360 Zhou Hongyi's official announcement of divorce, why is the stock split causing hot discussion?

On the evening of April 4, 2023, a listed company with a market value of 100 billion yuan, 360, suddenly announced that the actual controllers, Mr. Zhou Hongyi and Ms. Hu Huan, had gone through friendly negotiations to terminate their marriage relationship and made relevant arrangements for share splitting and other matters.

Beautiful Love, Best Choice

Mr. Zhou Hongyi once described his beautiful emotional life in his autobiography "The Disruptor".

At that time, Mr. Zhou Hongyi was a struggling engineer with a monthly salary of only 1000 yuan. And Hu Huan has a dignified temperament, with both parents being university professors, known as the "Founder Flower".

Although there is a gap, Mr. Zhou courageously chased after Ms. Hu from Shuimu Tsinghua BBS to Pizzahut, where he met the beautiful woman, and finally got married to win her back.

Mr. Zhou has repeatedly publicly stated that "a wife is the best choice". Ms. Hu once said, "There are not many women who appreciate Zhou Hongyi. Now it seems that I should be a woman with unique insight

Mutual support and successful listing

Behind every successful man, there is a woman who silently pays and is remarkable. During her more than 20 years of love, Ms. Hu has been fully supportive of Mr. Zhou.

In the 1990s, Mr. Zhou resigned to start a business, and the entrepreneurial funds came from Ms. Hu. During the most difficult period of Mr. Zhou's entrepreneurship, he had no income for a long time, relying solely on Ms. Hu to bear the pressure and work to earn money to support his family.

At the end of the 3Q War, more than thirty foreign police officers suddenly arrived at the headquarters of 360 Company. Mr. Zhou had to fly to Hong Kong first, and Ms. Hu personally arranged work at the company and communicated with employees, helping to stabilize the morale of the rear troops.

In 2018, 360 Company successfully went public, and the couple stood side by side. At that time, Mr. Zhou was standing at the pinnacle of success, and Ms. Hu was beside him.

Official announcement of divorce, split of shares

However, things are unpredictable, and after 25 years of marriage, Mr. Zhou and Ms. Hu ultimately did not survive the trials of time, and they were officially declared divorced.

On the evening of April 4, 2023, 360 announced that the actual controllers of the company, Mr. Zhou and Ms. Hu, had dissolved their marital relationship and made relevant arrangements regarding share splitting and other matters.

Mr. Zhou plans to split his direct holding of 446585200 shares (approximately 6.25% of the company's total shares, with a market value of approximately 9 billion RMB) under Ms. Hu's name.

After the split, Mr. Zhou directly and indirectly held 51.38% of the shares of 360 Company, excluding the number of shares in the share repurchase account. In total, he held 52.45% of the voting rights of 360 Company, and the actual controller of the company remained unchanged.

Divorce and split into shares, with zero personal income tax

The exorbitant divorce case between Mr. Zhou and Ms. Hu is not uncommon. There are often exorbitant divorce cases in the A-share market, such as Du Weimin and Yuan Liping, the actual controllers of Kangtai Biotechnology, who split their shares with a market value of 23.5 billion yuan.

Divorce of the actual controller of A-shares often involves the shares held. So, does the share split resulting from divorce require taxation?

According to the tax laws of our country, if an individual transfers restricted shares of a listed company and obtains transfer income, they need to be subject to personal income tax at a rate of 20% based on "property transfer income". The term 'transfer of restricted shares of listed companies' here includes' transfer of ownership of restricted shares by individuals due to legal inheritance or family property division'.

However, it should be noted that the transfer income needs to be calculated based on the "cost paid by the transferor when acquiring the shares". In other words, the transfer income is equal to the payment cost, that is, the transfer income is 0.

Therefore, in the A-share market, if the actual controller divorces and splits the shares, they need to pay 20% of their personal income according to the "property transfer income". However, since the transfer income is 0, the paid tax amount is generally also 0.

Permanent residency status, affecting taxation

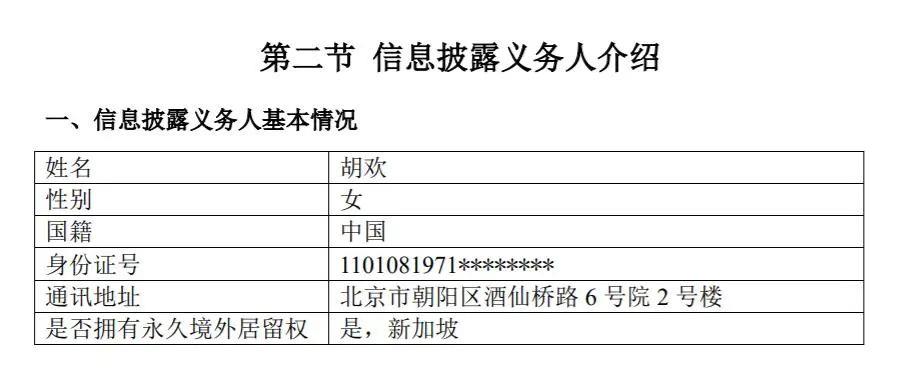

According to publicly disclosed announcement information, we know that Ms. Hu has permanent residency in Singapore. So, will this status affect their tax obligations?

Image source: screenshot of simplified equity change report on the official website of the Shanghai Stock Exchange

If an individual has Singapore tax status, they will not be required to pay individual income tax to Singapore if they receive stock transfer income and dividends from China in Singapore.

Because Singapore is a country where taxes are levied at the source. That is, all income received by Singaporean tax residents in Singapore from foreign sources (excluding those obtained through partnerships) is exempt from tax.

A beautiful marriage, arranged early

360's actual controller announced divorce, and for a while, online discussions continued. Some people believe that the love between Mr. Zhou and Ms. Hu has come to an end, and emotions are more important than money; Some people believe that it is "disguised reduction" and "golden cicada shedding its shell". We don't know the truth about the facts.

But the end of a marriage often comes with emotional harm and property loss, especially in the case of wealthy marriages. Therefore, a beautiful marriage needs to be well managed and the wealth of the family and enterprise needs to be arranged early in order to facilitate the marriage and avoid the impact of marriage disputes.

Attachment: Swipe down to view

Notice of the Ministry of Finance, the State Administration of Taxation, and the China Securities Regulatory Commission on the Relevant Issues of Levying Individual Income Tax on the Income from the Transfer of Restricted Shares of Listed Companies by Individuals (Cai Shui [2009] No. 167)

1、 Starting from January 1, 2010, personal income tax shall be levied on the income obtained from the transfer of restricted shares by individuals at a rate of 20% based on the "income from property transfer".

Supplementary Notice of the Ministry of Finance, the State Administration of Taxation, and the China Securities Regulatory Commission on the Relevant Issues of Levying Individual Income Tax on the Income from the Transfer of Restricted Shares of Listed Companies by Individuals (Cai Shui [2010] No. 70)

2、 According to Articles 8 and 10 of the Implementation Regulations of the Personal Income Tax Law, individuals who transfer restricted shares or engage in other transactions with the essence of transferring restricted shares and obtain cash, physical objects, securities, and other forms of economic benefits shall be subject to personal income tax. If restricted shares are transferred multiple times before the lifting of the ban, the transferor shall pay personal income tax in accordance with regulations for each transfer of income. Individual income tax shall be levied in accordance with regulations for those who:

(1) Individuals transfer restricted shares through the centralized trading system of the stock exchange or the Block trade system;

(2) Individual subscription or subscription of trading open end index fund (ETF) shares using restricted shares;

(3) Accepting a tender offer for personal restricted shares;

(4) Individual exercise of cash option to transfer restricted shares to a third party providing cash option;

(5) Transfer of restricted shares through personal agreement;

(6) The restricted shares held by individuals are subject to judicial deduction;

(7) Transfer of ownership of restricted shares by individuals due to legal inheritance or family property division;

(8) Individual use of restricted shares to repay the consideration paid by major shareholders to circulating shareholders in the split share reform of listed companies;

(9) Other situations with transfer substance.

You are a tax resident for a particular Year of Assessment if you are a:

1.Singapore Citizen or Singapore Permanent Resident(SPR)who normally resides in Singapore except for temporary absences; or

2.Foreigner who has stayed/worked in Singapore:

for at least 183 days in the previous calendar year; or

continuously for 3 consecutive years; or……

(Source: Singapore Taxation Bureau)

Related recommendations

- Can I get a tax refund if my bet fails? ——Comment on the case of Wang and Shanghai Taxation Bureau's refusal to refund taxes

- How shareholders can withdraw their shares Series 2: Company merger, division, or transfer of major assets

- From the Xiao incident to see the complex impact of spousal reporting - a double-edged sword in divorce proceedings

- Analysis of Criminal Legal Risks in Low altitude Economy and Preliminary Exploration of the Road to Criminal Compliance in Low altitude Economy