How to Accountable Shareholders for Corporate Debts Series 4: Accountable Shareholders with Accelerated Maturity of Capital Contributions (3)

——When the company is dissolved, the assets are insufficient to pay off debts

Bo Hui faces the wall with doubts and no way, and there are people turning to meet in different villages.

——Qing Dynasty, Niutao

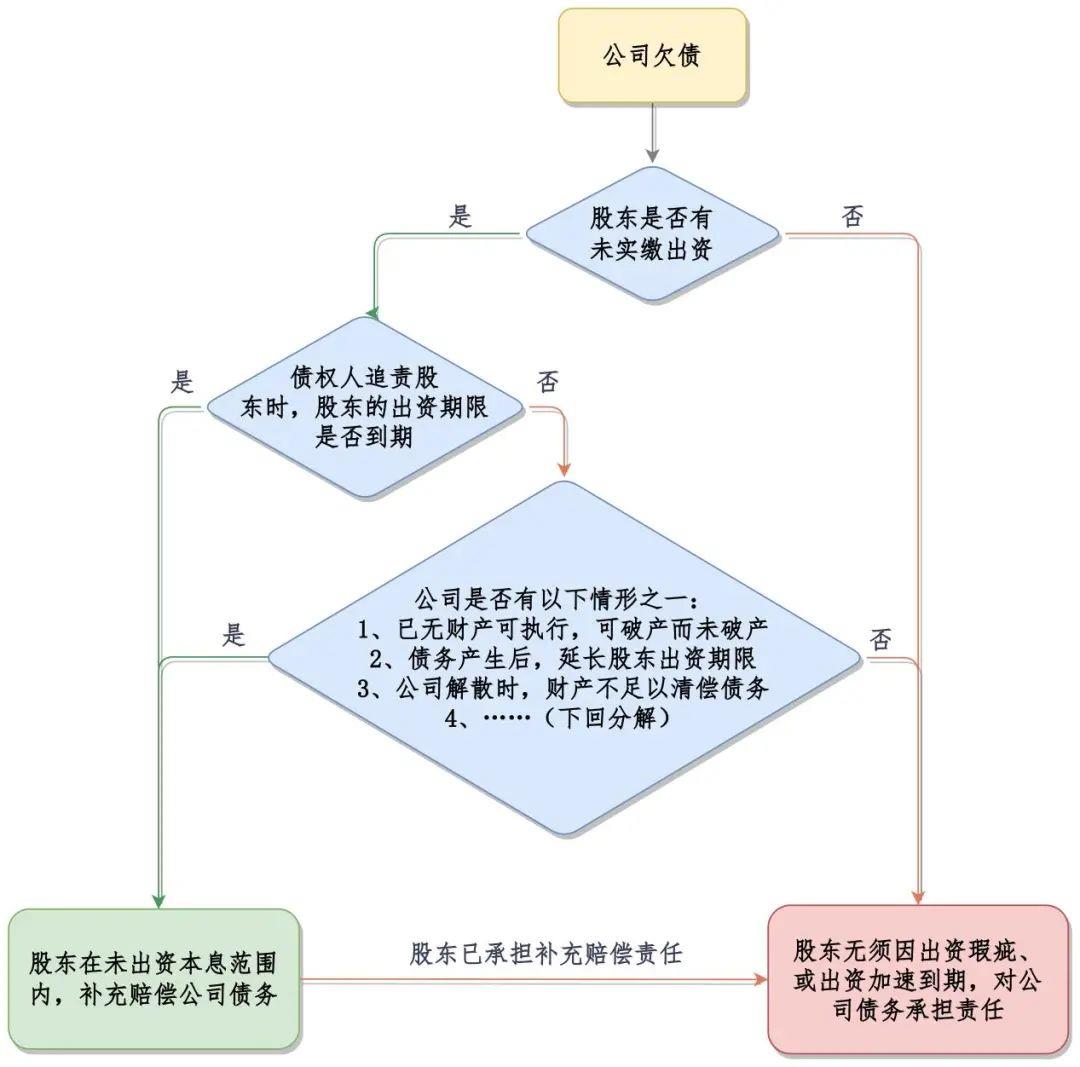

Previously, we mentioned that there are two situations where a company is in debt and its shareholders can accelerate the maturity of their capital contributions. Today, we will talk about the third scenario: when a company is dissolved, its assets are insufficient to pay off its debts.

Case Description

Once again, we invite Xiao Wan, Li Ge, Wan Li Company, and Ah Wen to:

So, Lawyer A represented Ah Wen and filed a lawsuit against Wanli Company, demanding that they pay Ah Wen 8.88 million yuan in principal and interest for the goods. The lawsuit was won, but Wanli Company has long been empty, and Lawyer A has no more options, so the outstanding payment may be lost.

Awen felt unwilling and turned to Lawyer B.

After lawyer B took over, the investigation found that the Articles of Association of Wanli agreed that both Xiaowan and Liga should subscribe 10 million yuan of capital, and each should pay 10 million yuan in full before the end of 2099; When Arvin was collecting the payment for the goods, Xiao Wan paid in full, but Li Ge only paid in 4 million and still owed 6 million.

Meanwhile, Lawyer B also found that Wanli Company has had its business license revoked!

So in June 2022, Lawyer B represented Ah Wen and sued Li Ge, demanding that Li Ge bear joint and several supplementary compensation liability for the 8.88 million principal and interest owed by Wanli Company to Ah Wen.

After filing the case, Lawyer B applied to the court for a lawyer's investigation order and found that the annual audit report of Wanli Company for the previous year showed that the net assets of Wanli Company were only 100000 yuan.

At the hearing, Li Ge admitted that Wanli Company had its business license revoked, but due to the lack of liquidation, the company was still in operation and had not been deregistered; At the same time, Li Ge argued that the annual audit report of Wanli Company for the previous year was only for the purpose of reporting to the company's industrial and commercial annual audit, and could not reflect the true financial situation of the company. Therefore, he should not be held responsible, but did not provide any evidence to prove his claim.

resolvent

So what will be the outcome of this case? Look at the following picture:

Can we hold Li Ge accountable? Let's see if Ligo meets the following three indispensable conditions:

1. Shareholders' paid in capital is less than their subscribed capital

Li Ge's paid in capital is only 4 million, which is less than his subscribed capital of 10 million.

2. When creditors hold shareholders accountable, the shareholder's actual contribution deadline has not yet arrived

When Ah Wen held Li Ge accountable, it was in June 2022, and according to the articles of association of Wanli Company, Xiao Wan and Li Ge only paid 10 million each before the end of 2099.

3. When the company is dissolved, the assets are insufficient to pay off debts

At the same time, the annual audit report of Wanli Company for the previous year showed that the company's net assets were only 100000 yuan, far lower than the principal and interest payments that Wanli Company had to make to Arvin.

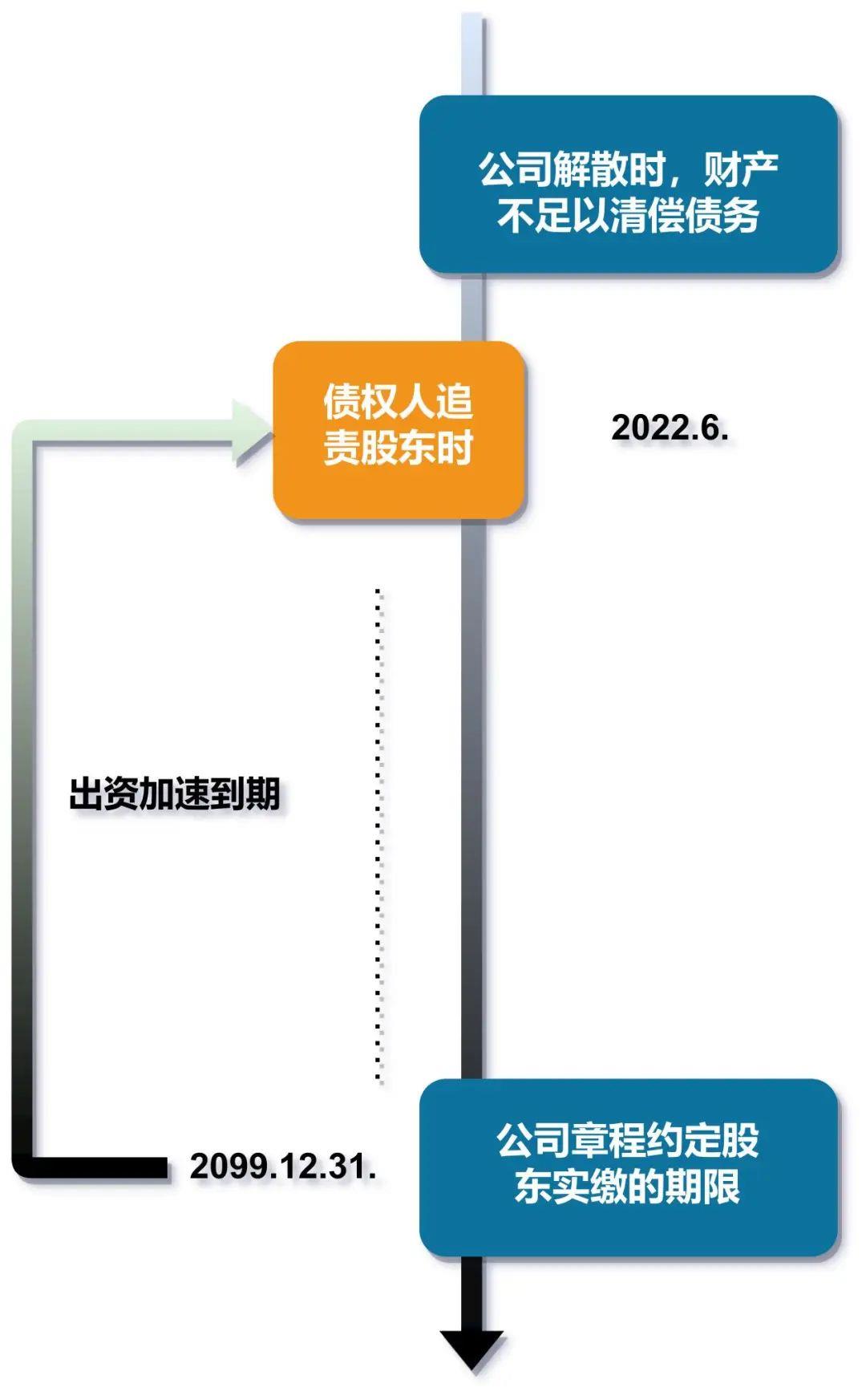

As all three conditions above have been met, the deadline for shareholder Ligo's investment has accelerated, as shown in the following figure:

What will be the outcome of this case?

Firstly, at this time, Ligo's remaining 6 million yuan needs to be paid in, which was originally due in 2099 but is now due.

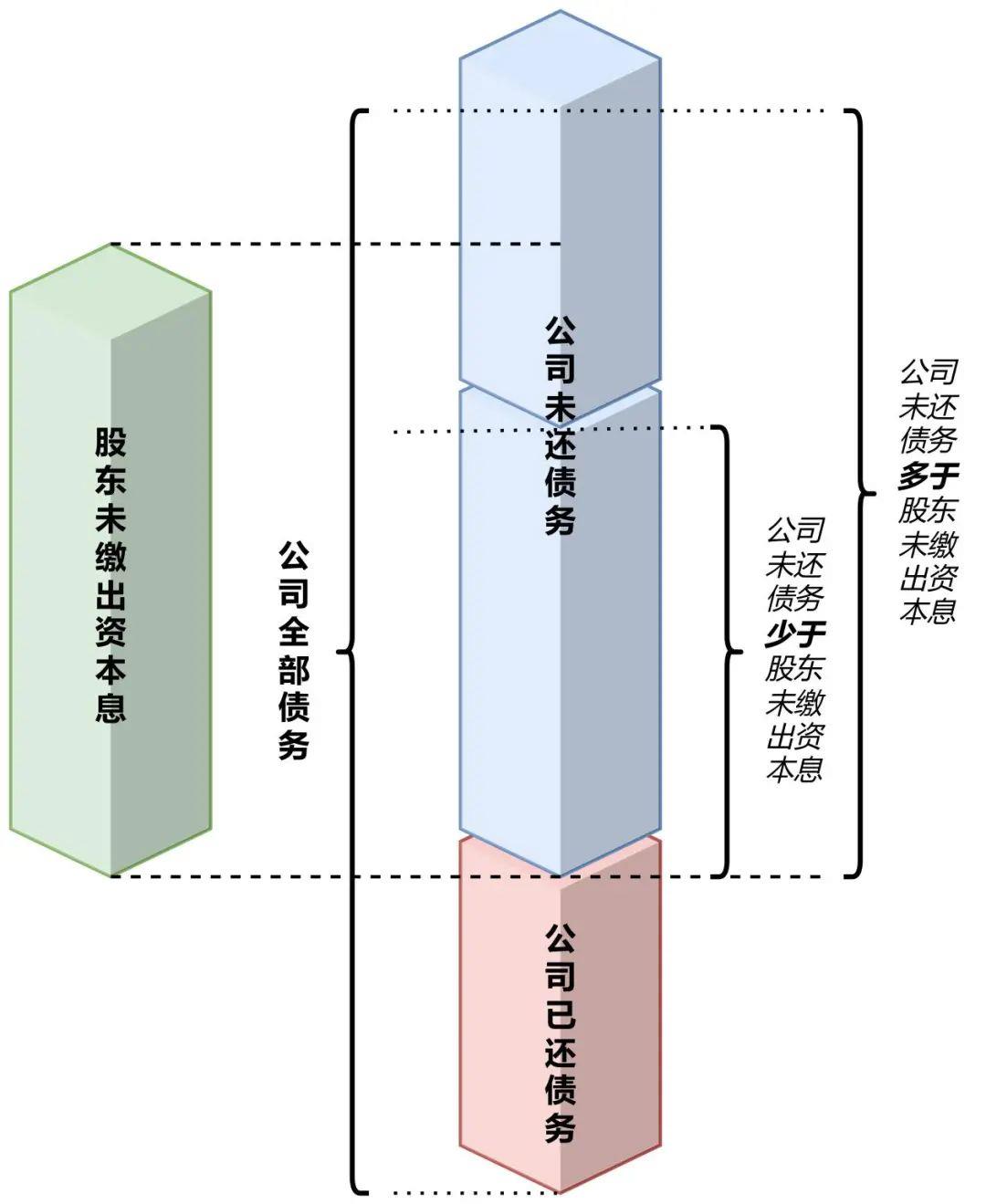

Secondly, for the unpaid principal and interest of Awen's 8.88 million yuan loan, the portion that Wanli Company has not paid will be borne by Ligo, but limited to the unpaid principal and interest of 6 million yuan (for example, a total of 6.06 million yuan); Apart from the 6.06 million principal and interest, the company's debts, whether it is the remaining payment from Ah Wen or the debts owed by Wanli Company to others, Li Ge no longer needs to bear them.

I don't understand? We will convert the above text into the following image:

How many such shareholders are there? Is the probability of success in accountability high?

The scope is relatively narrow and the success rate is relatively high.

Because in order to hold such shareholders accountable, the first step is to meet the conditions for company dissolution, so there are relatively few who meet the conditions and the scope is definitely relatively narrow.

However, the conditions that need to be met to hold such shareholders accountable are relatively clear, which is that their assets are not sufficient to repay their debts. In this regard, the "Interpretation 1 of the Enterprise Bankruptcy Law" has clear and specific provisions on the insufficient assets to repay debts, which are relatively easy to apply. Therefore, the success rate of holding such shareholders accountable is relatively high.

Next time, let's talk about the last situation where shareholders who accelerate the maturity of their capital contributions will be held accountable.

Let me give a preliminary notice. The last situation is not clearly defined in relevant laws and regulations; But based on legal principles and logical reasoning, as well as referring to the case of the Supreme Court and the case handled by myself, this situation can also accelerate the expiration of shareholder contributions!

For more information on the future, please listen to the breakdown in the next section!

References and annotations:

Article 180: The company shall be dissolved due to the following reasons:

(1) The expiration of the business term specified in the company's articles of association or the occurrence of other dissolution reasons specified in the company's articles of association;

(2) The shareholders' meeting or shareholders' meeting resolves to dissolve;

(3) Dissolution is required due to the merger or division of the company;

(4) The business license has been revoked, ordered to close down or revoked in accordance with the law;

(5) The people's court shall dissolve it in accordance with the provisions of Article 182 of this Law.

2. Provisions of the Supreme People's Court on Several Issues Concerning the Application of the Company Law of the People's Republic of China (II) (Revised in 2020)

When the company's assets are insufficient to repay its debts, if creditors claim that shareholders who have not paid their capital contributions, as well as other shareholders or initiators at the time of establishment of the company, bear joint and several liability for the company's debts within the scope of unpaid capital contributions, the people's court shall support them in accordance with the law.

3. Provisions of the Supreme People's Court on Several Issues Concerning the Application of the Enterprise Bankruptcy Law of the People's Republic of China (1) [i.e. Interpretation 1 of the Bankruptcy Law]

Article 3: If the debtor's balance sheet, audit report, asset evaluation report, etc. shows that all of its assets are insufficient to pay off all of its liabilities, the people's court shall determine that the debtor's assets are insufficient to pay off all of its debts, unless there is evidence to the contrary that the debtor's assets are capable of paying off all of its liabilities.

Related recommendations

- Exploration of Legal Liability for Drone Performances

- Upstream has been confirmed to be falsely opened, can downstream be deducted normally?

- How can private enterprises solve development problems after the implementation of the Private Economy Promotion Law? (1)

- Can I get a tax refund if my bet fails? ——Comment on the case of Wang and Shanghai Taxation Bureau's refusal to refund taxes