Interpretation of the Draft for Soliciting Opinions on the New Regulations of Supply Chain Finance - Regulatory Highlights of "Supply Chain Finance Information Service Institutions"

On February 6, 2025, the People's Bank of China, the National Development and Reform Commission and other departments drafted the Notice on Regulating Supply Chain Finance Business and Guiding Supply Chain Information Service Institutions to Better Serve SME Financing (Draft for Comments) (hereinafter referred to as the Draft for Comments). The third part of the document extensively elaborates on the "electronic voucher business for accounts receivable".

The concept of "accounts receivable electronic voucher business" may not be particularly familiar to the public, but it has already appeared in our lives, such as the "Yunxin" product of China Enterprise Cloud Chain, the "Di Chain" built by BYD and its member companies, as well as Jianxin, Hangxin, Rongxin, e-Xin, Shangyin Microelectronics, and so on.

The "accounts receivable electronic voucher business" actually developed from the "accounts receivable financing model" of supply chain finance, so we have to start with "supply chain finance".

1、 It all starts with 'supply chain finance'

We all know that the production, supply, and sales of a product cannot be independently completed by a single company, but are the result of the synergistic effect of the entire upstream and downstream industrial chain.

In this chain, if a company masters the brand and core technology, it will become the core enterprise in this chain, with strong strength in all aspects. Due to its dominant position, it often uses credit settlement methods to deal with suppliers. Moreover, banks are only willing to provide loans to these powerful enterprises.

However, if only the core enterprise plays well on its own, the huge potential and effectiveness of the supply chain cannot be fully realized. Only with a smooth supply chain can upstream enterprises solve their product backlog problems through downstream sales channels, and downstream enterprises can increase production capacity and sales volume through upstream enterprises, thereby expanding their strength and market share in the long run.

So... supply chain finance emerged in this way. Simply put, it refers to financial institutions identifying core enterprises in the supply chain, using financial tools to extend the good credit capabilities of core enterprises to small and medium-sized enterprises upstream and downstream of the supply chain, thereby improving the efficiency of capital flow and enhancing the competitiveness of the entire supply chain.

Let's give a simple example:

Because B has strong financial strength, the accounts receivable voucher issued by B is very attractive, and A can use it to sell to banks or factoring companies for early payment. After the accounts receivable are due, the bank and factoring company directly claim the debt from B. This is the most common "accounts receivable financing model" in supply chain finance.

2、 The emergence of supply chain finance service platforms

The accounts receivable financing model has greatly alleviated the financing difficulties of small and medium-sized enterprises in the supply chain, but some people feel that it is still too troublesome and financing is not convenient enough. Therefore, these people have set up a platform:

In the same example, if core enterprise B wants to purchase goods on credit from A, it can directly send a "cloud letter" (which you can understand as an electronic voucher for accounts receivable) to upstream supplier A on this platform. After receiving it, A can either transfer its holding of Yunxin to its upstream suppliers on this platform to settle outstanding payments, or use its holding of Yunxin through financial institutions or commercial factoring enterprises to achieve efficient financing through instant lending on the platform after providing basic information such as supply contracts, invoices, and delivery notes.

Yunxin can also be arbitrarily split and flexibly configured, breaking the limitations of traditional paper bills and providing convenience for the settlement of debt and credit of numerous enterprises in the upstream and downstream of the industry chain. The idle credit limit of core enterprises has also been fully utilized.

3、 What is the nature of electronic certificates such as "Yunxin" and what is the difference between them and commercial bills of exchange

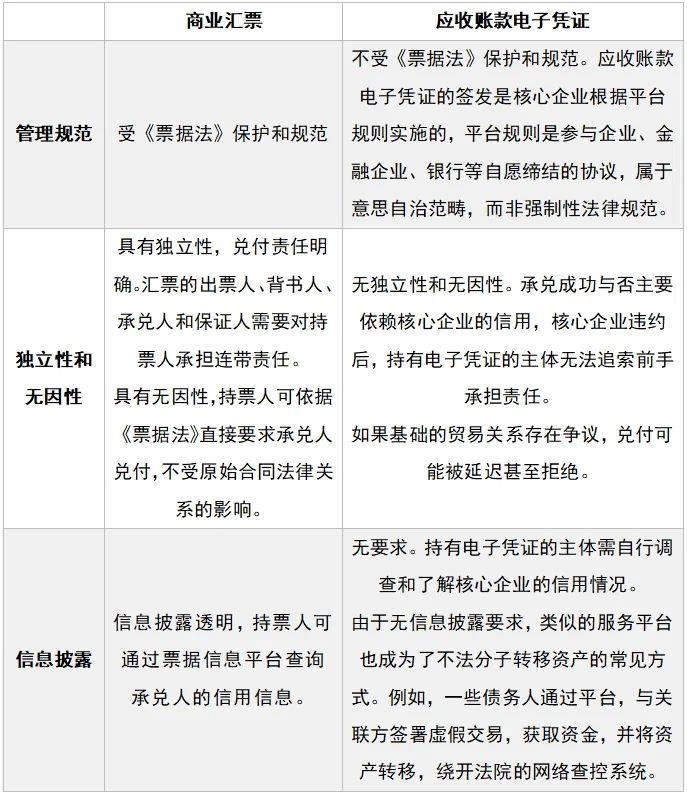

From the above example, it seems that electronic accounts receivable vouchers such as "Yunxin" are very similar to commercial acceptance bills. Essentially, they are both promises made by enterprises to repay a certain amount due in the future, and can be discounted to banks or traded.

That's right, they do have many similarities, but there are also many differences. Let's take a look at some comparisons:

Based on the above differences, it is generally believed in judicial practice that the legal nature of electronic vouchers such as "Yunxin" should be "accounts receivable vouchers" rather than "bills". The issuance, transfer, pledge, repayment or termination of the debt shall comply with the rules of debt transfer, and the relevant rules of the Civil Code of the People's Republic of China on contracts and guarantees shall apply, rather than the provisions of the Bill Law.

This viewpoint is also reflected in the document "Notice on Strictly Implementing Enterprise Accounting Standards and Effectively Doing a Good Job in Enterprise 2021 Annual Report Work": "Digital accounts receivable debt vouchers such as" Yunxin "and" Rongxin "obtained by enterprises for selling goods, providing services, etc., which do not belong to the regulated bills of the People's Republic of China Bill Law, should not be listed in the" accounts receivable "project. If the business model of enterprise management of" Yunxin "," Rongxin ", etc. aims to collect contract cash flow, it should be listed in the" accounts receivable "project; if it aims to collect both contract cash flow and sales, it should be listed in the" accounts receivable financing "project

4、 It is necessary for the government to timely issue a draft for soliciting opinions to curb industry chaos

In recent years, electronic accounts receivable vouchers and supply chain information service institutions have been highly popular, but they have actually been in a state of wild growth, and a large number of litigation cases have also emerged.

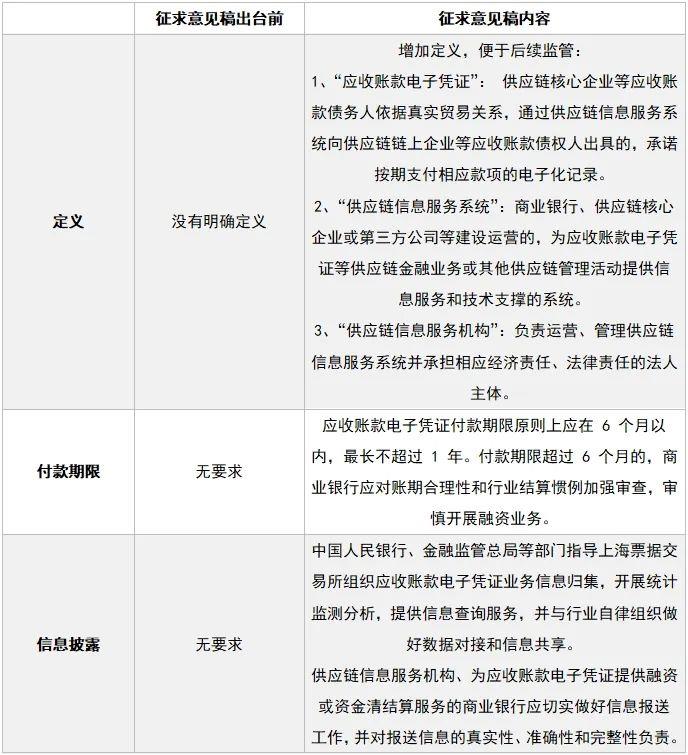

As mentioned at the beginning of the article, on February 6, 2025, the People's Bank of China, the National Development and Reform Commission and other departments drafted the Draft for Comments, which is now open to the public for comments. Here, I will briefly summarize the requirements for "supply chain finance information service institutions" mentioned in the third part of the draft for soliciting opinions:

Related recommendations

- Can I get a tax refund if my bet fails? ——Comment on the case of Wang and Shanghai Taxation Bureau's refusal to refund taxes

- How shareholders can withdraw their shares Series 2: Company merger, division, or transfer of major assets

- From the Xiao incident to see the complex impact of spousal reporting - a double-edged sword in divorce proceedings

- Analysis of Criminal Legal Risks in Low altitude Economy and Preliminary Exploration of the Road to Criminal Compliance in Low altitude Economy