Overseas Financing Transaction Series | Financing Structure Chapter: Exploring the Optimization of Financing Structure through Participation Mode

In overseas financing transactions, the establishment of the financing structure provides the foundation for the success of the project. This article takes the adjustment of a financing project structure handled by the author as an example to explore the optimization of the financing structure in overseas financing transactions.

In this project, foreign banks providing financing have proposed a challenge to the financing structure of China's foreign exchange management: a listed company opens an offshore account as a borrower at the Luxembourg branch of the borrowing bank, the parent company of the listed company provides a guarantee as a guarantor, and the Hong Kong subsidiary of the listed company provides a guarantee for the loan with the equity investment income obtained from the project repayment, while the project company provides a guarantee for the loan with the project income.

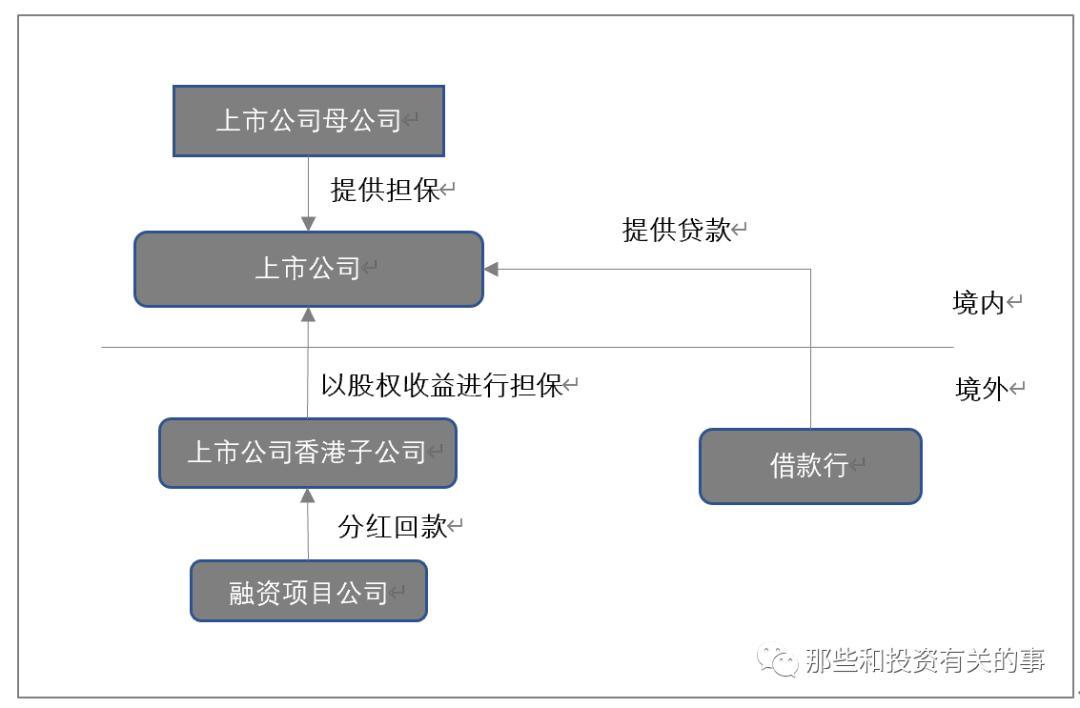

1、 Initial architecture

A simple illustration is as follows:

The legal regulatory challenges faced by the above model mainly occur in the following two stages:

1. Listed companies directly obtain loans from overseas banks

From the perspective of relevant regulatory regulations, the following approvals should be obtained at this stage:

● A listed company should obtain relevant internal approval for this loan in accordance with its articles of association and listed company management regulations;

● Listed companies make announcements in accordance with relevant rules;

● The amount of this loan should be within the range that listed companies can borrow in accordance with foreign exchange management regulations;

● Register the loan with the SAFE; In practice, SAFE has been relatively strict in reviewing cross-border loans made by listed companies, and this procedure also takes some time.

In addition to the relevant legal regulations mentioned above, this model also raises doubts in practice: Can Chinese enterprises directly open offshore accounts with overseas banks?

2. Listed companies remit money overseas to repay loans

The regulatory challenges encountered at this stage will be more daunting. According to current foreign exchange regulatory policies, foreign exchange business is divided into "current account" (for cross-border goods or services provided) and "capital account" (for cross-border equity investment, etc.). The remittance of funds from a listed company to its Hong Kong subsidiary due to this equity investment should be included in the capital account and reviewed by the SAFE on a case by case basis. More specifically, the method of capital increase should be adopted for outward remittance of funds according to the transaction structure, and the following approvals should be obtained:

● The National Development and Reform Commission approved the capital increase,

● The Bureau of Commerce or the Ministry of Commerce shall approve the capital increase;

● Register with SAFE.

In terms of time, the NDRC should make approval within 7 working days after receiving the review form, and the Commerce Bureau should make approval within 3 working days. However, it may take longer in actual operations around the world (below $300 million). At the same time, SAFE, as the gatekeeper of foreign exchange outflows at the local level, closely monitors foreign exchange outflows under capital accounts. In practice, there is a threshold for an actual foreign investment of US $50 million, and foreign management conducts more strict review and control on transactions exceeding the amount. In addition, when remitting foreign exchange, listed companies need to register with the competent SAFE through the bank. Each bank has its own internal audit process, making it difficult to predict a time frame.

Finally, according to our current understanding in practice, it is difficult to obtain approval from external management for methods other than capital increase under capital account.

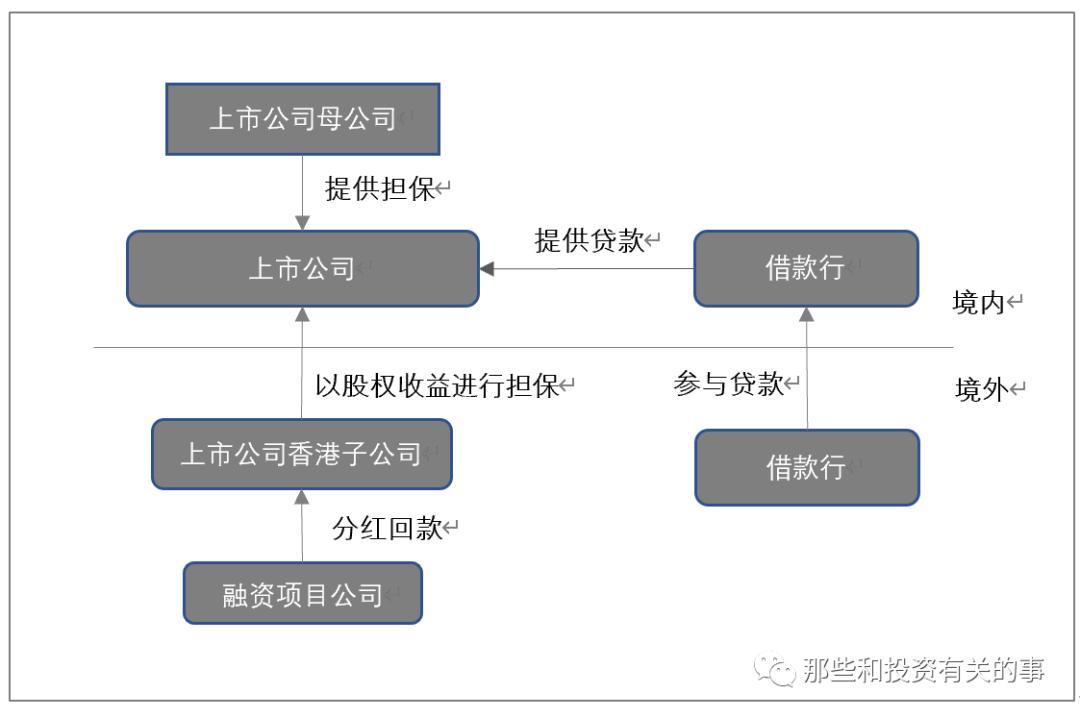

2、 Ideal architecture

Due to the above regulatory requirements, we propose to modify the financing structure in the form of funded participation. Firstly, domestic banks provide loans to borrowers, and overseas banks participate in the loans by providing funds to domestic banks. During the repayment and interest payment, domestic banks repay the loans to overseas banks through domestic banks. This financing arrangement avoids the loan arrangement becoming a cross-border loan, thereby avoiding a series of regulatory requirements in SAFE and NDRC. A simple illustration is as follows:

Of course, when using this method, the following points should be noted:

It is recommended that the legal relationship between the lending bank and the participating bank be governed by New York law or Luxembourg law. Under traditional British law, the relationship between a participating bank and a lending bank is that of a grantor and a participant. If the lending bank enters bankruptcy proceedings, the participating bank cannot be repaid even if the borrower pays off, and can only enter bankruptcy proceedings with other creditors of the lending bank to wait for repayment. Under New York law, the participating bank and the lending bank are sellers and buyers. In this case, if the lender enters bankruptcy proceedings, the participating bank can emphasize that the participation agreement is essentially a "true sale". Because if it is a "real sale", when the borrower makes a normal repayment, the repayment will be protected from being claimed by other creditors of the lending bank. Under Luxembourg law, similar to New York law, participating and lending banks can be identified as sellers and buyers.

In this mode, there is no direct legal relationship between the participating bank and the borrower. The risk of borrowing has not been effectively transferred from domestic lenders to overseas lenders. Therefore, even in the context of the absence of any regulations on the access and qualifications of overseas participating banks under Chinese law, in practice, as the financing bank does not have branches within China, the willingness of Chinese financial institutions to participate in this structure is not very high, and the participation structure should not be effectively applied to this transaction.

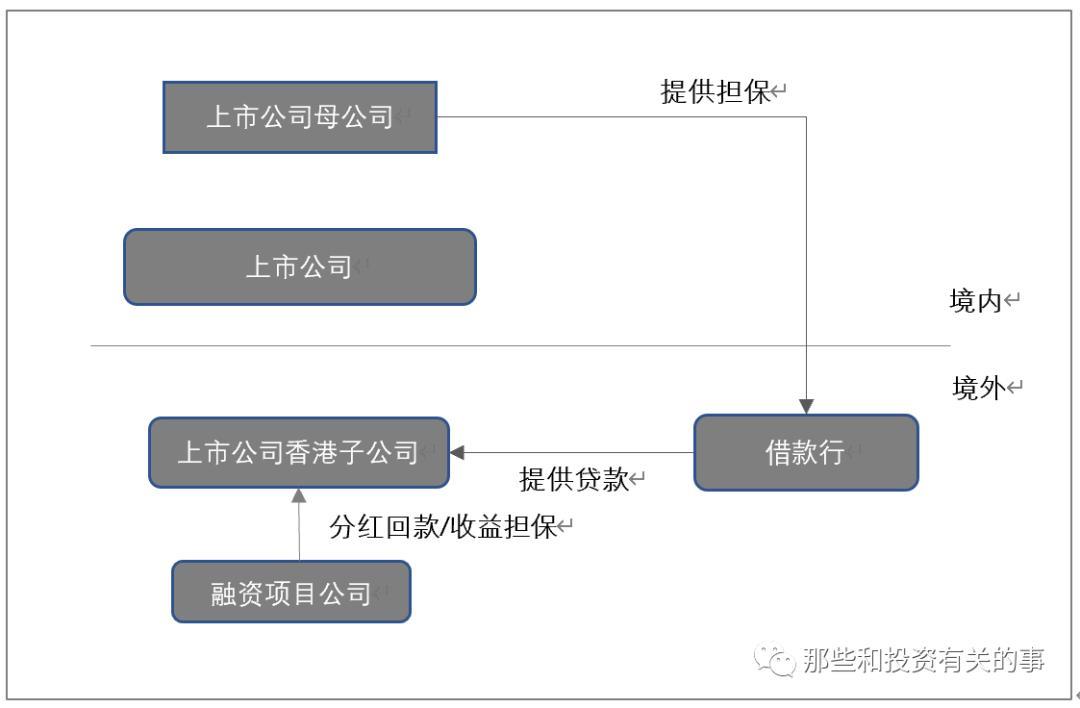

3、 Practical structure

Therefore, in the end, our proposed financing structure reverts to a more common pattern in the market, as shown below:

The biggest problem with this model is that the listed companies with the most abundant solvency and assets cannot join the financing institutions as guarantors. At the same time, as external loans and internal guarantees, the parent company of the listed company needs to go to external management to provide guarantees for registration. However, considering the above, it is still the best choice.

4、 Conclusion

The above is our practical experience in adjusting the financing structure in overseas cross-border financing. We hope to find the optimal financing structure for overseas financing of Chinese enterprises, laying a solid foundation for transaction execution.

Related recommendations

- Can I get a tax refund if my bet fails? ——Comment on the case of Wang and Shanghai Taxation Bureau's refusal to refund taxes

- How shareholders can withdraw their shares Series 2: Company merger, division, or transfer of major assets

- From the Xiao incident to see the complex impact of spousal reporting - a double-edged sword in divorce proceedings

- Analysis of Criminal Legal Risks in Low altitude Economy and Preliminary Exploration of the Road to Criminal Compliance in Low altitude Economy