2018 Annual Report on Monopoly Agreement Enforcement Cases and Ten Year Review of Monopoly Agreement Enforcement Cases

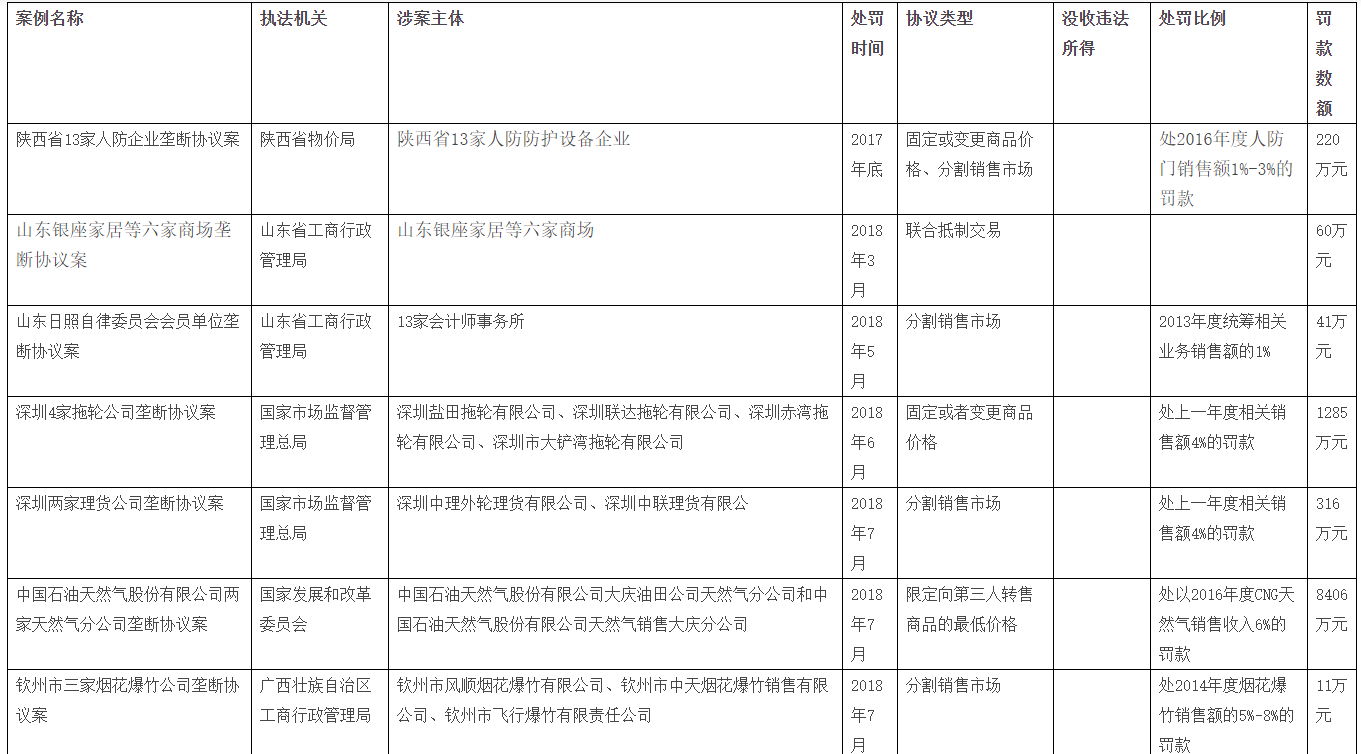

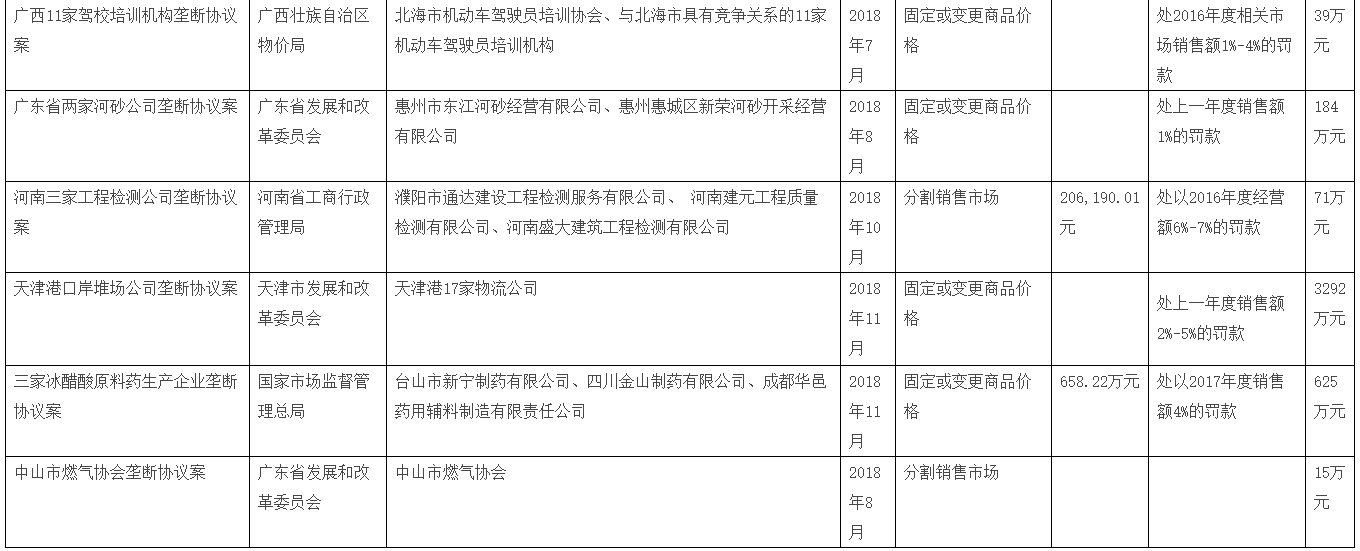

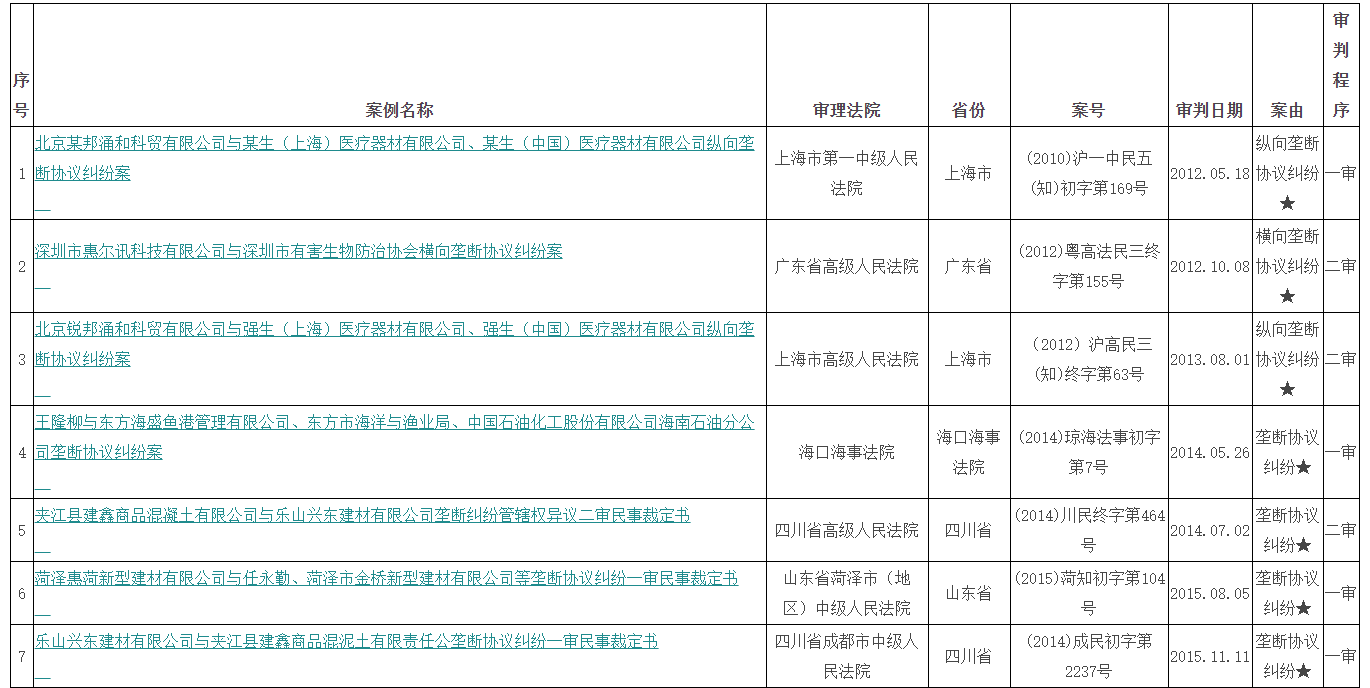

Section 1 Summary and Introduction of Main Cases Summary Table of Case Statistics

2.Introduction to Main Cases 4

(I)Administrative Penalty Cases 4

(II)Civil and administrative litigation cases of monopoly agreement

Section 2:Law Enforcement Analysis and Comments on Monopoly Agreement Cases in 2018 33

I.Characteristics of the Relationship between Law Enforcement Entities,Law Enforcement Industries,and Law Enforcement Regions 33

II.Application of Confiscation of Illegal Income and Penalty Proportion 33

.Determination of the Elements of Monopoly Agreement and the Burden of Proof in Civil Dispute Cases 34

.Legislation of the 2018 Monopoly Agreement

Section 3 Ten Year Review of Monopoly Agreement Enforcement Cases 38

I.Statistics of Administrative Penalty Cases 38

(I)Statistics of Administrative Penalty Cases Involving Fines 38

(II)Statistics of administrative penalty cases where fines are imposed and illegal income is confiscated 95

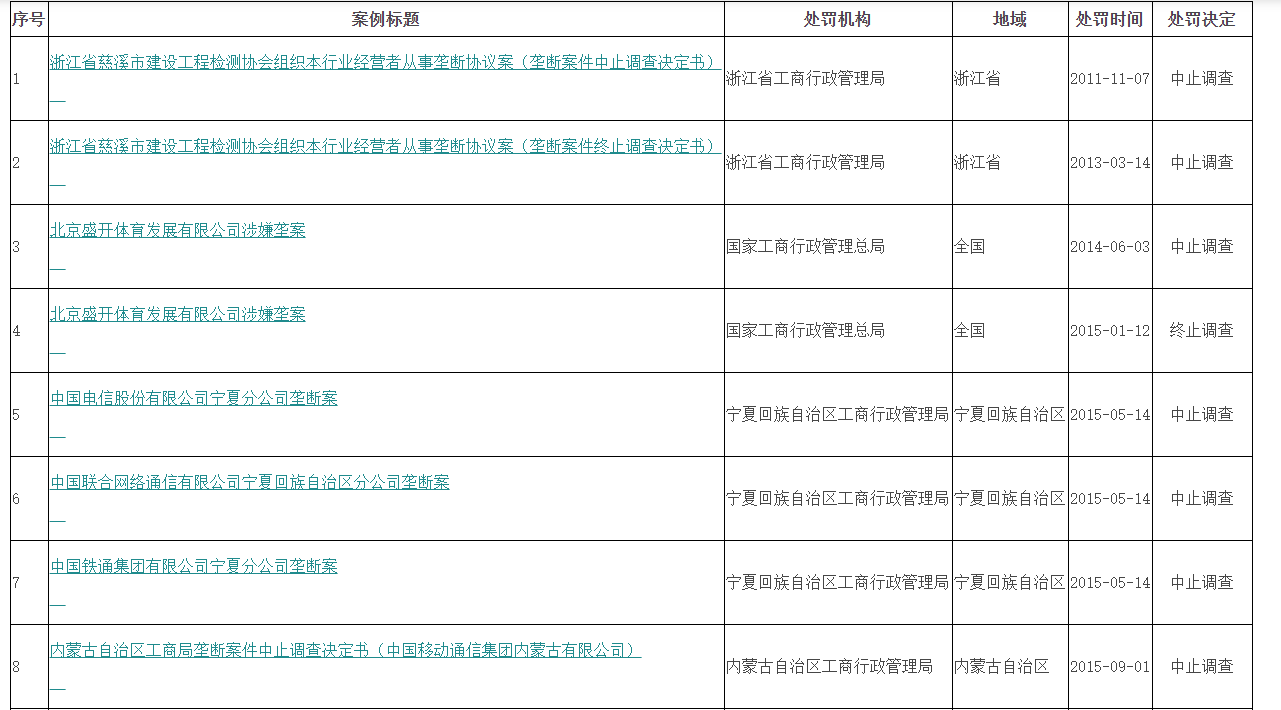

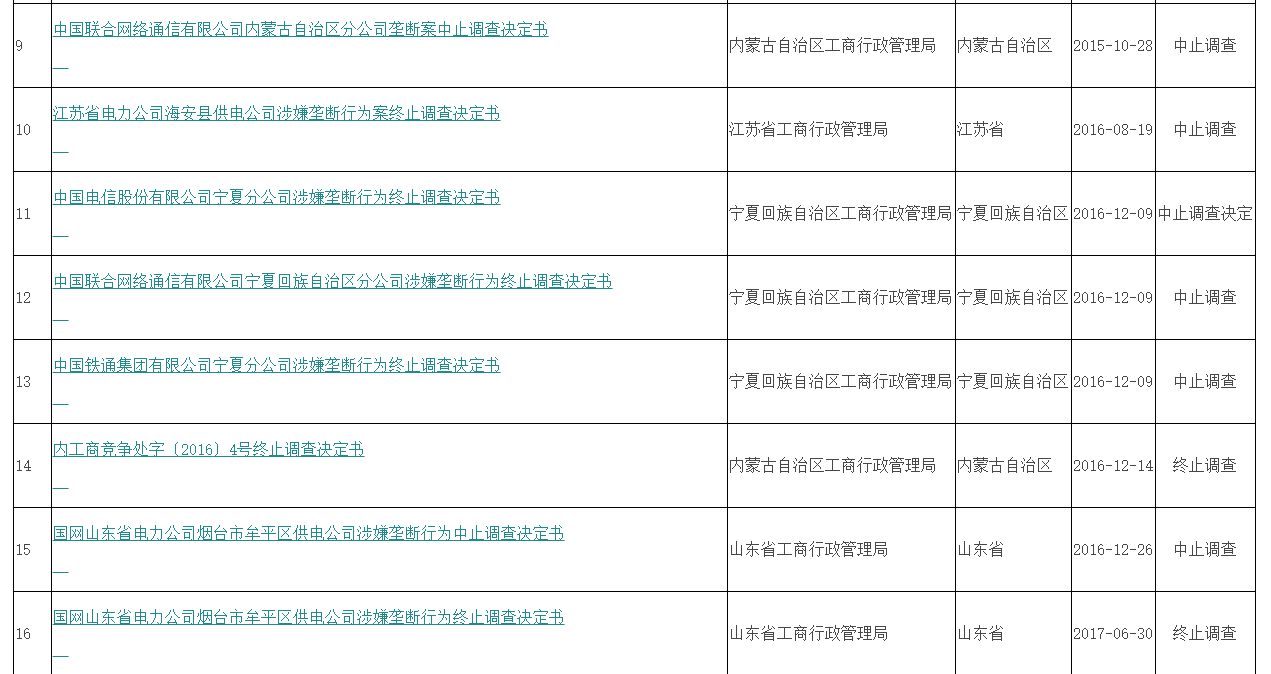

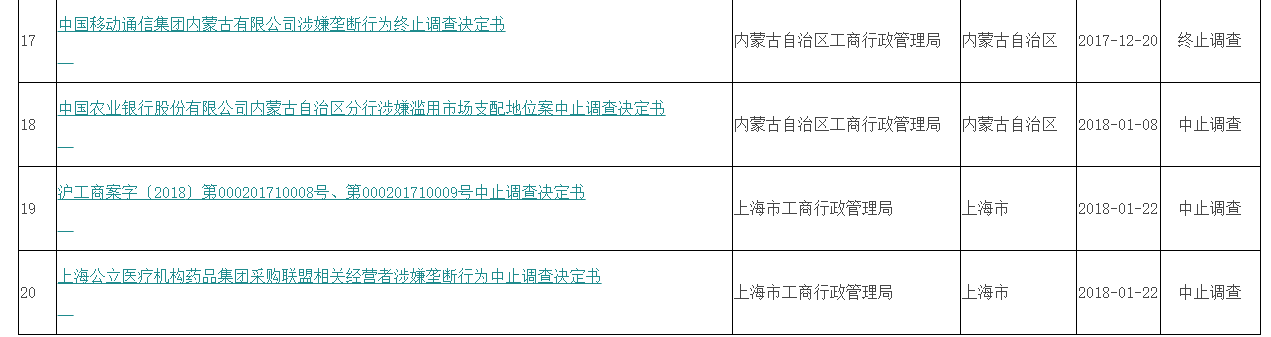

(III)Statistics of Administrative Penalty Cases Involving Suspension and Termination of Investigations

99(IV)Statistics of Administrative Penalty Cases Exempted from Punishment 101

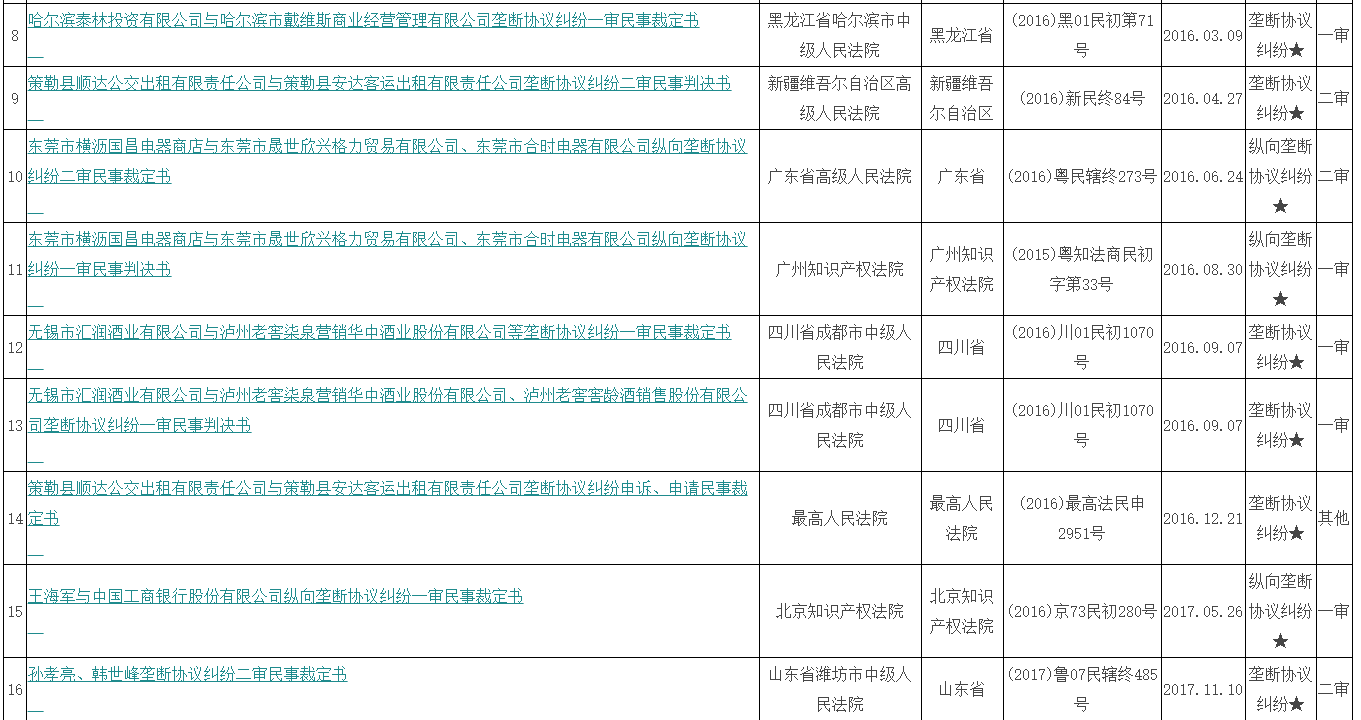

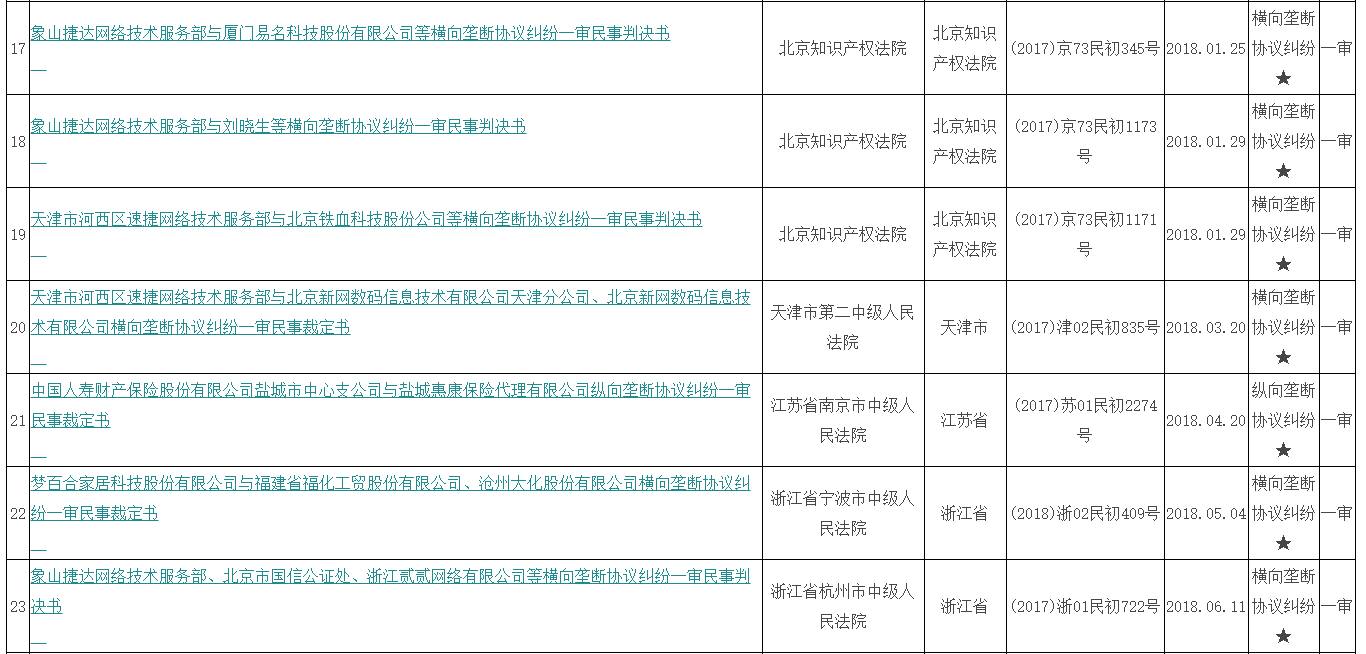

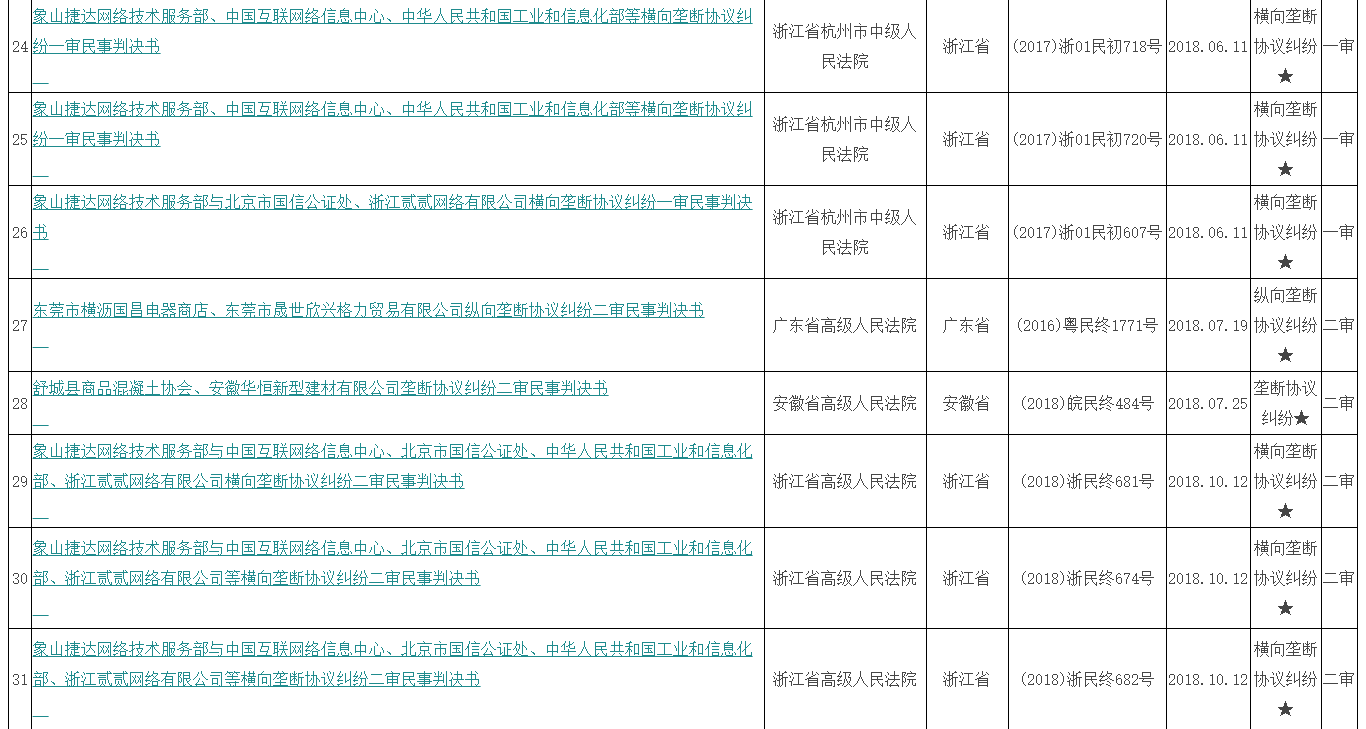

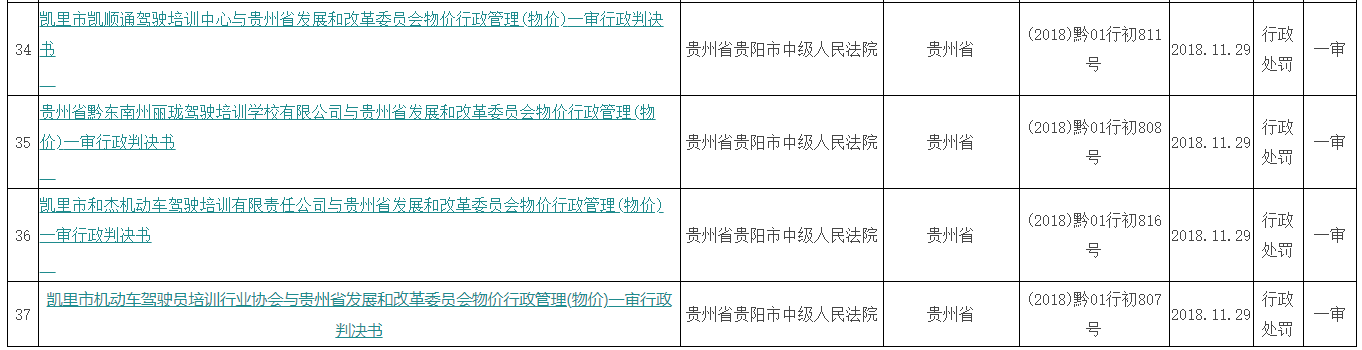

II.Statistics of Civil Litigation Cases 102

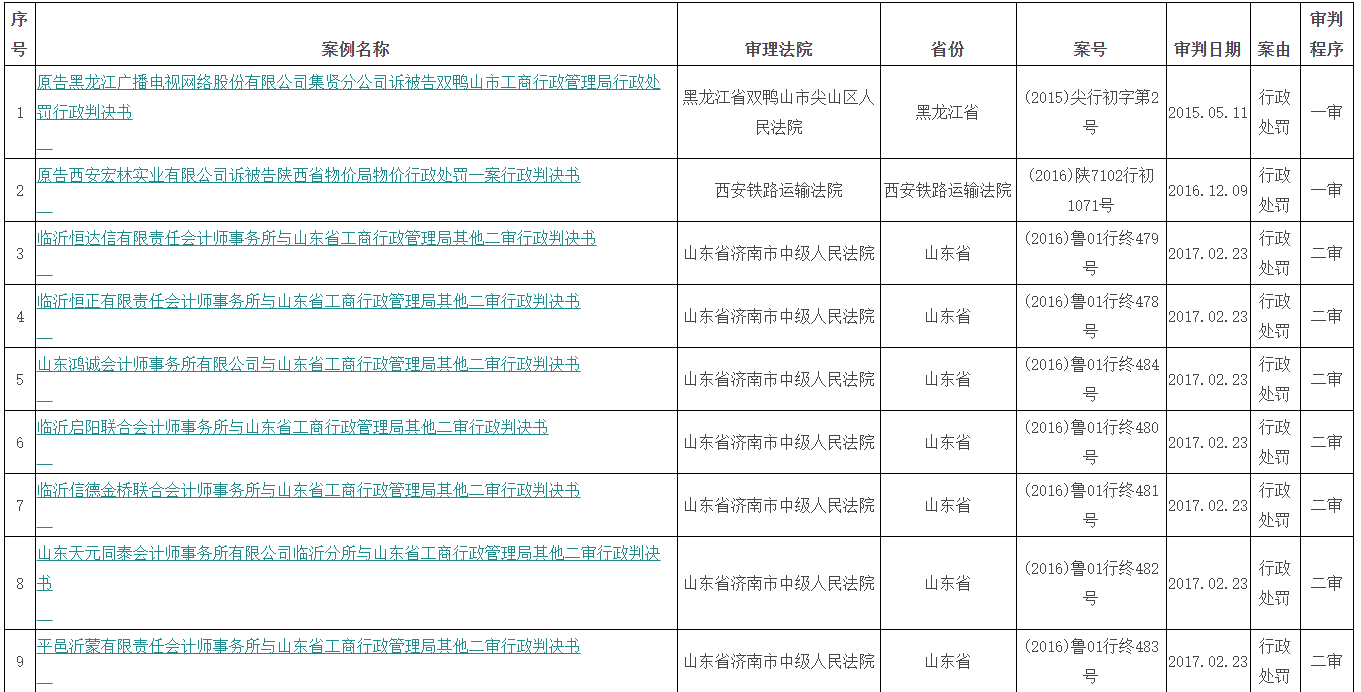

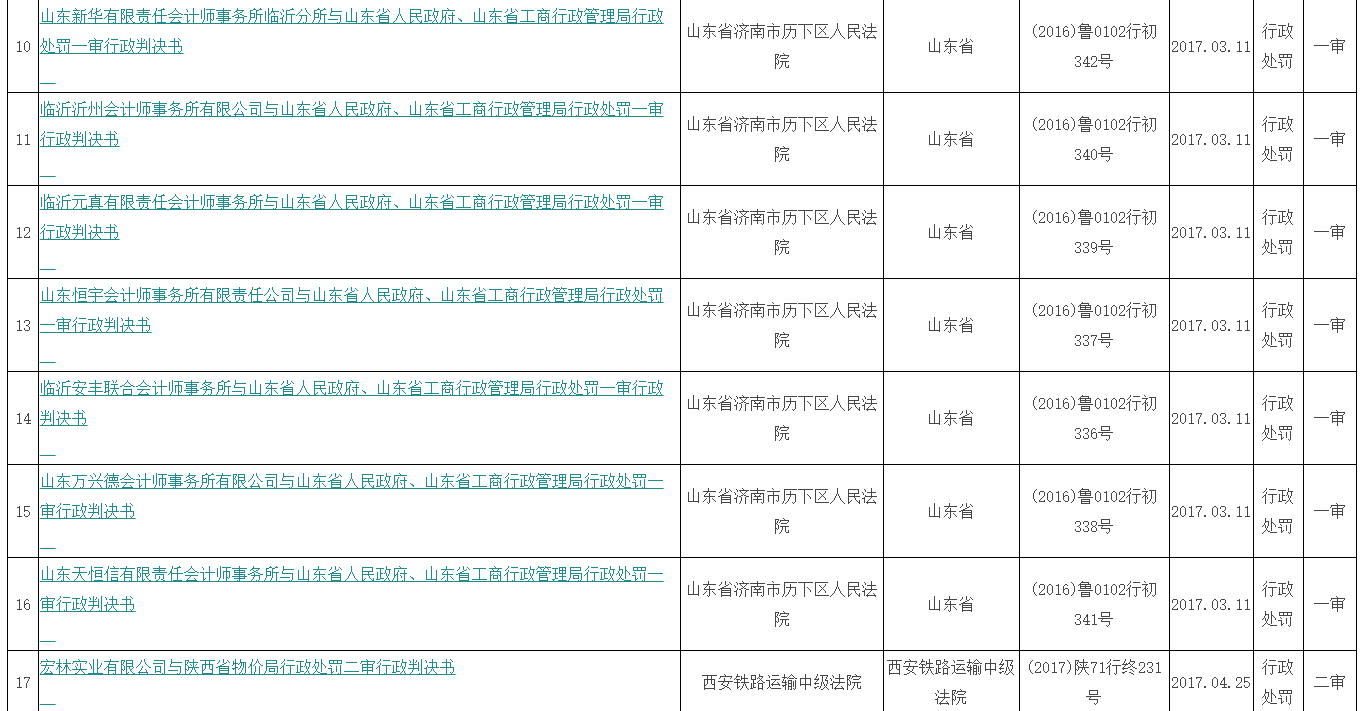

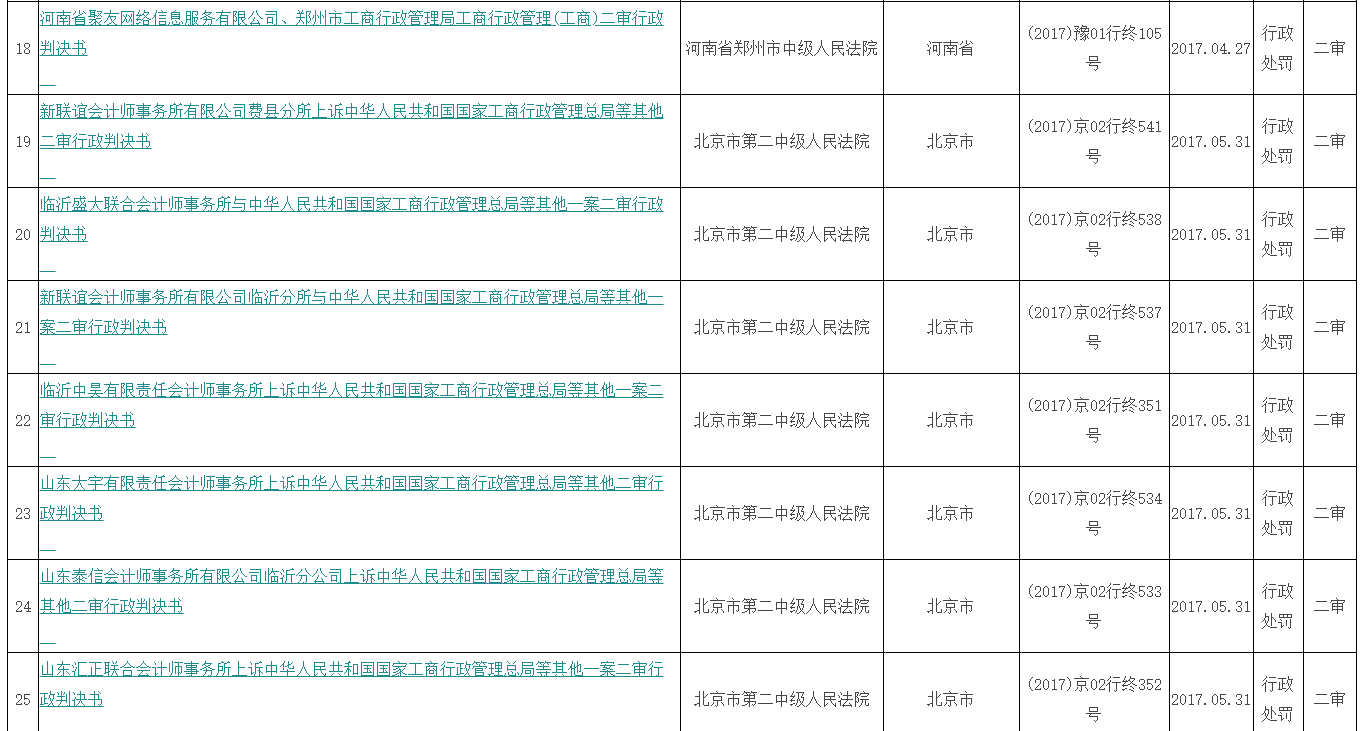

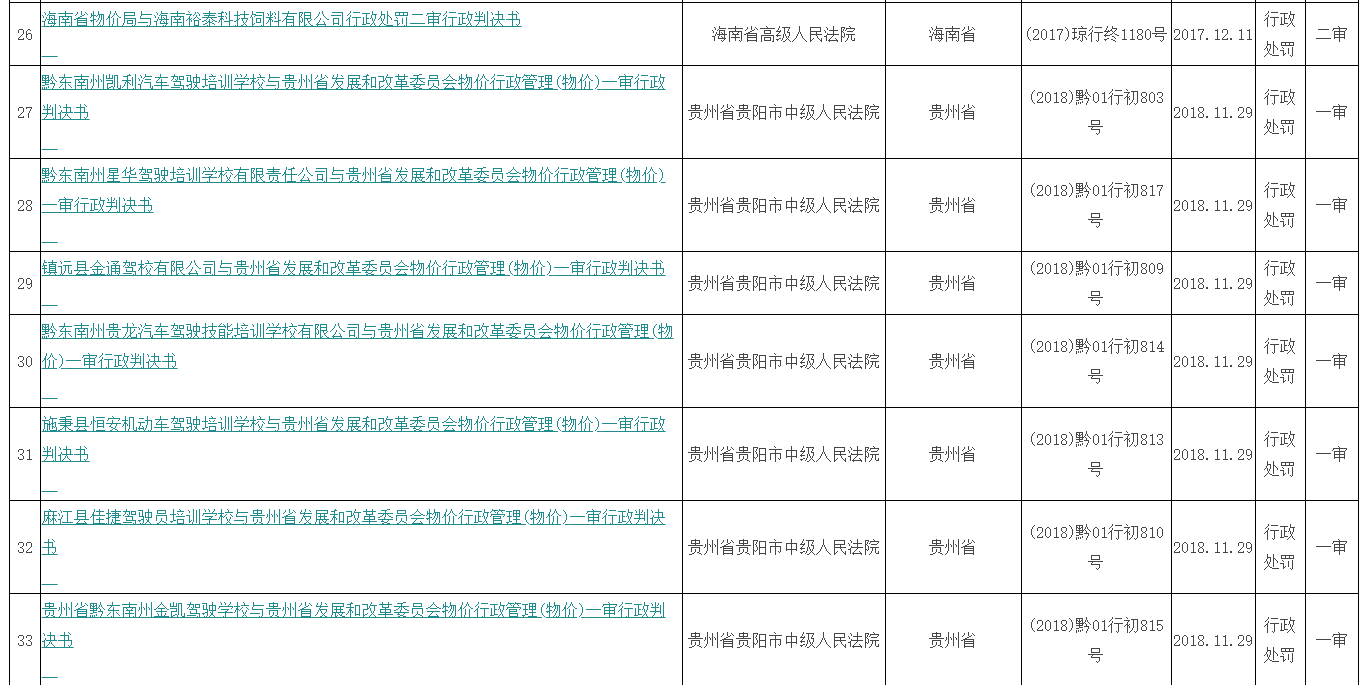

III.Statistics of Administrative Litigation Cases 108

IV.Equal Law Enforcement of Monopoly Agreements and the Court's Criteria for Determining Relevant Issues

"The enforcement of monopoly agreements treats all types of market entities equally and equally."one hundred and thirteen

(2)The determination of relevant issues in civil disputes over monopoly agreements is of far-reaching significance one hundred and thirteen

Section 1 Summary and Introduction of Main Cases

1、Summary of Case Statistics

Case Introduction(1)Administrative Penalty Case 1:Shaanxi 13

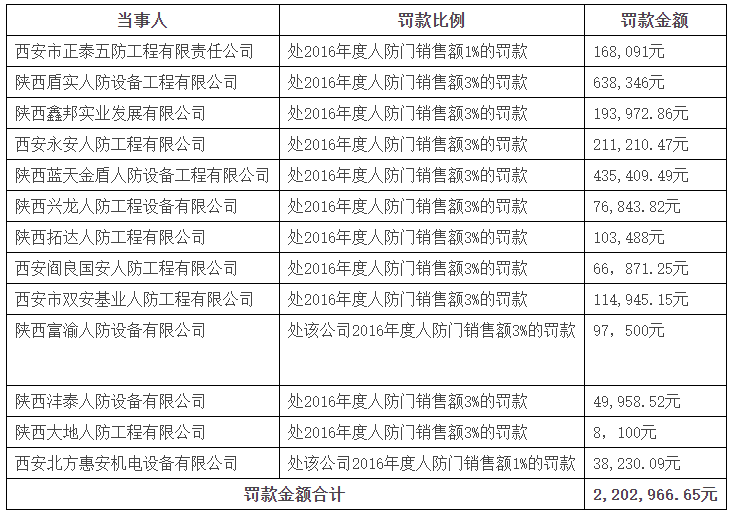

Family Defense Enterprise Monopoly Agreement Case[1]In March 2018,the Shaanxi Provincial Price Bureau officially announced that at the end of 2017,the Shaanxi Provincial Price Bureau issued an administrative penalty decision to 13 family defense equipment enterprises in the province in accordance with the law,imposing fines ranging from 1%to 3%of the sales of civil air defense door equipment in 2016 on the enterprises involved,totaling more than 2.2 million yuan,and ordering rectification.

With the approval of the National Defense Office,there are a total of 13 civil air defense protection equipment enterprises in Shaanxi Province with production qualifications for civil air defense doors,all of whom are parties to the case(hereinafter collectively referred to as"the parties"),and have jointly reached and implemented a price monopoly agreement.It has been found that:(1)13 parties are competitive operators and have reached a monopoly agreement to fix the sales price level of the civil air defense door.Since the second half of 2015,13 parties have gathered for many times to negotiate and reached a consensus on maintaining the information price of civil air defense doors.In April 2016,through negotiation,the"Shaanxi Civil Air Defense Protection Equipment Enterprise Self-discipline Platform"was established,and three agreements,including the"Shaanxi Civil Air Defense Protection Equipment Enterprise Self-discipline Charter","Shaanxi Civil Air Defense Protection Equipment Enterprise Self-discipline Agreement",and"2016 Self-discipline Enterprise Share",were jointly signed.The following agreements were reached:The sales price of civil air defense doors shall uniformly refer to the information price of Shaanxi civil air defense quota;2、Fixed civil air defense door installation fees,transportation fees,technical coordination fees,insurance fees,and other rates;3、Distribute the market share of each enterprise by uniformly dividing the sales market to ensure that the sales price of the civil air defense door is maintained at the information price level;4、Agreed deposit payment methods and penalties.Once the agreed low price sales are violated,the deposit will be confiscated by the self-discipline platform.(2)A monopoly agreement was implemented to fix the sales price level of civil air defense doors.On April 10th,2016,after the self-discipline charter and self-discipline agreement came into effect,13 parties paid part of the start-up expenses and 300000 yuan of deposit to the self-discipline platform,and participated in six distribution project meetings organized by the self-discipline platform.They exchanged views with participating civil air defense equipment companies on the implementation of fixed sales prices and segmented sales markets for civil air defense doors.Through the project allocation meeting,13 parties were awarded part of the project,and implemented the unified bidding behavior agreed in the"Self discipline Charter",implementing a monopoly agreement.The monopolistic behavior of relevant enterprises has led to an increase in the overall sales price of Shaanxi civil air defense doors compared to before the unified sales on the self-discipline platform.

Shaanxi Provincial Price Bureau believes that since 2016,in order to maintain the product price level and maintain their own profits,Shaanxi civil air defense protection equipment enterprises,as a special industry,have established the"Shaanxi Civil Air Defense Protection Equipment Enterprise Self-discipline Platform"through many meetings and negotiations,and jointly signed the"Shaanxi Civil Air Defense Protection Equipment Enterprise Self-discipline Charter","Shaanxi Civil Air Defense Protection Equipment Enterprise Self-discipline Agreement"Written agreements such as the"2016 Share of Self-regulated Enterprises"have been reached and implemented,including horizontal monopoly agreements to fix the sales price of civil air defense doors and split the sales market,which have eliminated and restricted relevant market competition,raised the overall sales price of the Shaanxi civil air defense door market,damaged the legitimate rights and interests of downstream real estate enterprises and end consumers,and violated the"Anti monopoly Law"on prohibiting operators with competitive relationships from reaching and implementing fixed prices Provisions of monopoly agreements such as market segmentation.At the end of 2017,13 parties were imposed administrative penalties to order them to stop their illegal activities,and the following fines were imposed:

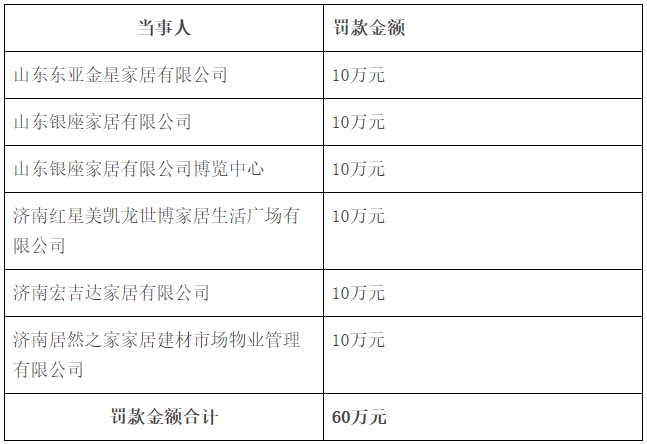

2.Authorized by the State Administration for Industry and Commerce,the Shandong

Provincial Administration for Industry and Commerce conducted a case investigation on the suspected monopoly behavior of six shopping malls including Shandong Ginza Home Appliances(hereinafter collectively referred to as"the parties")on October 14,2016,and made an administrative penalty decision on the parties involved on March 21,2018.

At the beginning of 2016,during the inspection process by the Shandong Provincial Administration for Industry and Commerce,it was found that media reports such as the Qilu Evening News reported that six parties signed agreements to jointly prevent on-site merchants from going out to participate in third-party fairs,and attached great importance to them.On March 14,2016,the Jinan Administration for Industry and Commerce also reported that six parties were suspected of reaching a monopoly agreement on a boycott transaction,and the Shandong Administration for Industry and Commerce immediately conducted a preliminary verification.On July 27,2016,the preliminary verification was reported in writing to the State Administration for Industry and Commerce.On August 31,2016,the State Administration for Industry and Commerce authorized the Shandong Provincial Administration for Industry and Commerce to investigate and handle the case.On October 14,2016,the case was officially filed for investigation.

Upon investigation,at the end of 2015,when the leaders of the six parties gathered for a meal,they unanimously believed that the current third-party marketing platform had seriously affected the normal operation of Jinan Home Shopping Mall.In January 2016,six parties jointly signed the"Notice to All Merchants-Notice on Prohibiting Merchants from Participating in Sales Activities Outside Various Types of Home Furnishings"(hereinafter referred to as"Notice to All Merchants"),drafted by Shandong East Asia Golden Star Home Furnishings Co.,Ltd.(one of the parties),based on the principle of standardizing business order and protecting consumer rights and interests,through consultation,The main content includes"Starting from April 1,2016,all merchants are strictly prohibited from participating in all such off-site sales activities organized by various media websites and third-party marketing platforms.Once discovered,all home shopping malls will be severely investigated and punished,and effective measures will be taken jointly until they are removed from the market.".

Shandong Provincial Administration for Industry and Commerce believes that the six parties'business scope involves the wholesale and retail of furniture,building decoration materials,lamps,handicrafts,and venue leasing.They are located in the same geographical range,and have obvious substitutability in product characteristics,with a direct competitive relationship.In various media,websites,and third-party marketing platforms,many operators have overlapping business scopes with those of six parties,which are replaceable and competitive in terms of product characteristics.Therefore,among the six parties,the six parties and the same business operators in various media,websites,and third-party marketing platforms are competitive operators within the meaning of the Anti monopoly Law.In addition,the six parties and various media,websites,and third-party marketing platforms should maintain market competition order through legitimate operations,and have fair access to transactions with relevant merchants.Relevant merchants should also have the right to legally choose multiple ways to promote and sell their products.The appearance of joint restriction by six parties is to regulate business order,but in fact,it hinders normal transactions between various media,websites,third-party marketing platforms,and related merchants.At the same time,it limits the right of related merchants to freely choose trading partners,and affects the convenience of consumers'free choice of goods.Therefore,this act is essentially a monopolistic act in which six parties reach a joint exclusion and limit competition.

In summary,the Shandong Provincial Administration for Industry and Commerce believes that the actions of the six parties violate the provisions of Article 13,Paragraph 1(5),of the Anti monopoly Law on"boycott transactions"and Article 7,Paragraph 1(3),of the Provisions of the Administration for Industry and Commerce on Prohibiting Monopoly Agreements,"jointly restricting specific operators from engaging in transactions with operators that have a competitive relationship with them.".After the six parties reached a monopoly agreement,through administrative interviews with the Shandong Provincial Administration for Industry and Commerce,the six parties rectified their illegal acts,promptly repealed the"Notice to All Merchants",and did not actually implement the monopoly agreement.Therefore,the Shandong Provincial Administration for Industry and Commerce has decided to impose the following penalties on the parties in accordance with the provisions of Article 46,paragraph 1,of the Anti monopoly Law,which states that"if the monopoly agreement reached has not yet been implemented,a fine of not more than 500000 yuan may be imposed":

3.The Shandong Rizhao Self Regulatory Commission Member Unit Monopoly Agreement Case[3]was authorized by the former State Administration for Industry and Commerce.On April 5,2016,the Shandong Provincial Administration for Industry and Commerce conducted a filing investigation on the suspected monopoly agreement case of the Rizhao Self Regulatory Commission Member Unit,and on May 7,2018,the administrative penalty decision was made against the 14 accounting firms(hereinafter collectively referred to as the"parties")involved in the case in Rizhao City.

After investigation,14 parties held a signing ceremony for the"Rizhao City Accounting Firm Industry Self-discipline Convention"on December 14,2010.In March 2011,the overall distribution of business income began.Each unit paid its local audit,capital verification,and other related business income to a unified dedicated bank account,and then redistributed the income of each unit according to the indicators agreed in advance.In May 2012,all member units of the Rizhao Self Discipline Committee jointly discussed and reached the"Juxian County Business Overall Allocation Method",which agreed that three member units would undertake the relevant business of Rizhao Juxian County,while member units outside Juxian County would handle the business of Juxian County,and 70%of the overall business amount would be allocated by the member units of Juxian County through agreement.After the three member units have paid the relevant business income from Juxian County,Rizhao,to the special account of the Rizhao Self-discipline Committee,only these three member units will be separately allocated according to the agreed proportion in advance.After June 2014,all member units stopped paying the income pooling fund.In July 2014,three member units in Juxian County negotiated and refunded the income pooling fund during the overall allocation period.From May to July 2016,11 member units of the Rizhao Self-discipline Committee,excluding 3 in Juxian County,negotiated and refunded the income pooling fund during the overall allocation period.

Shandong Provincial Administration for Industry and Commerce believes that under normal market competition,the income earned by operators should be directly proportional to their business performance,which is the direct motivation for operators to participate in market competition,and the relevant markets can therefore develop in an orderly manner.As equal market operating entities,14 parties should have a fair competition relationship in relevant businesses,and jointly reach and implement the"Implementation Measures for Overall Distribution of Business Income,""Detailed Rules for the Implementation of Business Inspection,Overall Planning,and Distribution,"and"Juxian County Business Overall Distribution Measures,"integrating relevant income and re dividing it based on indicators such as market share in previous years,although it is argued that its original intention is to promote industry self-discipline,However,in essence,the income of operators who have expanded their market share through normal competition is divided among other operators with competitive relationships,directly resulting in more work without more,while less work can be compensated.This obviously unfair approach not only fails to promote industry self-discipline,but also harms the interests of operators in the industry who obtain development results through normal competition,fails to achieve the ultimate goal of fair competition in the industry,weakens the enthusiasm of operators to participate in market competition,destroys the fair competition order of relevant industries,and is not conducive to improving economic operation efficiency and stimulating the vitality of market entities.

Juxian County,Rizhao City,is a part of the administrative jurisdiction of Rizhao City,and operators have the right to compete on an equal footing in carrying out relevant businesses in this area.However,14 parties reached a"Juxian County Business Overall Allocation Method"through mutual agreement,dividing Juxian County into a separate regional market,and artificially dividing the member units of the Self-discipline Committee into local Juxian County and external Juxian County.It is agreed that only three local member units in Juxian County will independently coordinate and allocate relevant business within the Juxian County area,while member units outside Juxian County will handle Juxian County business,and 70%of the overall business amount will be allocated by Juxian County member units through agreement.The above practices hinder the motivation and enthusiasm of operators outside the region to participate in competitive activities in the region,and have typical characteristics of behaviors prohibited by the Anti monopoly Law.In summary,the Shandong Provincial Administration for Industry and Commerce believes that the actions of the parties are suspected of violating the relevant provisions of Article 13,Paragraph 1,of the Anti monopoly Law:"Prohibiting operators with competitive relationships from entering into the following monopoly agreements:(3)Splitting the sales market or raw material procurement market",which constitutes an act of splitting the sales market.As the chairman unit,Rizhao Fangda Certified Public Accountants Co.,Ltd.undertakes leadership responsibilities such as convening and presiding over meetings of the self-discipline committee and coordinating and communicating with member units in the Rizhao self-discipline committee.Other member units,as participants in the overall distribution of business income,assume common responsibilities.

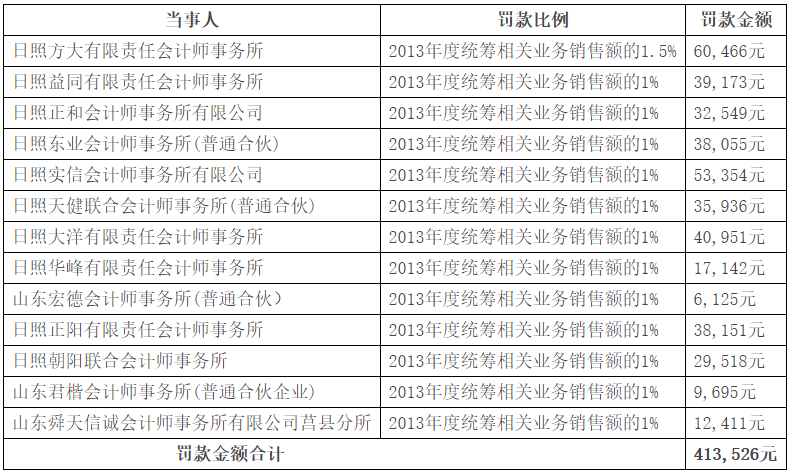

Shandong Provincial Administration for Industry and Commerce has imposed administrative penalties on 13 members of the Rizhao Self-discipline Committee(the Rizhao Branch of Xinlianyi Certified Public Accountants Co.,Ltd.was cancelled on December 29,2016),ordering them to stop their illegal activities,and concurrently imposing the following fines:

4.The Monopoly Agreement Case of Four Tow Companies in Shenzhen[4]:Since November 2017,the State Administration of Market Supervision and Administration has investigated four tug companies in Shenzhen(Shenzhen Yantian Tug Co.,Ltd.,Shenzhen Lianda Tug Co.,Ltd.,Shenzhen Chiwan Tug Co.,Ltd.,Shenzhen Dachanwan Tug Co.,Ltd.,hereinafter collectively referred to as"the parties")for allegedly concluding and implementing price monopoly agreements.

According to the survey,at least since 2010,the four parties have held regular or irregular meetings to communicate the overall trend of tugboat fees and maintain a basically consistent overall price trend;On the other hand,communicate on the issue of tugboat fees for individual shipping companies,and maintain a basically consistent negotiation strategy.The specific performance is as follows:(1)There is a competitive relationship between the four parties:the business licenses of the four parties clearly specify the permitted business areas,which are respectively subordinate to different port areas,and do not overlap with each other.However,due to the relatively close distance between Yantian Port Area in the east of Shenzhen Port and Shekou Port Area in the west,Chiwan Port Area,and Dachanwan Port Area,there is relatively fierce market competition among different port areas.Tug fees are included in the overall cost incurred by the shipping company at the port as part of the shipping company's port fees.Therefore,competition between different port areas will be transmitted to their subordinate tugboat companies,resulting in a competitive relationship between tugboat companies.(2)Communication between the four parties on tugboat charges has been conducted to maintain a basically consistent pricing behavior:The survey shows that the four parties hold regular or irregular meetings every year to communicate on tugboat charges and other matters,in order to maintain a consistent overall trend in the level of charges.From the perspective of the level of tugboat fees charged by the four parties,since 2010,the level of fees charged by the four parties and other tugboat companies in the Shenzhen Port Area has shown a steady upward trend,with a basically consistent time node and range of changes,indicating a consistent price behavior.In addition,when merger and other matters occur among some shipping companies,the four parties communicate with other tugboat companies on the issue of tugboat rates and charges to maintain a basically consistent negotiation strategy.

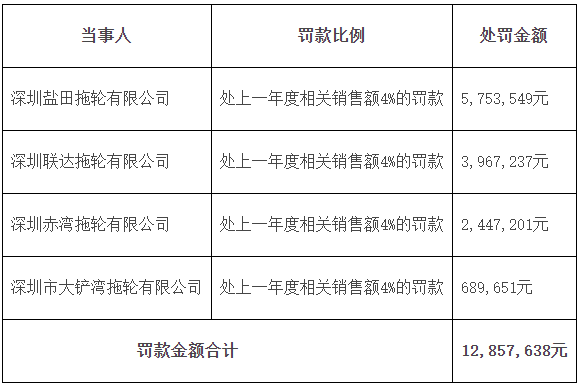

The State Market Supervision and Administration has determined that communication between the four parties on the issue of tugboat fees,based on which the price behavior is basically consistent,limits competition among tugboat companies,and is an act of reaching and implementing a"fixed or changed commodity price"monopoly agreement.Considering that the four parties have communicated on the overall price trend,there is less involvement in the tugboat rates of specific shipping companies;Due to factors such as a small proportion of tugboat fees in port fees and limited damage to competition between ports,administrative penalties were imposed on the four parties on June 11,2018 to order them to stop their illegal activities,and the following fines were imposed:

5.Monopoly Agreement between Two Tally Companies in Shenzhen[5]The State Administration of Market Supervision and Administration investigated the behavior of two tally companies in Shenzhen(Shenzhen Zhongli Shipping Tally Co.,Ltd.and Shenzhen Zhonglian Tally Co.,Ltd.,hereinafter collectively referred to as"the parties")in reaching and implementing monopoly agreements in November 2017.

Upon investigation,it is found that(1)there is a competitive relationship between the parties:both parties are engaged in tallying business in the western port area of Shenzhen Port.From the perspective of equity structure,although China Merchants Logistics Group Co.,Ltd.(hereinafter referred to as"China Merchants Logistics")holds 50%of the respective shares of the parties after 2013,China Merchants Logistics is a relatively controlling shareholder for Shenzhen Zhongli Ocean Shipping Tally Co.,Ltd.,with the remaining two shareholders,China Ocean Shipping Tally Corporation and China Shenzhen Ocean Shipping Agency Co.,Ltd.,holding 29%and 21%of the respective shares;For Shenzhen Zhonglian Tally Co.,Ltd.,China Merchants Logistics and Zhonglian Tally Co.,Ltd.each hold 50%of the shares,and China Merchants Logistics does not have a relatively controlling position.From the perspective of actual business management,the two parties independently carry out production and operation.After the new tally company entered the Western Port Area of Shenzhen Port in August 2016,communication and coordination between the two parties ceased and normal market competition began.Therefore,the two parties belong to competitive operators.(2)The two parties divided the market share and jointly pushed up the tallying price in the western port area of Shenzhen Port:From May 2013 to August 2016,the two parties divided the market share in the western port area of Shenzhen Port into five parts,and regularly communicated the tallying rate to jointly push up the tallying market price.The specific performance is as follows:(1)The two parties have reached and implemented an agreement to divide market share.In May 2013,the two parties reached an agreement on the division of the tally market in the western port area of Shenzhen Port during the"Five Year Plan"period.After that,the above agreement was implemented:on the one hand,customers were transferred through price coordination.After 2013,the two parties have repeatedly adopted price coordination methods,with Shenzhen Zhongli Shipping Tally Co.,Ltd.offering higher price conditions to customers,prompting them to choose the tallying service of Shenzhen Zhonglian Tally Co.,Ltd.to achieve the purpose of transferring customers.According to the email,at least 8 customers have been transferred through communication and coordination.On the other hand,the two parties directly transfer the difference in tallying income.For the tallying revenue exceeding the"Five Five Year Plan",Shenzhen Zhongli Shipping Tally Co.,Ltd.signed a tallying market share transfer agreement with Shenzhen Zhonglian Tally Co.,Ltd.four times on December 29,2013,December 30,2014,July 16,2015,and December 30,2015,respectively,to transfer the part of the revenue exceeding 50%of the market share to Shenzhen Zhonglian Tally Co.,Ltd.,with a total transfer amount of 9.724 million yuan.(2)The two parties jointly pushed up the tally price in the western port area of Shenzhen Port.Since 2013,the two parties have repeatedly communicated with each other about the tally price through email and other means,signed a tally contract with customers that has increased prices year by year,and worked hard to push the tally price to the level of 12 yuan per standard box.From the perspective of actual implementation prices,the tally prices of both parties have been increasing year by year since 2013.By 2016,the tally prices for all customers of Shenzhen Zhongli Shipping tally Co.,Ltd.had basically increased to the level of 12 yuan per standard box;Shenzhen Zhonglian Tally Co.,Ltd.also raised the tally price of most customers to around 12 yuan per standard box.

The two parties raised the following defense reasons:According to the relevant documents of the former Ministry of Communications,the Ministry of Transport,and the National Development and Reform Commission,the market adjusted price for tallying service fees is implemented.Therefore,before September 15,2017,government guidance prices will be implemented for tally service fees.The actions of the two parties are aimed at better implementing the unified regulations of the former Ministry of Communications and raising the tally price to the level of the government's guidance price.There may be some unreasonable aspects in the form,but they do not violate the relevant provisions of the Anti monopoly Law.One of the parties,Shenzhen Zhongli Shipping Tally Co.,Ltd.,also proposed another defense reason:it does not have a competitive relationship with Shenzhen Zhonglian Tally Co.,Ltd.On the one hand,China Merchants Logistics is a shareholder of both companies,and both hold 50%of the shares;On the other hand,some indirect shareholders of the two companies are the same.Therefore,any agreement signed between it and Shenzhen Zhonglian tally company does not constitute a monopoly agreement.

The State Administration of Market Supervision and Administration believes that the defense opinions of the two parties are not tenable.The reasons are as follows:(1)Regardless of whether the tallying price is a government guided price or a market regulated price,operators should independently establish charging standards based on their own production and operating costs and market supply and demand conditions in accordance with the principles of fairness,legality,and good faith.The practice of two parties communicating with each other and jointly pushing up the prices in the tally market violates the relevant requirements for independent pricing by operators,and excludes and restricts market competition.(2)There is a competitive relationship between the two parties.On the one hand,from the perspective of national policy requirements,it is clear that"in order to establish a moderate competition mechanism in the tally market,two tally companies in each port cannot be controlled and operated by identical investment entities",as the basic principle for establishing a second foreign shipping tally company.Before August 2016,only two parties were engaged in production and operation in the Western Port Area of Shenzhen Port,and the two parties should conduct fair competition in accordance with the above requirements.On the other hand,from the perspective of actual operation,after the new tally company entered the Western Port Area of Shenzhen Port in August 2016,the two parties stopped dividing the market and coordinating prices,and have already engaged in normal market competition.

The State Administration of Market Supervision and Administration has determined that the two parties,as operators with competitive relationships,transferred customers through price coordination from May 2013 to August 2016,and transferred part of the revenue exceeding the market division every year,eliminating and limiting competition between the two parties,which is an act of concluding and implementing a"split sales market"monopoly agreement;"The exchange of tallying price information between the two parties,which jointly drives up the tallying market price in the western port area of Shenzhen Port,limits price competition between the two parties,and is an act of reaching and implementing a monopoly agreement on"fixing or changing commodity prices."".In consideration of the fact that the two parties have voluntarily stopped their illegal activities in August 2016,a decision was made to impose administrative penalties on the two parties on July 9,2018 in accordance with the law.The specific penalties are as follows:

6.The National Development and Reform Commission has investigated,in accordance with the law,the behavior of PetroChina Daqing Oilfield Company Natural Gas Branch and PetroChina Natural Gas Sales Daqing Branch(hereinafter collectively referred to as"the parties")entering into and implementing price monopoly agreements with counterparties.

After investigation,the two parties reached and implemented a monopoly agreement limiting the minimum price for resale of CNG natural gas with 13 downstream CNG(compressed natural gas)mother stations in Harbin,Qiqihar,and Daqing regions(hereinafter referred to as"Harbin Daqi region"),in violation of the relevant provisions of Article 14 of the Anti monopoly Law,limiting the minimum price for resale of CNG natural gas by downstream CNG mother stations.The specific performance is as follows:(1)Hold a meeting to agree on the minimum resale price.On August 11 and August 25,2016,the relevant principals of the two parties convened a meeting of 13 CNG parent stations,requiring each CNG parent station to resell to the sub station at a price of no less than 2.25 yuan/cubic meter,and implemented uniformly from September 1,2016.Previously,each CNG parent station independently determined the resale price to its sub stations based on market conditions,with the price level ranging from 1.76 yuan/cubic meter to 2.3 yuan/cubic meter,but mainly concentrated around 2.00 yuan/cubic meter.(2)Organize the signing of"Harbin Daqi CNG Market Sales Agreement".On August 29,2016,the two parties organized 13 downstream CNG parent stations to jointly sign the"Kazakhstan Daqi CNG Market Sales Agreement",which clearly stipulates that from September 1,2016,the CNG parent station shall sell CNG natural gas at a minimum sales price of 2.25 yuan/cubic meter,and any parent station shall not be lower than the minimum sales price.(3)Issue a"Supplementary Notice"to promote the implementation of the minimum price limit.On September 2,2016,the two parties issued a Supplementary Notice on the Implementation of the"Harbin Daqi CNG Market Sales Agreement"to 13 CNG parent stations,requiring that sales be made strictly in accordance with the agreed minimum price,and threatening to stop gas supply if they refuse to implement it.

At the same time,under the supervision of both parties,the downstream CNG parent station implemented a price monopoly agreement.Performance:(1)The downstream CNG parent station has implemented a minimum price limit.Upon investigation,from September 1,2016,the CNG parent station in Harbin Daqi region will be sold at the minimum price of 2.25 yuan/cubic meter.(2)CNG parent stations are required to regularly report sales prices and other data based on the implementation of the minimum price limit.After the signing of the"Harbin Daqi CNG Market Sales Agreement",the two parties require the CNG parent station to regularly report the sales target,sales volume,and sales unit price,and track the implementation of the minimum sales limit;On April 19,2017,the"Parent Station Customer Questionnaire"and"Parent Station Customer Questionnaire"were distributed to the CNG parent station,and a questionnaire survey was conducted on the"export sales situation"and"floor price implementation situation"after the signing of the"Hadaqi CNG Market Sales Agreement",further tracking and supervising the implementation of price limits.(3)Establish a monitoring team to monitor the implementation of the minimum price limit for CNG parent stations,and threaten those who refuse to implement the plan by cutting back,limiting gas,or even stopping gas.In order to supervise the price implementation of downstream CNG parent stations,the two parties organized a"supervision team"to focus on supervising the price implementation of each CNG parent station through on-site inspection.

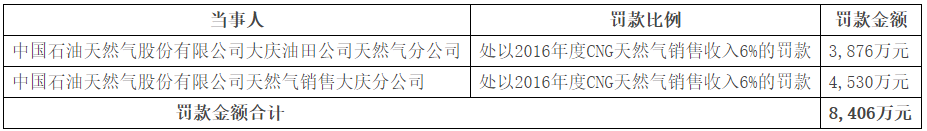

The above-mentioned actions of the two parties constitute an illegal act of concluding and implementing a monopoly agreement on"limiting the minimum price for resale of goods to third parties",which seriously excludes and restricts market competition for natural gas products,harms the legitimate rights and interests of end customers and consumers,and undermines a fair market environment.Considering that the two parties were able to actively cooperate in the investigation process,truthfully state relevant facts,promptly conduct self-inspection and self correction,and revoked the Hadaqi CNG Market Sales Agreement and conducted comprehensive rectification.On January 26,2018,the National Development and Reform Commission,in accordance with the law,imposed administrative penalties on the two parties to conclude and implement a monopoly agreement,ordering them to stop their illegal activities,and concurrently imposed the following fines:

7.According to reports from the public and preliminary investigation and verification by the Administration for Industry and Commerce of the Guangxi Zhuang Autonomous Region and the Qinzhou Municipal Administration for Industry and Commerce,it is found that Qinzhou Fengshun Fireworks and Fireworks Co.,Ltd.(hereinafter referred to as"Fengshun Company")and Qinzhou Zhongtian Fireworks and Fireworks Sales Co.,Ltd.(hereinafter referred to as"Zhongtian Company")Qinzhou City Flying Fireworks Co.,Ltd.(hereinafter referred to as"Flying Company")(hereinafter referred to as"the parties")has signed the"Qinnan District Fireworks and Fireworks Wholesale Market Operation and Management Agreement",which is suspected of reaching a monopoly agreement and violating the relevant provisions of the"Anti monopoly Law of the People's Republic of China".Authorized by the State Administration for Industry and Commerce,on January 5,2015,the Administration for Industry and Commerce of the Guangxi Zhuang Autonomous Region filed a case investigation into the alleged monopoly of the party in the fireworks and firecrackers market in Qinnan District,Qinzhou City.

According to the investigation,Qinnan District of Qinzhou City is composed of 12 towns and 4 streets,with 3 fireworks and firecrackers wholesale enterprises being the three parties involved in this case.On April 12,2012,the Qinzhou Municipal Bureau of Work Safety Supervision and Administration issued a notice specifying:First,it is required that fireworks and firecrackers trading(wholesale)enterprises in various counties(districts)can only engage in business activities within their jurisdiction and cannot operate across jurisdictions;Second,fireworks and firecrackers retail outlets must purchase fireworks and firecrackers from prescribed fireworks and firecrackers business(wholesale)enterprises,and cannot purchase fireworks and firecrackers from other channels.In order to ensure their respective interests and in accordance with the spirit of the aforementioned documents,the three parties,led by Zhongtian Company,organized Fengshun Company and Flying Company to discuss the division and management of fireworks and firecrackers business households in the streets and towns under the jurisdiction of Qinnan District,Qinzhou City by sales areas,and reached an agreement.On April 20,2014,they signed the"Qinnan District Fireworks and Firecrackers Wholesale Market Operation and Management Agreement"(hereinafter referred to as the"Management Agreement").The Management Agreement stipulates the"regional division,execution time,responsibilities,rights,obligations,and liabilities for breach of contract"of the three fireworks and firecrackers wholesale companies in Qinnan District,and the main contents are as follows:(1)Division of operation and management areas.Divide the towns and townships in Qinnan District into three regions,with the three parties responsible for selling different towns and streets;(2)Divide the execution time of regional operation management.From May 15,2014 to May 15,2017,after the expiration of the contract,the three parties will discuss the division of regional operations;(3)The three parties are not allowed to engage in private firearms and illegal products,and the fireworks and firecrackers products operated by both parties must be affixed with the dealer's anti-counterfeit label,and the anti-counterfeit label must be submitted to the Safety Supervision Bureau for filing for inspection by law enforcement departments;(4)The three parties must do a good job in purchasing and selling business,product distribution,tracking services,and other work in their respective regions.Strictly abide by the provisions of the agreement on division of regional operations and management,and do not operate across regions.It is strictly prohibited to provide retail operators with services for handling various licenses beyond regions;(5)Liability for breach of contract:1.If it is found that the opposite party sells fireworks and firecrackers to retail operators,it shall be considered as illegal operation of private firearms and punished with a penalty for breach of contract.2."None of the three parties is able to provide all the necessary procedures for handling the relevant certificates and licenses for operating fireworks and firecrackers to the retail operators within the other party's area.If verified,the observant party has the right to claim liquidated damages from the breaching party.".

After the signing of the Management Agreement,(1)Fengshun Company produced the company's anti-counterfeit label and informed the retail operators of fireworks and firecrackers in the area according to the area specified in the Management Agreement from May to December 2014,requiring them to purchase fireworks and firecrackers from their sources and uniformly affix their anti-counterfeit labels to the fireworks and firecrackers that had not been sold out by each operator.Goods that do not have their anti-counterfeiting labels affixed shall be confiscated as"private guns"to ensure the implementation of the provisions on wholesale supply of fragmented products.(2)In 2014,the flight company customized the company's anti-counterfeiting label,and in 2014,it informed the retail operators of fireworks and firecrackers in the area according to the area specified in the Management Agreement,requiring them to purchase fireworks and firecrackers products from the area,and uniformly affix their anti-counterfeiting labels to the previously unsold fireworks and firecrackers products of each operator.Goods that do not have their anti-counterfeiting labels affixed shall be confiscated as"private guns"to ensure the implementation of the provisions on wholesale supply of fragmented products.(3)Zhongtian Company customized the company's anti-counterfeit label,and affixed the company's anti-counterfeit label to the products sold by the company wholesale.During 2014,according to the area designated in the Management Agreement,it informed the retail operators of fireworks and firecrackers in the area,requiring them to purchase fireworks and firecrackers from their sources,and uniformly affixed their anti-counterfeit labels to the fireworks and firecrackers products that had not been sold out by each operator previously.Goods that do not have their anti-counterfeiting labels affixed shall be confiscated as"private guns"to ensure the implementation of the provisions on wholesale supply of fragmented products.

The three parties require retailers applying for the"fireworks and firecrackers retail license"to pay a certain amount of purchase price in advance."Those who fail to pay the purchase price in accordance with the specified amount,or do not apply for a"fireworks and firecrackers retail license,"or impose sanctions by restricting the quantity of supplies.".Some retailers are afraid that they will not be able to obtain sufficient supply during the peak sales season,so they are forced to pay the purchase price in advance.During the peak sales season,some retailers with less advance payment for orders cannot purchase from other wholesalers,even if the designated supplier does not have a marketable product to choose from.The actions of the three parties have resulted in fireworks and firecrackers retailers in the designated area being able to purchase only from the designated sole fireworks and firecrackers wholesale enterprise,depriving them of their independent choice in terms of suppliers,business varieties,commodity prices,etc.

The Administration for Industry and Commerce of the Guangxi Zhuang Autonomous Region believes that according to the"Regulations on the Safety Management of Fireworks and Firecrackers",the law does not prohibit fireworks and firecrackers wholesale enterprises from supplying goods to retailers across administrative regions,nor does it stipulate that fireworks and firecrackers retailers can only purchase fireworks and firecrackers from wholesale enterprises within their administrative regions.Accordingly,the three parties,as the three fireworks and firecrackers wholesale enterprises in Qinnan District,belong to independent legal entities that have a horizontal competitive relationship according to law.They should have fully and orderly competed in accordance with the rules of the market economy and the Regulations on the Safety Management of Fireworks and Firecrackers,but they actively organized and implemented the division of the wholesale sales market and signed the Management Agreement based on the administrative restrictions of the safety supervision department.This has led to the formation of an interest alliance among the three parties that originally had a competitive relationship in Qinnan District,forming a dependence on the planned quota,losing the motivation and enthusiasm to participate in the competition,making it impossible for operators and consumers in the fireworks and firecrackers retail industry to enjoy the economic benefits brought about by full competition in the wholesale sector,and objectively meeting the business purpose of the three parties to obtain high monopoly profits through the division of the wholesale sales market.Therefore,the"Management Agreement"signed and implemented between the parties belongs to the monopoly agreement of"dividing the sales market"prohibited by Article 13,Paragraph 1(3)of the Anti monopoly Law.

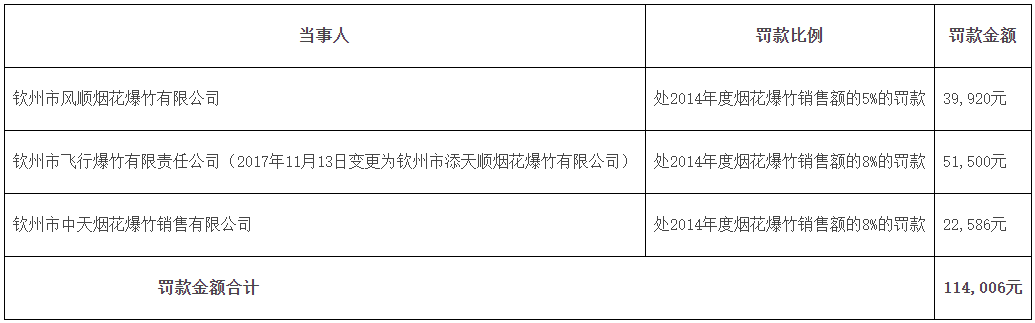

The Administration for Industry and Commerce of the Guangxi Zhuang Autonomous Region held that on July 25,2018,it imposed administrative penalties on the three parties to order them to stop their illegal acts,and imposed the following fines:

8.In December 2016,Beihai Motor Vehicle Driver Training Association(hereinafter referred to as"Beihai Motor Vehicle Driver Training Association")needed to introduce the timekeeping training system of Guangxi Yunjia Network Technology Co.,Ltd.in the name of backward technology of the original timekeeping training system,to collect fees related to registration management fees and training fees for C1 driving training,Several times,11 competitive driving training institutions(hereinafter referred to as"driving training institutions")in Beihai City have been organized to reach an agreement on the price increase of C1 driving training through WeChat groups,convening meetings,oral negotiations,and other methods,and reached a price monopoly agreement:for students who signed up for C1 driving training after January 20,2017,the fee standard for registration management fees should be uniformly adjusted to not less than 2000 yuan per person.On January 16,2017,through WeChat official account,the information was released that:after being studied and approved by Beihai Motor Vehicle Driver Training Association,from January 20,2017,the new mode of time charging and paying after training was uniformly implemented in Beihai,and the registration fee of 2000 yuan/person was uniformly adjusted.Due to the unified price increase of the organization and member units of the Beihai Driving Training Association,the number of applicants for C1 driving training at 11 driving training institutions in the city doubled during January 17-19,2017,and during the Spring Festival,which also caused negative repercussions in society.

Since January 20,2017,11 driving training institutions have respectively adjusted the charging standard for C1 driving training registration management fees to 1950-2050 yuan per person,and implemented collusive price increases.Their price increases are consistent,and there are monopolistic acts of collaborative price increases,in violation of the provisions of Article 13,Paragraph 1(1)of the Anti monopoly Law that prohibit competitive operators from entering into fixed or changed commodity price monopoly agreements,It constitutes a monopolistic agreement with competitive operators to reach and implement fixed or changed commodity prices,which limits market competition,harms the interests of consumers,and undermines the market environment for fair competition.

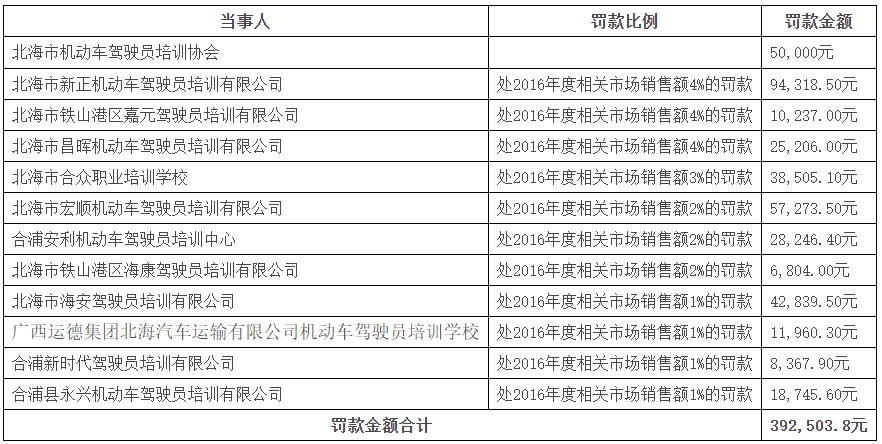

After more than a year and a half of anti monopoly law enforcement investigations,the Price Bureau of the Guangxi Zhuang Autonomous Region imposed administrative penalties on the Beihai Motor Vehicle Driver Training Association and 11 competitive motor vehicle driver training institutions in Beihai City in July 2018 for reaching and implementing price monopoly agreements on matters such as C1 motor vehicle driver training registration management fee increases,and the following penalties were imposed:

9.The Monopoly Agreement between Two River Sand Companies in Guangdong Province[9]Guangdong Development and Reform Commission confirmed the following facts through investigation:Huizhou Dongjiang River Sand Operation Co.,Ltd.(one of the parties)sent a letter on negotiating the sales price of Dongjiang Huizhou River Sand to Huizhou Huicheng Xinrong River Sand Mining and Operation Co.,Ltd.(one of the parties)on June 17,2015,It is recommended that Huizhou Huicheng Xinrong River Sand Mining and Operation Co.,Ltd.set the sales price of river sand at the Xinrong sand field adjacent to its Tantou sand field(sales price:75 yuan/m3)to 67 yuan/m3.According to the Report on Adjusting the Sales Price of River Sand submitted by Huizhou Huicheng District Xinrong River Sand Mining and Operation Co.,Ltd.to the Huicheng District River Sand Mining Leading Group on December 7,2015,Huizhou Huicheng District Xinrong River Sand Mining and Operation Co.,Ltd.adjusted the price in accordance with the price adjustment proposal of Huizhou Dongjiang River Sand Operation Co.,Ltd,After the price adjustment,the average sales price of river sand for the entire bid section of Huizhou Huicheng Xinrong River Sand Mining and Operation Co.,Ltd.reached 67 yuan/m3.

The Guangdong Provincial Development and Reform Commission believes that the parties'coordinated adjustment of river sand prices,the conclusion and implementation of price monopoly agreements,and the fixing and disguised fixing of river sand sales prices have limited sufficient competition in the Huizhou river sand market,raised the price level,and harmed the legitimate interests of river sand demanders,"Violation of Article 13 of the Anti monopoly Law,which prohibits competitive operators from entering into the following monopoly agreements:(1)fixing or changing commodity prices,"and Article 17 of the Anti Price Monopoly Provisions,which prohibits competitive operators from entering into the following price monopoly agreements:(1)fixing or changing the price level of goods and services(hereinafter collectively referred to as commodities).".

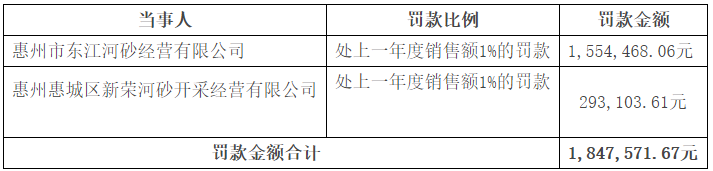

On August 14,2018,the Development and Reform Commission of Guangdong Province imposed an administrative penalty on the party concerned to order it to stop the illegal act,and imposed the following fines:

10.In May 2017,according to reports from the public,the Henan Administration for Industry and Commerce issued a lawsuit against Puyang Tongda Construction Engineering Testing Service Co.,Ltd.(hereinafter referred to as"Tongda Company"),Henan Jianyuan Engineering Quality Testing Co.,Ltd.(hereinafter referred to as"Jianyuan Company")Henan Shengda Construction Engineering Testing Co.,Ltd.(hereinafter referred to as"Shengda Company")(hereinafter referred to as the three companies collectively referred to as"the parties")was suspected of entering into and implementing monopolistic acts and conducted inspections.In July 2017,it reported the inspection results to the former State Administration for Industry and Commerce.In August 2017,with the authorization of the former State Administration for Industry and Commerce for investigation and processing,the Henan Administration for Industry and Commerce filed a case investigation against three parties on October 9,2017.

Upon investigation,on March 6,2015,initiated by Tongda Company,the three parties signed the"Strategic Cooperation Agreement for Testing Units in Puyang City"on the grounds of"promoting the development of testing industry in Puyang City,standardizing testing behavior,and improving testing efficiency."According to the agreement,the three parties jointly funded the establishment of the"Puyang Construction Project Quality Testing Service Hall"to focus on testing business operations.From March 2015 to October 2017,the three parties committed the following major monopolistic acts:(1)Unified operation.The three parties have set up business acceptance counters in the"Puyang City Construction Project Quality Inspection Service Hall",but the specific business will be jointly designated by the manager.According to the distribution principles agreed in the agreement,the testing business will be distributed as a whole,and the assigned testing business will be completed according to a unified process.No separate form of construction project quality testing business will be conducted externally.(2)Unified management."The system and process information such as"Testing and Entrustment Process Flow Chart","Sample Management System","Entrustment Management System","Hall Service Management System","Report Management System","Charge Management System",and"Testing Price"shall be uniformly displayed in the"Service Hall",and unified processes and systems shall be implemented.".(3)Uniform charge.A charging window is set up in the service hall,where the three parties arrange personnel to charge according to a unified charging price,and the collected testing fees are uniformly managed.(4)Unified distribution.The three parties shall allocate testing service fees in accordance with the agreed proportion.

The aforementioned actions of the three parties have the following harmful consequences:(1)Destroying the competitive order of the Puyang urban construction project quality testing market.Each party is an independent and competitive entity in the construction project quality testing market,and should continuously improve the testing and service levels through fair competition to provide high-quality and efficient testing services for construction projects.However,after the three parties reached and implemented a monopoly agreement,the competitive relationship between them was eliminated,and the competitive order in the construction project quality testing market in Puyang City was disrupted.(2)Harming the legitimate interests of relevant construction engineering enterprises.The three parties reached and implemented a monopoly agreement,limiting the power of construction engineering enterprises to choose transaction methods such as sample collection and delivery methods,testing prices,and testing times.They can only passively accept fixed transaction methods that are beneficial to the testing party,damaging the legitimate interests of relevant construction engineering enterprises.(3)Harming the interests of relevant people and the public.The three parties reached and implemented a monopoly agreement,increasing the costs of sample collection and delivery,labor,and testing in the construction project quality testing process,and damaging the interests of the relevant people and the public.

Henan Administration for Industry and Commerce believes that the above actions of the three parties violate the provisions of"segmentation of the sales market or raw material market"prohibited by Article 13,Paragraph 1(3)of the Anti monopoly Law of the People's Republic of China,and conclude and implement a monopoly agreement and implement a monopoly agreement.On October 22,2018,the three parties were imposed administrative penalties to order them to stop their illegal activities,and the following fines were imposed:

11.According to laws and regulations such as the"Anti monopoly Law",the Tianjin Development and Reform Commission has,since June 2018,issued a lawsuit against Tianjin Zhenhua Haijing Logistics Co.,Ltd.,Sinotrans(Tianjin)Storage and Transportation Co.,Ltd.,Shengshi Logistics(Tianjin)Co.,Ltd.,Tianjin Zhenhua International Logistics and Transportation Co.,Ltd.,Tianjin Keyun International Logistics Group Co.,Ltd Tianjin Jinshi Minmetals International Logistics Co.,Ltd.,Tianjin Boda Group Co.,Ltd.,Tianjin Malenda Logistics Co.,Ltd.,Tianjin Shengshi Container Co.,Ltd.,Changhua International Logistics(Tianjin)Co.,Ltd.,Tianjin Sinotrans Container Development Co.,Ltd.,Tianjin Zhongchuang Haitong Logistics Co.,Ltd.,Tianjin Chaohua Zhongdian Logistics Co.,Ltd.,Tianjin Dihai Container Yard Co.,Ltd A total of 17 Tianjin port yard companies(hereinafter collectively referred to as"the parties"),including Tianjin Xingang Branch of China Storage Development Co.,Ltd.,Tianjin Binhai COSCO Container Logistics Co.,Ltd.,and Tianjin Foreign Logistics Co.,Ltd.,have been investigated for allegedly concluding and implementing price monopoly agreements.

After investigation:(1)17 parties belong to the same storage yard companies in Tianjin Port Area,and 17 parties have a competitive relationship in the storage yard service market of Tianjin Port.Firstly,in terms of business scope,the business license of the storage yard company involved in the case indicates that the business scope includes"container storage,handling,and loading/unloading"and other services;Secondly,in terms of commodity functions,the services provided by the involved yard company to the opposite party include container storage,handling,lifting,and other related services;Thirdly,in terms of the nature of the industry,the companies involved in the case are all container yard operators,and relevant business projects must be approved by the industry competent department before they can operate.Fourthly,in terms of regional market,the business premises of the companies involved in the case are all located in the Tianjin Port Area,with relatively close spatial distance and relatively fierce competition.(2)All 17 parties have participated in concluding and implementing monopoly agreements that fix or change the price of services.It has been verified that since 2010,17 parties have fixed the prices of comprehensive surcharges and unloading fees through signing proposals,gathering and dining,email communication,telephone contact,and other forms.On December 24,2010,April 8,2011,March 29,2012,and December 20,2012,17 parties reached a proposal for a fixed comprehensive surcharge and unloading fee with the involved storage yard.Since then,17 parties have formed a relatively stable price alliance and continued to work together to adjust the specific prices of the above fees.

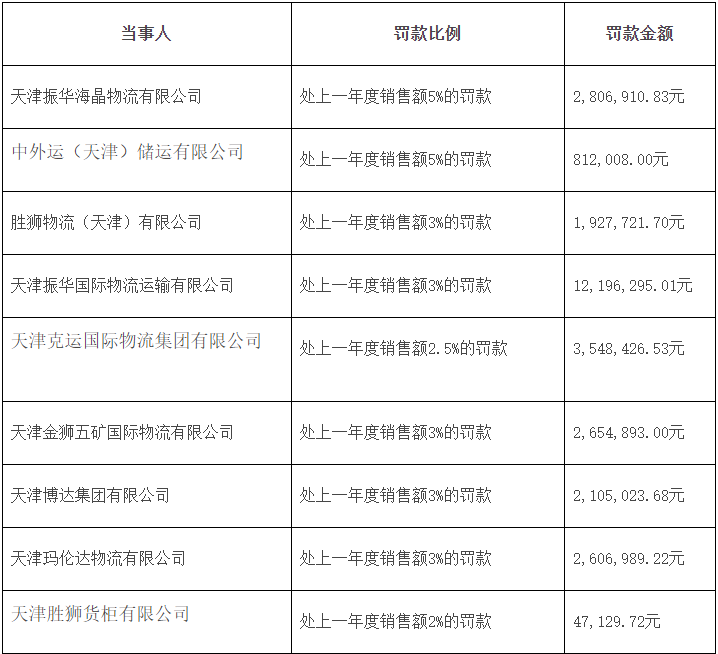

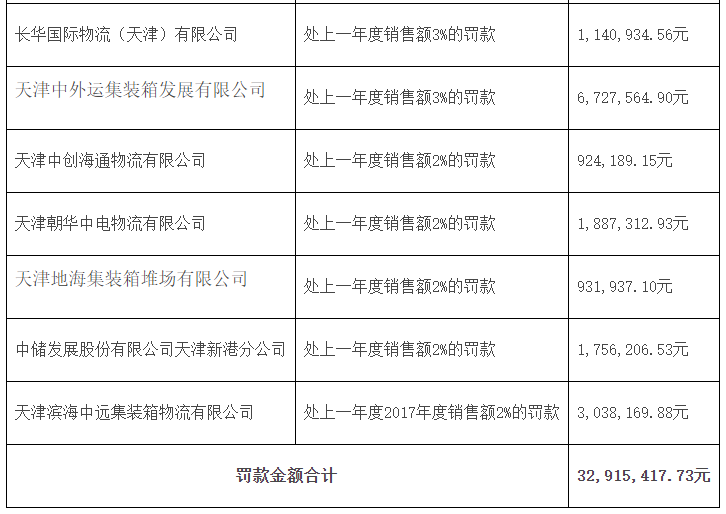

The Tianjin Development and Reform Commission believes that 17 parties,as operators with competitive relationships,have fixed or changed the comprehensive surcharges and unloading fees that are subject to market regulation in accordance with the law in the form of agreements,thereby eliminating and restricting competition in the Tianjin port yard service market,and violating the provisions of Article 13,paragraph 1(a),of the Anti monopoly Law,It is an illegal act of a competitive operator to enter into and implement a"fixed or changed commodity price monopoly agreement".On November 16,2018,16 parties other than Tianjin Foreign Logistics Co.,Ltd.were imposed administrative penalties to order them to stop their illegal activities,and the following fines were imposed:

12.The Monopoly Agreement Case of Three Iced Acetic Acid API Manufacturing Enterprises[12]According to laws and regulations such as the"Anti monopoly Law of the People's Republic of China",the State Administration of Market Supervision and Administration investigated the behavior of Taishan Xinning Pharmaceutical Co.,Ltd.,Sichuan Jinshan Pharmaceutical Co.,Ltd.,and Chengdu Huayi Pharmaceutical Accessory Manufacturing Co.,Ltd.(hereinafter collectively referred to as"the parties")in reaching and implementing a price monopoly agreement.After investigation:(1)The three parties are competitive operators.The main reason is that the three parties are three independent market entities,all producing and selling raw materials of glacial acetic acid,which are mainly used for the production of hemodialysis concentrate,with obvious substitutability,forming a direct competitive relationship.(2)The three parties reached a price monopoly agreement.The three parties reached a monopoly agreement to increase the sales price of raw materials for glacial acetic acid through telephone communication,face-to-face communication,and meetings.In October 2017,the three parties conducted a telephone communication to exchange market conditions of glacial acetic acid APIs,exchange production and sales information,propose to jointly increase the price of glacial acetic acid APIs,and all expressed their willingness to increase the price.In November 2017,during the China International Pharmaceutical Intermediates Packaging Equipment Fair(Xiamen),the three parties further discussed the issue of increasing the price of raw materials for glacial acetic acid.In December 2017,the three parties exchanged views on the above discussion and the joint increase in the sales price of glacial acetic acid,and all three parties recognized the joint increase in price.In January 2018,the three parties held a meeting in Nanchang to further discuss the issue of increasing the price of raw materials for glacial acetic acid.After the above communication and negotiation,the three parties reached a monopoly agreement to increase the sales price of glacial acetic acid APIs.They agreed to uniformly increase the sales price of glacial acetic acid APIs from March 1,2018,with a price of 28 yuan to 28.5 yuan/kg for downstream hemodialysis plants and 33 yuan/kg for pharmaceutical enterprises.As a competitive operator,the parties exchange price information and form a willingness to uniformly increase prices,which constitutes an illegal act of concluding a price monopoly agreement with a competitive operator.(3)The three parties have implemented the above-mentioned price monopoly agreement.The three parties implemented the above price monopoly agreement in the process of establishing the sales price of glacial acetic acid API and the actual sales process.Before the monopoly agreement was reached,the average price of glacial acetic acid sold by the three parties was 9.3 yuan/kg.After reaching a monopoly agreement,the three parties informed downstream customers of the price increase through issuing price adjustment letters,oral notices,and other methods.The price for hemodialysis plants rose to 28 yuan/kg,and the price for pharmaceutical companies rose to 33 yuan/kg.The adjusted sales price is consistent with the monopoly agreement.During the actual sales process,the three parties sold at the above prices and strictly implemented the monopoly agreement.

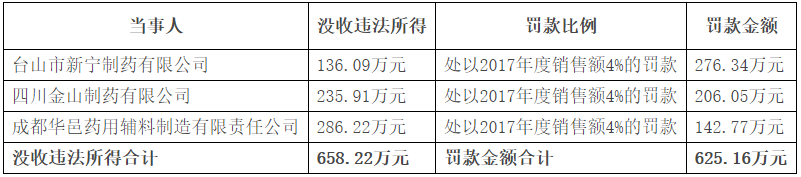

The State Administration of Market Supervision and Administration believes that the above-mentioned actions of the three parties are illegal acts of reaching and implementing a"fixed or changed commodity price"monopoly agreement,and the nature of the actions is serious and the degree of harm is relatively deep.Performance:(1)Serious exclusion and restriction of market competition.As the only three glacial acetic acid manufacturers in the market,after reaching and implementing a monopoly agreement,they uniformly raised the price of glacial acetic acid APIs,seriously disrupting the market competition order.(2)Increasing the burden on downstream pharmaceutical enterprises.Glacial acetic acid is the main raw material for the production of hemodialysis concentrate.The sharp rise in price directly increases downstream production costs and increases the cost burden of downstream pharmaceutical companies.(3)Harm the normal treatment of hemodialysis patients.The high price of raw materials for glacial acetic acid has led to downstream pharmaceutical companies reducing production and stopping production of hemodialysis concentrate,endangering the normal treatment of hemodialysis patients.However,considering that the parties were able to cooperate with the investigation,truthfully state relevant facts,actively carry out rectification,and the duration of the illegal act was relatively short,the following administrative penalty decisions were made against the three parties according to law on November 16,2018:

13.Zhongshan Gas Association Monopoly Agreement Case[13]On October 1,2010,Zhongshan Gas Association(hereinafter referred to as"the parties")formulated and implemented the"One Regulation and Two Rules of Self-discipline in the Gas Industry of Zhongshan City",which prohibits members of bottled gas supply stations from cooperating with multiple gas operating enterprises or foreign gas operating enterprises,causing gas supply enterprises to divide and control the bottled gas supply stations,eliminating and restricting market competition among enterprises,It also ensures implementation by forcing gas operating enterprises and bottled gas supply stations to join associations,collecting deposits,and establishing self-discipline inspection teams.The parties'control of the gas market in Zhongshan City has distorted the normal market competition.Through the supervision and control of the gas industry in Zhongshan City,and other means,the control has been achieved,making the competitive gas operating enterprises in Zhongshan City form an action effect of dividing the supply and marketing market of downstream bottled gas supply stations in the gas industry.At the same time,the parties specifically implemented the"Notice on Improving the Ventilation of Gas Appliance Products"issued by the Zhongshan City Gas Management Office on May 26,2016.The gas appliances have unreasonable market access barriers that have been set up in a legal system,impairing consumers'free choice rights,and eliminating and restricting full competition in the gas appliance market in Zhongshan City.

The Guangdong Provincial Development and Reform Commission believes that the parties involved in organizing operators in their industry to engage in monopolistic acts violate the provisions of Article 16 of the Anti monopoly Law,which states that"industry associations shall not organize operators in their industry to engage in monopolistic acts prohibited by this chapter",and Article 13,which states that"operators with competitive relationships are prohibited from entering into the following monopolistic agreements:(3)Splitting the sales market",In August 2018,the following administrative penalty decision was made against the party concerned:order to stop the illegal act;And impose a fine of 150000 yuan.

(2)Civil and administrative litigation case

1 of monopoly agreement,Beijing Electric Power Company v.LS Corporation of Korea,constituting a monopoly[14]

According to a report on China Intellectual Property Information Network on September 21,2018,The Beijing Intellectual Property Court accepted a lawsuit against the plaintiff State Grid Beijing Electric Power Company(hereinafter referred to as"Beijing Electric Power Company"),which was established in September 1991 and whose business scope includes power supply,operation,maintenance,and other projects of electric equipment.The defendant LS Cable&System Ltd.(hereinafter referred to as"LS Cable Company"),which was established in May 1962 in South Korea,was mainly engaged in the sales of electric cables(cables used to transmit and distribute electric energy),Is one of the world's leading enterprises in this field

Monopoly Agreement Dispute Case.

Beijing Electric Power Company claims that on April 2,2014,the European Commission determined that 11 high-voltage cable manufacturers,including LS Cable Company,had reached fixed prices for underground cables of 110 kV and above,and submarine cable products,projects,and services of 33 kV and above(hereinafter referred to as"high-voltage cable products")worldwide from 1999 to January 2009,when the European Commission conducted investigations The implementation of a"cartel"agreement that divides sales regions and customer markets(i.e.,monopolistic agreement behavior)has restricted market competition for high-voltage cable products in the European Economic Area and worldwide,and has imposed penalties totalling nearly 302 million euros on several high-voltage cable manufacturers,including LS Cable Company.As the main investment,construction and operation entity of the power grid,Beijing Electric Power Company needs to purchase a large number of high-voltage cable products for long-term use in power grid construction and power development.During the period when LS Cable Company implemented the monopolistic agreement behavior recognized by the European Commission,Beijing Electric Power Company purchased a large number of high-voltage cable products from LS Cable Company,which was seriously affected and significantly damaged by the aforementioned monopolistic agreement behavior.

For this reason,Beijing Electric Power Company claims that the aforementioned actions taken by LS Cable Company violate relevant provisions of China's anti monopoly law,price law,and other laws.It requests the court to confirm that LS Cable Company has implemented a monopoly agreement against it,and order LS Cable Company to bear all litigation costs in this case.At the same time,Beijing Electric Power Company also declares that it reserves other rights such as legal claims.

The case is currently being further tried.

2.The final judgment of the first vertical monopoly agreement dispute case in Guangdong[15]According to the report on China Court website on August 2,2018,the final judgment of the first vertical monopoly agreement dispute case in Guangdong was announced.The Guangdong Provincial High People's Court determined that the agreement signed between Dongguan Shengshi Xinxing Gree Trading Co.,Ltd.and Dongguan Heshi Electric Appliance Co.,Ltd.has a restrictive minimum resale price clause and does not constitute a vertical monopoly,maintaining the original judgment of the first instance.

The defendants Dongguan Shengshi Xinxing Gree Trading Co.,Ltd.(hereinafter referred to as"Shengshi Company")and Dongguan Heshi Electric Appliance Co.,Ltd.(hereinafter referred to as"Heshi Company")are respectively the general distributor and supplier of Gree Electric Appliance in Dongguan City.They entered into a tripartite agreement with the plaintiff Dongguan Hengli Guochang Electric Appliance Store(hereinafter referred to as"Guochang Electric Appliance Store")in 2012 and 2013,It is expressly agreed that Guochang Electric Appliance Store must comply with the relevant systems and requirements of Shengshi Company's market management standards,and the minimum retail price during the terminal sales process shall not be lower than the minimum retail price for each period,and no form of low price behavior shall occur.A deposit was collected from the plaintiff to ensure the performance of the contract.At the beginning of 2015,Heshi Company fined Guochang Electric Appliance Store 13000 yuan and did not return the earnest deposit in full,citing that Guochang Electric Appliance Store violated the agreement during February 2013 and sold a certain type of household air conditioning product at a lower retail price.In May 2015,Guochang Electric Appliance Store sued Shengshi Company and Heshi Company to the Guangzhou Intellectual Property Court,claiming that the agreement signed between Shengshi Company and it contained provisions limiting the minimum resale price,constituting a vertical monopoly agreement,and requesting compensation for losses and refund of the deposit.The joint defense of Shengshi Company and Heshi Company believes that the elimination and restriction of competitive effects are the constitutive requirements for the establishment of a vertical monopoly agreement.Although there are provisions in the tripartite agreement that limit the minimum resale price,they do not constitute a vertical monopoly agreement.

The court of second instance held that one of the focuses of controversy in the second instance of this case was whether Shengshi Company and Heshi Company constituted a vertical monopoly behavior?If it constitutes a vertical monopoly,how to bear civil liability.The analysis of the focus second trial judgment is as follows:(1)Shengshi Company,Heshi Company and Guochang Electric Appliance Store have reached and implemented an agreement to limit the minimum resale price.According to the facts ascertained by the court,Guochang Electric Appliance Store(Party C of the contract),Shengshi Company(Party A of the contract),and Heshi Company(Party B of the contract)signed a contract for the year of 2012 The 2013 tripartite agreement on the sales of household air conditioners for Gree Electric Appliances in Dongguan clearly stipulates"Party C must comply with the relevant systems and requirements of Party A's market management regulations,and the minimum retail price during the terminal sales process shall not be lower than the minimum retail price of Party A for each period,and shall not generate any form of low price behavior.If Party C violates the regulations,Party A has the right to punish it according to the relevant market regulations documents,until it cancels its business qualification,and takes back its doorstep,display cabinet,prototype,etc..."At the beginning of 2015,Heshi Company failed to refund the"maintenance sincerity deposit"paid by Guochang Electric Appliance Store for violating the agreement during February 2013 by selling a certain type of household air conditioner product at a lower retail price than the minimum retail price set by Shengshi Company,and was fined 13000 yuan by Shengshi Company according to the above agreement.The above facts indicate that between 2012 and 2013,Shengshi Company and Heshi Company reached and implemented an agreement to limit the minimum resale price with the trading counterpart Guochang Electric Appliance Store.

(2)The agreement reached in this case prohibiting the operator from entering into a minimum price limit for resale of goods to a third party with the counterparty is not a monopoly agreement.The court of second instance held that,first of all,an agreement to limit the minimum resale price specified in Article 14 of the Anti monopoly Law must have the effect of eliminating and restricting competition before it can be recognized as a monopoly agreement.Secondly,whether an agreement limiting the minimum resale price has the allocation of burden of proof to exclude and limit the effects of competition should,in principle,follow the principle of"who claims,who provides evidence"in the Civil Procedure Law,in the absence of clear provisions in laws,regulations,and judicial interpretations.However,considering that the plaintiff's ability to provide evidence is limited,and that vertical monopoly cases involve the regulation of market competition order,which is related to social and public interests,When hearing cases involving vertical monopoly agreements,the people's court should not be in a passive position on the issue of proof as in ordinary civil cases,but can take the initiative to obtain evidence ex officio according to the needs of the case.However,if relevant evidence cannot be collected after the plaintiff adduces evidence and the court retrieves evidence,the legal consequences of failing to provide evidence should still be borne by the plaintiff.The evidence in this case is insufficient to prove that the agreement to limit the minimum resale price is a monopoly agreement.

(3)The agreement to limit the minimum resale price in this case does not have the effect of excluding or restricting competition.The court of second instance held that although Gree's household air conditioning products have a relatively advantageous position in the relevant market,due to the relatively sufficient competition in the relevant market for household air conditioning products,it cannot be determined that Shengshi Company has the purpose of limiting the minimum resale price to achieve high monopoly profits,nor has it had serious consequences of excluding and restricting competition.Therefore,our court has legally determined that the clause limiting the minimum resale price stipulated in the"Dongguan Gree Electric Appliance Household Air Conditioner Sales Tripartite Agreement"in this case does not have the effect of excluding or restricting competition,and is not a monopoly agreement prohibited by Article 14(2)of the Anti monopoly Law.

In summary,the court of second instance held that,based on the evidence provided by Guochang Electric Appliance Store and the evidence obtained by our court ex officio,although Gree's household air conditioning products have a relatively advantageous position in the relevant market,due to the relatively sufficient competition in the relevant market for household air conditioning products,it cannot be recognized that Shengshi Company has the purpose of limiting the minimum resale price to achieve high monopoly profits,Nor have there been serious consequences of excluding and restricting competition.Therefore,according to law,it is determined that the clause limiting the minimum resale price agreed in the"Dongguan Gree Electric Appliance Household Air Conditioner Sales Tripartite Agreement"does not have the effect of excluding or restricting competition,and is not a monopoly agreement prohibited by Article 14(2)of the Anti monopoly Law.Shengshi Company and Heshi Company do not constitute a vertical monopoly and do not bear civil liability.

Accordingly,the court of second instance held in accordance with the law that the clause limiting the minimum resale price agreed upon in the tripartite agreement in this case did not have the effect of excluding or restricting competition,and was not a monopoly agreement prohibited by the antitrust law.Shengshi Company and Heshi Company did not constitute a vertical monopoly behavior,so it rejected the lawsuit request of Guochang Electric Appliance Store in accordance with the law.

3.The first case of disputes over vertical monopoly agreements and abuse of market dominance in China was concluded and the Shanghai Intellectual Property Court issued a first instance judgment[16](no judgment was found).It is reported that,On July 27,2018,the Shanghai Intellectual Property Court(hereinafter referred to as the"Shanghai Intellectual Property Court")concluded the case of the plaintiff Wuhan Hanyang Guangming Trade Co.,Ltd.(hereinafter referred to as the"Guangming Company")v.the defendant Shanghai Hantai Tire Sales Co.,Ltd.(hereinafter referred to as the"Hantai Company")concerning the dispute over the vertical monopoly agreement and the abuse of market dominance.The first instance decision rejected all the plaintiff's claims.

The defendant Hantai Company is the general distributor of Hantai tires in China.The plaintiff Guangming Company acted as the defendant's distributor from January 2012 to June 2016,acting as an agent for the wholesale sales of Hantai brand passenger car tires in Wuhan.In the course of the transaction,the plaintiff believed that the defendant reached and implemented a monopoly agreement limiting the minimum price for resale of Hantai tire products to a third party,and engaged in a monopolistic act of abusing its market support position by wholesale selling tire products at an unfair high price higher than the market terminal retail price.Therefore,Guangming Company filed a lawsuit with the Shanghai Intellectual Property Court,requesting the court to order Hantai Company to immediately stop abusing its dominant market position and compensate Guangming Company for various losses totaling over 31 million yuan.Hantai argued that the evidence provided by the plaintiff was a clause in the 2012 special distribution agreement,which was deleted after 2014 and 2015,and does not constitute a vertical monopoly agreement.Hantai has no dominant market position globally or nationally,and its actions do not constitute monopolistic behavior.

After hearing,the Shanghai Intellectual Property Court held that"the passenger car tire replacement market in Chinese Mainland"was the most directly affected market and the most influential market for consumers'interests,which should be the most concerned market in the hearing of the case.After the court's trial,it was found that the brand competition in the relevant market of this case is quite sufficient,and the mid range tire products where the Hantai brand is located are highly competitive;Hantai Company does not have pricing power in relevant markets,let alone a dominant market position;Although Hantai Company reached and implemented a minimum resale price agreement with dealers from 2012 to 2013,from 2012 to 2016,the consumption volume in the three relevant markets of the case increased year by year and the price decreased year by year.The factory price,minimum resale price,and retail price of Hantai brand tires also decreased year by year,indicating that there is effective brand competition in the relevant markets of the case.Accordingly,the Shanghai Intellectual Property Court determined that the minimum resale price restrictions imposed by the defendant did not have the effect of excluding or restricting market competition,and did not constitute a monopoly agreement.The Shanghai Intellectual Property Court ruled against all the plaintiff's claims.