"Burial" 377 boxes of financial information hinder law enforcement. Who is the winner behind the A-share version of "Rage"?

Article source: Yema Finance official account, article: Zhang Kaijing, editor: Gao Yan.

Sun Jiaqi, senior partner of Gaopeng Law Firm, accepted an interview with Yema Finance.

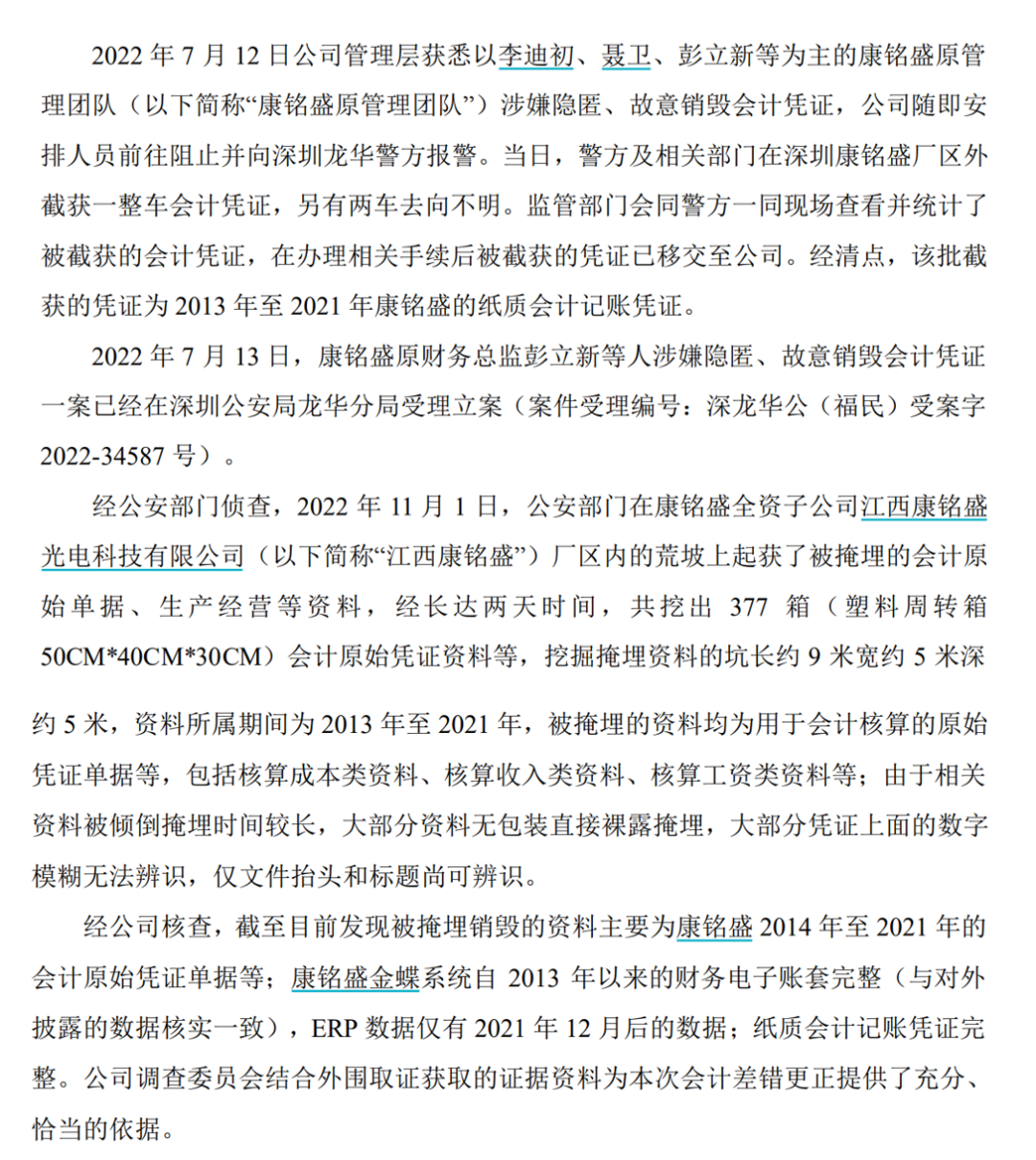

"The public security department found buried accounting original documents, production and operation data on the barren slope of the factory area." "A total of 377 boxes (50cm plastic turnover boxes) were excavated." × 40cm × "The pit for excavating and burying accounting documents is about 9 meters long, about 5 meters wide, and about 5 meters deep." "Most of the documents are directly exposed and buried without packaging, and the numbers on most documents are fuzzy and unrecognizable." "

This is a movie like plot that takes place in the listed company ST Long (300301. SZ) and its subsidiary Kang Mingsheng.

Source: ST Bulletin

Kang Mingsheng is a company acquired by ST rectangular through mergers and acquisitions, and is also the main revenue force of ST rectangular. However, in 2022, ST Fang's annual report was issued with non-standard opinions due to significant defects in Kang Mingsheng's management, which led to the "Beatles and Hats" phenomenon, exacerbating the conflict between the two sides. Since then, the management of the two sides have been tit for tat, and the fight has intensified.

The dramatic scene of 377 boxes of materials from the "Burial" is the "masterpiece" of Kang Mingsheng's party. Prior to this, the case of Peng Lixin, the former financial director of Kang Mingsheng, and others suspected of concealing and intentionally destroying accounting vouchers has been accepted and filed in the Longhua Branch of Shenzhen Public Security Bureau.

The continuous internal fight hits every player on the card table. Kang Mingsheng's former senior management team has lost control, and ST Fang's current controlling shareholder, Nanchang Optics Valley, has also been heavily indebted. The listed company has just issued its third "possible termination of listing" announcement within a month on February 27.

Only the Deng brothers, the founder of ST Long, have already cashed in and left

Kang Mingsheng: From "thigh" to "cumbersome"

On the evening of February 27th, ST disclosed a risk warning announcement that the listing might be terminated. This is also the third time since January 31 that the company has made the same prompt.

ST Secretary Fang explained that this was related to the "Notice" issued by the Shenzhen Stock Exchange in January this year. In order to improve the effectiveness of risk disclosure, delisted risk companies should disclose risk announcements every ten trading days from the disclosure of their first risk enhancement announcement to the disclosure of their annual reports.

The content of the risk warning points to the situation where ST Fang's 2021 financial report was issued with non-standard opinions by Dahua Certified Public Accountants.

Upon audit, Dahua Certified Public Accountants believes that Kang Mingsheng has significant defects in control, inventory management, sales and collection, and information system management.

In this context, if ST's 2022 annual report continues to receive non-standard opinions, the company will be forced to delist. Conversely, if the audit results of the company's 2022 annual report are standard and unqualified, the delisting risk can be revoked.

Obviously, currently listed companies have been dragged down by Kang Mingsheng. Interestingly, not long ago, Kang Mingsheng was still "thigh".

Under the leadership of founder Li Dichu, Kang Mingsheng has become a leading enterprise in China's LED lighting industry. From 2013 to 2016, Kangmingsheng's performance maintained stable growth, with revenue increasing from 441 million yuan to 1019 million yuan, and net profit also increasing from 42.5093 million yuan to 138 million yuan.

More importantly, its products are also highly competitive overseas, with sales networks spread across more than 50 countries and regions such as Southeast Asia, the Middle East, South America, and Africa. In December 2015, the company once listed on the New Third Board and was selected as the innovation layer twice in a row.

Also during this period, Kang Mingsheng completed the reorganization with Rectangular Group and became a subsidiary of the latter. However, as the parent company, Rectangular Group often experienced significant fluctuations in its performance due to its LED product positioning in the domestic mid to low end market and lingering in price wars throughout the year.

Also in 2013, despite a 40% increase in revenue, Long Group's net profit fell for the second consecutive year, falling to less than 30 million yuan. In terms of revenue structure, the company's domestic revenue accounts for over 97% of its total revenue.

"The acquisition of Kangmingsheng in 2014 is actually an outlet for the rectangular group to ensure the packaging market," said Yu Bin, an analyst at LEDinside, Jibang Consulting.

By 2018, Rectangular Group had increased its shareholding in Kangmingsheng to 99.96% through multiple increases. During the period, the revenue share of Kangmingsheng in listed companies also increased from 64% to 68%.

For the rectangular group, the cost of taking Kang Mingsheng is not too big. The company invested a total of 1.144 billion yuan before and after the initial transaction. Of the 528 million yuan, 445 million yuan was paid through targeted share issuance; In subsequent transactions, another 240 million yuan was raised from the regular increase of Anxin Fund and Baoying Fund.

In addition, Rectangular Group also agreed with Kang Mingsheng that after paying the consideration for the acquisition of Kang Mingsheng, Chairman Li Dichu and the core management team would purchase shares of Rectangular Group with a total amount of no less than 330 million yuan through the secondary market.

What is Kang Mingsheng covering up during truck transfer and hillside burial?

At first, the two sides established a good cooperative relationship. From 2015 to 2017, Kang Mingsheng successfully completed the performance bet with Long Group, and Li Dichu was promoted to the general manager of a listed company for the first time.

In February 2017, in the Dongguan Club of the beautiful Mission Hills Golf Club, there were bursts of beautiful symphony music. The executives of the two companies gathered together and held the 11th National Distributor Conference of Kangmingsheng. The words of the speech expressed full confidence in the future of Kangmingsheng.

However, under the calm water, there are already undercurrents surging.

In 2016, the rectangular group suffered its first loss after listing; In 2017, the company still lost money after deducting the profits brought by Kang Mingsheng. From the perspective of market value, net profit, gross profit margin, etc., rectangular group ranks in the middle and lower reaches of the electronic components industry.

Source: Wind data

In order to reverse the decline, rectangular group tried to transform education while acquiring Kangmingsheng, but the huge investment not only failed to bring returns, but also increased the company's debt pressure. By the end of 2017, the equity pledge ratio of three of the founders, Deng Zichang, Deng Ziquan, Deng Zihua, and Deng Zixian, exceeded 99%, while the other one also exceeded 96%.

Therefore, the Deng brothers began planning to find a new "Spike Pan Xia". In March 2018, Deng Brothers transferred part of their equity and voting rights to Nanchang Guanggu and Xinwang Capital, and Wang Min became the actual controller of the listed company. In the same year, the second gambling period between Kang Mingsheng and Rectangular Group was officially launched, which also laid the groundwork for subsequent disputes.

The variables will come soon. With exports declining, inventories piling up, and profits falling, the LED lighting industry has entered a "painful period", and Kang Mingsheng has not been spared. Especially after the arrival of the epidemic, the company's performance was severely damaged, and it was unable to complete this bet.

According to the agreement, the original shareholders of Kang Mingsheng need to compensate for the uncompleted part, but there are differences between the two parties on the specific amount of compensation. In Li Dichu's view, the epidemic is a force majeure event, and compensation that includes its impact is only reasonable. The two sides have filed a lawsuit against each other for this reason, and to this day, the case has not yet been decided.

There was originally a gap. Towards the end of the annual reporting season, the rectangular group became ST rectangular due to the issuance of non-standard Kang Mingsheng, which gradually turned the management struggle between the two sides into white-hot.

In June 2022, ST Rector held a board meeting to remove Li Dichu from his position as a director on the grounds of not cooperating with the company's investigation committee and refusing to implement the shareholder's resolution on dividend distribution; Li Dichu issued a statement accusing the recall resolution of the rectangular group of violating laws and regulations, and even proposed to the shareholders' meeting to remove Wang Min. The reason is that Wang Min excluded the entrepreneurial team of more than 5% of the major shareholders from the management of the listed company, and concealed huge debts without a bottom line to empty the listed company.

The struggle between the two sides once tended to evolve into physical conflict. According to the Shanghai Securities News, on July 13, multiple ST rectangular personnel attempted to assault the Kang Mingsheng sentry box, enter the company's office area, and seize control of the company.

According to the details disclosed by ST Fang, on the evening of July 11th, Li Dichu organized some financial personnel to pack up financial information, suspected of preparing to transfer or conceal financial vouchers and accounting books. The company immediately reported to the Securities Regulatory Bureau and the police, and later found 108 boxes of information on a truck intercepted outside the Kangmingsheng factory area, which was a paper accounting voucher for Kangmingsheng from 2013 to 2021.

The police immediately filed a case against Kang Mingsheng's former financial director, Peng Lixin, and others for allegedly concealing and intentionally destroying accounting vouchers. After further investigation, the public security department seized 377 boxes of materials on the barren slope of the Kangmingsheng factory area on November 1, the contents of which are still the original vouchers and documents used for accounting from 2013 to 2021. The numbers on most vouchers are even illegible, with only the header and title of the document still recognizable.

However, Li Dichu also has his own view on this. It stated that the reason for calling the truck to transfer data was that some unknown personnel had harassed and surrounded Kang Mingsheng for a long time, and there were security risks in the headquarters; "I have no knowledge of the matter of burying 377 boxes of data.".

Li Dichu also stated that the 377 boxes of data were all documents such as production schedules, raw material and semi-finished product flow sheets of the Jiangxi subsidiary. It was the Jiangxi subsidiary that worried about selling waste paper and leaking company information that dug up outdated data during the factory renovation in 2021. "If I had known, I wouldn't have let them do this."

According to "Daily Economic News", due to insufficient evidence, the police have taken bail pending trial measures against Peng Lixin.

The latest news is that on February 6th, the CSRC filed a case against Kang Mingsheng for allegedly refusing or obstructing the securities regulatory authority and its staff from performing their supervision and inspection duties according to law.

Sun Jiaqi, a senior partner at Beijing Gaopeng Law Firm, pointed out that concealing and intentionally destroying accounting vouchers involves criminal crimes, but whether the specific circumstances constitute a crime depends on the specific evidence. "Li Dichu's statement may be true, otherwise Peng Lixin may have been approved for arrest. The arrest has not yet been approved, indicating that the case is under further investigation."

Sun Jiaqi also stated that refusing to obstruct the enforcement of law by securities regulatory agencies is a problem at the administrative penalty level. Obstruction of concealment does not necessarily mean that there is financial fraud, and it may just be that other people do not want to know the specific financial situation.

Who is the "big winner" in the middle of the Capital Bureau?

Up to now, the internal strife of the subsidiary and parent company has caused a situation of multiple losses.

ST rectangular performance continues to decline. The performance forecast shows that the company expects a net loss of between 160 million yuan and 230 million yuan in 2022. Although it has narrowed year-on-year, the company's revenue is only between 680 million yuan and 780 million yuan, halving year-on-year. In terms of share price, the company has dropped more than 93% from its peak in 2015.

Kang Mingsheng's former senior management team has also become a suspect in violation of laws and regulations from its former "thigh", and has no legal connection with Kang Mingsheng. When Li Dichu talked about Kang Mingsheng's declining performance, he said bluntly, "Just like looking at my own son, I feel sad."

However, Nanchang Optics Valley and Wang Min, who took over the listed company from the Deng Brothers a few years ago, failed to achieve their desired goals.

At first, the Deng brothers trusted Nanchang Optical Valley very much. Despite the wide gap in revenue scale between the two sides, Nanchang Optical Valley still needs to conduct a large amount of financing and pledge to obtain the share exchange funds. The Deng Brothers are still willing to entrust 12.56% of the total share capital of the company they hold to Nanchang Optical Valley after transferring 9.93% of the equity, helping the latter quickly become the new controlling shareholder of the listed company.

However, there is still a problem with the funding of Nanchang Optical Valley. In 2018, when it signed the Equity Transfer Agreement with Xinwang Capital and Deng Brothers, it was agreed to invest 716 million yuan in exchange for 17.43% of the shares, which would be delivered in three phases. However, Nanchang Optical Valley ultimately failed to pay the consideration for the third phase of the transfer, and was therefore sued by the Deng Brothers.

Due to debt recovery, the 14.97% shares of listed companies obtained by Nanchang Optical Valley in the previous two deliveries have been frozen.

At the same time, the money that Nanchang Optical Valley borrowed from the bank to pay the high transfer amount has not been repaid, and the company has also been sued by Jiangxi Bank. In December of last year, the collateral for the loan, ST rectangular equity, was partially auctioned, and the shareholding ratio of Nanchang Optical Valley decreased to 9.93%.

If the subsequent loans continue to be urged by the banks, it is not ruled out that the ST rectangular equity held by Nanchang Optical Valley will continue to be auctioned, resulting in the possibility of losing its actual control of the listed company.

It is worth noting that Xinwang Capital, which joined STB with Nanchang Optical Valley, has suffered serious losses at present. Behind Xinwang Capital are Nanchang State-owned Assets and Jinshajiang Venture Capital. Based on the cost of 5.2 yuan per share in the Equity Transfer Agreement, the closing price of ST Square on March 2 was 1.99 yuan per share, and the company's initial investment of 308 million yuan had risen by more than 60%.

Image source: Wind Data

Among the various forces, only the Deng brothers avoided being involved in this dispute because they left early. Not only that, as early as the acquisition of Kang Mingsheng and cross-border education, the Deng brothers had concentrated on reducing their holdings; After completing the second equity transfer to Nanchang Optical Valley in 2019, the Deng brothers continued to reduce their holdings and cash out.

In 2019 and 2021, the Deng brothers were repeatedly criticized by the Shenzhen Stock Exchange for violating regulations to reduce their holdings, and even received regulatory letters from the GEM.

At the end of 2014, the four Deng brothers held 64.45% of the shares of ST Long in total; After a series of reduction and transfer, the four brothers had disappeared from the top ten shareholders of ST Long by the middle of 2022. Based solely on its reduced holdings in the secondary market and block trading plus equity transfer payments, the Deng Brothers cashed out at least 1.61 billion yuan, which is even greater than the current market value of ST Long.

Just, can the Deng brothers really be considered winners when a company built by themselves has reached this stage?

What do you think of Kang Mingsheng's behavior of burying data? Do you think the departure of the Deng Brothers is a "good move"?

Related recommendations

- Can I get a tax refund if my bet fails? ——Comment on the case of Wang and Shanghai Taxation Bureau's refusal to refund taxes

- How shareholders can withdraw their shares Series 2: Company merger, division, or transfer of major assets

- From the Xiao incident to see the complex impact of spousal reporting - a double-edged sword in divorce proceedings

- Analysis of Criminal Legal Risks in Low altitude Economy and Preliminary Exploration of the Road to Criminal Compliance in Low altitude Economy