph,

control refers to the right or actual status of a business operator, directly

or indirectly, alone or jointly, that has or may have a decisive influence on

the production and business activities or other major decisions of other

business operators. Therefore, formally speaking, control in the sense of

concentration of undertakings includes direct control and indirect control,

separate control and joint control; In terms of content, control refers to the

right or actual state that has or may have a decisive impact on the operator's

production and business activities or other major decisions. This definition is

similar to the definition of control in EU competition law[1], in that the

right of right only needs to have the possibility of having a decisive effect

on other operators, without the need to prove that the decisive influence is

actually exercised now or in the future. This additional provision would

facilitate a more accurate grasp of what constitutes control.

Therefore, in practice, in the case of acquiring a minority stake, even if the

acquirer has not obtained a controlling position in the target company, there

is still the possibility of acquiring control. According to officially

announced cases, there are many cases in which control has been acquired as a

result of the acquisition of minority shares, and the establishment of the

concept of control is conducive to further clarifying the legislative basis for

law enforcement agencies to review minority equity acquisition cases.

Second, potential changes in anti-monopoly filing standards

Article 24 of the Draft provides new clarification on the anti-monopoly filing

criteria. First of all, paragraph 2 of Article 24 authorizes the State

Administration for Market Regulation to adjust the anti-monopoly declaration

threshold, in other words, the State Administration for Market Regulation can

formulate and modify the declaration standards according to the level of

economic development, industry scale, etc., the current anti-monopoly

declaration standards were promulgated and implemented in August 2008, and now 11

years have passed, and the current level of economic development and industry

scale are not the same as 11 years ago, therefore, In the future, SAMR may

revise the current filing standards to raise the current filing threshold.

In addition, according to Paragraph 3 of Article 24 added in the Draft for

Comments, if a concentration of undertakings does not meet the reporting

standards, but has or may have the effect of eliminating or restricting

competition, the Anti-Monopoly Authority under the State Council shall conduct

an investigation in accordance with law. Therefore, legally speaking, the State

Administration for Market Regulation still has the power to investigate the

concentration that does not meet the anti-monopoly filing standards, which is a

fallback clause, although so far, there have been no cases investigated for

failing to meet the anti-monopoly filing standards, but this fallback clause is

not meaningless. On March 9, 2017, the German Bundestag approved the Ninth

Amendment to the Anti-Competition Restriction Act[2], which introduced a new

declaration standard of transaction price, and similar to China's current

anti-monopoly filing standards, the German anti-monopoly declaration standards

before the revision only used turnover as the basis for determining whether

declarations were required. The purpose of the new filing criteria in Germany

is to ensure that start-ups that may generate significant competitive concerns

in the future, especially Internet-related start-ups, are subject to the German

merger control regime if the company has no or little turnover at the time of

the transaction. Therefore, the Ninth Amendment introduces the transaction

price consideration on the basis of turnover, so that the acquisition of target

companies with small turnover is also subject to the review of the German

Federal Cartel Office if it reaches a certain transaction price. I understand

that paragraph 3 of Article 24 of the Draft serves as a catch-all clause to

provide a basis for the State Administration for Market Regulation to enforce

anti-monopoly regulations against start-up enterprises that do not meet the

filing standards but can generate significant competitive concerns, especially

Internet-related start-ups.

Third, true and accurate data and information

Article 51 is added to the Draft for Comments, which states that when the

documents or materials provided by the declarant exist or may be untrue or

inaccurate and need to be re-examined, the Anti-Monopoly Authority under the

State Council may, at the request of the interested party or ex officio,

conduct an investigation in accordance with the law and revoke the original

review decision. Article 51 makes it possible for transactions that have been

approved by antitrust for providing untrue or inaccurate materials to face the

consequences of revoking the original review decision and being reinvestigated.

The purpose of this article is to urge the declaring party to provide true and

accurate data and information when making antitrust declarations.

Fourth, the stop-meter system

Article 30 of the Draft provides for a suspension system for anti-monopoly

review. According to the current Anti-Monopoly Law, the first stage of

anti-monopoly review is 30 days, calculated from the date of filing, the second

stage is a total of 90 days, and the third stage is 60 days; The review period

for the above 180 is often insufficient for those cases that are tried under

ordinary procedures, particularly those that may raise significant competition

concerns. In order to allow the Anti-Monopoly Bureau sufficient and reasonable

time to conduct the anti-monopoly review, Article 30 of the Draft introduces a

suspension system for anti-monopoly review, that is, the required time is not

included in the above-mentioned 180-day review period in the following

circumstances: 1. The review period is suspended upon the application or

consent of the declarant; 2. The business operator submits additional documents

and materials in accordance with the requirements of the Anti-Monopoly Law Enforcement

Agency under the State Council; 3. The Anti-Monopoly Authority under the State

Council conducts consultations with the business operator on additional

restrictive conditions in accordance with Article 33 of this Law.

Fifth, higher fines

A new Article 50 has been added to the Draft for Comments, which addresses new

penalties related to concentration of undertakings. According to the current

Anti-Monopoly Law, the maximum fine for concentration that should be declared

but implemented without declaration and concentration that is implemented

without approval after declaration is 500,000 RMB. In view of this small

penalty, many transactions that should file an anti-monopoly declaration do not

file an anti-monopoly declaration with the law enforcement agency in accordance

with the law, or choose to file an anti-monopoly declaration with the law

enforcement agency after the transaction is partially implemented. For example,

in the case of Canon's acquisition of Toshiba Medical, Canon chose to file an antitrust

filing with the antitrust law enforcement agency only after the first step of

implementing the transaction, when the Ministry of Commerce finally imposed an

administrative penalty of RMB 300,000 on the applicant Canon, while in the same

case, the European Commission imposed a fine of EUR 28 million on the acquirer

Canon in June 2019, a difference of more than 700 times between the two fines.

Article 50 of the Draft changes this situation in one fell swoop, according to

which the Anti-Monopoly Law Enforcement Agency shall impose a fine of not more

than 10% of the previous year's sales if a concentration of undertakings falls

under any of the following circumstances: (1) the concentration is carried out

without making a declaration when it should be declared; (2) Carrying out

concentration without approval after declaration; (3) Deciding in violation of

additional restrictive conditions; (4) Carrying out a concentration in

violation of the decision prohibiting the concentration of undertakings. Therefore,

for "rushing" cases, the maximum fine amount can reach 10% of the

operator's sales in the previous year. This new provision is also very similar

to EU legislation on snatching[3], except that EU legislation clearly

stipulates that the calculation base of the snatching fine is the aggregate

turnover of the operator's turnover in the previous fiscal year, so it is

foreseeable that the amount of the fine for snatching cases under EU

competition law will be very high. As for whether the previous year's sales of

business operators as stipulated in Article 50 of the Draft refer to the total

turnover of business operators or the turnover within the relevant geographical

market of business operators, it needs to be further clarified in subsequent

cases.

Therefore, given that the Draft greatly increases the amount of fines for

potential run-up cases, the economic costs incurred by run-up will be higher,

therefore, for concentrations that meet the filing criteria, we suggest that an

anti-monopoly declaration should be filed with the State Administration for

Market Regulation before implementation.

First, vertical monopoly agreements

According to Article 14 of the Draft for Comments, the term "monopoly agreement" as used in this Law refers to an agreement, decision or concerted act that eliminates or restricts competition, and the second paragraph of the current Anti-Monopoly Article 13 on horizontal monopoly agreements is deleted. In Ruibang v. Johnson & Johnson Vertical Monopoly Agreement, the Shanghai High Court discussed whether the provisions of horizontal monopoly agreements with the premise of eliminating or restricting competition also apply to vertical monopoly agreements, and ultimately found that the principle of reasonable analysis should be applied to the determination of vertical monopoly agreements. For example, in the Hainan Yutai Vertical Monopoly Agreement case, the Hainan Provincial High Court to some extent recognized the practice of prohibition + individual exemption for the application of vertical agreements in administrative law enforcement. However, with regard to whether the principle of prohibition + exemption will continue to be maintained in the administrative law enforcement of vertical monopoly agreements, it needs to be further clarified. In addition, Article 17 of the Draft prohibits business operators from organizing or assisting other business operators to reach monopoly agreements. Therefore, in practice, if the upstream supplier is organized to help downstream distributors reach horizontal monopoly agreements, the upstream supplier may be punished.

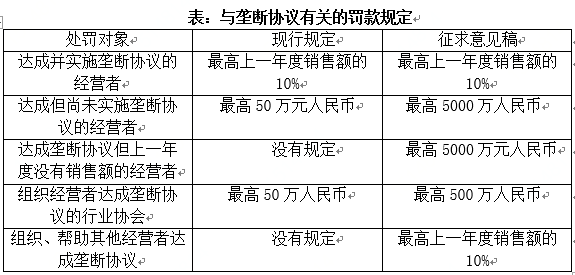

Second, a higher amount of fines

According to Article 53 of the Draft for Comments, a fine of up to RMB 50 million may be imposed on a business operator that has no sales in the previous year or has not yet implemented the monopoly agreement reached. Therefore, monopoly agreements that are reached but not implemented are themselves subject to a high penalty risk.

3, abuse of market

dominance

Regarding the abuse of a dominant market position, the Draft mainly adds a

provision in Article 21: In determining that operators in the Internet sector have

a dominant market position, they should also consider factors such as network

effects, economies of scale, lock-in effects, and the ability to hold and

process relevant data. This new provision reflects the focus of antitrust

legislation on the Internet sector.

Compared with other industries, the determination of market dominance in the

Internet field is more complicated and has its own industry particularities, so

the factor of market share is not necessarily the most critical factor in

determining the existence of market dominance in the Internet field. For

example, in the 360 v. Tencent Monopoly case, when Tencent's market share in

the PC and mobile instant messaging service markets exceeded 80%, the Supreme

People's Court still found that Tencent did not have a dominant market

position. Therefore, for the Internet industry, the determination of its market

dominance needs to consider a variety of factors, including network effects,

economies of scale, lock-in effects, and the ability to master and process

relevant data.

4. Criminal responsibility

China's current Anti-Monopoly Law does not stipulate criminal liability for

monopolistic acts. Article 57 of the Draft stipulates that if a business

operator commits a monopolistic act and causes losses to others, it shall bear

civil liability according to law. Where a crime is constituted, criminal

responsibility shall be pursued in accordance with law. Therefore, for the

first time, the consultation draft introduces criminal liability for

monopolistic conduct through legislation, and there is a possibility that

company executives and employees will be criminalized for monopolistic conduct.

However, the Draft for Comments does not regulate what criminal liability is

triggered by monopolistic behavior, so this part needs to be further defined

and explained by the Criminal Law Amendment.

U.S. antitrust law has long criminalized monopolistic conduct, and for EU

competition law, the European Commission does not have the power to impose

criminal penalties for monopolistic conduct because EU member states have not

passed legislation authorizing the European Commission to impose criminal

penalties, but EU member states have discretion as to whether monopolistic

conduct is criminally penalized, such as the United Kingdom, under which cartel

conduct may result in imprisonment or fines. Therefore, the introduction of

criminal liability in the Draft for Comments is in line with the trend of

anti-monopoly law enforcement in the world.

[1]“Control

shall confer the possibility of exercising decisive influence on an

undertaking.”

[2] See: https://www.gesetze-im-internet.de/gwb/BJNR252110998.html

[3]“The Commission may by decision impose fines not

exceeding 10%of the aggregate turnover of the undertaking concerned.”

(This article is translated by software translator for reference only.)

Related recommendations

- Tax lawyers review the draft of the revised Tax Collection and Administration Law for soliciting opinions

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 3): "Height Limit" Single Release Mechanism

- New Measures for Punishing "Dishonesty" by the Supreme People's Court at the Two Sessions in 2025 (Part 2): Grace Period System

- Interpretation of the Management Measures for Compliance Audit of Personal Information Protection - Feeling the Rhythm and Rhythm of Regulatory Flow