Overseas Capital Markets Series | Listing in Switzerland

At the 2015 Sino UK Economic and Financial Dialogue, the Chinese and British governments announced the launch of a feasibility study of the Shanghai Luntong mechanism. Since then, the curtain has opened for Chinese companies to go to the London Exchange to raise funds. In 2018, relevant regulations of the Shanghai Luntong Stock Exchange were introduced, formally establishing a mechanism for mutual issuance of depositary receipts between the Shanghai Stock Exchange and the London Stock Exchange. In 2019, the first GDR issued by an A-share listed company under the Shanghai Luntong mechanism was listed on the London Stock Exchange. In 2021, the CSRC solicited opinions on the new regulations of the China Europe Link mechanism and expanded and optimized the capacity of Shanghai Luntong. In 2022, China Securities Regulatory Commission (CSRC) issued new regulations on the China Europe Link mechanism, which included Germany and Switzerland into the scope of application of the interconnection and exchange of depository receipts business between domestic and foreign stock exchanges. At the same time, the Shanghai and Shenzhen Stock Exchange also issued relevant supporting rules.

Under the interconnection mechanism, depository receipts business issues and trades depository receipts in the capital market of one location as underlying securities. Each depository receipt represents a certain amount of underlying securities, and investors holding depository receipts can enjoy corresponding rights and interests in underlying securities. The underlying securities of depositary receipts may be issued stocks or other securities of overseas companies. Cross-border conversion includes converting underlying stocks to depositary receipts, converting this direction to generation, and converting depositary receipts to underlying stocks, converting this direction to redemption. Through generation and redemption, Chinese enterprises achieve a smooth channel for fund-raising between the Chinese capital market and the international capital market.

In a word, GDR refers to "qualified domestic listed companies listed on domestic stock exchanges that issue depositary receipts overseas and list on overseas stock exchanges.". Overseas underlying securities issuers publicly issue depositary receipts in China using non newly added stocks as underlying securities, that is, red chip enterprises issuing CDRs in China, will be detailed in a separate article. This article will discuss the relevant legal systems and practices of Chinese companies issuing GDRs on the Swiss Exchange.

1、 Applicable laws and regulations

The applicable regulations and rules regarding the issuance of depositary receipts by Chinese enterprises in overseas capital markets, namely, the competent authorities of domestic depositors in China and the Shanghai and Shenzhen Stock Exchange, are summarized as follows:

1. Law

Article 131 of the Company Law stipulates that the State Council may make separate regulations on the issuance of shares of other types by companies other than those specified in this Law.

Article 12 of the Securities Law stipulates that public issuance of depositary receipts shall meet the conditions for initial public issuance of new shares and other conditions prescribed by the securities regulatory authority under the State Council.

Administrative regulations

In 1994, the State Council passed the "Special Provisions on the Overseas Offering and Listing of Shares by Joint Stock Limited Companies", stipulating that joint stock limited companies that offer shares to overseas investors and list them overseas should submit a written application with relevant materials in accordance with the requirements of the Securities Commission of the State Council and submit it to the Securities Commission of the State Council for approval.

3. Regulations

In February 2022, the CSRC revised the "Regulation on the Interconnection and Interoperability of Depositary Receipt Business between the Shanghai Stock Exchange and the London Stock Exchange (Trial Implementation)" (CSRC Announcement [2018] No. 30), which was renamed the "Regulation on the Interconnection and Interoperability of Depositary Receipt Business between Domestic and Foreign Stock Exchanges" (hereinafter referred to as the "Regulation"), and the original regulation was repealed. The relevant provisions on depositary receipts issued and listed overseas by domestic listed companies will be detailed later.

4. Regulations

In March 2022, the Shanghai Stock Exchange issued the "Interim Measures for Interconnection and Interoperability of Depositary Receipts for Listing and Trading with Overseas Stock Exchanges", repealing the previously issued "Guidelines for Interconnection and Interoperability of Depositary Receipts between the Shanghai Stock Exchange and the London Stock Exchange" (SZF [2018] No. 89), and formulating relevant business guidelines, including "Guidelines for Interconnection and Interoperability of Depositary Receipts Business No. 1 - Cross-border Conversion of Depositary Receipts" The "Guidelines for Interconnected Depositary Receipts Business No. 2 - Market Making of Chinese Depositary Receipts" and "Guidelines for Interconnected Depositary Receipts Business No. 1 - Trading Business" stipulate the qualifications, listing, trading, and information disclosure management of depositors and cross-border conversion institutions.

In March 2022, Shenzhen Stock Exchange issued the "Interim Measures for Interconnection and Interoperability of Depositary Receipt Listing Transactions" and the "Business Guide No. 1 - Cross Border Conversion of Depositary Receipts", and subsequently formulated the "Business Guide No. 1 - Cross Border Conversion of Global Depositary Receipts".

In March 2022, China Securities Depository and Clearing Co., Ltd. promulgated the "Implementation Rules for the Registration and Settlement of Interconnected Depositary Receipts on Domestic and Foreign Stock Exchanges of China Securities Depository and Clearing Co., Ltd.", which specifically stipulates the registration and settlement of interconnected depositary receipts.

2、 GDR issuance system

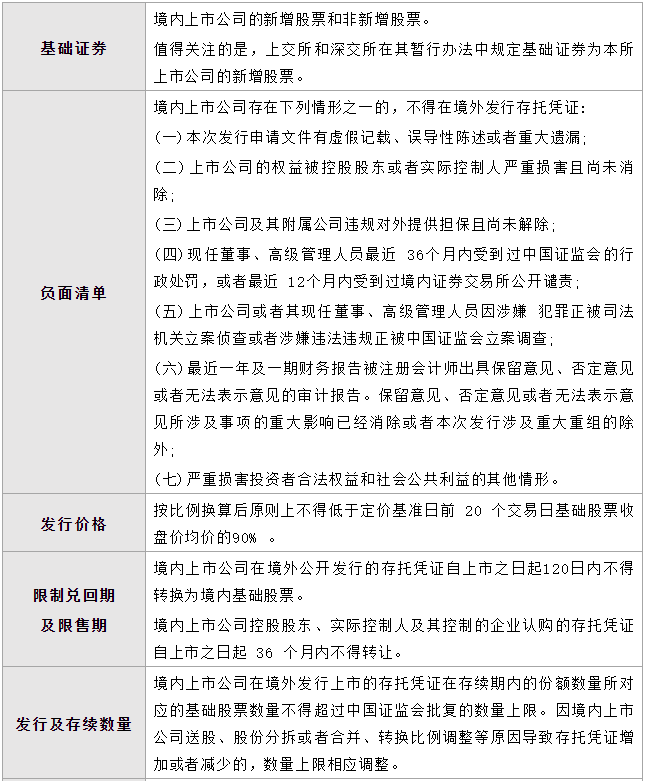

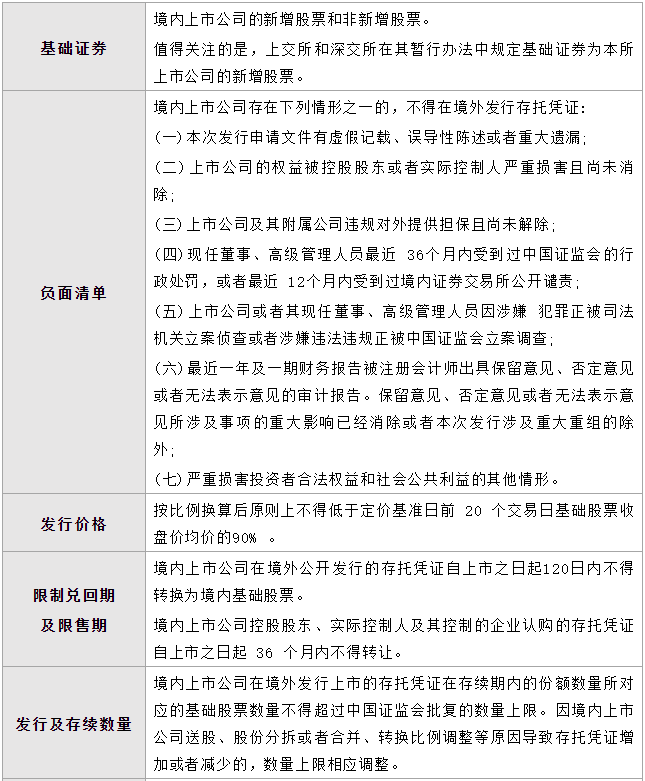

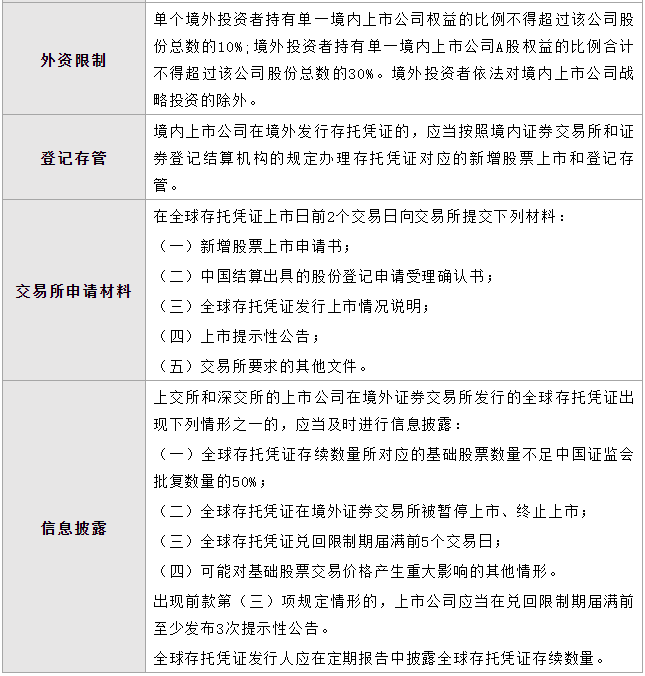

"If a domestic listed company issues depositary receipts overseas based on its newly added stocks or lists depositary receipts overseas based on its non newly added stocks, it shall comply with the Securities Law, relevant laws and regulations on overseas issuance and listing of domestic enterprises, and the provisions of the China Securities Regulatory Commission.". "If a domestic listed company issues depositary receipts overseas based on its newly added stocks, it shall also comply with the relevant provisions on the issuance of securities by listed companies.". We have sorted out the current regulatory policies related to GDR issuance as follows:

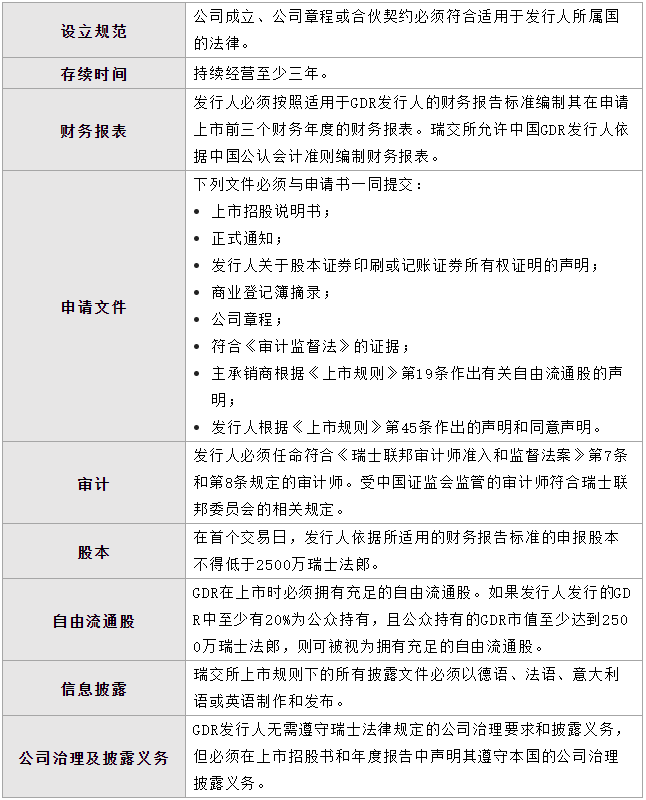

According to the listing rules of the Swiss Exchange, the regulatory requirements for GDR issuers are as follows:

3、 Why choose overseas listing

As a refinancing approach for listed companies, the advantages of issuing GDR compared to the fixed increase of A-shares are as follows:

1. Use of funds

Currently, there are no strict restrictions on the use of raised funds in the regulatory policies and laws of both China and Europe. The funds can be left abroad for overseas investment and mergers, or can be transferred back to China for replenishment or debt repayment.

2. Transfer Restrictions

The shares subscribed by A-share refinancing investors cannot be transferred within 6 months, and GRD can be circulated from the date of listing.

3. Corporate governance

In A+H listed companies, H-share and A-share shareholders are considered as different categories of shareholders, and related corporate governance aspects such as voting at shareholders' meetings will increase governance costs. GDR investors are considered to be in the same category as A-share shareholders, which has a small impact on corporate governance costs.

4. Disclosure costs

As described below, GDR can apply Chinese accounting standards to audit costs and subsequent disclosure costs, and can exempt relevant disclosure obligations.

4、 Why Switzerland

Currently, the overseas listing places recognized by the Chinese government, which are expanded from Shanghai Luntong, include the United Kingdom, Germany, and Switzerland. From the perspective of issuance, except for a few companies, such as Yongtai Technology and Pacific Insurance, which have chosen to be listed on the London Stock Exchange, other companies have chosen to issue GDRs in Switzerland. The Swiss exchange is a preferred destination for Chinese listed companies. The main considerations for Chinese listed companies are as follows:

The valuation level of the Swiss Stock Exchange is relatively high in Europe. Compared to the London and Frankfurt exchanges, the average market value of the Swiss exchange is much higher than its average level. Two thirds of blue chip companies in Europe are listed here, and three of the top five European companies with market capitalization are listed on the Swiss Stock Exchange, namely Nestle, Roche and Novartis.

In terms of the approval process, the Swiss Stock Exchange is more efficient. The review of application materials at the Swiss Stock Exchange generally takes only 20 working days, and listed companies can complete the overseas listing process within 3 to 4 months, reducing issuance costs. From a regulatory perspective in Switzerland, the GDR project of the Swiss Stock Exchange involves two parts of the review process: (i) the listing application of GDR must be approved by the SIX Exchange Regulation; (ii) The prospectus must be approved by the SER Prospectus Office. Swiss regulators conduct formal reviews of listing applications and prospectuses, typically lasting around 20-30 trading days. Therefore, it only takes about three to four months for the Swiss GDR project to complete as soon as possible. In the London GDR project, the Financial Conduct Authority of the United Kingdom conducts relatively strict review of the prospectus, usually with three to four rounds of feedback. It typically takes about four to six months to complete a London GDR project.

3. In terms of regulatory system, the Swiss Stock Exchange is more relaxed. For example, in terms of audit requirements, Swiss law stipulates that only audit companies approved and regulated by the Swiss Federal Audit and Supervision Bureau (RAB) can provide listing services. If the auditors of a foreign issuer are subject to the supervision of a foreign audit supervision institution recognized by the Swiss Federal Commission, they are not subject to the approval and supervision of the Swiss Federal Audit Supervision Bureau RAB. Otherwise, the auditor of a foreign issuer must obtain approval and supervision from the Swiss Federal Audit Supervision Office. According to the interconnection policy between China and Switzerland, Swiss regulators respect the supervision of auditors by the China Securities Regulatory Commission. The UK has stricter requirements for auditors and auditing standards. The auditors of GDR issuers must complete registration with the UK Financial Reporting Commission (FRC) before issuing their first annual report after the listing of GDR, and comply with the various requirements of the FRC. GDR issuers listed on the London Stock Exchange also have higher post listing compliance obligations and fees than the Swiss Stock Exchange.

In terms of the information disclosure system after listing, the Swiss Stock Exchange has made some exemptions for GDR issuers.

5. Investor Recognition. GDR is still a new product for the Swiss Stock Exchange. Chinese companies conducting GDR issuance in Switzerland are more diversified, including companies in new energy, equipment manufacturing, medical, consumer goods, and other industries. The London Stock Exchange is a mature GDR market that currently provides GDRs from issuers in 44 countries, including Russia, Central and Eastern Europe, Asia, and the Middle East. So far, Chinese companies that issue GDRs on the London Stock Exchange are mainly in the financial and energy industries.

5、 Concerns of the CSRC

In 2022, a total of 10 A-share companies completed GDR issuance, with only one company choosing to be listed on the London Stock Exchange, while the rest chose to be listed on the Swiss Stock Exchange.

There are still more than 20 listed companies waiting in line to issue GDR materials that have been approved by the CSRC. According to the feedback already released by the International Department of the Securities Regulatory Commission, several enterprises such as Tianci Materials, Yuyue Technology, and Milkewei have submitted application materials for issuing GDR in Switzerland to the Securities Regulatory Commission.

From the perspective of feedback issues on disclosure, the issues that the CSRC focuses on include:

1. The impact of converting GDR into A-shares after the expiration of the restricted redemption period on its trading and market;

2. After the issuance, it is expected that the total proportion of equity held by foreign investors will approach the upper limit of 30%, and the proposed countermeasures and operability during the GDR issuance and subsequent conversion period;

3. Whether the pledge and freezing of the controlling shareholders' shares may lead to changes in the company's controlling rights and have a significant impact on this issuance and listing;

4. Describe the custody and custody arrangements for this IPO, including the depositors, custodians, and other related matters of this GDR;

5. Whether the projects that have been built, are under construction, and are invested with raised funds belong to high energy consumption and high emissions projects.

From the above issues, it can be seen that the regulatory focus is on the redemption risk generated by the issuance of GDRs for listed companies, as well as related foreign capital regulatory issues.

epilogue

In recent years, based on the efforts of the Swiss and Chinese governments in building cross-border financial and monetary infrastructure such as currency swaps, RMB qualified foreign institutional investors pilot projects, and RMB clearing, capital flows between China and Switzerland have become increasingly frequent. Among the Chinese companies listed on the Swiss Stock Exchange last year, Guoxuan Hi-Tech raised a total of 685 million US dollars, making it the largest IPO in the Swiss capital market last year. As the CEO of the Swiss Stock Exchange, Dieselhoff, stated in an interview, "There is no doubt that exchanges such as the New York Stock Exchange are larger in size. If companies want to become a big fish in a small pond, rather than a small fish in a big pond, the Swiss Stock Exchange will be more attractive." For many Chinese companies, going to Switzerland for a listing is a choice in the current context of increased geopolitical friction.

We hope to discuss with Chinese companies the option of going to Switzerland for a listing.

Related recommendations

- Can I get a tax refund if my bet fails? ——Comment on the case of Wang and Shanghai Taxation Bureau's refusal to refund taxes

- How shareholders can withdraw their shares Series 2: Company merger, division, or transfer of major assets

- From the Xiao incident to see the complex impact of spousal reporting - a double-edged sword in divorce proceedings

- Analysis of Criminal Legal Risks in Low altitude Economy and Preliminary Exploration of the Road to Criminal Compliance in Low altitude Economy